Dollar's Decline: Ripple Effects On Asian Currencies

Table of Contents

Increased Export Competitiveness for Asian Nations

A weaker dollar translates directly into increased export competitiveness for Asian nations. With the dollar less valuable, goods priced in Asian currencies become relatively cheaper in dollar-denominated markets, including the vast US market. This increased price competitiveness boosts demand for Asian exports.

- Increased demand for Asian goods in the US and other dollar-using countries: Manufacturers in countries like Vietnam, China, and Bangladesh, exporting goods to the US, see a surge in orders as their products become more affordable.

- Potential for boosted economic growth in export-oriented Asian economies: Countries heavily reliant on exports, such as South Korea and Taiwan, can experience a significant boost in GDP growth due to increased export revenues.

- Case studies showing the positive impact on specific sectors (e.g., technology, manufacturing): The technology sector in countries like Taiwan and South Korea, for example, could see increased demand for their electronics and semiconductors due to the dollar's decline. Similarly, manufacturing hubs in countries like Vietnam and Bangladesh will likely experience increased orders for apparel and other manufactured goods.

Volatility and Uncertainty in Asian Currency Markets

The dollar's fluctuating value creates significant volatility in Asian currency exchange rates. This uncertainty presents substantial risks for businesses and investors alike. The unpredictable nature of the exchange rate makes it difficult to forecast future revenues and costs.

- Potential for currency exchange losses for businesses engaging in international trade: Companies involved in import and export activities face the risk of substantial financial losses if they fail to properly hedge against currency fluctuations.

- Increased risk for investors holding assets denominated in Asian currencies: Investors holding investments in Asian markets need to be aware of the potential for losses if the value of their holdings declines relative to the dollar.

- The role of hedging strategies in mitigating currency risk: Employing sophisticated hedging strategies, such as forward contracts or currency options, is crucial for mitigating currency risk and protecting against potential losses. Understanding currency risk management is vital for businesses and investors during periods of dollar weakness.

Impact on Inflation in Asian Countries

The dollar's decline can significantly impact inflation rates in Asian economies. The cost of dollar-denominated imports increases, leading to inflationary pressures, particularly in nations that are heavily reliant on imported goods.

- Increased cost of dollar-denominated imports: Countries importing raw materials, intermediate goods, or finished products priced in dollars face higher costs, leading to an increase in the prices of these goods in their local markets.

- Potential for inflationary pressures, especially in countries heavily reliant on imports: Countries with large trade deficits and significant dependence on imported goods may experience higher inflation rates.

- The role of central bank policies in managing inflation: Central banks in the region play a crucial role in managing inflationary pressures through monetary policy tools such as interest rate adjustments.

Investment Flows and Capital Movements

The weakening dollar can influence foreign direct investment (FDI) and portfolio investment flows into Asian countries. The relative attractiveness of Asian assets compared to those in dollar-denominated markets changes.

- Increased attractiveness of Asian assets for foreign investors seeking diversification: Investors looking to diversify their portfolios away from dollar-denominated assets may shift their investments towards Asian markets, leading to capital inflows.

- Potential capital inflows into Asian markets: This influx of capital can stimulate economic growth and support investments in infrastructure and other sectors.

- Potential challenges for Asian economies facing capital outflows: Conversely, some Asian economies might face capital outflows if investors perceive higher risks or better opportunities elsewhere.

Conclusion: Navigating the Changing Landscape of Asian Currencies

The dollar's decline presents a complex picture for Asian economies. While increased export competitiveness offers significant opportunities for growth, the resulting currency volatility and potential inflationary pressures pose substantial challenges. Understanding the interplay between the weakening dollar and Asian currencies is critical for effective economic management. Navigating this changing landscape requires careful consideration of investment strategies, risk mitigation techniques, and proactive policy responses by governments and central banks. Understanding the dollar's decline and its ripple effects on Asian currencies is crucial for investors and businesses alike. Stay tuned for further analysis and insights into the evolving dynamics of the global currency market.

Featured Posts

-

Sabrina Carpenter To Headline Fortnite Virtual Festival

May 06, 2025

Sabrina Carpenter To Headline Fortnite Virtual Festival

May 06, 2025 -

Broadway Buzz Betty Gilpins All In Approach To Oh Mary

May 06, 2025

Broadway Buzz Betty Gilpins All In Approach To Oh Mary

May 06, 2025 -

Fortnite A Beginners Guide To The Game

May 06, 2025

Fortnite A Beginners Guide To The Game

May 06, 2025 -

Nikes Next Big Move A Fitness Brand With Skims

May 06, 2025

Nikes Next Big Move A Fitness Brand With Skims

May 06, 2025 -

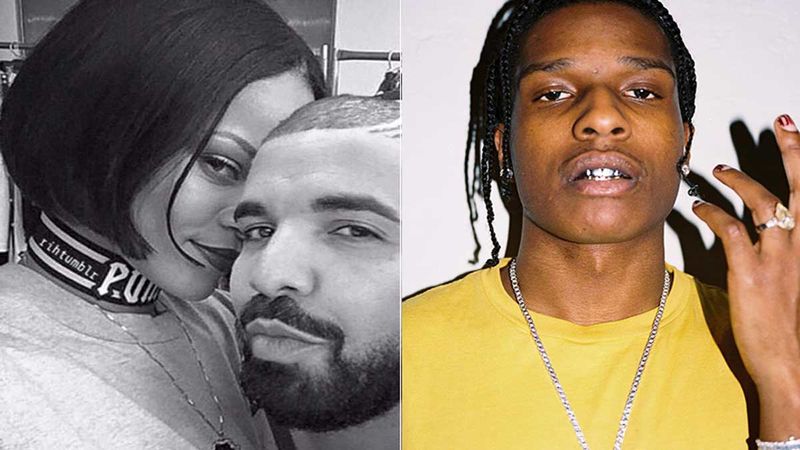

Rihanna Fuels Speculation Is She Dating A Ap Rocky

May 06, 2025

Rihanna Fuels Speculation Is She Dating A Ap Rocky

May 06, 2025