Dismissing Stock Market Valuation Worries: Insights From BofA

Table of Contents

BofA's Core Argument Against Valuation Concerns

BofA's central argument hinges on the belief that robust corporate earnings growth will ultimately outweigh current valuation multiples, rendering concerns about high P/E ratios less significant. Their analysis incorporates several key factors:

-

Strong Corporate Earnings Growth: BofA forecasts continued strong earnings growth for many companies, driven by factors like technological innovation, global expansion, and resilient consumer spending. This growth, they argue, will justify the current, seemingly high, valuations.

-

Falling Interest Rates (Historically): While interest rates are a complex factor, historically, falling interest rates have a positive impact on future earnings. Lower borrowing costs translate into increased profitability for companies, thereby supporting higher stock prices. Note: This section should be updated to reflect current interest rate environments.

-

Inflation Projections: BofA's analysis considers the impact of inflation on market valuations. While inflation can erode purchasing power, their projections suggest that the current inflationary pressures are likely to be transitory and manageable, without significantly impacting the overall growth trajectory.

-

Historical Valuation Comparisons: BofA likely compares current valuation multiples (like the price-to-earnings ratio) to historical data. This comparison may reveal that current valuations, while high, are not unprecedented and fall within the range of historical norms during periods of strong economic growth.

Addressing Key Valuation Metrics

BofA's analysis likely delves into specific valuation metrics to support their claims. Let's examine some key ones:

-

Price-to-Earnings Ratio (P/E): BofA's interpretation of high P/E ratios likely emphasizes that these ratios are relative and need to be considered within the context of earnings growth. High P/E ratios can be justified if earnings are expected to grow substantially in the future.

-

Sector-Specific Valuations: The analysis probably examines valuations on a sector-by-sector basis. Some sectors might be overvalued, while others might present attractive opportunities. Understanding these sector-specific differences is crucial for targeted investment strategies.

-

Price-to-Sales Ratio (P/S): This metric provides another perspective on valuation, especially useful for companies with low or negative earnings. BofA's analysis might show that the P/S ratio is still within reasonable bounds, considering the overall growth prospects.

-

Dividend Yield: BofA likely considers dividend yields in its overall valuation assessment. A healthy dividend yield can compensate for a higher P/E ratio, offering a more balanced perspective.

Potential Risks and Counterarguments

While BofA presents a bullish outlook, it's crucial to acknowledge potential risks and counterarguments:

-

Market Corrections: The possibility of a market correction remains. BofA's analysis likely assesses the likelihood and potential impact of such corrections, suggesting strategies to mitigate the risks.

-

Recessionary Risks: Economic downturns can significantly impact valuations. BofA's assessment likely weighs the probability of a recession and its potential effects on corporate earnings and stock prices.

-

Geopolitical Risks: Global events, like political instability or trade wars, can introduce unexpected volatility. BofA’s analysis considers such factors and their potential influence on the market.

-

BofA's Risk Mitigation Strategies: BofA likely outlines strategies to manage these risks, such as diversification, hedging, and disciplined investment approaches.

BofA's Recommended Investment Strategies

Based on their analysis, BofA might recommend specific investment strategies:

-

Sector Allocation: BofA likely suggests focusing on sectors poised for strong growth based on their research.

-

Portfolio Diversification: Diversifying across different asset classes and sectors is paramount to managing risk and optimizing returns.

-

Long-Term Investment: BofA likely advocates for a long-term investment horizon, recognizing that market fluctuations are normal and that a long-term strategy is crucial for achieving sustainable growth.

-

Risk Management: Implementing robust risk management strategies is vital. This may involve setting stop-loss orders, using hedging techniques, and carefully monitoring portfolio performance.

Conclusion

BofA's analysis suggests that concerns about high stock market valuations may be overstated. Their bullish outlook is rooted in projections of strong corporate earnings growth, the historical impact (or potential impact, dependent on current rates) of interest rates, and a careful consideration of inflation and geopolitical factors. However, potential risks, like market corrections and recessionary possibilities, must be acknowledged and managed through diversified portfolios and robust risk management strategies. Don't let stock market valuation worries deter you. Learn more about BofA's analysis and develop a robust investment strategy based on their insights. Understand the nuances of stock market valuation and make smarter investment choices today!

