Dutch Central Bank To Fine ABN Amro? Bonus Scheme Under Scrutiny

Table of Contents

The Alleged Violations of ABN Amro's Bonus Scheme

The DNB's investigation focuses on potential breaches of banking regulations related to ABN Amro's bonus structure. The alleged violations have sparked significant debate about responsible risk-taking and the ethical implications of executive compensation.

Potential Breaches of Banking Regulations

The DNB's scrutiny likely involves several key regulatory areas:

- Rules on responsible risk-taking: The bonus scheme may have incentivized excessive risk-taking, potentially leading to financial instability or losses for the bank. This could contravene regulations designed to prevent reckless behavior that endangers the financial system.

- Bonuses linked to short-term gains: The structure might have prioritized short-term profits over long-term sustainability, potentially neglecting crucial factors like environmental, social, and governance (ESG) considerations. This is a growing concern for regulators globally.

- Insufficient oversight: Allegations suggest a lack of robust internal controls and oversight of the bonus scheme. This could imply inadequate monitoring of risk exposure and a failure to ensure compliance with existing regulations.

- Failure to comply with European Union Directives: ABN Amro, like all EU banks, is bound by various directives concerning banking practices. The investigation might uncover a failure to adhere to these guidelines concerning responsible lending and risk assessment.

Lack of Transparency and Accountability

Beyond specific regulatory breaches, the investigation also targets the transparency and accountability surrounding ABN Amro's bonus scheme. Critics allege:

- Lack of transparency in design and implementation: The criteria for awarding bonuses might have lacked clarity, making it difficult to assess their fairness and alignment with the bank's overall strategic goals.

- Insufficient internal controls: Weak internal controls could have allowed inappropriate bonus payments, potentially rewarding individuals whose actions contributed to losses or risky behavior.

- Lack of accountability for executive compensation decisions: The process for deciding bonus amounts might not have involved sufficient independent oversight, potentially leading to excessive payouts without adequate justification.

- External pressure: Pressure from shareholders or other stakeholders might have contributed to the design and implementation of a bonus scheme that prioritized short-term gains over long-term stability.

The Potential Consequences for ABN Amro

The potential consequences for ABN Amro extend beyond a simple financial penalty. The repercussions could significantly impact the bank's reputation and long-term stability.

The Scale of the Potential Fine

The size of the potential fine remains uncertain, but precedents from other similar cases in Europe suggest it could be substantial. This financial penalty would not only directly affect ABN Amro's profitability but could also:

- Damage the bank's reputation: A significant fine would severely tarnish ABN Amro's image and damage its credibility with customers and investors.

- Impact investor confidence: The fine could lead to decreased investor confidence, potentially resulting in a decline in the bank's stock price and increased borrowing costs.

- Trigger further investigations: The DNB’s action might trigger further investigations by other regulatory bodies, both within the Netherlands and at the European level, potentially leading to additional penalties.

Wider Implications for the Dutch Banking Sector

The DNB’s investigation has broader ramifications for the Dutch banking sector. It could:

- Influence other banks' bonus schemes: Other Dutch banks might review and adjust their bonus schemes to ensure compliance with regulations and to avoid similar penalties.

- Lead to stricter banking regulations: The investigation could prompt the Dutch government to tighten banking regulations, increasing oversight and accountability in the compensation practices of financial institutions.

- Strengthen the DNB’s reputation: A firm stance against ABN Amro would underscore the DNB's commitment to maintaining financial stability and ethical conduct within the Dutch banking system. This could boost confidence in the effectiveness of Dutch financial supervision.

The DNB's Role and Ongoing Investigation

The DNB's active role in investigating ABN Amro's bonus scheme highlights its commitment to maintaining financial stability in the Netherlands.

The DNB's Investigative Process

The DNB is likely following a rigorous investigative process, including:

- Gathering evidence: Collecting documents, conducting interviews, and analyzing internal data related to ABN Amro's bonus scheme.

- Holding hearings: Conducting hearings with ABN Amro executives and other relevant individuals to gather testimony and clarify the details of the bonus scheme.

- Establishing timelines: Determining a timeline for the completion of its investigation and a decision on potential penalties.

The DNB's Focus on Financial Stability

This investigation directly relates to the DNB's core mandate to maintain financial stability within the Netherlands. The DNB's actions demonstrate:

- Commitment to responsible banking: The investigation underscores the DNB's commitment to promoting responsible banking practices and preventing excessive risk-taking.

- Alignment with EU regulations: The DNB's actions are consistent with broader efforts across the European Union to strengthen financial regulations and oversight.

- Focus on preventing future crises: The investigation aims to prevent future financial crises by ensuring that banking practices within the Netherlands adhere to the highest standards of ethical conduct.

Conclusion

The potential ABN Amro fine highlights a critical issue regarding the design and implementation of bonus schemes within the Dutch banking sector. The DNB's ongoing investigation underscores the importance of responsible risk-taking, transparency, and accountability in executive compensation. This case has significant implications not only for ABN Amro but also for the broader Dutch banking industry and the future of financial regulation in the Netherlands.

