Dutch Stocks Continue Decline Amidst Escalating US Trade War

Table of Contents

The Direct Impact of US Tariffs on Dutch Businesses

The US trade war has directly impacted several key sectors of the Dutch economy, resulting in a decline in Dutch stock valuations. Specific industries heavily reliant on US trade are experiencing significant challenges. This includes:

-

Agricultural Exports: The Netherlands is a major exporter of agricultural products, including flowers, dairy, and meat. US tariffs on these goods have reduced demand and profitability for Dutch farmers and exporters. This translates directly into decreased revenue and potential job losses, influencing stock prices within the agricultural sector. Data from [Insert Source – e.g., Statistics Netherlands] shows a [Insert Percentage]% decrease in agricultural exports to the US since the implementation of tariffs.

-

Manufacturing Exports: Dutch manufacturers, particularly in sectors like machinery and chemicals, also face significant headwinds due to increased tariffs and reduced demand from the US market. The ripple effect extends to smaller businesses supplying these manufacturers, creating a domino effect throughout the supply chain. Companies like [Insert Example of Dutch Manufacturing Company] have publicly reported reduced profits and operational challenges as a consequence of these trade tensions.

-

Economic Slowdown: The combined impact on these key sectors is contributing to a broader economic slowdown in the Netherlands, impacting investor confidence and further depressing Dutch stock prices. The uncertainty surrounding future trade relations adds to the overall economic gloom.

Global Market Volatility and Investor Sentiment

The uncertainty surrounding the US trade war is not confined to bilateral trade relationships; it is causing significant global market volatility and impacting investor sentiment worldwide.

-

Flight to Safety: Investors are increasingly exhibiting risk aversion, moving their capital away from riskier assets, including Dutch stocks, and towards safer havens like government bonds. This shift in investment strategy is evident in the decreased trading volumes and lowered market capitalization of several Dutch companies.

-

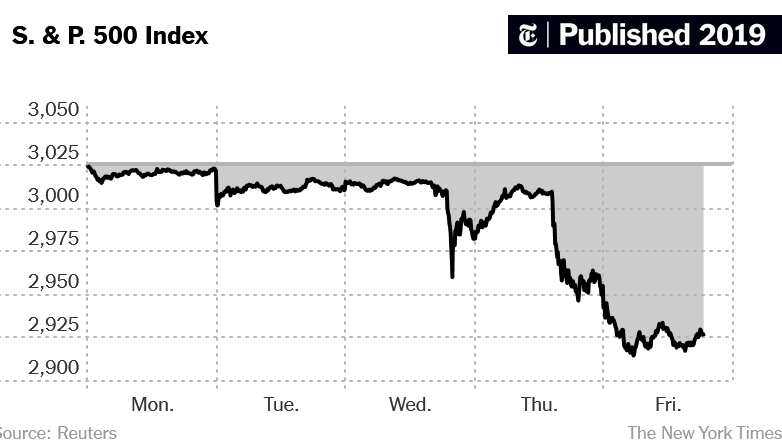

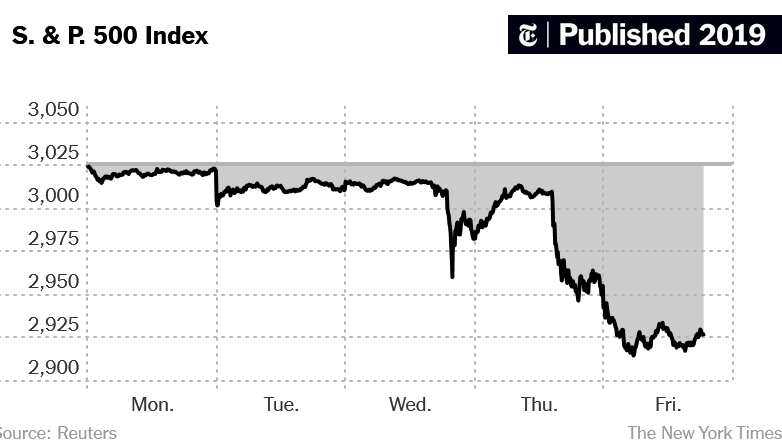

Correlation with Global Indices: A clear correlation exists between the performance of major global stock market indices (like the S&P 500 and the DAX) and the Dutch stock market. When global markets experience declines due to trade war anxieties, Dutch stocks generally follow suit.

-

Decreased Investor Confidence: Several indicators, including decreased trading volumes, falling market capitalization, and reduced initial public offerings (IPOs), all point towards a considerable decrease in investor confidence in the Dutch stock market.

The Euro's Weakness and its Role in the Decline

The weakening Euro against the US dollar also plays a significant role in the decline of Dutch stocks.

-

Export Competitiveness: While a weaker Euro can theoretically boost export competitiveness, the negative impact of US tariffs overshadows this potential benefit. The decreased demand caused by the tariffs outweighs any advantages gained from currency fluctuations.

-

Import Costs: Conversely, the weaker Euro increases the cost of imports for Dutch businesses, impacting their profitability and adding inflationary pressure on the domestic economy. This further adds to the economic uncertainty.

Potential Government Responses and Mitigation Strategies

The Dutch government is exploring several strategies to mitigate the impact of the US trade war on the national economy.

-

Economic Stimulus: Fiscal and monetary policy adjustments, including potential tax cuts or increased government spending, could be implemented to stimulate economic activity and boost investor confidence.

-

Support Packages: Targeted support packages for affected industries, such as agricultural subsidies or loan guarantees for manufacturers, could help alleviate some of the immediate economic pressures. However, the long-term effectiveness of these measures is debated, and their impact on Dutch stock performance remains uncertain.

Conclusion

This article has explored the significant decline in Dutch stocks, directly linking it to the escalating US trade war and its subsequent effects on global markets and the Dutch economy. The uncertainty surrounding the trade conflict, coupled with a weaker Euro, has significantly dampened investor confidence. The direct impact on key export sectors like agriculture and manufacturing, combined with the global flight to safety, has created a perfect storm for negative stock market performance in the Netherlands.

Call to Action: Staying informed about the evolving US trade war and its impact on Dutch stocks is crucial for investors. Regularly monitor developments related to Dutch stocks and US trade war to make informed investment decisions and adapt your portfolio accordingly. Consider diversifying your investments to mitigate the risks associated with ongoing global market volatility. Understanding the nuances of this complex situation is key to navigating the challenges and potentially capitalizing on opportunities within the Dutch stock market.

Featured Posts

-

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025 -

Dylan Dreyers Family Life New Post With Brian Fichera Creates Conversation

May 24, 2025

Dylan Dreyers Family Life New Post With Brian Fichera Creates Conversation

May 24, 2025 -

Joe Jonas Responds To Couples Argument The Full Story

May 24, 2025

Joe Jonas Responds To Couples Argument The Full Story

May 24, 2025 -

Amsterdam Stock Market Three Day Slump 11 Drop Since Wednesday

May 24, 2025

Amsterdam Stock Market Three Day Slump 11 Drop Since Wednesday

May 24, 2025 -

Elena Rybakina Put K Tretemu Krugu V Rime

May 24, 2025

Elena Rybakina Put K Tretemu Krugu V Rime

May 24, 2025