Don't Ignore: Crucial HMRC Child Benefit Communications

Table of Contents

Understanding Your HMRC Child Benefit Communications

HMRC uses various methods to contact you regarding your Child Benefit. Staying informed requires understanding these channels and keeping your contact details up-to-date. Missed communications can easily lead to problems, so vigilance is key.

- HMRC Letters: Traditional mail remains a primary method. Check your post regularly for official HMRC correspondence.

- Online Portal Updates: Your HMRC online account is a crucial resource. Regularly logging in allows you to access payment information, update details, and view important notifications.

- Email Notifications: HMRC may send emails regarding important updates. Ensure your registered email address is current and check your inbox for official communications. Be wary of phishing emails – always verify the sender's address.

- Text Messages: In some cases, HMRC may use text messages for urgent updates or payment confirmations.

Crucially: Always keep your address, email address, and phone number up-to-date on your HMRC online account. This ensures you receive all essential Child Benefit communications promptly.

- Regularly check your HMRC online account for updates.

- Ensure your registered address and email address are correct and current.

- Familiarize yourself with the types of HMRC communications, including payment confirmations, changes of circumstances notifications, and requests for information.

- Learn to identify official HMRC communications to protect yourself from scams. Look for official letterheads, secure email addresses (@gov.uk), and professional language.

Key Information to Look Out For in HMRC Child Benefit Correspondence

HMRC Child Benefit communications contain vital information impacting your payments and entitlements. Paying close attention to these details is essential for avoiding problems.

- Payment Amounts: Confirm that the stated Child Benefit payment amounts align with your expectations.

- Changes to Benefits: Be vigilant for notifications regarding changes to your entitlement. This might include increases or decreases in payments, or even cessation of payments due to changes in circumstances (e.g., your child turning 16).

- Tax Implications: Understand the tax implications, especially the High Income Child Benefit Charge. HMRC will communicate clearly if this applies to you.

- Reporting Changes: You have a responsibility to inform HMRC of any changes in your circumstances (e.g., changes to your income, address, marital status, or the number of children you have). Failing to do so can lead to overpayments or penalties.

- Eligibility Criteria: Stay informed about changes to eligibility criteria for Child Benefit.

What to Do if You Haven't Received Your Child Benefit Payment or Communication

If you haven't received your Child Benefit payment or any communication from HMRC, take immediate action.

- Check Your HMRC Online Account: This is your first point of call. Log in to see if there's any information about the missing payment or communication.

- Contact the HMRC Helpline: If the problem persists, contact the HMRC helpline. Their number is readily available on the government website.

- Use the Online Contact Form: The HMRC website offers an online contact form for submitting queries.

- Keep Records: Maintain records of all communications with HMRC, including dates, methods of contact, and any reference numbers provided.

Avoiding HMRC Child Benefit Fraud and Scams

Unfortunately, scams targeting Child Benefit recipients are prevalent. Be vigilant and protect your personal information.

- Suspicious Emails and Texts: Never click on links in unsolicited emails or texts claiming to be from HMRC.

