Digital Banking Giant Chime Files For US IPO, Revealing Strong Revenue Increase

Table of Contents

Chime's Strong Financial Performance and Revenue Growth

Chime's decision to pursue an IPO is directly linked to its robust financial performance. The company has demonstrated significant year-over-year revenue growth, solidifying its position as a major player in the fintech space.

Revenue Increase Details

While precise figures may vary pending official SEC filings, reports suggest a substantial percentage increase in Chime's revenue. This growth can be attributed to several key factors:

- Increased customer acquisition through strategic partnerships: Chime has successfully leveraged partnerships to expand its reach and attract a wider customer base.

- Expansion of financial products and services: Beyond its core offerings, Chime has diversified its product portfolio, including credit-building tools and investment options, attracting a more diverse customer segment.

- Successful implementation of targeted advertising: Chime’s marketing campaigns have effectively reached its target demographic, leading to increased customer acquisition and engagement.

- Strong organic growth driven by customer satisfaction: Positive word-of-mouth and high customer retention rates have contributed significantly to Chime's growth.

Profitability and Financial Health

While Chime hasn't yet reached profitability, its strong revenue growth and efficient operating model suggest a path to profitability in the near future. Analyzing its financial health requires examining several key metrics:

- Net income: While currently negative, the trajectory of net income is crucial in assessing the long-term viability of the Chime IPO.

- Operating expenses: Chime's focus on technology and efficiency in operations is vital in managing costs and improving profitability.

- Debt-to-equity ratio: A healthy debt-to-equity ratio indicates a stable financial position and reduced risk for investors. The specifics will be crucial information in the IPO prospectus.

Chime's business model, centered around fee-based revenue from various financial services, positions it favorably for long-term profitability. However, potential challenges such as increased competition and regulatory changes need to be carefully considered.

Key Details of the Chime IPO Filing

The Chime IPO filing provides crucial information for potential investors, including valuation and the use of proceeds.

IPO Valuation and Share Offering

The expected valuation of Chime at the time of its IPO is highly anticipated by market analysts and investors. The number of shares offered to the public, along with the price range per share, will directly influence the overall market capitalization. Key details to watch for include:

- Estimated market capitalization at IPO: This figure will reflect the market's perception of Chime's future growth potential.

- Number of shares to be offered to the public: This determines the level of dilution for existing shareholders.

- Expected price range per share: This directly impacts the investment opportunity for potential buyers.

- Underwriters: The investment banks handling the IPO play a crucial role in the pricing and distribution of shares.

- Expected trading date and stock ticker symbol: These details are critical for investors planning to participate in the IPO.

Use of Proceeds from IPO

Chime plans to use the funds raised from the IPO to fuel its continued growth and expansion. This includes:

- Investments in enhancing the mobile banking app: Improving user experience and adding new features will be vital in maintaining a competitive edge.

- Expansion into new markets or product offerings: Geographic expansion and the introduction of new financial services will drive revenue growth.

- Strategic acquisitions to strengthen its market position: Acquiring smaller fintech companies could accelerate innovation and market share gains.

Implications for the Digital Banking Sector and Investors

Chime's IPO has significant implications for both the digital banking industry and potential investors.

Impact on the Competitive Landscape

Chime's entry into the public markets intensifies competition within the digital banking sector. Its success will impact other key players like Robinhood, PayPal, and traditional banks offering digital services:

- Chime's potential to disrupt the traditional banking system: Its innovative approach and focus on underserved customer segments present a significant challenge to established institutions.

- The impact of increased competition on other digital banking players: Other digital banks will need to adapt and innovate to compete with Chime's growing market presence.

Investment Opportunities and Risks

The Chime IPO presents both significant opportunities and inherent risks for investors:

- Potential for high returns but also considerable risk: The success of the IPO depends on various factors, including market conditions and Chime's ability to execute its growth strategy.

- Factors investors should consider before investing in the Chime IPO: These include thorough due diligence, analysis of financial statements, understanding the competitive landscape, and assessment of potential regulatory risks. Market volatility and broader economic conditions will also play a role.

Conclusion

Chime's upcoming IPO represents a major milestone for the digital banking sector. Its impressive revenue growth, coupled with a strong customer base and innovative business model, positions it for continued success. However, potential investors should carefully weigh the opportunities and risks before committing to the Chime IPO. Conduct thorough research and consult with a financial advisor before making any investment decisions. Stay updated on the latest developments related to the Chime IPO for informed decision-making. Understanding the nuances of the Chime IPO and its implications for the wider fintech market is crucial for making a well-informed investment choice.

