Dutch Stock Market Instability Linked To US Trade Relations

Table of Contents

The Impact of US Tariffs on Dutch Businesses

US tariffs on specific Dutch exports have directly impacted the profitability of numerous companies and consequently, their stock prices. These tariffs, often imposed as part of broader trade disputes, create significant headwinds for Dutch businesses reliant on the US market. For example, increased tariffs on Dutch agricultural products, such as dairy and flowers, have led to reduced export revenue and squeezed profit margins. Similarly, manufacturers of certain machinery and chemical products have experienced decreased demand in the US, resulting in lower production and stock valuations.

The consequences of these tariffs are multifaceted:

- Reduced export revenue: Tariffs increase the price of Dutch goods in the US, making them less competitive and reducing demand.

- Decreased profitability: Lower sales volumes and increased costs directly impact a company's bottom line.

- Stock price declines: Negative financial performance translates into a decrease in investor confidence and lower stock valuations.

- Potential job losses: If businesses are unable to compete effectively, they may be forced to cut costs, leading to job losses.

Investor Sentiment and Market Volatility

Uncertainty surrounding US trade policy significantly influences investor confidence in the Dutch stock market. Negative news regarding US-Dutch trade relations, such as the announcement of new tariffs or escalating trade disputes, often triggers a wave of risk aversion among investors. This translates into tangible effects on the market:

- Increased market volatility: Investor uncertainty leads to rapid and unpredictable price swings in the Dutch stock market.

- Fluctuations in stock prices: Stocks of companies heavily reliant on US trade are particularly susceptible to sharp price drops.

- Decreased trading volume (in some cases): Uncertainty can lead to investors adopting a wait-and-see approach, reducing trading activity.

- Capital flight: Investors may withdraw their investments from the Dutch market, seeking safer havens elsewhere.

Specific Sectors Most Affected

Several Dutch industries are particularly vulnerable to shifts in US trade relations due to their high dependence on the US market or the nature of their products. These sectors face unique challenges when confronted with US trade policies:

- Agriculture: The Dutch agricultural sector, renowned globally for its dairy products and flowers, is highly exposed to US tariffs, impacting export volumes and profitability.

- Manufacturing: Specific machinery and chemical manufacturers heavily reliant on US exports experience a significant drop in demand due to tariffs.

- Technology: The Dutch technology sector, particularly companies involved in the production of semiconductor components, can be significantly affected by disruptions in global supply chains caused by trade tensions.

Potential Mitigation Strategies

The Dutch government and businesses can employ several strategies to mitigate the negative impacts of US trade relations on the stock market. These include:

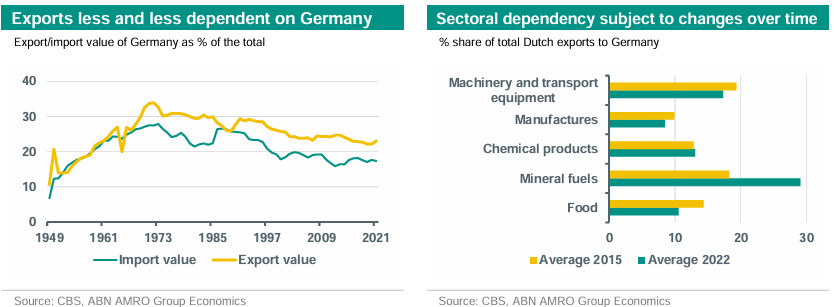

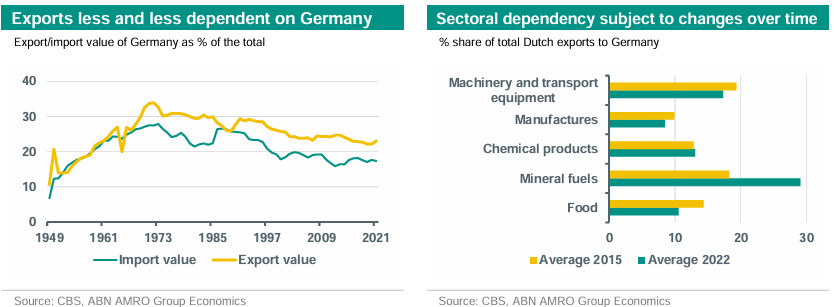

- Diversification: Reducing reliance on the US market by exploring new export destinations and diversifying customer bases.

- Seeking new markets: Actively pursuing trade opportunities in other regions to reduce dependence on the US.

- Lobbying efforts: Working with the Dutch government to engage in diplomatic efforts to resolve trade disputes and reduce tariffs.

- Government support programs: Implementing government policies that provide financial aid and incentives to businesses affected by trade disputes.

Conclusion: Understanding Dutch Stock Market Instability Linked to US Trade Relations

The instability in the Dutch stock market is demonstrably linked to the uncertainties and impacts stemming from US trade relations. US tariffs, investor sentiment, and the vulnerability of specific sectors like agriculture, manufacturing, and technology have all played significant roles in shaping this instability. Understanding this relationship is crucial for both investors and businesses operating in the Netherlands. Stay informed about US trade policy developments and their potential impact on the Dutch stock market. Consider the implications for your investment strategies and business plans, and prioritize ongoing monitoring of market instability and proactive risk management strategies. The Dutch stock market's future performance is intrinsically tied to the evolution of US trade relations; understanding this dynamic is essential for navigating the complexities of this interconnected global economy.

Featured Posts

-

Samsonova Ustupila Aleksandrovoy Na Starte Shtutgartskogo Turnira

May 24, 2025

Samsonova Ustupila Aleksandrovoy Na Starte Shtutgartskogo Turnira

May 24, 2025 -

Could Jonathan Groffs Just In Time Performance Secure A Tony Award Triumph

May 24, 2025

Could Jonathan Groffs Just In Time Performance Secure A Tony Award Triumph

May 24, 2025 -

11 Drop Amsterdam Stock Exchange Extends Losing Streak To Three Days

May 24, 2025

11 Drop Amsterdam Stock Exchange Extends Losing Streak To Three Days

May 24, 2025 -

Apple Stock And Tariffs A Look At Buffetts Investment Strategy

May 24, 2025

Apple Stock And Tariffs A Look At Buffetts Investment Strategy

May 24, 2025 -

Last Minute Changes To Trump Tax Bill Before House Passage

May 24, 2025

Last Minute Changes To Trump Tax Bill Before House Passage

May 24, 2025