EToro Targets $500 Million In Resumed IPO

Table of Contents

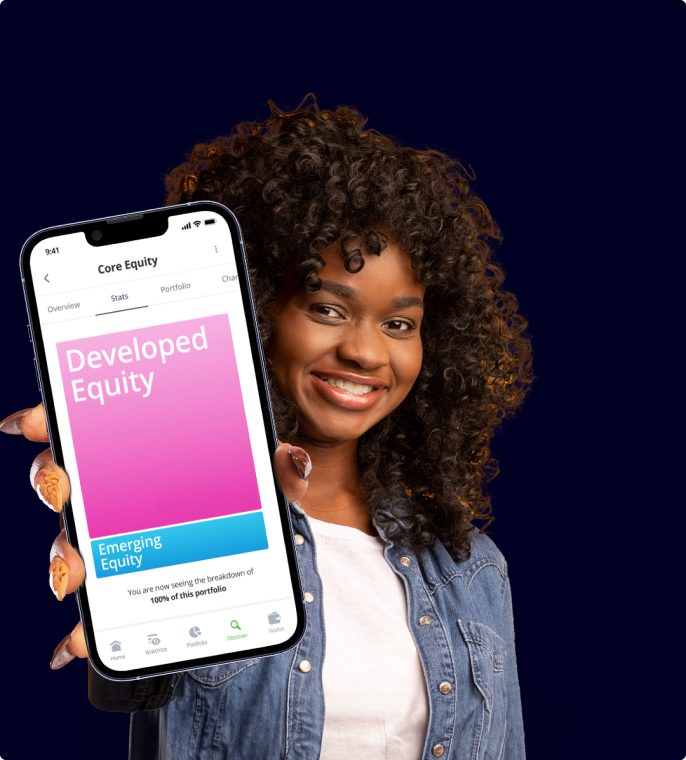

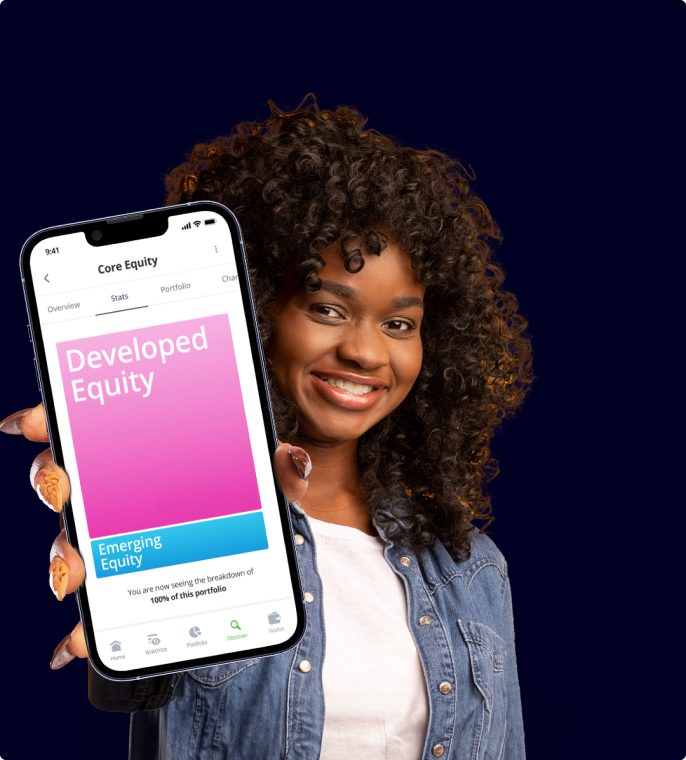

eToro, the popular social trading and investment platform, is reportedly aiming for a renewed initial public offering (IPO) targeting a significant $500 million valuation. This follows a previous attempt and signals renewed investor confidence in the company's growth trajectory and innovative approach to online trading. This article delves into the key aspects of this resumed IPO and its implications for the future of eToro and the social trading sector.

eToro's Renewed IPO Strategy

Reasons Behind the Resumption

eToro's decision to pursue an IPO again is likely driven by several factors:

- Improved Market Conditions: The initial attempt may have faced unfavorable market conditions. A resurgence in investor confidence and a more stable market environment could be contributing to this renewed effort.

- Enhanced Financial Performance and User Growth: Stronger financial performance, indicated by increased revenue, user acquisition, and engagement metrics, makes the company more attractive to potential investors. eToro’s consistent growth in users and trading volume strengthens its IPO prospectus.

