Dragon Den Shock: Businessman Rejects Top Investors, Accepts Risky Deal

Table of Contents

The Lucrative Offers Rejected: Why Did He Say No?

Mark Olsen presented EcoPack Solutions, a company poised to disrupt the environmentally damaging packaging industry, to the Dragons. The offers poured in, each seemingly a golden ticket to success:

-

Offer 1: Deborah Meaden – £500,000 for 20% equity. This offered immediate capital injection and the expertise of a seasoned investor. However, Olsen felt the equity stake was too high, limiting his long-term control. Pros: Significant funding, established network. Cons: High equity percentage, potential loss of control.

-

Offer 2: Peter Jones – £750,000 for 30% equity with a further £250,000 in convertible loan notes. While larger than Meaden's offer, the additional loan notes added complexity and potential future dilution. Pros: Higher funding, strong business acumen. Cons: Higher equity stake, loan note complexities.

-

Offer 3: Touker Suleyman – £1 million for 40% equity. Suleyman's offer was the most significant in terms of capital, but the massive equity percentage was a deal breaker for Olsen. Pros: substantial capital. Cons: Extremely high equity stake, loss of significant control.

Olsen initially seemed poised to accept one of these Dragon's Den investment offers, his face betraying a mixture of excitement and relief. However, a sudden shift in his demeanor signaled a different path. He politely declined, citing a better opportunity.

The Risky Deal: Unveiling the Alternative

The "risky" deal Olsen chose involved a strategic partnership with a smaller, less established firm, "GreenTech Innovations." This deal involved a significantly lower upfront investment of £200,000 for a 10% equity stake. What made it risky? GreenTech Innovations was a smaller player with a less proven track record compared to the established Dragon's Den investors.

-

Specifics of the risky deal: GreenTech Innovations offered marketing expertise, access to their established distribution network, and crucial technology integration for EcoPack's production process.

-

Potential Rewards: The partnership promised rapid expansion into new markets and potentially much higher ROI in the long run due to GreenTech's marketing prowess and technological synergy.

-

Potential Risks: The smaller investment meant slower initial growth, and the success of the partnership depended on GreenTech's ability to deliver on their promises. The potential for failure, and loss of the initial investment, was considerable.

Analyzing the Decision: Was it Smart or Foolhardy?

Was Olsen’s decision a stroke of genius or a reckless gamble? Business analysts are divided. Some argue that the long-term potential of the GreenTech partnership outweighs the short-term benefits of the Dragon's Den investment offers. The access to established distribution channels and technological synergy could propel EcoPack to greater heights faster than the more conservative approach.

-

Arguments for the decision's rationality: Maintaining greater control over his company, accessing complementary expertise, and leveraging a potentially faster growth trajectory.

-

Arguments against the decision's rationality: Significantly less initial funding, higher risk of failure due to the less established partner, and potential for slower initial growth.

-

Expert opinions on the risks and rewards: Industry experts have suggested that Olsen's decision was a calculated risk, prioritizing long-term growth and control over immediate financial gain. The success of this strategy remains to be seen.

The Aftermath: What Happened After the Dragon's Den Shock?

(Note: This section would be updated with information on the outcome of Olsen's decision if available. For example, has EcoPack seen significant growth through the GreenTech partnership? Has it outperformed the potential growth from accepting the Dragon's Den investment offers?)

Conclusion: Lessons Learned from the Dragon Den Shock

Mark Olsen's rejection of lucrative Dragon's Den investment offers for a seemingly riskier alternative is a prime example of the complexities of business decisions. This Dragon Den shock highlighted that the perceived safety of large investment deals isn’t always the best route to success. The decision emphasized the importance of considering long-term strategic partnerships and growth potential alongside immediate financial gains. While the ultimate success of Olsen's risky strategy is yet to be fully determined, his bold move underscores the importance of carefully assessing risk and reward in any business venture. What would YOU have done? Discuss this Dragon's Den Shock in the comments below!

