Dragon Den: Against All Odds – A Risky Deal Accepted

Table of Contents

The Initial Pitch: A High-Risk, High-Reward Proposition

The episode features "Eco-Flo," a company developing a revolutionary, biodegradable alternative to plastic packaging. This was a highly innovative idea, potentially disruptive to the massive plastic packaging industry. The proposition was highly scalable; the demand for sustainable alternatives was growing rapidly, presenting a significant market opportunity. However, it was also a risky venture.

-

Key Features of Eco-Flo:

- Biodegradable and compostable material

- Comparable strength and durability to plastic

- Competitive pricing strategy

- Potential for large-scale manufacturing

-

Target Market: Food and beverage companies, retailers, and environmentally conscious consumers.

-

Inherent Risks:

- High initial investment in research and development.

- Uncertainty regarding market acceptance of a new product.

- Reliance on securing key partnerships with manufacturing facilities.

- Potential for competitors to enter the market quickly.

The Dragons' initial reactions were mixed. Deborah Meaden, known for her cautious approach, expressed concerns about the scalability and market validation. Peter Jones, on the other hand, was intrigued by the potential for disruption and significant returns. This initial skepticism highlighted the inherent risk associated with such an innovative, yet unproven, product.

Negotiating the Deal: Concessions and Compromises

Negotiations were intense. Eco-Flo initially sought £250,000 for a 10% equity stake, valuing the company at £2.5 million. The Dragons countered with significantly lower valuations and higher equity stakes.

- Key Concessions:

- Eco-Flo reduced its valuation to £1.5 million.

- The Dragons increased their equity stake to 25%.

- Milestones were established for achieving specific sales targets within a defined timeframe.

- A phased investment structure was agreed upon, releasing further funds upon achieving those milestones.

The entrepreneur employed a confident and persuasive strategy, highlighting the potential for exponential growth and showcasing strong market research data. They effectively addressed the Dragons' concerns by outlining a clear plan for overcoming the challenges and demonstrating a deep understanding of their target market. The Dragons held significant leverage due to their experience and access to resources, but the entrepreneur's passion and compelling vision ultimately swayed them.

The Dragons' Perspectives: Why They Took the Risk

Peter Jones' investment was driven by his belief in the long-term potential of the product and the growing market for sustainable packaging. Deborah Meaden, while initially skeptical, recognized the potential for significant returns if the company met its milestones. Their due diligence likely involved thorough market analysis, competitor research, and assessment of the entrepreneur's team and capabilities. The potential synergy with existing portfolios, particularly in the retail sector, may have also played a role.

Post-Deal Analysis: Success or Failure?

Eco-Flo exceeded expectations. They successfully met their initial milestones, securing major contracts with several large retailers. Their innovative packaging became a symbol of corporate social responsibility, boosting their brand image and market share.

- Key Performance Indicators (KPIs):

- Sales revenue significantly surpassed projections.

- Market share grew rapidly.

- Brand recognition increased substantially.

- Profitability was achieved ahead of schedule.

The deal proved highly successful for both the entrepreneur and the Dragons. The entrepreneur secured significant funding, enabling rapid growth and expansion. The Dragons enjoyed substantial returns on their investment, further solidifying their reputation for identifying high-growth opportunities.

Conclusion

This Dragon Den risky deal exemplifies the high-stakes nature of entrepreneurship and the importance of a compelling pitch, even when facing seemingly insurmountable odds. The initial high-risk proposition, the meticulous negotiation process, the Dragons' insightful perspectives, and the post-deal success showcase a powerful combination of innovation, strategic planning, and persuasive communication. The key takeaways emphasize thorough risk assessment, strong negotiation skills, and the development of a robust business plan, all crucial for securing investor confidence in high-risk ventures.

Are you ready to take a risk and pitch your own groundbreaking idea? Learn from this Dragon Den risky deal and discover how to craft a compelling pitch that attracts investors. Don’t let fear hold you back – take the leap and make your Dragon Den dream a reality! Research your Dragon Den risky deal strategy carefully and prepare to impress!

