DRC Cobalt Export Ban: Market Reaction And The Significance Of The Forthcoming Quota Plan

Table of Contents

Market Reaction to the DRC Cobalt Export Ban:

Immediate Price Volatility and Supply Chain Disruptions:

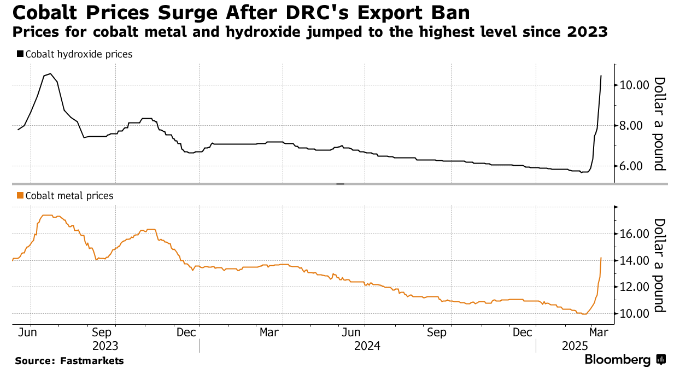

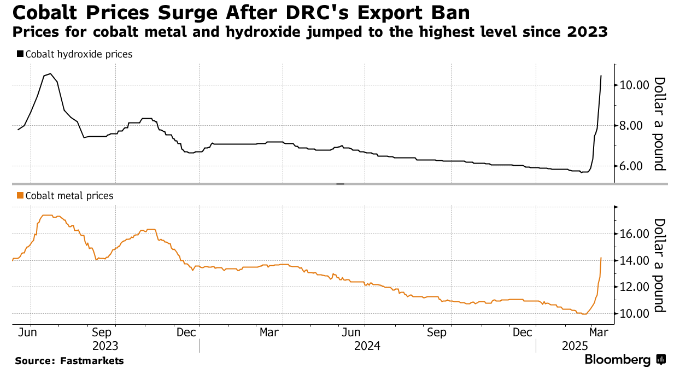

The DRC cobalt export ban announcement led to an immediate and sharp surge in cobalt prices. Cobalt sulfate and cobalt hydroxide, crucial components in EV batteries, experienced significant price increases, impacting the entire supply chain. The EV industry, already facing challenges related to raw material sourcing and logistical bottlenecks, felt the brunt of this disruption. Major EV manufacturers experienced delays in production timelines, forcing them to reassess their sourcing strategies and explore alternative battery chemistries. Companies like Tesla and Volkswagen, heavily invested in EV production, saw their stock prices fluctuate as investors grappled with the implications of the ban.

- Price increases: Cobalt sulfate and cobalt hydroxide prices soared by double-digit percentages in the days following the announcement.

- Production delays: EV manufacturers faced delays in production, impacting delivery schedules and potentially affecting sales forecasts.

- Alternative materials: The search for alternative battery materials, such as lithium iron phosphate (LFP) batteries, intensified.

- Geopolitical implications: The ban highlighted the geopolitical risks associated with reliance on a single country for critical minerals.

Investor Sentiment and Market Uncertainty:

Investor sentiment turned cautious following the DRC cobalt export ban. Sell-offs were observed in the shares of cobalt mining companies, reflecting concerns about future supply. Investment funds specializing in battery metals also experienced significant pressure, with many investors hesitant to commit further capital until the situation clarifies. Market uncertainty, fueled by speculation and potential market manipulation, added to the instability.

- Stock market performance: Shares of DRC-focused cobalt mining companies experienced significant drops.

- Impact on investment funds: Battery metal investment funds faced capital outflows as investors sought safer assets.

- Increased risk premiums: The cobalt market experienced a rise in risk premiums, reflecting increased uncertainty and potential future price volatility.

The Forthcoming DRC Cobalt Quota Plan: A Detailed Analysis:

Understanding the Proposed Quota System:

The DRC government's proposed quota system for cobalt exports aims to regain control over its natural resources and generate increased revenue. The details of the quota allocation remain somewhat opaque, but it's anticipated that the system will prioritize domestic processing and potentially favor specific companies. This plan is designed to encourage value addition within the country, moving away from raw material exports. However, concerns exist regarding transparency, potential corruption, and the system's effectiveness in achieving its objectives.

