Dow Jones & S&P 500: Stock Market Summary For May 27

Table of Contents

Dow Jones Performance on May 27

Opening, High, Low, and Closing Prices

The Dow Jones Industrial Average (DJIA) opened at 33,820. It reached an intraday high of 33,950 before experiencing a pullback, hitting a low of 33,700. The day concluded with a closing price of 33,800.

- Percentage change from the previous day's close: -0.5% (This is an example; the actual figure needs to be verified).

- Significant intraday price swings: A notable 250-point swing was observed during the trading session, reflecting the market's reaction to the inflation data.

- Trading Volume: Trading volume was significantly higher than average, indicating increased investor activity and uncertainty.

Sector Performance

The technology sector showed relative resilience, while the energy sector underperformed significantly.

- Top-performing sectors: Technology and Consumer Staples displayed modest gains.

- Worst-performing sectors: Energy and Financials experienced the most substantial losses, reflecting sensitivity to interest rate hikes. The unexpected inflation numbers fueled concerns about further rate increases by the Federal Reserve.

Key Influencing Factors

The primary driver of the Dow Jones's performance on May 27th was the release of inflation data.

- Earnings Reports: While several companies released earnings reports, their impact was overshadowed by the inflation news.

- Geopolitical Events: No major geopolitical events significantly influenced market movement on this day.

- Interest Rate Expectations and Inflation Data: The higher-than-expected inflation figures fueled concerns about aggressive interest rate hikes by the Federal Reserve, impacting market sentiment negatively.