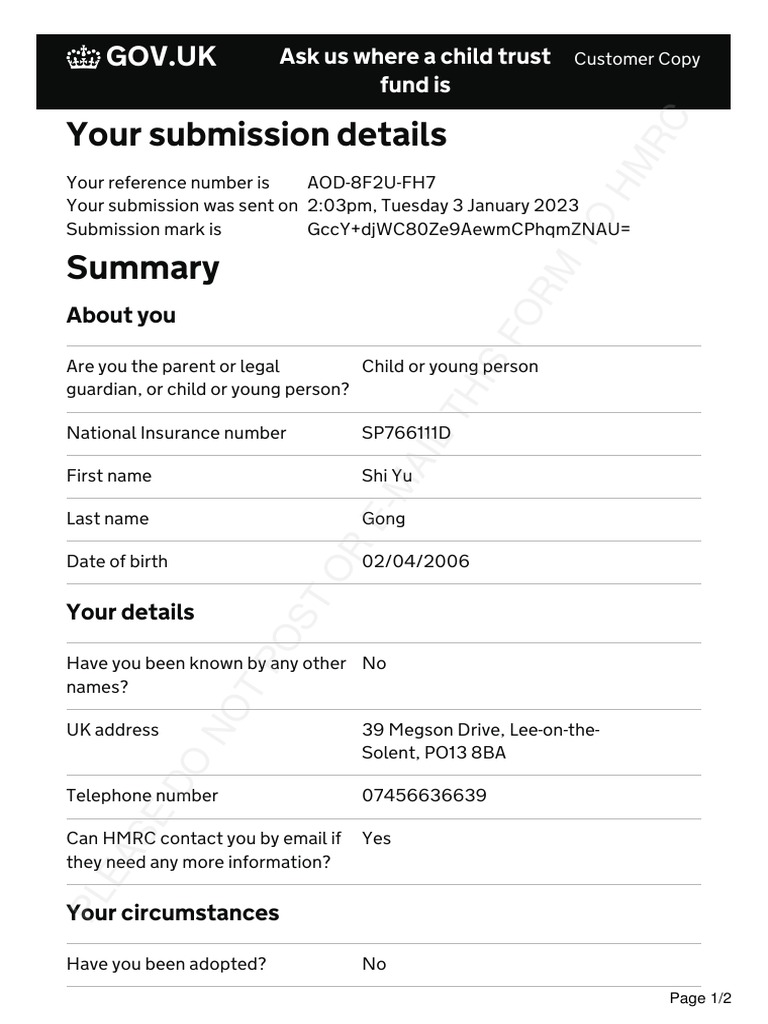

- Unsolicited Communication: Never disclose your personal information (National Insurance number, bank details, etc.) in response to unsolicited communication.

- Official Website Access: Only access your HMRC account through the official government website.

- Phishing Attempts: Be aware of phishing attempts that mimic official HMRC communications. Always verify the sender's address and the legitimacy of any links before clicking.

Conclusion: Stay Informed About Your HMRC Child Benefit

Promptly addressing all HMRC Child Benefit communications is vital to avoid financial difficulties and ensure you receive the benefits you're entitled to. Regularly checking your HMRC online account and promptly reporting any issues will help you manage your Child Benefit effectively. Don't miss out on crucial HMRC Child Benefit updates! Take control of your HMRC Child Benefit communications today! Contact HMRC immediately if you have any questions or concerns regarding your Child Benefit payments.

Featured Posts

-

Factors Contributing To D Wave Quantum Inc Qbts Stocks Monday Gains

May 20, 2025

Factors Contributing To D Wave Quantum Inc Qbts Stocks Monday Gains

May 20, 2025 -

Newly Discovered Letters Expose Agatha Christies Literary Feud

May 20, 2025

Newly Discovered Letters Expose Agatha Christies Literary Feud

May 20, 2025 -

Is Betting On Natural Disasters Like The La Wildfires Acceptable A Moral And Ethical Dilemma

May 20, 2025

Is Betting On Natural Disasters Like The La Wildfires Acceptable A Moral And Ethical Dilemma

May 20, 2025 -

Hmrc Refunds Could Millions Be Entitled To A Payout

May 20, 2025

Hmrc Refunds Could Millions Be Entitled To A Payout

May 20, 2025 -

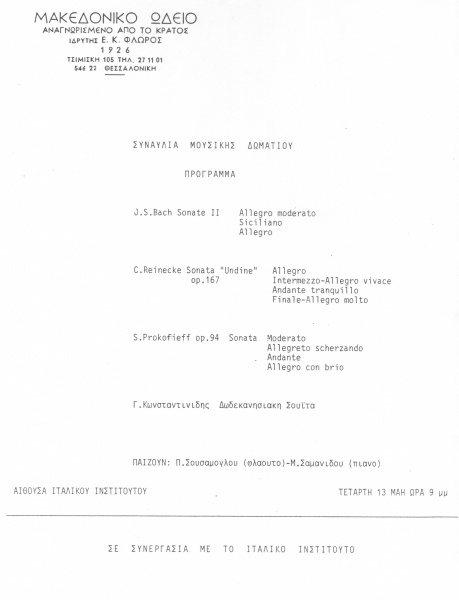

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Stin Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Stin Dimokratiki

May 20, 2025