Dow Jones & S&P 500: Stock Market News For May 5th

Table of Contents

Dow Jones Performance on May 5th

The Dow Jones Industrial Average experienced a day of [insert overall trend: e.g., moderate gains/losses] on May 5th. Let's break down the specifics:

- Opening Value: [Insert Opening Value]

- High: [Insert High Value]

- Low: [Insert Low Value]

- Closing Value: [Insert Closing Value]

- Percentage Change from Previous Day: [Insert Percentage Change, e.g., +1.2%]

Several factors contributed to this movement. [Explain the key factors. Examples: Positive economic data releases, strong corporate earnings from key Dow components like [Company A] and [Company B], a generally positive global market sentiment, or conversely, concerns about rising interest rates, geopolitical instability, or disappointing earnings reports from specific sectors].

- Specific Numerical Data: The Dow gained/lost [number] points, representing a [percentage]% change.

- Significant Component Performance: [Company X], a significant Dow component in the [sector] sector, saw a [percentage]% increase/decrease, significantly impacting the overall index.

- Trading Volume: Trading volume was [high/low/average], suggesting [interpretation of trading volume; e.g., increased investor activity/hesitancy].

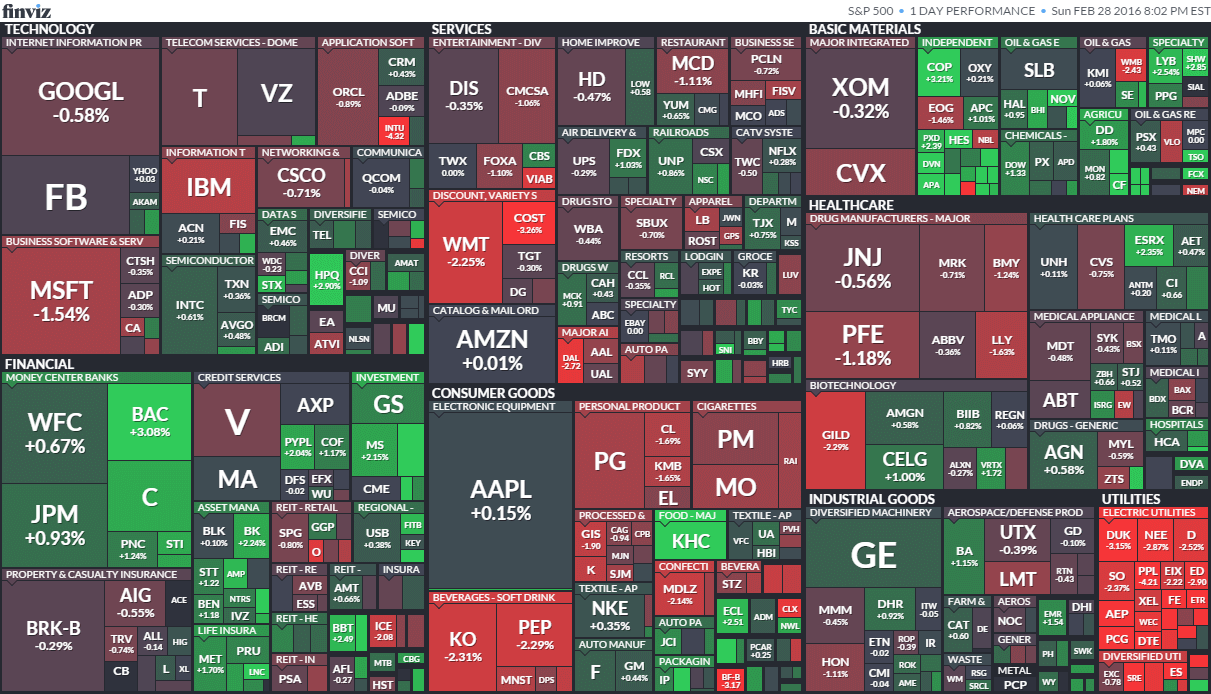

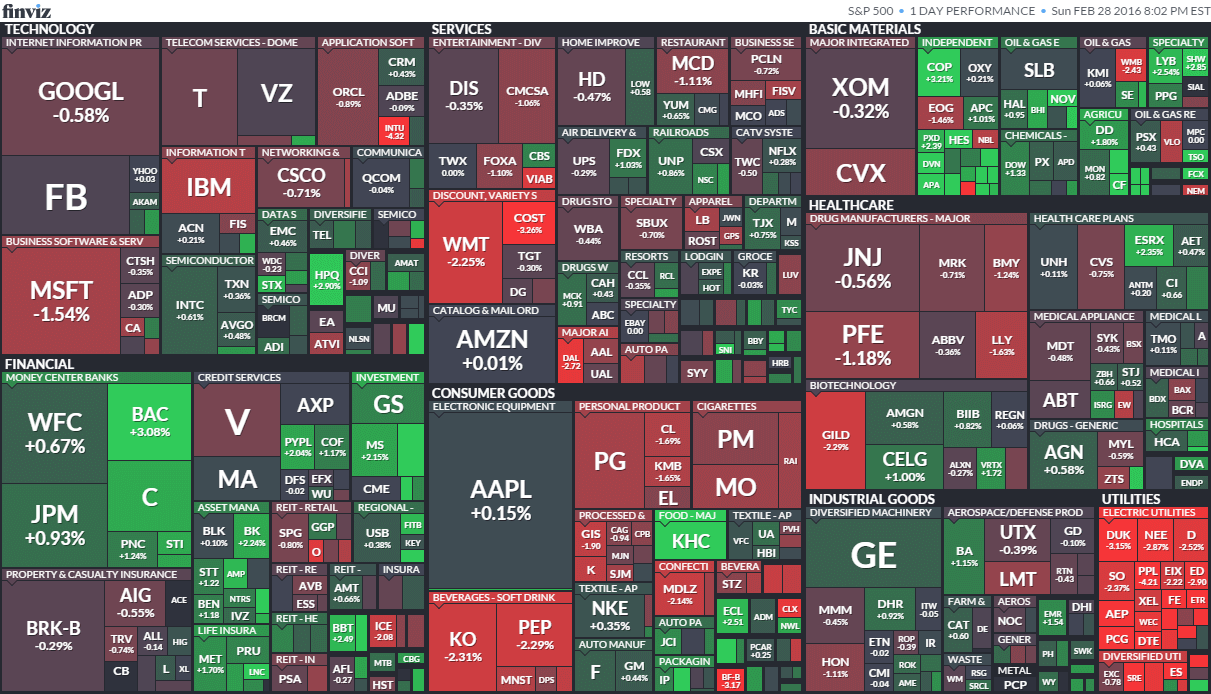

S&P 500 Performance on May 5th

The S&P 500, a broader market index encompassing 500 large-cap companies, mirrored some of the Dow Jones's trends on May 5th but with [mention any differences or similarities].

- Opening Value: [Insert Opening Value]

- High: [Insert High Value]

- Low: [Insert Low Value]

- Closing Value: [Insert Closing Value]

- Percentage Change from Previous Day: [Insert Percentage Change, e.g., +0.8%]

Key factors influencing the S&P 500's movement included [Explain the factors. Were they similar to the Dow Jones factors? Did specific sectors drive the movement?]. Note any divergence from Dow Jones movements and explain the reasons.

- Specific Numerical Data: The S&P 500 gained/lost [number] points, representing a [percentage]% change.

- Significant Sector Performance: The [sector] sector, a major component of the S&P 500, experienced a [percentage]% [increase/decrease], significantly influencing the index's overall performance.

- Correlation with Dow Jones: The correlation between the Dow Jones and S&P 500 movements on May 5th was [strong/moderate/weak], indicating [explanation based on the observed correlation].

