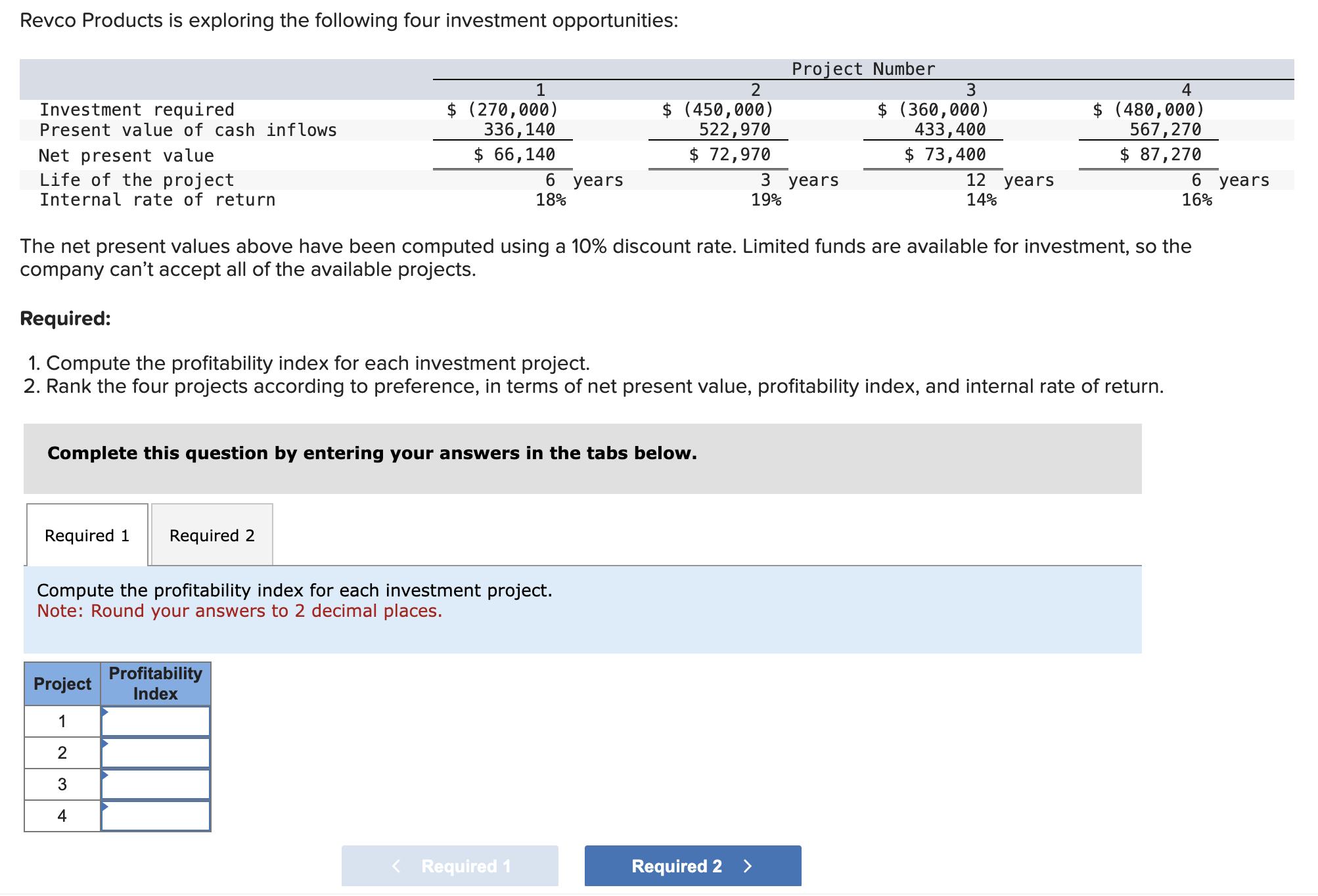

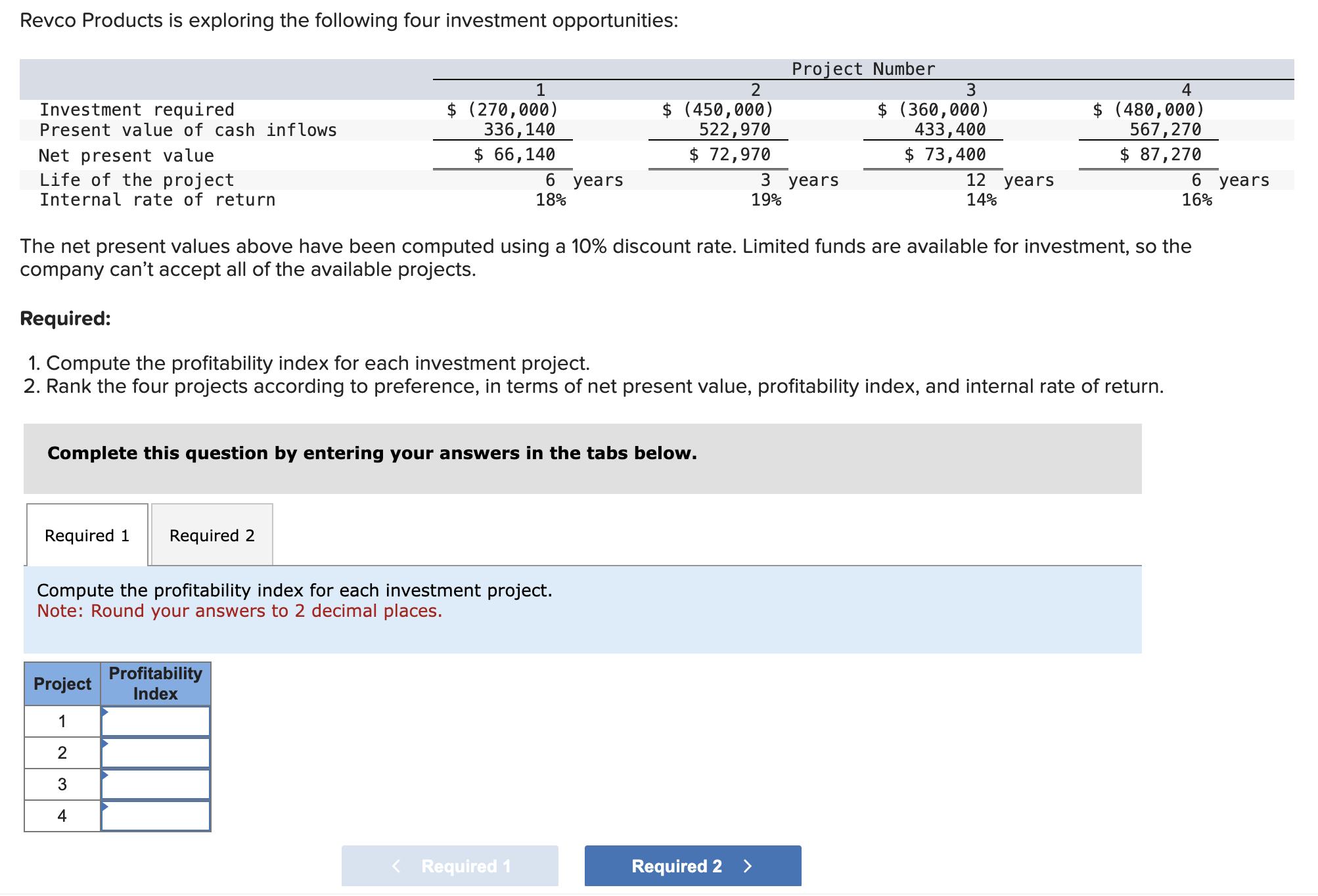

Dragon's Den: Little Coffee's Four Investment Offers

Table of Contents

Investment Offer 1: A Small Stake for Rapid Expansion

This first Dragon's Den investment offer proposed a smaller investment in exchange for a relatively small equity stake.

Funding Amount and Equity Percentage

The offer involved a £50,000 investment in exchange for a 5% equity stake in Little Coffee.

Proposed Use of Funds

Little Coffee planned to use this funding primarily for targeted marketing campaigns on social media and enhancing its online presence to increase brand awareness and drive sales. A smaller portion would be allocated to purchasing new, more efficient coffee roasting equipment.

- Advantages:

- Maintains majority control for Little Coffee's founders.

