Dow Delays Major Canadian Project Amid Market Volatility

Table of Contents

Details of the Delayed Project

Dow Chemical's delayed project, tentatively named "Project NorthStar," is a proposed petrochemical plant located in Alberta, Canada. The project, initially estimated to cost $5 billion CAD, was expected to create over 10,000 jobs during construction and several thousand permanent positions once operational. Dow cited several factors contributing to the delay, primarily fluctuating energy prices, significantly increased material costs driven by global supply chain disruptions, and a general tightening of credit markets making securing financing more difficult.

- Project Type: Large-scale petrochemical plant designed to produce ethylene and polyethylene.

- Projected Timeline: The original timeline projected completion by 2025. The delay pushes the potential restart date into an indefinite future, pending improved market conditions.

- Initial Investment Amount: $5 billion CAD (approximately $3.7 billion USD).

- Job Creation Numbers Affected: Over 10,000 construction jobs and thousands of permanent operational jobs are currently on hold.

In a statement released to the media, a Dow Chemical spokesperson said, "Given the current economic uncertainty and volatility in the energy markets, we have made the difficult decision to postpone Project NorthStar. We will continue to monitor market conditions and assess the viability of restarting the project at a later date." This statement reflects the cautious approach many companies are taking in the face of unpredictable market forces.

Impact of Market Volatility on Resource Development

Market volatility significantly impacts large-scale resource development projects. Fluctuating commodity prices, particularly for oil and natural gas, directly affect the profitability of such ventures. Similarly, interest rate hikes and decreased investor confidence contribute to increased financing costs and reduced willingness to invest in long-term projects like Project NorthStar. This economic uncertainty creates a ripple effect, impacting not only the project itself but also related industries and the broader Canadian economy.

- Commodity Price Fluctuations: The recent volatility in oil and natural gas prices, coupled with increased inflation in raw materials, has significantly increased the project's projected costs, making it financially less attractive.

- Investor Sentiment: Investor apprehension regarding the long-term stability of the energy sector and concerns about potential regulatory changes have also contributed to the delay. Financing for such large-scale projects relies heavily on securing significant investor confidence.

- Potential Long-Term Consequences: Delays in major resource development projects can have far-reaching consequences, including job losses, reduced economic growth, and a potential slowdown in Canada's energy sector. This uncertainty can discourage future investment and hinder the development of critical infrastructure.

Dow's Response and Future Outlook

Dow Chemical's official statement acknowledges the challenges posed by market volatility and emphasizes the company's commitment to long-term sustainability. The company plans to continuously evaluate the situation, with a potential restart of Project NorthStar contingent on improved market conditions, including more stable commodity prices and increased investor confidence. In the interim, Dow is focusing on optimizing its existing Canadian operations and exploring other strategic investment opportunities within the country.

- Dow's Official Press Release: The press release highlights the company's commitment to responsible resource development and its ongoing assessment of the market.

- Potential Contingency Plans: Dow is exploring alternative strategies, including potentially scaling down the project or seeking strategic partnerships to share the financial risk.

- Dow's Ongoing Commitment to Canadian Operations: Dow has reaffirmed its commitment to its Canadian operations, suggesting that Project NorthStar's delay doesn't represent a withdrawal from the Canadian market.

- Long-Term Implications: The long-term implications for the Canadian energy landscape depend on future market trends and government policies. The delay underscores the need for greater regulatory certainty and support for large-scale projects to mitigate risks associated with market volatility.

Conclusion

Dow Chemical's delay of its major Canadian project serves as a stark reminder of the challenges posed by market volatility in the resource development sector. Fluctuating commodity prices, economic uncertainty, and shifting investor confidence significantly impact the viability of large-scale projects, with knock-on effects for employment and economic growth in Canada. The delay highlights the crucial need for robust risk management strategies and a clearer understanding of the interconnectedness of global economic factors and their impact on domestic energy projects.

Understanding the complexities of market volatility and its impact on major projects is crucial for informed decision-making in the Canadian energy sector. Stay informed on the latest developments regarding Dow's Canadian project and other related resource developments to better navigate the evolving landscape. Further analysis of similar projects and their response to market fluctuations is needed to mitigate future risks and foster a more stable and sustainable energy future in Canada. Continued monitoring of Canadian project developments and market volatility is essential.

