EToro's $500 Million IPO: A Resumption Of Plans

Table of Contents

The Resumption of eToro's IPO Plans

eToro's journey towards an IPO hasn't been without its challenges. Previous attempts faced delays due to a confluence of factors, including fluctuating market conditions and navigating the complexities of regulatory hurdles in various jurisdictions. The volatile nature of the global financial landscape, particularly impacting tech stocks, contributed significantly to these setbacks. However, recent developments paint a much more optimistic picture.

The renewed push for an eToro IPO stems from a series of positive developments that demonstrate the company's robust growth and stability. These include:

- Improved financial performance in recent quarters: eToro has reported consistently strong financial results, showcasing significant revenue growth and increasing profitability. This demonstrable financial health is a key factor attracting potential investors.

- Expansion into new markets and increased user acquisition: eToro's strategic expansion into new geographical markets has broadened its user base considerably, solidifying its global reach and market share. This global expansion fuels revenue diversification and reduces reliance on single markets.

- Successful integration of new features and services: Continuous innovation and the successful launch of new features and services, such as enhanced copy trading functionalities and improved educational resources, have strengthened eToro's platform appeal and user engagement. These improvements indicate the company's commitment to ongoing development.

- Positive regulatory developments: eToro has actively engaged with regulatory bodies worldwide, securing necessary licenses and approvals that pave the way for a smoother IPO process and instill investor confidence. Regulatory clarity is crucial for a successful IPO.

- Strengthening of the company's leadership team: The company has bolstered its leadership with experienced professionals, adding expertise in finance, technology, and regulatory compliance, further enhancing investor confidence and preparedness for the IPO.

Potential Implications of the eToro IPO

The successful completion of the eToro IPO holds significant implications for both the company and investors.

For eToro, the IPO offers:

- Access to significant capital for further growth and expansion: The influx of capital will fuel further innovation, expansion into new markets, and strategic acquisitions, strengthening its competitive position.

- Increased brand awareness and market recognition: A successful IPO significantly enhances brand visibility and credibility, attracting more users and solidifying eToro's position as a leading social trading platform.

- Enhanced credibility and legitimacy in the financial markets: The IPO process itself brings a higher level of scrutiny and validation, enhancing trust among investors and regulatory bodies.

For investors, the eToro IPO presents:

- Opportunities to gain exposure to the fast-growing fintech sector: Investing in eToro offers participation in a dynamic and rapidly expanding industry with substantial growth potential.

- Potential for high returns: Successful fintech IPOs often deliver substantial returns for early investors, although this is subject to market conditions and inherent risks.

- Diversification opportunities: eToro offers a diversified investment opportunity, lessening reliance on traditional investment vehicles.

However, it's crucial to acknowledge potential challenges:

- Market volatility: Fluctuations in the stock market can significantly impact the IPO's performance and its success.

- Regulatory scrutiny: Ongoing regulatory changes and scrutiny within the fintech sector pose a potential risk to the company's operations and valuation.

- Competition from established players: The online brokerage industry is highly competitive, with established players vying for market share.

Factors Contributing to the Success of the eToro IPO

The renewed confidence surrounding the eToro IPO is built upon several key factors:

- Innovative social trading platform with a strong user base: eToro's unique social trading platform, allowing users to copy the trades of successful investors, has fostered a large and engaged community. This strong user base is a crucial asset.

- Strategic partnerships with financial institutions and technology providers: eToro's strategic alliances have expanded its reach, access to resources, and technological capabilities.

- Strong management team with a proven track record of success: A capable and experienced leadership team inspires confidence in the company's ability to execute its strategic plans and navigate challenges effectively.

- Favorable market conditions for technology and fintech companies: The current market environment, despite some volatility, shows continued strong interest in technology and fintech companies, bolstering the appeal of the eToro IPO.

- Increasing investor interest in the social trading and investment space: The growing popularity of social trading and investment platforms creates a fertile ground for companies like eToro to flourish.

Competitive Landscape and eToro's Position

eToro operates within a competitive landscape populated by established players such as Robinhood, Interactive Brokers, and Charles Schwab. However, eToro differentiates itself through its unique social trading features, a strong focus on education, and a diverse range of assets available for trading. This provides a competitive advantage in attracting new users and retaining existing ones.

Conclusion

The resurgence of eToro's $500 million IPO plans signifies a significant milestone for the company and the fintech sector. The combination of strong financial performance, a robust user base, strategic partnerships, and favorable market conditions has contributed to renewed investor confidence. While market volatility and regulatory scrutiny remain potential challenges, the long-term prospects for eToro appear promising. The eToro IPO presents both significant opportunities and risks for investors.

Call to action: Stay informed about the latest developments regarding the eToro IPO. Follow reputable financial news sources for updates on the eToro IPO and its potential impact on the investment landscape. Learn more about the exciting opportunities and potential risks associated with investing in the eToro IPO. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Cannonball U Your Complete Tv Guide

May 14, 2025

Cannonball U Your Complete Tv Guide

May 14, 2025 -

Jude Bellinghams Potential Transfer Arsenal Vs Manchester United

May 14, 2025

Jude Bellinghams Potential Transfer Arsenal Vs Manchester United

May 14, 2025 -

Experiencias Deleznables Una Guia A Las Euforias

May 14, 2025

Experiencias Deleznables Una Guia A Las Euforias

May 14, 2025 -

Mission Impossible Dead Reckoning Svalbard Filming Challenges Revealed By Cruise And Atwell

May 14, 2025

Mission Impossible Dead Reckoning Svalbard Filming Challenges Revealed By Cruise And Atwell

May 14, 2025 -

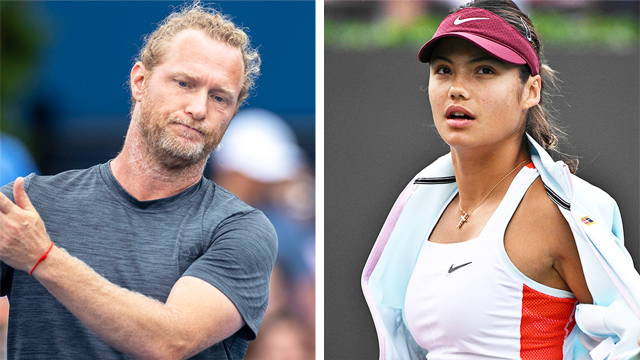

Tennis Star Raducanu Announces Coaching Change

May 14, 2025

Tennis Star Raducanu Announces Coaching Change

May 14, 2025