Featured Posts

-

Liverpool Arsenal Hold Talks With Top Premier League Agent

May 14, 2025

Liverpool Arsenal Hold Talks With Top Premier League Agent

May 14, 2025 -

El Flujo Ilegal De Armas Republica Dominicana Como Puente Entre Estados Unidos Y Haiti

May 14, 2025

El Flujo Ilegal De Armas Republica Dominicana Como Puente Entre Estados Unidos Y Haiti

May 14, 2025 -

Upcoming Pokemon Go Raids Spotlight Hours And Community Days May 2025

May 14, 2025

Upcoming Pokemon Go Raids Spotlight Hours And Community Days May 2025

May 14, 2025 -

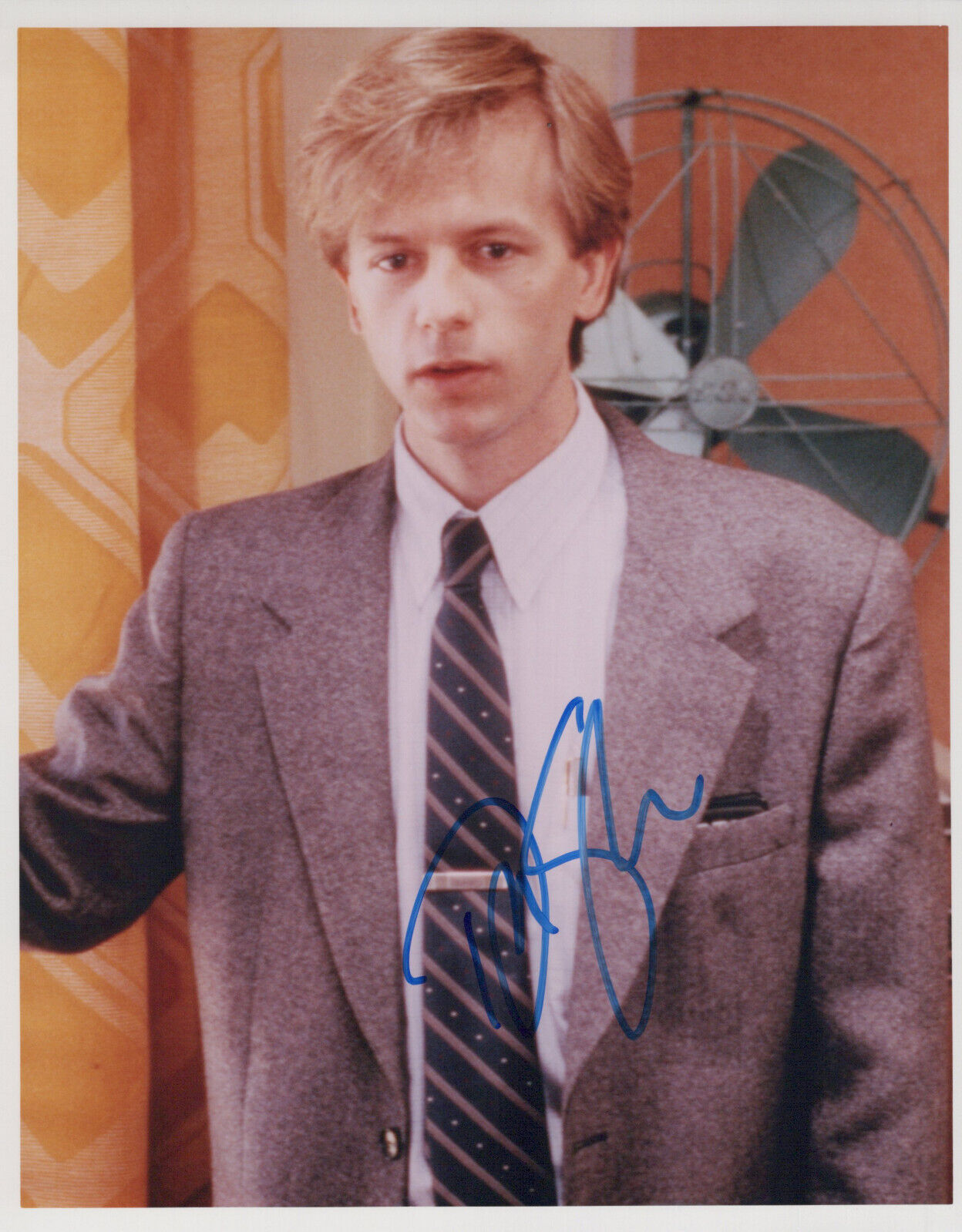

Was There A Tommy Boy Sequel Pitch From David Spade

May 14, 2025

Was There A Tommy Boy Sequel Pitch From David Spade

May 14, 2025 -

Il Destino Del Primo Figlio Appuntamento A Sanremo Con Marzia Taruffi Il 12 Aprile

May 14, 2025

Il Destino Del Primo Figlio Appuntamento A Sanremo Con Marzia Taruffi Il 12 Aprile

May 14, 2025