- Strategic Positioning: The social trading market is expanding rapidly. This IPO allows eToro to capitalize on this growth and solidify its position as a leader in the sector. This strategic move positions eToro for further expansion and innovation.

- Improved Regulatory Landscape: A clearer and more favorable regulatory environment can significantly reduce risks associated with the IPO and enhance investor confidence. This could be a result of increased clarity in regulations affecting social trading platforms.

Target Valuation and Funding Goals

The $500 million target valuation reflects eToro's ambition and confidence in its future growth. This significant amount of funding is likely earmarked for:

- Expansion into New Markets: eToro could utilize the funds to expand its geographical reach, targeting new user demographics and regions with high growth potential in online trading.

- Research and Development (R&D): Investment in R&D is crucial for maintaining a competitive edge. eToro might allocate funds to develop innovative trading tools, improve its platform's user experience, and explore new technologies within the social trading sphere.

- Strategic Acquisitions: Acquiring smaller companies with complementary technologies or user bases could accelerate eToro’s growth and expand its product offerings.

- Strengthening its Brand: A portion of the funds may be dedicated to enhancing brand awareness, marketing efforts, and user acquisition campaigns for sustained growth.

This valuation represents a considerable increase compared to previous funding rounds, showcasing the company's impressive growth and attracting significant attention from potential investors in the social trading sphere. The impact on existing shareholders will depend on the terms of the IPO and the final share price.

eToro's Competitive Landscape and Market Position

Key Competitors and Market Share

eToro operates in a competitive landscape dominated by several established players:

- Direct Competitors: Platforms like Robinhood, TradingView, and Webull offer similar services, creating a fiercely competitive environment in the online trading and investment sector.

- eToro's Unique Selling Propositions (USPs): eToro differentiates itself through its unique social trading features, copy trading capabilities, and a user-friendly interface, fostering community engagement and education.

- Market Share and Growth Potential: While precise market share figures are difficult to obtain, eToro's significant user base and brand recognition position it favorably for continued growth within the expanding social trading market.

Impact of Regulatory Changes

Regulatory changes significantly influence eToro's IPO strategy and operations:

- Compliance with Regulations: eToro must ensure strict compliance with evolving financial regulations in each jurisdiction it operates in. This is critical for maintaining trust among its investors and regulators.

- International Expansion: Navigating diverse regulatory environments is essential for successful international expansion. This requires meticulous planning and adapting to differing legal frameworks concerning online trading.

- Challenges and Opportunities: While regulatory hurdles present challenges, compliance also builds investor trust, fostering credibility and attracting more investors to the platform.

Potential Risks and Opportunities Associated with the eToro IPO

Market Volatility and Investor Sentiment

The success of eToro's IPO is subject to market volatility and investor sentiment:

- Global Economic Conditions: Economic downturns or uncertainty can negatively impact investor appetite for IPOs, potentially affecting the valuation and the success of eToro’s IPO.

- Sensitivity Analysis: Thorough due diligence and a sensitivity analysis of different market scenarios are crucial to mitigate risks associated with market fluctuations and investor confidence.

- Attracting Investors: Securing sufficient investor participation at a favorable valuation requires a compelling narrative, strong financial performance, and a clear growth strategy within the evolving social trading sphere.

Long-Term Growth Prospects and Sustainability

eToro's long-term success hinges on several factors:

- User Growth and Retention: Sustained user growth and high retention rates are critical for long-term viability. This requires continuous innovation, improved user experience, and building a loyal user base within the ever-competitive online trading space.

- Revenue Growth and Profitability: Demonstrating consistent revenue growth and achieving profitability are essential for attracting long-term investors and ensuring the company’s financial health.

- Sustainability of the Social Trading Model: The long-term sustainability of the social trading model depends on continuous innovation, adapting to changing market trends, and maintaining investor confidence in the online trading platform.

Conclusion

eToro's renewed attempt at a $500 million IPO represents a significant milestone for the company and the broader social trading industry. While challenges exist regarding market volatility and regulatory landscapes, the platform's robust user base, innovative features, and strategic expansion plans suggest a strong potential for success. The outcome of this eToro IPO will be closely watched by investors and industry analysts alike, as it could reshape the landscape of online trading. Stay informed about the progress of the eToro IPO and explore the possibilities of investing in this exciting sector by following reputable financial news sources and conducting thorough due diligence before making any investment decisions. Learn more about the eToro IPO and its potential impact on the social trading market.