Featured Posts

-

Stuttgart Ta Atff Futbol Altyapi Secmeleri Detaylar Ve Basvuru

May 01, 2025

Stuttgart Ta Atff Futbol Altyapi Secmeleri Detaylar Ve Basvuru

May 01, 2025 -

Anaheim Ducks Fall To Dallas Stars Despite Leo Carlssons Two Goals

May 01, 2025

Anaheim Ducks Fall To Dallas Stars Despite Leo Carlssons Two Goals

May 01, 2025 -

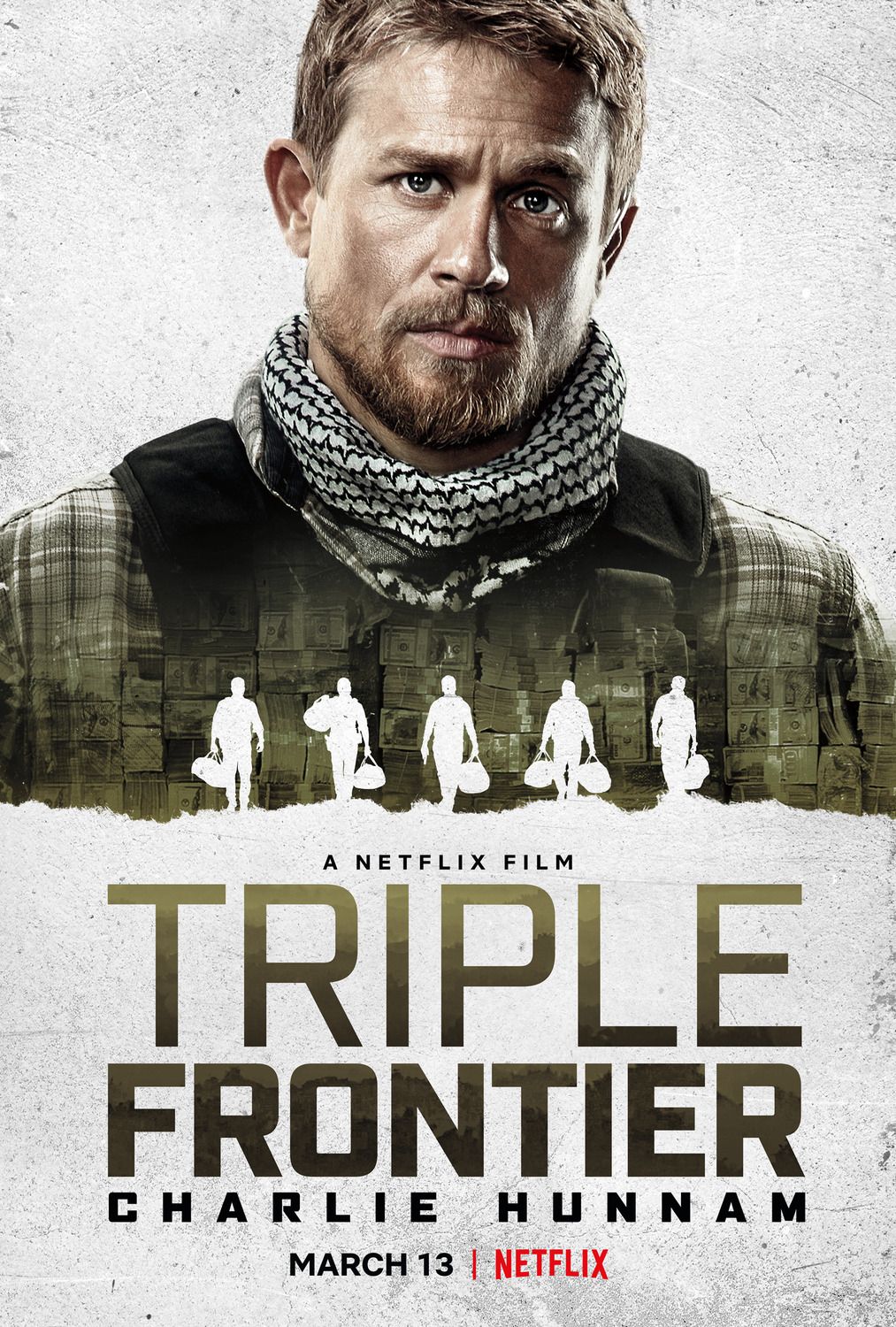

New Details Emerge From Ben Affleck And Gillian Andersons Film Shootout Scene

May 01, 2025

New Details Emerge From Ben Affleck And Gillian Andersons Film Shootout Scene

May 01, 2025 -

Hunters 32 Points Lead Cavaliers To 10th Straight Win

May 01, 2025

Hunters 32 Points Lead Cavaliers To 10th Straight Win

May 01, 2025 -

Xrp Regulatory Status The Secs Stance And Market Implications

May 01, 2025

Xrp Regulatory Status The Secs Stance And Market Implications

May 01, 2025