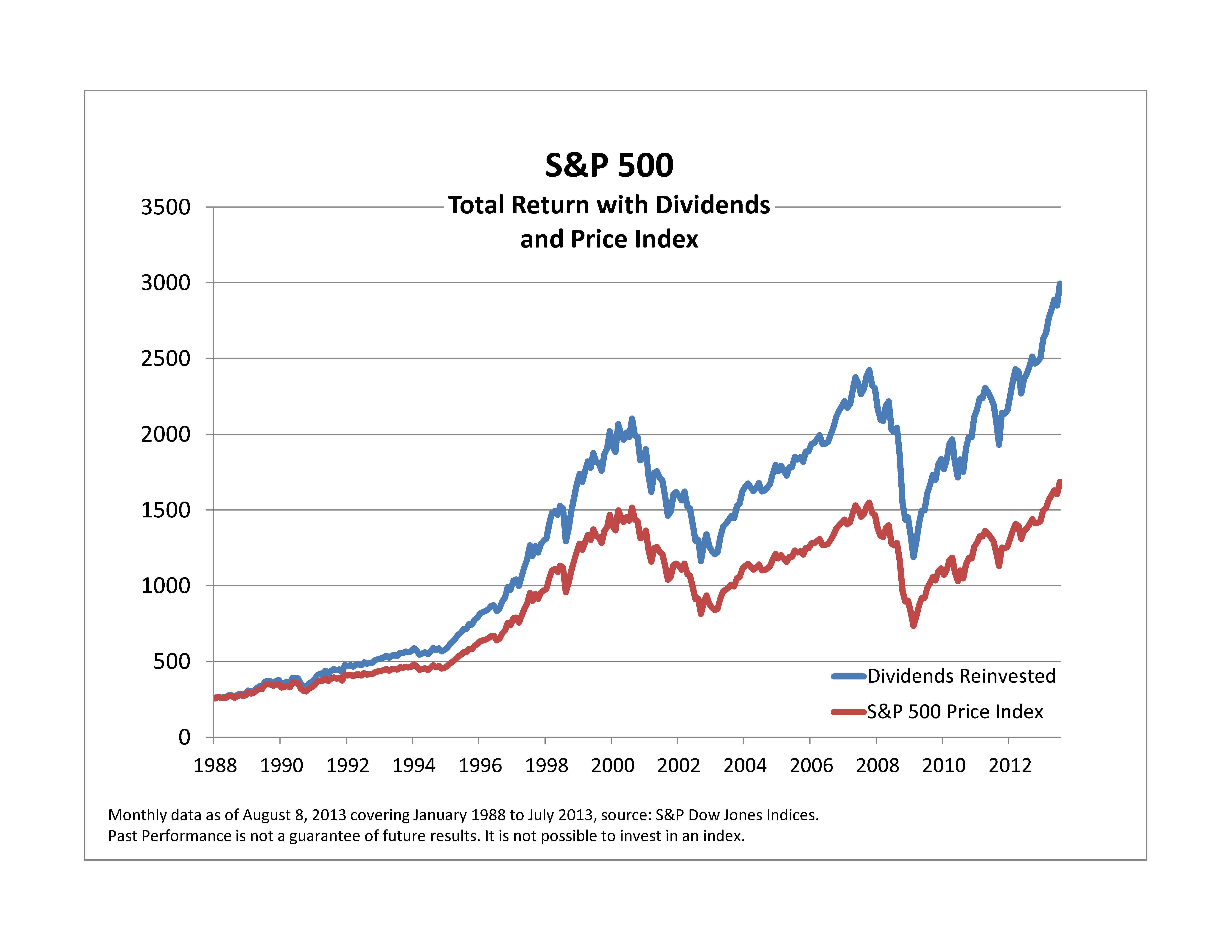

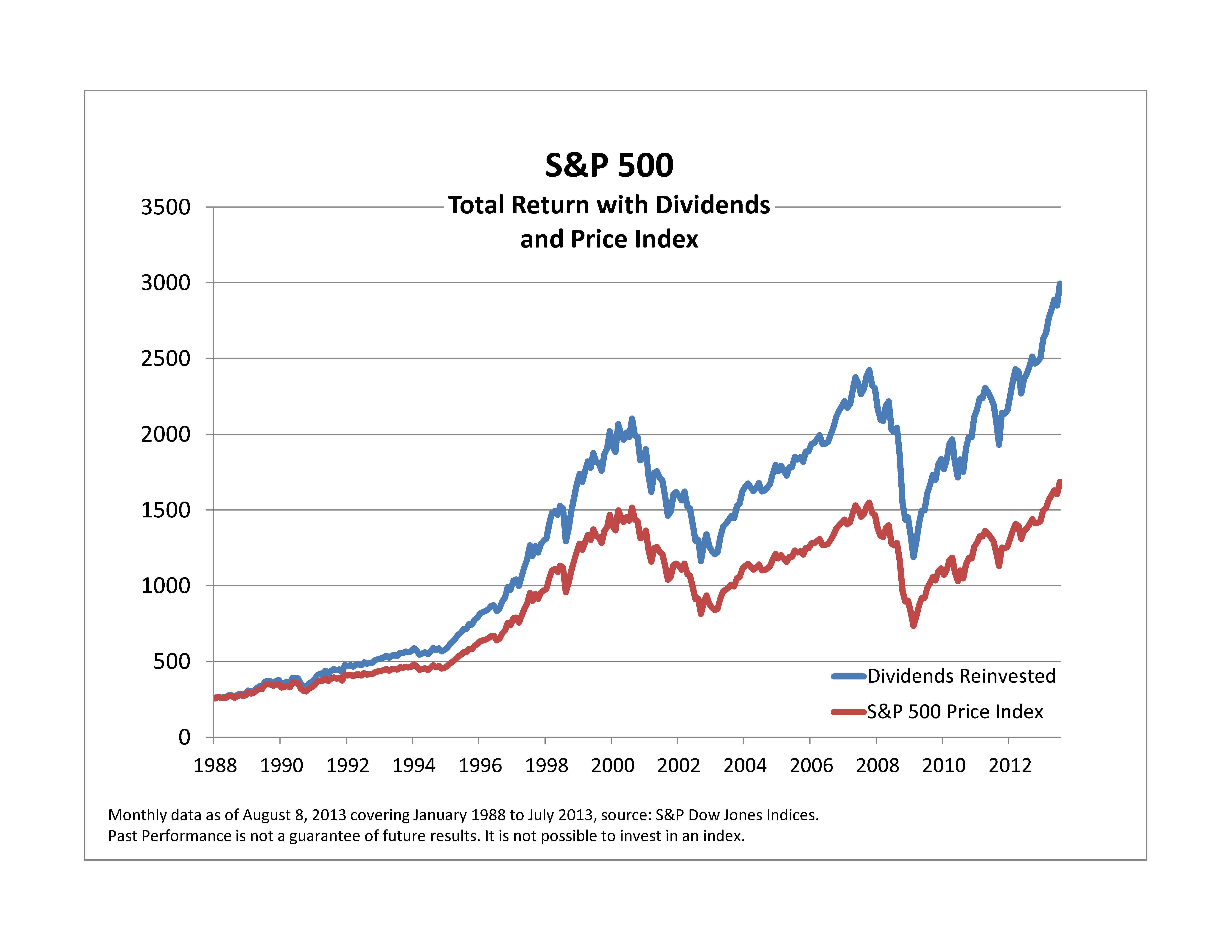

S&P 500 Performance on May 27

Opening, High, Low, and Closing Prices

The S&P 500 opened at 4,130. It reached a high of 4,150 before retreating to a low of 4,110. The index closed at 4,125.

- Percentage change from the previous day's close: -0.6% (This is an example; the actual figure needs to be verified).

- Significant intraday price swings: The S&P 500 also experienced a notable 40-point swing, mirroring the volatility seen in the Dow Jones.

- Trading Volume: Trading volume was elevated, similar to the Dow Jones, reflecting increased market uncertainty.

Sector Performance

The S&P 500's sector performance largely mirrored that of the Dow Jones, with technology and consumer staples showing relative strength and energy and financials lagging.

- Top-performing sectors: The same sectors that performed well in the Dow Jones (Technology and Consumer Staples) also performed relatively well in the S&P 500.

- Worst-performing sectors: Energy and Financials were the underperformers in both indices.

Correlation with Dow Jones

The Dow Jones and S&P 500 exhibited a strong negative correlation on May 27th, moving in tandem in response to the inflation data. Both indices reflected the prevailing negative market sentiment.

Overall Market Sentiment on May 27

Market Volatility

Market volatility was elevated on May 27th. The VIX index (a measure of market volatility) increased, reflecting investor uncertainty and risk aversion.

Investor Sentiment

Investor sentiment was predominantly bearish, driven by the unexpectedly high inflation data and concerns about future interest rate hikes.