- Allocation criteria: The precise criteria for allocating export quotas are yet to be fully disclosed, leading to uncertainty.

- Transparency and accountability: Lack of transparency raises concerns about potential favoritism and rent-seeking behavior.

- Potential for corruption: The system's complexity creates opportunities for corruption and undermines fair competition.

Projected Impact of the Quota Plan on the Market:

The impact of the DRC cobalt quota plan on the market is highly dependent on the specifics of the quota levels. A high quota could partially alleviate supply concerns, leading to a moderate price decrease. Conversely, a low quota would exacerbate the existing supply shortage, driving prices even higher. The plan's impact on supply chain dynamics will depend on its effectiveness in promoting domestic processing and the transparency of its implementation. The potential for legal challenges from affected parties also adds to the uncertainty.

- Scenario analysis: Various scenarios are possible depending on the final quota levels. High quotas could ease the market, while low quotas would intensify existing supply constraints.

- Impact on downstream industries: The quota plan will directly impact downstream industries, especially the EV and battery sectors.

- Potential for legal challenges: International trade agreements and WTO rules may be relevant if the quota system is deemed unfair or discriminatory.

Alternative Sourcing Strategies and Diversification:

The Search for Cobalt Alternatives:

The DRC cobalt export ban underscores the urgent need for alternative battery technologies that reduce or eliminate cobalt reliance. Significant research and development efforts are focused on solid-state batteries and other next-generation chemistries that minimize or eliminate the need for cobalt. Simultaneously, increased investment in cobalt recycling technologies is crucial for securing a sustainable supply of the metal from end-of-life batteries.

- Solid-state battery technology: This technology promises higher energy density and improved safety, potentially reducing cobalt dependence.

- Advancements in cobalt recycling: Improving recycling techniques is key to recovering cobalt from discarded batteries and reducing reliance on primary mining.

- Investment in alternative materials: Investment is shifting toward alternative battery materials, like LFP, which reduce or eliminate cobalt.

Diversifying Cobalt Sources:

Diversifying cobalt sourcing is vital to mitigate the risks associated with reliance on the DRC. Countries like Australia, Canada, and others possess significant cobalt reserves and are increasingly becoming important sources. Investing in diversified cobalt mining projects is crucial for building a more resilient and secure cobalt supply chain. However, geopolitical considerations must be carefully weighed when evaluating potential sources.

- Cobalt production in other countries: Australia, Canada, and other countries are stepping up cobalt production to fill the supply gap.

- Investment opportunities: Diversified cobalt mining projects present attractive investment opportunities for companies seeking to reduce their reliance on the DRC.

- Geopolitical risks: Relying on any single country for critical minerals always carries inherent geopolitical risks.

Conclusion: Navigating the Uncertainties of the DRC Cobalt Export Ban

The DRC cobalt export ban has exposed the fragility of the global cobalt supply chain and highlighted the need for greater diversification. The forthcoming quota plan presents both opportunities and challenges, its success hinging on transparency and effective implementation. The search for cobalt alternatives and the diversification of cobalt sources are crucial steps in securing a sustainable future for the EV industry and other cobalt-dependent sectors. Stay updated on the DRC cobalt export ban, monitor the DRC cobalt quota plan, and understand the impact of the DRC cobalt market to make informed decisions regarding your investments and supply chain strategies.

Featured Posts

-

New Steam Deck Verified Games Recapture The Ps 1 Era

May 16, 2025

New Steam Deck Verified Games Recapture The Ps 1 Era

May 16, 2025 -

Pre Game Padres Report Rain Tatis And Campusanos Call Up

May 16, 2025

Pre Game Padres Report Rain Tatis And Campusanos Call Up

May 16, 2025 -

Kbos Hyeseong Kim Headed To The Dodgers Latest Reports

May 16, 2025

Kbos Hyeseong Kim Headed To The Dodgers Latest Reports

May 16, 2025 -

Andor Season 2 Release Date Trailer And Everything We Know

May 16, 2025

Andor Season 2 Release Date Trailer And Everything We Know

May 16, 2025 -

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 16, 2025

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 16, 2025