- Allows for faster growth and quicker scaling of operations.

- Disadvantages:

- Limited funding restricts the scope of expansion.

- Increased potential for future equity dilution if further investment rounds are required.

Investment Offer 2: Strategic Partnership with a Dragon

This Dragon's Den investment offer went beyond simple funding.

Specific Dragon Involved and Their Expertise

Deborah Meaden, known for her retail and marketing expertise, offered a £100,000 investment in exchange for a 10% equity stake.

Details of the Partnership

Beyond the financial investment, Meaden offered invaluable mentorship, guidance on retail strategy, and access to her extensive network of contacts within the food and beverage industry.

- Advantages:

- Access to invaluable industry expertise and mentorship from a highly successful entrepreneur.

- Significant networking opportunities that could accelerate Little Coffee's growth.

- Disadvantages:

- Potential loss of control over certain business decisions.

- Requires a compromise on the company's strategic direction to align with Meaden's vision.

Investment Offer 3: Significant Funding for National Rollout

This Dragon's Den investment offer aimed for significant, rapid expansion.

Funding Amount and Equity Percentage

This offer, from Peter Jones, provided £250,000 in exchange for a 20% equity stake.

National Expansion Strategy

Little Coffee intended to utilize this substantial funding to rapidly expand its operations nationally, opening new retail locations and potentially exploring franchise opportunities.

- Advantages:

- Rapid establishment of a national presence, capturing significant market share.

- Access to considerable resources to fuel aggressive growth.

- Disadvantages:

- Higher equity dilution compared to other offers.

- Increased financial risk associated with rapid expansion across a larger geographical area.

Investment Offer 4: Debt Financing for Sustainable Growth

Unlike the equity offers, this Dragon's Den investment option focused on debt.

Loan Amount and Repayment Terms

Touker Suleyman offered a £150,000 loan with a fixed interest rate and a manageable repayment schedule over five years.

Focus on Organic Growth Strategies

Little Coffee would use this debt financing to implement organic growth strategies, focusing on improving operational efficiency and targeted marketing efforts.

- Advantages:

- Little Coffee retains full ownership and control of the company.

- Manageable debt burden with a clear repayment plan.

- Disadvantages:

- Slower growth compared to equity-funded expansion.

- Requires consistent profitability to manage interest payments.

Conclusion: Which Dragon's Den Investment Offer is Best for Little Coffee?

Each Dragon's Den investment offer presented distinct advantages and disadvantages for Little Coffee. The small stake offer provided rapid growth but limited funding, while the strategic partnership offered mentorship but potential loss of control. The significant funding option facilitated a rapid national rollout but with high equity dilution. Finally, debt financing allowed for sustainable growth but at a slower pace. Considering Little Coffee's unique selling proposition – its commitment to ethical sourcing and high-quality coffee – the debt financing offer from Touker Suleyman seems the most prudent. It allows for controlled, organic growth, maintaining full ownership and avoiding the potentially disruptive influence of a major equity partner. This approach aligns with Little Coffee's long-term vision and allows for sustainable expansion.

Which Dragon's Den investment offer do you think is the best fit for Little Coffee? Share your thoughts on Little Coffee's investment strategy in the comments below!

Featured Posts

-

Live Eurovision 2025 In Australia Your Complete Viewing Guide

May 01, 2025

Live Eurovision 2025 In Australia Your Complete Viewing Guide

May 01, 2025 -

Mercedes Mone Seeks Tbs Championship Rematch Against Momo Watanabe

May 01, 2025

Mercedes Mone Seeks Tbs Championship Rematch Against Momo Watanabe

May 01, 2025 -

Transparency Issues Plague Usps Louisville Congressman Sounds Alarm On Mail Delays

May 01, 2025

Transparency Issues Plague Usps Louisville Congressman Sounds Alarm On Mail Delays

May 01, 2025 -

Altitude Afeta Estevao Palmeiras Enfrenta Problema Com Jogador Em Jogo

May 01, 2025

Altitude Afeta Estevao Palmeiras Enfrenta Problema Com Jogador Em Jogo

May 01, 2025 -

The Truth Behind Michael Sheens Million Pound Giveaway

May 01, 2025

The Truth Behind Michael Sheens Million Pound Giveaway

May 01, 2025