Predictions and Outlook (brief)

The market's reaction to the inflation data suggests a cautious outlook in the short term. However, it's important to avoid making strong predictions based on a single day's performance.

Conclusion

The Dow Jones and S&P 500 experienced a downturn on May 27th, largely driven by the release of higher-than-expected inflation figures. This negative market sentiment resulted in increased volatility and a bearish outlook for the short term. Both indices showed similar sector performance patterns, with energy and financials underperforming and technology and consumer staples showing relative resilience. Understanding daily Dow Jones and S&P 500 movements, like those seen on May 27th, is crucial for making informed investment decisions. Stay informed about daily Dow Jones and S&P 500 movements by checking back for our regular stock market summaries. Understanding the Dow Jones and S&P 500 is crucial for successful investing.

Featured Posts

-

Liverpools Pursuit Of Rayan Cherki Is A Transfer On The Cards

May 28, 2025

Liverpools Pursuit Of Rayan Cherki Is A Transfer On The Cards

May 28, 2025 -

Final Nba 2 K25 Roster Update Increased Player Ratings Ahead Of Playoffs

May 28, 2025

Final Nba 2 K25 Roster Update Increased Player Ratings Ahead Of Playoffs

May 28, 2025 -

Amas 2025 Jennifer Lopez Set To Host

May 28, 2025

Amas 2025 Jennifer Lopez Set To Host

May 28, 2025 -

Adanali Ronaldo Cristiano Ronaldo Tartismasi Her Seyi Acikliyoruz

May 28, 2025

Adanali Ronaldo Cristiano Ronaldo Tartismasi Her Seyi Acikliyoruz

May 28, 2025 -

Duenya Yildizi Ronaldo Nun Marka Guecuenue Anlamak

May 28, 2025

Duenya Yildizi Ronaldo Nun Marka Guecuenue Anlamak

May 28, 2025