Featured Posts

-

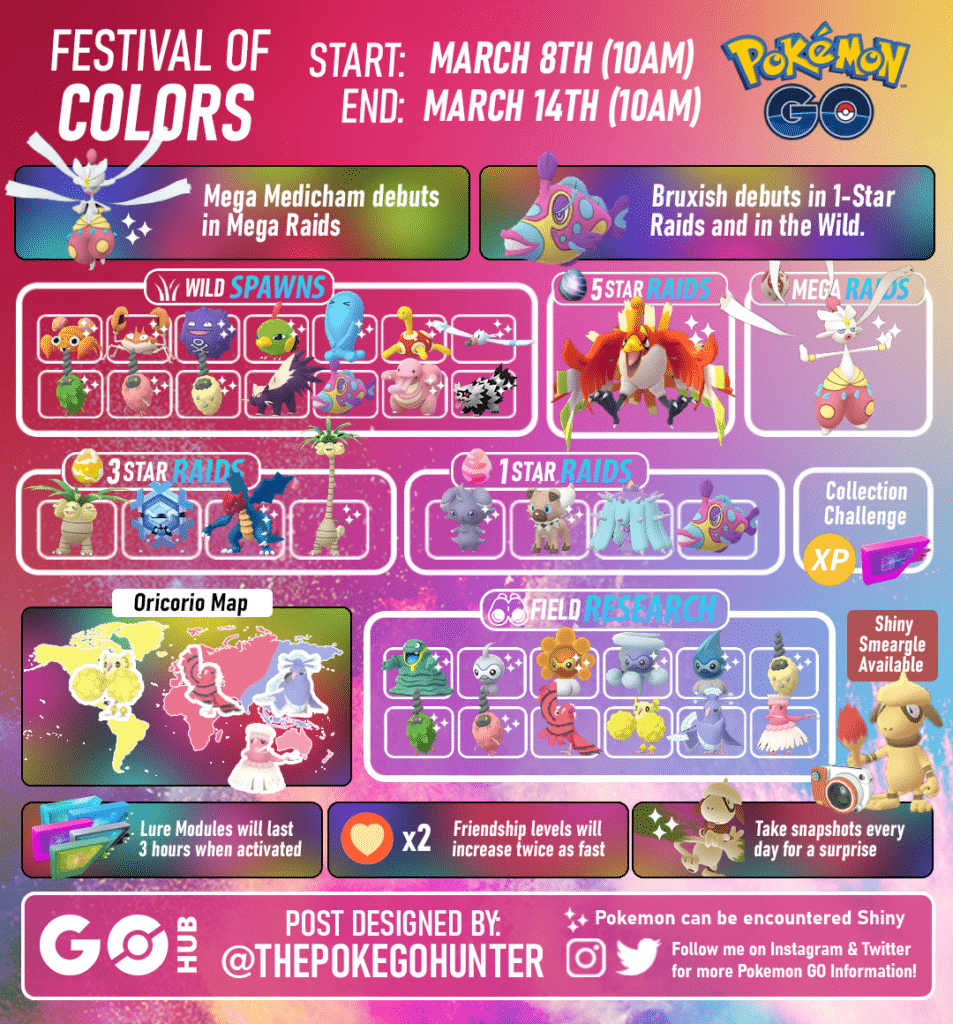

Pokemon Go May 2025 Complete Event Calendar

May 14, 2025

Pokemon Go May 2025 Complete Event Calendar

May 14, 2025 -

Muzikos Protestu Ir Saunu Savaite Bazelyje Eurovizijos Pradzios Svente

May 14, 2025

Muzikos Protestu Ir Saunu Savaite Bazelyje Eurovizijos Pradzios Svente

May 14, 2025 -

Le Projet De Loi Help Extension Act Et Son Impact Sur L Economie Haitienne

May 14, 2025

Le Projet De Loi Help Extension Act Et Son Impact Sur L Economie Haitienne

May 14, 2025 -

Eurovision Song Contest 2025 Complete Guide To Participants Dates And Uk Representative

May 14, 2025

Eurovision Song Contest 2025 Complete Guide To Participants Dates And Uk Representative

May 14, 2025 -

Enquete Sur Le Derapage Budgetaire Le Cas Alexis Kohler

May 14, 2025

Enquete Sur Le Derapage Budgetaire Le Cas Alexis Kohler

May 14, 2025