Dow Jones Index: Cautious Climb Continues After Strong PMI Data

Table of Contents

Strong PMI Data Fuels Optimism

Understanding the PMI

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers in the manufacturing and service sectors. A PMI above 50 generally signals expansion, while a reading below 50 indicates contraction. Its significance lies in its ability to provide a forward-looking perspective on economic activity, often acting as a leading indicator of future GDP growth. The PMI's broad scope, encompassing a range of businesses, makes it a robust tool for economic analysis.

- PMI exceeding expectations signals strong manufacturing and service sector activity, suggesting a healthy economic climate. For example, a recent PMI reading significantly above the consensus forecast would translate to a more optimistic outlook for corporate earnings.

- Positive PMI data boosts investor confidence, leading to increased buying and pushing the Dow Jones Index higher. This influx of investment capital directly impacts stock prices.

- A recent PMI reading of X (replace with actual data) significantly impacted the Dow Jones Index, resulting in a Y% increase (replace with actual data). You can find the latest PMI data from sources like the Institute for Supply Management (ISM) and Markit Economics. [Link to reliable PMI data source 1] [Link to reliable PMI data source 2]

- The strength of the PMI indicates potential for continued growth and strengthens the case for a positive outlook for the Dow Jones Index in the short to medium term.

Cautious Optimism: Factors Dampening Enthusiasm

Inflationary Pressures

Lingering concerns about inflation continue to temper the enthusiasm surrounding the strong PMI data. High inflation erodes purchasing power, potentially leading to decreased consumer spending and ultimately slower economic growth. This creates a challenging environment for businesses and investors alike.

- High inflation can erode consumer spending and slow economic growth, dampening the positive effects of the strong PMI. This creates an environment of uncertainty for businesses, impacting their stock prices.

- The potential for further interest rate hikes by the Federal Reserve in response to inflation poses a significant risk to the stock market's performance. Rising interest rates increase borrowing costs, impacting corporate profits and potentially leading to a sell-off.

- Recent statements from the Federal Reserve regarding their commitment to controlling inflation suggest that interest rate hikes remain a possibility. Closely monitoring these announcements is crucial for understanding their effect on the Dow Jones Index.

Geopolitical Uncertainty

Ongoing geopolitical events introduce significant uncertainty into the market, adding another layer of complexity to the analysis of the Dow Jones Index. These events can significantly impact investor sentiment and lead to increased market volatility.

- The ongoing conflict in Ukraine (or other relevant geopolitical event) and its impact on energy prices and global supply chains contribute significantly to market uncertainty. This affects various sectors represented in the Dow Jones Index.

- Such events contribute to market volatility, making it challenging to predict the future trajectory of the Dow Jones Index with complete accuracy. This volatility can lead to rapid price swings, both positive and negative.

- Investor sentiment is directly impacted by geopolitical events. Negative news tends to trigger risk aversion, leading to selling pressure and potentially causing the Dow Jones Index to decline.

Analyzing the Dow Jones Index's Recent Performance

Key Sectors Driving Growth

Following the release of the positive PMI data, certain sectors within the Dow Jones Index have shown significant growth. This growth is largely driven by the positive economic outlook reflected in the PMI.

- The Technology sector (mention specific companies like Apple, Microsoft) has seen strong performance, reflecting investor confidence in the long-term growth potential of these companies.

- The Industrial sector (mention specific companies) has also benefitted from the robust manufacturing activity highlighted by the PMI. The increased demand for goods is driving growth in this sector.

- [Include relevant charts and graphs illustrating the performance of these sectors, clearly labelled and sourced]