Featured Posts

-

A Conservative View On Harvards Challenges And Solutions

Apr 26, 2025

A Conservative View On Harvards Challenges And Solutions

Apr 26, 2025 -

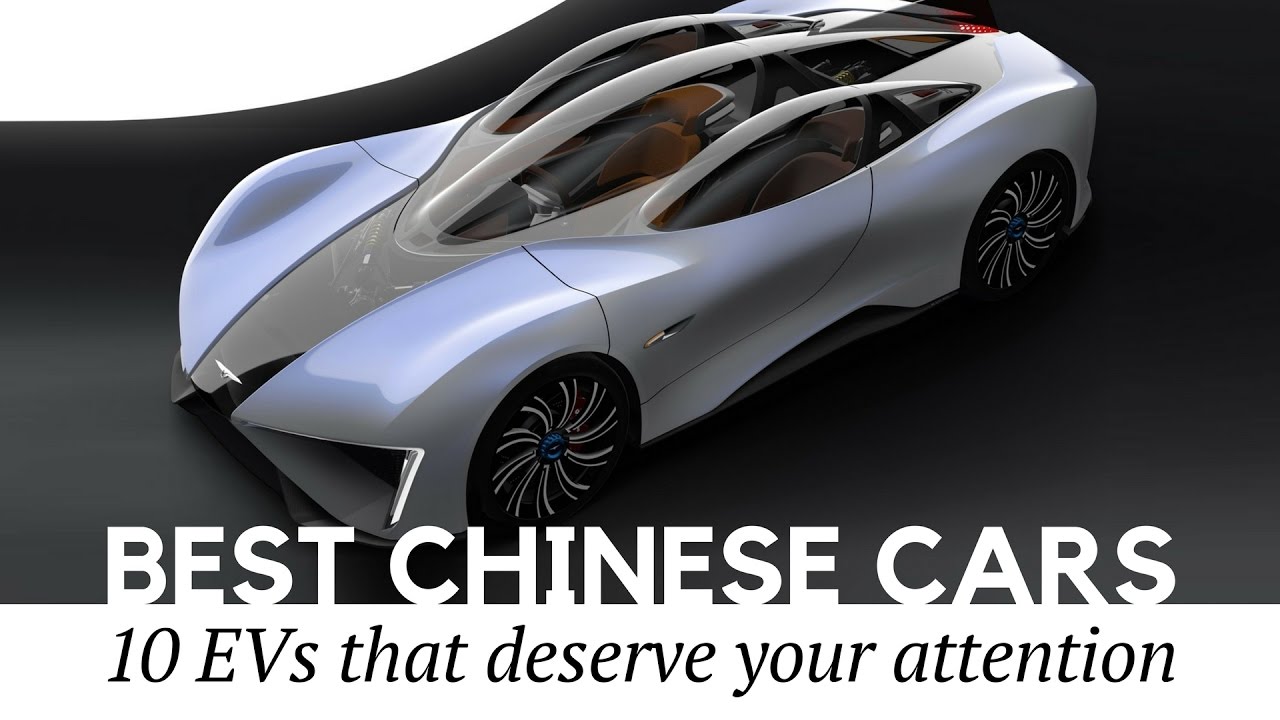

A Comprehensive Analysis The Future Of Chinese Made Vehicles

Apr 26, 2025

A Comprehensive Analysis The Future Of Chinese Made Vehicles

Apr 26, 2025 -

A Timeline Of Karen Reads Murder Cases

Apr 26, 2025

A Timeline Of Karen Reads Murder Cases

Apr 26, 2025 -

Dow Futures Chinas Economy And Todays Stock Market Trends

Apr 26, 2025

Dow Futures Chinas Economy And Todays Stock Market Trends

Apr 26, 2025 -

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025