Call to Action: Stay informed about developments in this important case affecting ABN Amro and the Dutch financial landscape. Follow our site for updates on the potential ABN Amro fine and the DNB's ongoing scrutiny of the bank's bonus scheme. Continue reading about the implications for Dutch banking regulations and responsible compensation practices. For more insights into the intricacies of financial regulations and their impact on the Netherlands' banking sector, continue exploring our website.

Featured Posts

-

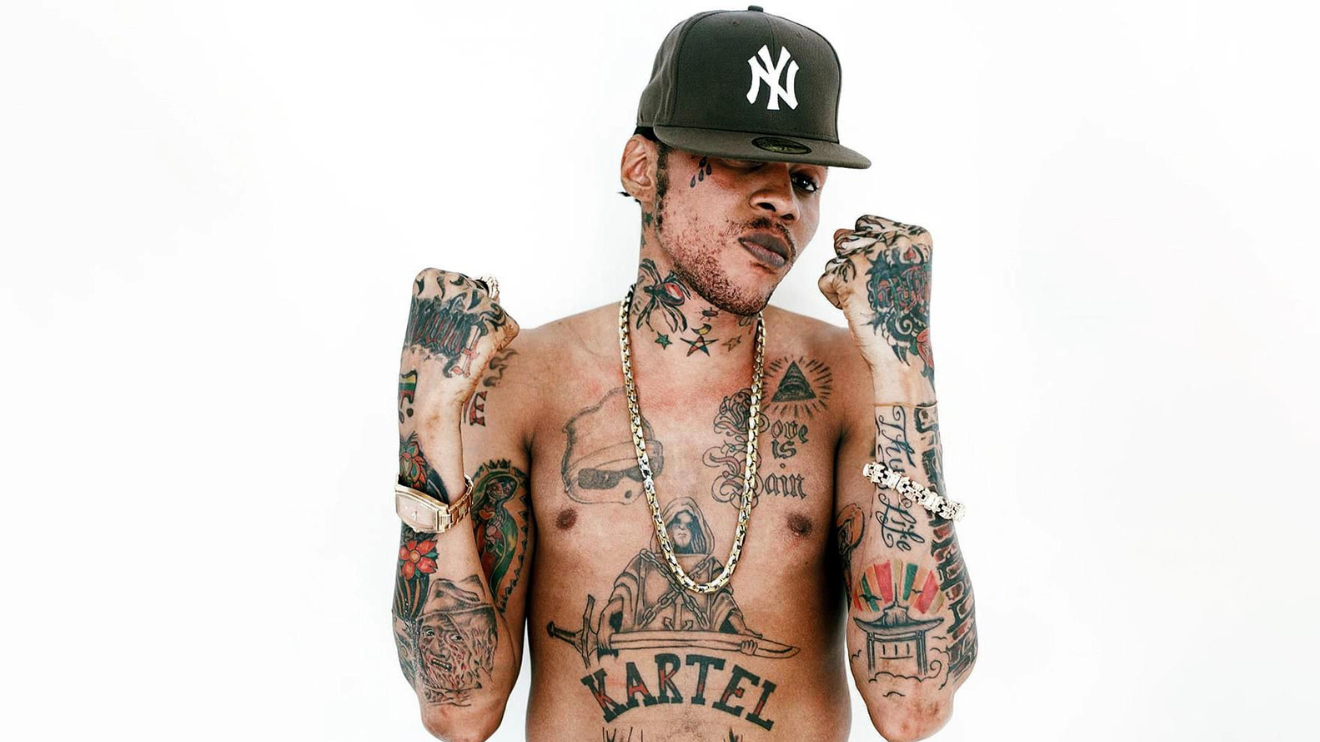

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025 -

Razvod Vanje Mijatovic Potpuna Istina O Razlazu

May 21, 2025

Razvod Vanje Mijatovic Potpuna Istina O Razlazu

May 21, 2025 -

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025 -

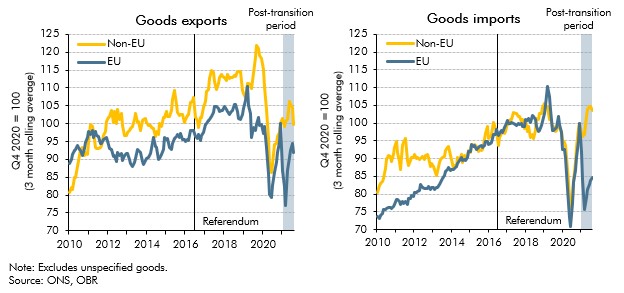

The Brexit Effect A Uk Luxury Industry Export Analysis

May 21, 2025

The Brexit Effect A Uk Luxury Industry Export Analysis

May 21, 2025 -

Is This The End David Walliams And Simon Cowells Britains Got Talent Conflict

May 21, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Conflict

May 21, 2025