Dragon's Den: Analyzing The Investment Decisions Of The Dragons

Table of Contents

The Dragons' Investment Criteria: Beyond the Numbers

While financial projections are crucial, the Dragons on Dragon's Den look for much more than just numbers. Their investment strategy involves a thorough assessment of several key criteria, going beyond simple business plan analysis. Successful entrepreneurs understand this and tailor their pitches accordingly. Here's what the Dragons truly value:

-

Strong Management Team and Experience: The Dragons invest in people as much as ideas. A proven track record, relevant experience, and a passionate, capable team significantly increase the chances of success. For example, entrepreneurs demonstrating prior entrepreneurial success or relevant industry expertise often impress the Dragons. This shows competence and reduces perceived risk involved in Dragon's Den due diligence.

-

Scalability and Market Potential: The Dragons are looking for businesses with significant growth potential. A product or service that can be scaled quickly and efficiently to reach a large market is more attractive than a niche product with limited expansion possibilities. This involves demonstrating a clear understanding of market size and growth projections.

-

Clear Understanding of the Target Market and Competitive Landscape: A successful pitch demonstrates thorough market research. Entrepreneurs need to articulate their target audience, their needs, and how the product or service uniquely addresses those needs. Understanding the competitive landscape and highlighting a clear competitive advantage is also vital. Failing to demonstrate this understanding often leads to a failed pitch.

-

Robust Business Model with Clear Revenue Streams: The Dragons want to see a well-defined business model with clear and realistic revenue streams. This includes demonstrating a clear path to profitability and sustainable growth. A solid business plan outlining key revenue drivers, pricing strategies, and cost structures is essential for a successful Dragon's Den investment strategy.

-

The "X-Factor": Passion, Innovation, and Unique Selling Propositions: This intangible element separates the good pitches from the great ones. Passion for the product, innovative ideas, and a unique selling proposition (USP) that sets the business apart from competitors are highly valued by the Dragons. This is often what gives an entrepreneur the edge.

Analyzing Successful Dragon's Den Pitches: A Case Study Approach

To understand Dragon's Den investment decisions, studying successful pitches provides invaluable insight. Analyzing these pitches reveals key elements that contributed to their success. Let's explore some examples:

-

Detailed Examples of Successful Pitches: Many successful pitches on Dragon's Den showcase compelling narratives, emphasizing the problem being solved and the unique solution offered. They clearly articulate the value proposition and demonstrate market traction.

-

Pitch Structure, Presentation Style, and Communication Skills: Successful entrepreneurs deliver concise, engaging pitches with clear structure. They confidently answer tough questions, showcasing expertise and passion. Their presentation style is professional, persuasive, and tailored to the Dragons.

-

Business Models and Viability: Successful pitches are built on robust, well-researched business models demonstrating clear paths to profitability. This involves realistic financial projections and a well-defined go-to-market strategy.

-

Negotiation Strategies: Successful entrepreneurs demonstrate strong negotiation skills, balancing their aspirations with the Dragons' expectations. They display flexibility and the ability to reach mutually beneficial agreements. Links to relevant Dragon's Den episodes showcasing these aspects would be extremely beneficial here.

Common Pitfalls to Avoid in Your Dragon's Den Pitch

Learning from the mistakes of unsuccessful entrepreneurs is crucial. Common pitfalls include:

-

Lack of Market Research: Insufficient market research often leads to unrealistic projections and a poor understanding of the target audience.

-

Unrealistic Financial Projections and Weak Business Plans: Overly optimistic or poorly supported financial projections often deter the Dragons. A weak business plan lacks clarity and fails to demonstrate a clear path to profitability.

-

Poor Communication and Presentation Skills: A poorly delivered pitch, lacking clarity and confidence, often fails to impress.

-

Inability to Answer Tough Questions: Entrepreneurs need to be prepared to answer challenging questions about their business, market, and competition.

-

Overvaluing the Business and Unrealistic Expectations: Demanding unrealistic valuations or exhibiting arrogance frequently results in rejection.

The Role of Risk and Reward in Dragon's Den Investment Decisions

The Dragons carefully assess both risk and potential return on investment (ROI). Their investment philosophies vary, reflecting individual risk tolerances.

-

Dragons' Individual Risk Tolerance and Investment Philosophies: Some Dragons prefer lower-risk, steady-growth investments, while others are more willing to take on higher-risk ventures with the potential for substantial returns.

-

Evaluating Potential for High Returns vs. Level of Risk: The Dragons weigh the potential for high returns against the level of risk involved. This risk assessment is central to their investment decisions.

-

High-Risk, High-Reward vs. Low-Risk, Low-Reward Investments: The show provides examples of both types of investments, illustrating how the Dragons balance risk and reward in their decision-making.

Conclusion

Understanding Dragon's Den investment decisions requires a holistic approach. By focusing on a strong business plan, a compelling presentation, realistic financial projections, and a clear understanding of the Dragons' expectations, entrepreneurs can significantly increase their chances of securing funding. Mastering the art of the pitch, learning from successful Dragon's Den pitches, and avoiding common mistakes are key. Are you ready to refine your Dragon's Den investment strategy and craft your winning Dragon's Den pitch?

Featured Posts

-

England Vs France Six Nations Dalys Late Show Steals The Victory

May 01, 2025

England Vs France Six Nations Dalys Late Show Steals The Victory

May 01, 2025 -

Nothings Modular Phone A Reinvention Of Mobile Technology

May 01, 2025

Nothings Modular Phone A Reinvention Of Mobile Technology

May 01, 2025 -

Michael Sheen And Channel 4 Face Million Pound Giveaway Scandal

May 01, 2025

Michael Sheen And Channel 4 Face Million Pound Giveaway Scandal

May 01, 2025 -

Lack Of Police Accountability Campaigners Express Grave Concerns

May 01, 2025

Lack Of Police Accountability Campaigners Express Grave Concerns

May 01, 2025 -

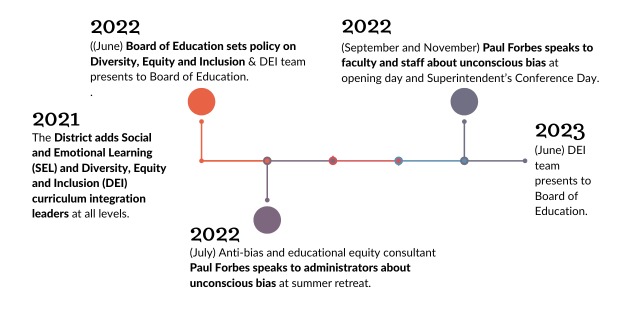

Targets Changed Stance On Diversity Equity And Inclusion

May 01, 2025

Targets Changed Stance On Diversity Equity And Inclusion

May 01, 2025