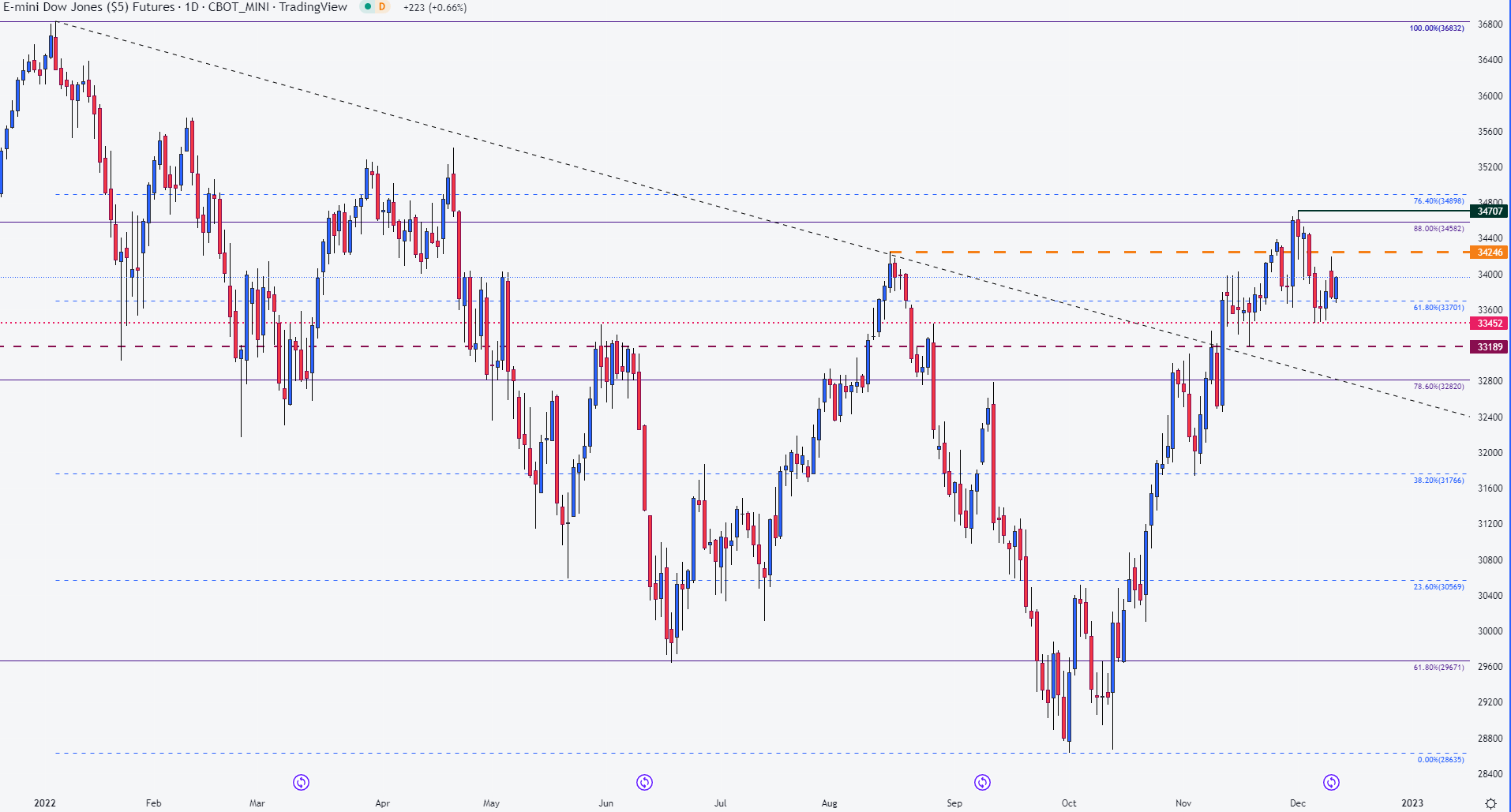

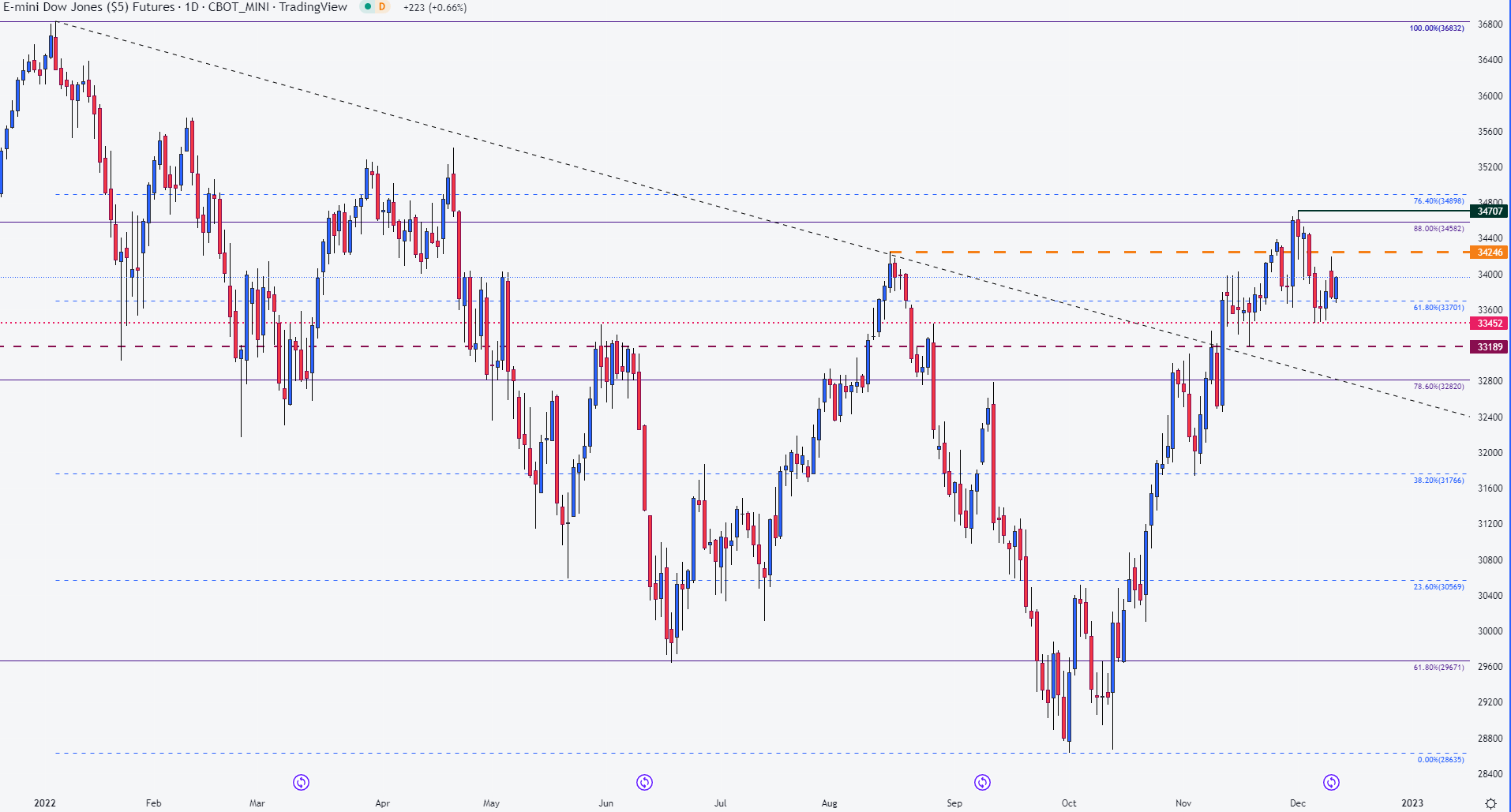

Technical Analysis of the Dow Jones Index

Technical analysis provides further insights into the Dow Jones Index's potential future price movements. By studying various indicators, analysts can gain a clearer understanding of prevailing market trends.

- The 50-day and 200-day moving averages (or other relevant indicators) suggest [explain the current state and implications of these indicators]. (Include a chart showing these indicators)

- Support and resistance levels are currently at [mention the levels] suggesting potential price boundaries. (Include a chart showing these levels)

- These indicators suggest a [bullish/bearish/neutral] outlook for the Dow Jones Index in the near term. (Remember to clearly define and explain your reasoning)

Conclusion

The Dow Jones Index has experienced a cautious climb following strong PMI data, reflecting a balance between optimism regarding economic growth and concerns about inflation and geopolitical uncertainty. While the positive PMI provides a foundation for continued growth, investors should remain vigilant about ongoing challenges. The interplay of economic indicators, inflation, and geopolitical events will continue to shape the Dow Jones Index's trajectory.

Call to Action: Stay informed about the latest developments affecting the Dow Jones Index and other key market indicators to make informed investment decisions. Monitor the Dow Jones Index closely for further insights into market trends and potential opportunities. Regularly check for updated analyses on the Dow Jones Index and related economic data to navigate the market effectively.

Featured Posts

-

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 25, 2025

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 25, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Spike For At And T

May 25, 2025

Broadcoms V Mware Acquisition A 1 050 Price Spike For At And T

May 25, 2025 -

Massive Rubber Duck To Promote Water Safety In Myrtle Beach

May 25, 2025

Massive Rubber Duck To Promote Water Safety In Myrtle Beach

May 25, 2025 -

Solving The Disappearance Methods And Techniques

May 25, 2025

Solving The Disappearance Methods And Techniques

May 25, 2025 -

The Ferrari Challenge Comes To South Florida Racing Days Unveiled

May 25, 2025

The Ferrari Challenge Comes To South Florida Racing Days Unveiled

May 25, 2025