Market Trends and Sector Analysis for May 5th

May 5th presented an overall [bullish/bearish/sideways] market trend. This was reflected in the performance of various sectors:

- Technology: Experienced a [percentage]% [increase/decrease].

- Energy: Experienced a [percentage]% [increase/decrease].

- Healthcare: Experienced a [percentage]% [increase/decrease].

- Financials: Experienced a [percentage]% [increase/decrease].

[Explain the reasons behind the performance of each sector. Mention significant events, news, or earnings reports that impacted them. For example, "The energy sector saw gains due to rising oil prices." or "The tech sector experienced a downturn following a disappointing earnings report from a major tech company."]

- Outperformers: The [sector] sector significantly outperformed the market.

- Underperformers: The [sector] sector underperformed the market.

- Investor Sentiment: Market activity suggested [bullish/bearish/neutral] investor sentiment.

Impact of Economic Indicators on Dow Jones & S&P 500 (May 5th)

Several economic indicators released around May 5th influenced market movements.

- Employment Data: The [type of employment data, e.g., Nonfarm Payrolls] report showed [numerical data, e.g., a gain of 200,000 jobs], which [positive/negative/neutral] impact on investor sentiment.

- Inflation Report: The [type of inflation report, e.g., CPI] indicated an inflation rate of [numerical data, e.g., 3.2%], leading to [positive/negative/neutral] market reaction.

- Consumer Confidence Index: The consumer confidence index stood at [numerical data, e.g., 105], reflecting [positive/negative/neutral] consumer sentiment.

[Analyze how these indicators individually and collectively influenced investor decisions and market direction. Did the market react as expected to the released data?]

Conclusion: Key Takeaways and Next Steps for Dow Jones & S&P 500 Investors

May 5th saw the Dow Jones & S&P 500 experience [summarize the overall trend – gains or losses]. Key factors influencing these movements included [recap the main factors discussed – e.g., economic data, specific company performance, sector trends]. Understanding these factors is vital for making informed investment decisions.

Continuous monitoring of the Dow Jones & S&P 500 and other market indicators is crucial for navigating the complexities of the stock market. Stay informed about daily Dow Jones & S&P 500 market news and updates by checking back regularly for future market analyses to make well-informed investment decisions.