Featured Posts

-

Alberto Ardila Olivares Un Sistema Para Garantizar Goles

Apr 27, 2025

Alberto Ardila Olivares Un Sistema Para Garantizar Goles

Apr 27, 2025 -

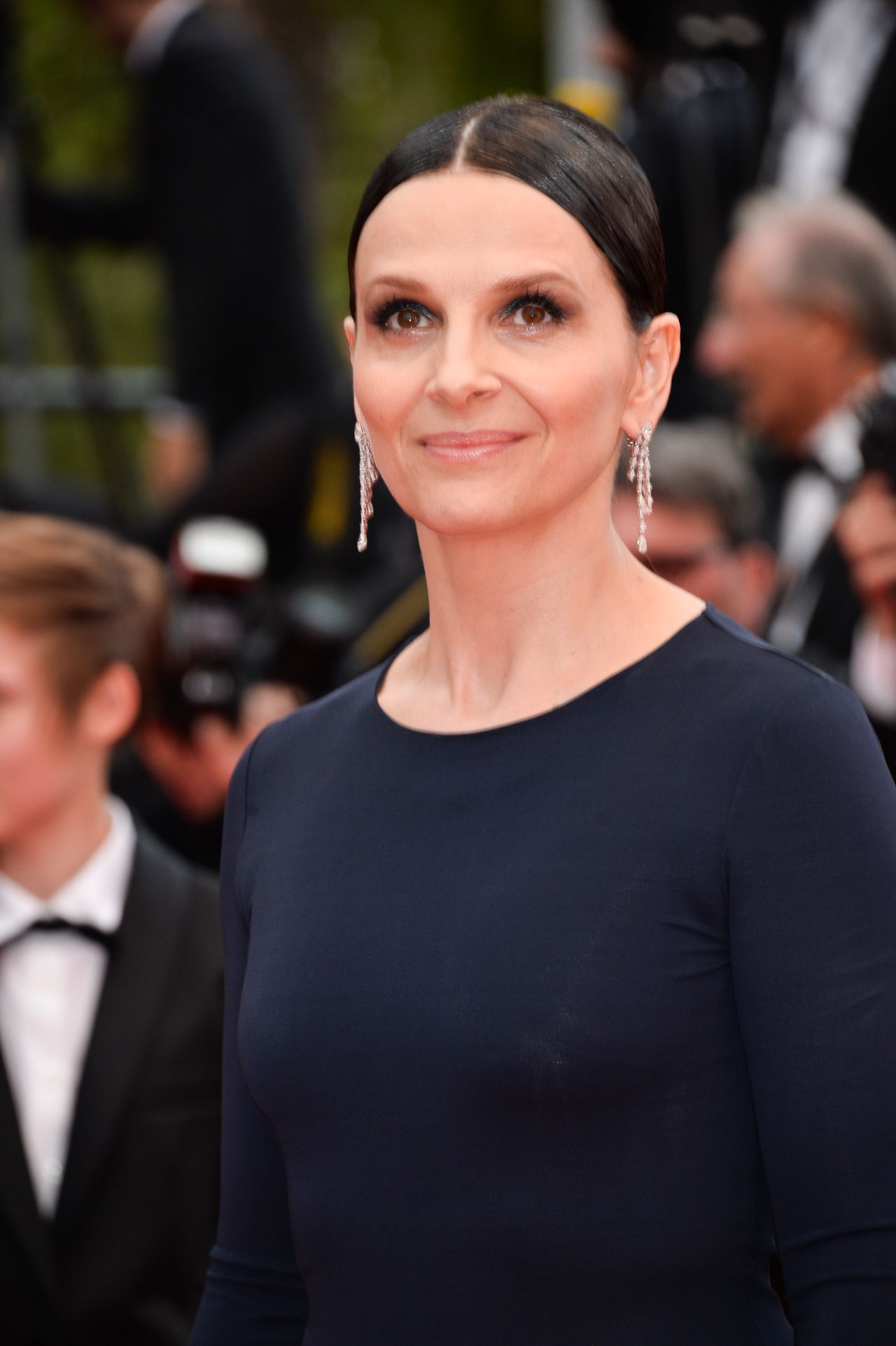

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025 -

2025 Cannes Film Festival Juliette Binoches Presidency Announced

Apr 27, 2025

2025 Cannes Film Festival Juliette Binoches Presidency Announced

Apr 27, 2025

Latest Posts

-

Alberta Economy Hit Dow Project Delay And Tariff Impacts

Apr 28, 2025

Alberta Economy Hit Dow Project Delay And Tariff Impacts

Apr 28, 2025 -

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025 -

Hudsons Bays Final Days Massive Discounts On Closing Stock

Apr 28, 2025

Hudsons Bays Final Days Massive Discounts On Closing Stock

Apr 28, 2025 -

Final Hudsons Bay Stores 70 Off Liquidation Event

Apr 28, 2025

Final Hudsons Bay Stores 70 Off Liquidation Event

Apr 28, 2025 -

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025