Dubai REIT IPO Size Soars To $584 Million

Table of Contents

Record-Breaking IPO Size and Market Implications

The $584 million raised by this Dubai REIT IPO significantly surpasses previous offerings in the market, instantly establishing it as a major player. This substantial figure speaks volumes about the current investor sentiment towards Dubai’s real estate sector and the broader economy. The success of this IPO reflects a surge in investor confidence, driven by Dubai's robust economic growth, strategic infrastructure projects, and the overall appeal of its prime real estate.

- Comparison to previous IPOs: Previous REIT IPOs in Dubai have typically raised significantly less capital, making this a truly exceptional event.

- Subscription Rates: The high subscription rate indicates an extremely strong demand from both local and international investors eager to secure a stake in this promising investment opportunity.

- Expert Opinions: Market analysts are predicting a positive ripple effect throughout the Dubai real estate market, with this IPO potentially triggering further investment and development.

The Appeal of Investing in Dubai Real Estate via REITs

Investing in Dubai real estate through REITs offers several compelling advantages. Dubai's strategic location, thriving economy, and world-class infrastructure create a stable and attractive investment environment. REITs provide a simplified pathway for investors to gain exposure to these benefits.

- Tax Benefits: REITs often provide tax advantages, making them an attractive investment option for both individuals and institutional investors.

- Capital Appreciation and Dividend Income: Investors can benefit from potential capital appreciation as property values rise, alongside consistent dividend income generated from rental yields.

- Diversification: REITs offer diversification beyond traditional investment portfolios, reducing overall risk.

- Market Stability and Growth: Dubai’s real estate market is known for its resilience and potential for sustained growth, making it a highly sought-after investment destination.

Details of the Dubai REIT IPO

This specific Dubai REIT IPO focuses on a carefully curated portfolio of high-quality properties across diverse sectors within the city. The management team comprises experienced real estate professionals with a proven track record of success.

- Investment Strategy: The REIT's investment strategy focuses on long-term capital appreciation and stable rental income generation from a diversified portfolio of properties.

- Portfolio Composition: The portfolio includes a mix of residential, commercial, and potentially retail properties, strategically located across key areas of Dubai to reduce risk.

- Management Team: The experienced management team brings a wealth of expertise to the table, inspiring investor confidence in the REIT's long-term performance.

- Notable Investors: The high-profile investors involved in the IPO further underscore the attractiveness and potential of this venture.

Future Outlook for Dubai REITs and the Real Estate Market

The success of this $584 million Dubai REIT IPO is expected to pave the way for further REIT activity in Dubai. The long-term outlook for Dubai's real estate market remains positive, driven by continued economic growth, population increase, and ongoing infrastructure development.

- Future REIT Activity: We can expect to see more REIT IPOs in Dubai, capitalizing on the success of this initial offering and the growing investor appetite.

- Growth Drivers: Factors such as Expo 2020 legacy projects, tourism growth, and ongoing urbanization continue to drive demand for real estate in Dubai.

- Potential Headwinds: While the outlook is positive, potential risks such as global economic uncertainty and interest rate fluctuations must be considered.

- Long-Term Opportunities: Despite potential risks, the long-term growth prospects for Dubai real estate remain strong, offering attractive investment opportunities for those willing to take a calculated risk.

Conclusion: Investing in the Future with Dubai REIT IPOs

The $584 million Dubai REIT IPO marks a significant milestone for Dubai's real estate market, demonstrating strong investor confidence and signaling further growth potential. This successful offering highlights the attractive nature of REITs as a vehicle for real estate investment, particularly within the vibrant Dubai market. Learn more about the exciting world of Dubai REIT IPOs and explore potential investment opportunities today! [Link to relevant resource]

Featured Posts

-

Succesvol Kamerbrief Certificaten Verkopen Via Abn Amro Een Praktische Handleiding

May 21, 2025

Succesvol Kamerbrief Certificaten Verkopen Via Abn Amro Een Praktische Handleiding

May 21, 2025 -

Analyzing A Hell Of A Run From Ftv Live

May 21, 2025

Analyzing A Hell Of A Run From Ftv Live

May 21, 2025 -

Four Star Admiral Convicted Unraveling The Corruption Scandal

May 21, 2025

Four Star Admiral Convicted Unraveling The Corruption Scandal

May 21, 2025 -

Understanding Winter Weather Advisories And School Closures

May 21, 2025

Understanding Winter Weather Advisories And School Closures

May 21, 2025 -

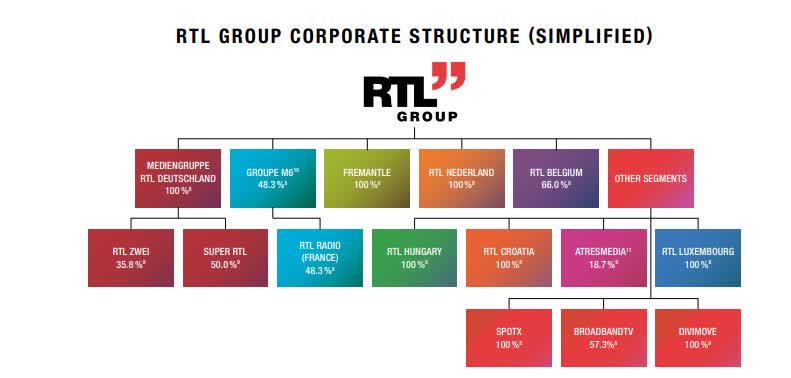

Analyzing Rtl Groups Progress Towards Streaming Profitability

May 21, 2025

Analyzing Rtl Groups Progress Towards Streaming Profitability

May 21, 2025