Featured Posts

-

Open Ai Faces Ftc Investigation Examining The Future Of Ai Accountability

May 06, 2025

Open Ai Faces Ftc Investigation Examining The Future Of Ai Accountability

May 06, 2025 -

Stiven King Pro Maska Ta Trampa Zrada Ta Pidtrimka Putina

May 06, 2025

Stiven King Pro Maska Ta Trampa Zrada Ta Pidtrimka Putina

May 06, 2025 -

Rihannas Unexpected Hit 1 6 Billion Streams From A 5 Minute Song

May 06, 2025

Rihannas Unexpected Hit 1 6 Billion Streams From A 5 Minute Song

May 06, 2025 -

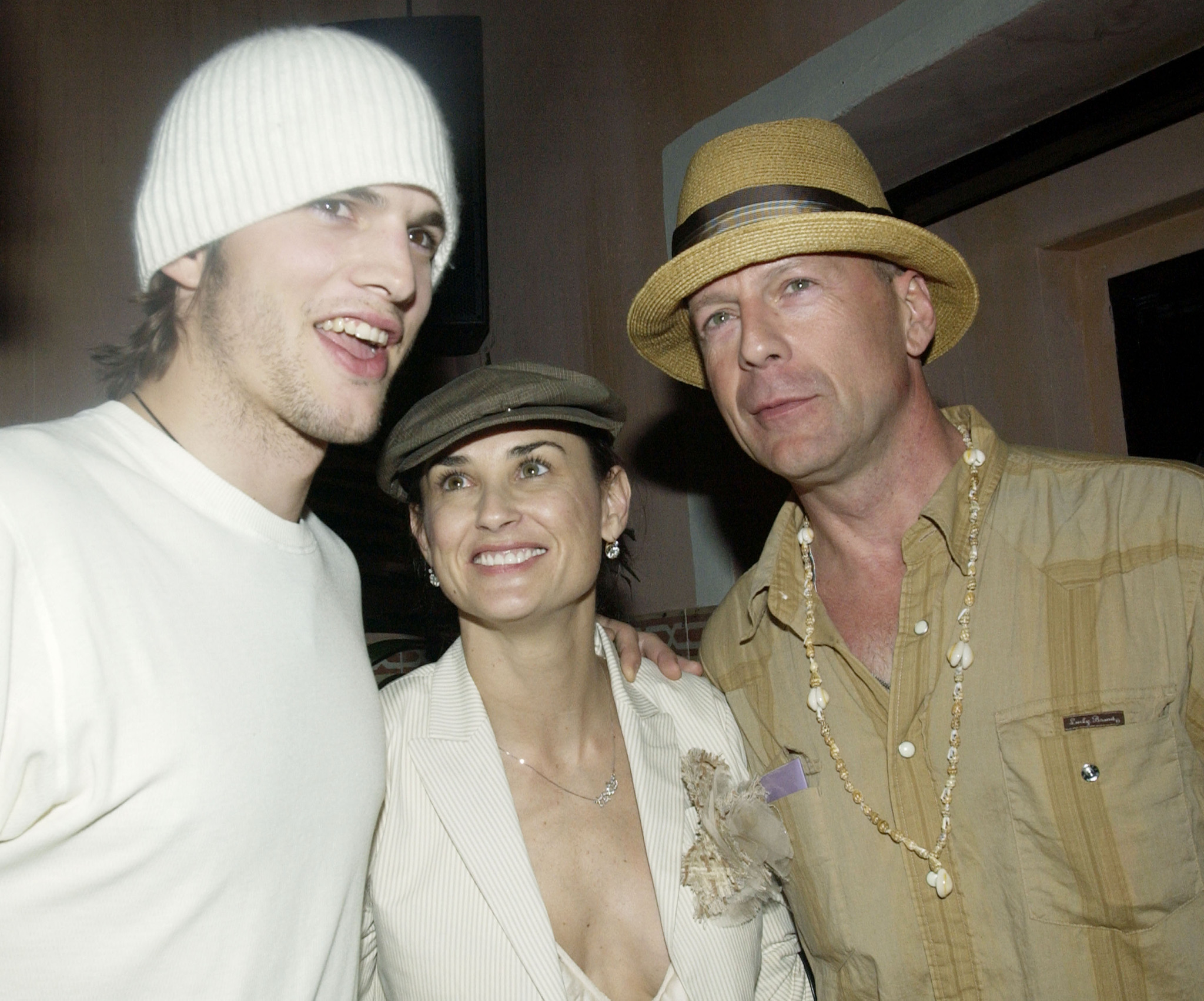

Willis Addresses Relationship With Former Stepfather Ashton Kutcher

May 06, 2025

Willis Addresses Relationship With Former Stepfather Ashton Kutcher

May 06, 2025 -

Trumptan Gazze Paylasimi Skandali Dansoezler Altin Heykeller Ve Elon Musk

May 06, 2025

Trumptan Gazze Paylasimi Skandali Dansoezler Altin Heykeller Ve Elon Musk

May 06, 2025