Featured Posts

-

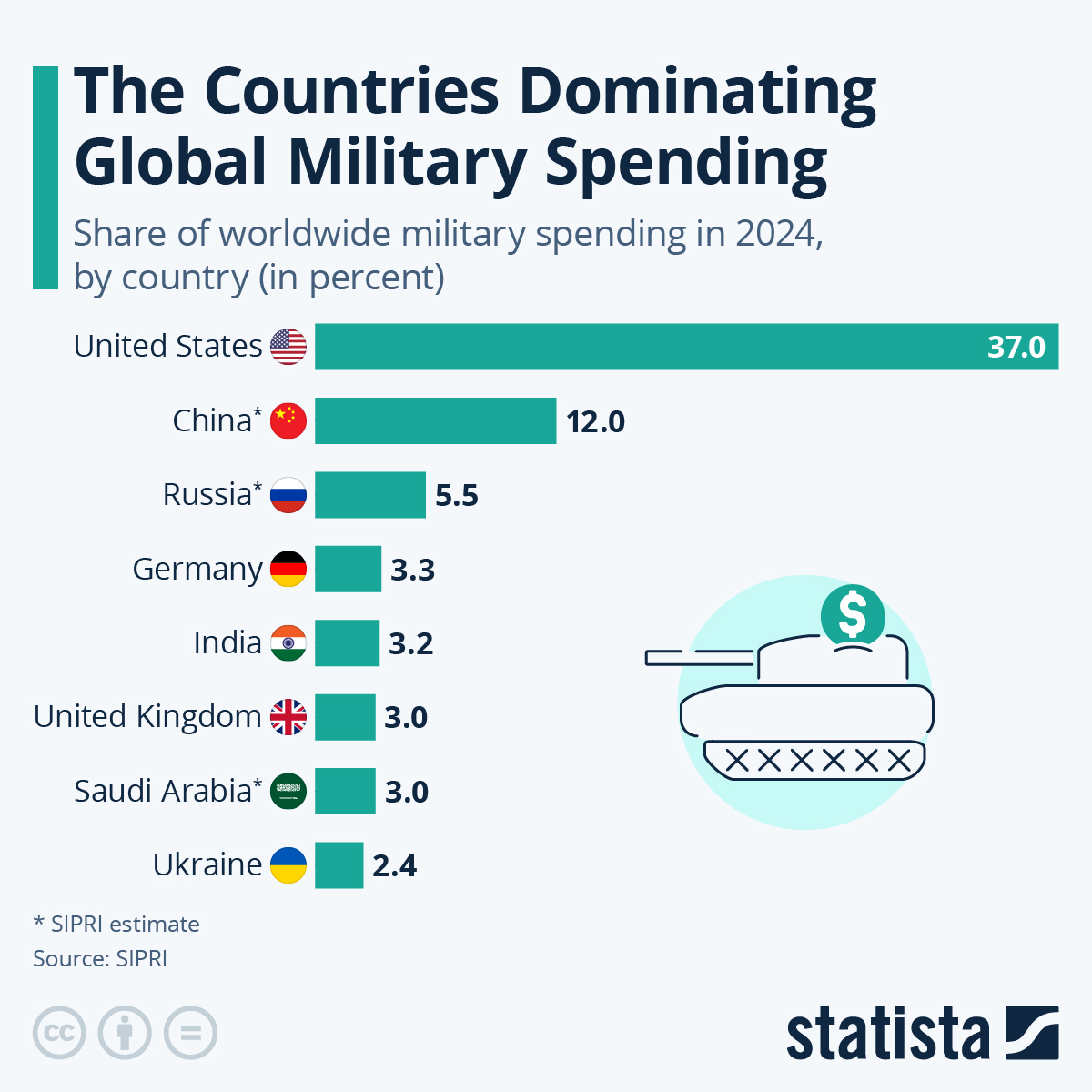

Europes Rising Defense Budgets Analyzing The Surge In Global Military Spending

May 01, 2025

Europes Rising Defense Budgets Analyzing The Surge In Global Military Spending

May 01, 2025 -

Cay Fest On Film A Closer Look At Splice

May 01, 2025

Cay Fest On Film A Closer Look At Splice

May 01, 2025 -

Viewers Question Dragons Den After Repeat Shows Failed Business

May 01, 2025

Viewers Question Dragons Den After Repeat Shows Failed Business

May 01, 2025 -

France Triumphs Duponts Performance At The Masterclass

May 01, 2025

France Triumphs Duponts Performance At The Masterclass

May 01, 2025 -

Christopher Stevens Review Michael Sheens Channel 4 Giveaway

May 01, 2025

Christopher Stevens Review Michael Sheens Channel 4 Giveaway

May 01, 2025