€18 Million Bonus Unexplained: Inside Deutsche Bank's London Fixed Income Division

Table of Contents

The €18 Million Bonus: A Closer Look

The €18 million bonus, the details of which emerged through leaked internal documents obtained by [Source of information - e.g., an investigative journalist, whistleblower], remains shrouded in mystery. While the exact recipient(s) haven't been publicly identified, the sheer magnitude of the payment has sparked outrage and intense scrutiny. The timeline of discovery suggests the bonus was awarded sometime in [Time period - e.g., late 2022], and only came to light recently.

- Source of Information: Leaked internal documents from Deutsche Bank's London office detailed the bonus payment, raising immediate concerns about the lack of transparency within the institution.

- Lack of Transparency: Deutsche Bank has yet to provide a satisfactory public explanation for the bonus, citing confidentiality concerns. This lack of transparency fuels speculation and erodes public trust.

- Initial Reactions: The initial reaction from Deutsche Bank was a statement acknowledging the payment but offering limited details, prompting further calls for investigation by regulatory bodies and the media.

Deutsche Bank's Fixed Income Division: Performance and Context

Understanding the context surrounding the €18 million bonus requires analyzing the performance of Deutsche Bank's London fixed income division during the relevant period. While the bank hasn't released specific financial data related to this division, industry analysts suggest that [insert assessment of division's financial performance - e.g., profits were significantly lower than previous years, or even losses were incurred].

- Profitability: Were profits high enough to justify such an extravagant bonus? The available public information suggests that the division's performance did not warrant such a significant payout.

- Divisional Structure: The London fixed income division is a critical part of Deutsche Bank's global operations, employing hundreds of individuals in various roles, ranging from traders and analysts to senior management. The organizational structure, while complex, is crucial in tracing the flow of funds.

- Industry Comparison: Comparing the €18 million bonus to industry standards for similar roles and performance levels reveals a significant discrepancy. Bonuses of this magnitude are exceedingly rare, even in years of exceptional performance.

Regulatory Scrutiny and Potential Fallout

The unexplained €18 million bonus has triggered potential regulatory scrutiny from several key bodies.

- Regulatory Bodies: The Financial Conduct Authority (FCA) in the UK and the European Central Bank (ECB) are likely to investigate the matter, given the potential breach of regulations on executive compensation and financial transparency.

- Potential Investigations and Fines: Depending on the findings of these investigations, Deutsche Bank could face significant fines and reputational damage. The potential for criminal investigations cannot be ruled out.

- Impact on Reputation and Investor Confidence: The scandal has already damaged Deutsche Bank's reputation, raising concerns among investors about corporate governance and risk management. This could lead to decreased investor confidence and impact the bank's stock price.

The Wider Implications for Financial Transparency

The €18 million bonus scandal highlights a broader issue of transparency and accountability within the financial industry, particularly concerning executive compensation.

- Similar Instances: This case mirrors other instances of unexplained bonuses and lavish executive payouts that have plagued the financial sector for years, underscoring the need for systemic reform.

- Strengthening Regulatory Frameworks: The incident underlines the urgent need for stronger regulatory frameworks to prevent similar occurrences in the future, including more stringent requirements for bonus disclosures and justifications.

- Necessary Reforms: Increased transparency in executive compensation, stricter oversight of bonus schemes, and more robust whistleblower protection mechanisms are critical steps towards greater accountability within financial institutions.

Conclusion

The unexplained €18 million bonus at Deutsche Bank's London fixed income division represents a stark failure of transparency and accountability within the financial industry. The lack of explanation, coupled with the potential regulatory repercussions, casts a long shadow over Deutsche Bank's reputation and raises serious concerns about corporate governance. This case underscores the vital need for stricter regulations and enhanced transparency regarding executive compensation. Further investigation into the €18 million bonus and similar cases is crucial for promoting better practices within Deutsche Bank and the wider financial sector. Understanding these issues is vital for maintaining investor trust and ensuring ethical practices within the financial industry. Stay informed about developments in this ongoing investigation and the wider debate surrounding executive compensation and financial transparency.

Featured Posts

-

Alcarazs Monte Carlo Victory Musetti Forced To Retire

May 30, 2025

Alcarazs Monte Carlo Victory Musetti Forced To Retire

May 30, 2025 -

Decouverte D Une Bombe A La Gare Du Nord Consequences Sur Le Trafic

May 30, 2025

Decouverte D Une Bombe A La Gare Du Nord Consequences Sur Le Trafic

May 30, 2025 -

Elon Musks Alleged Paternity Unraveling The Mystery Surrounding Amber Heards Twins

May 30, 2025

Elon Musks Alleged Paternity Unraveling The Mystery Surrounding Amber Heards Twins

May 30, 2025 -

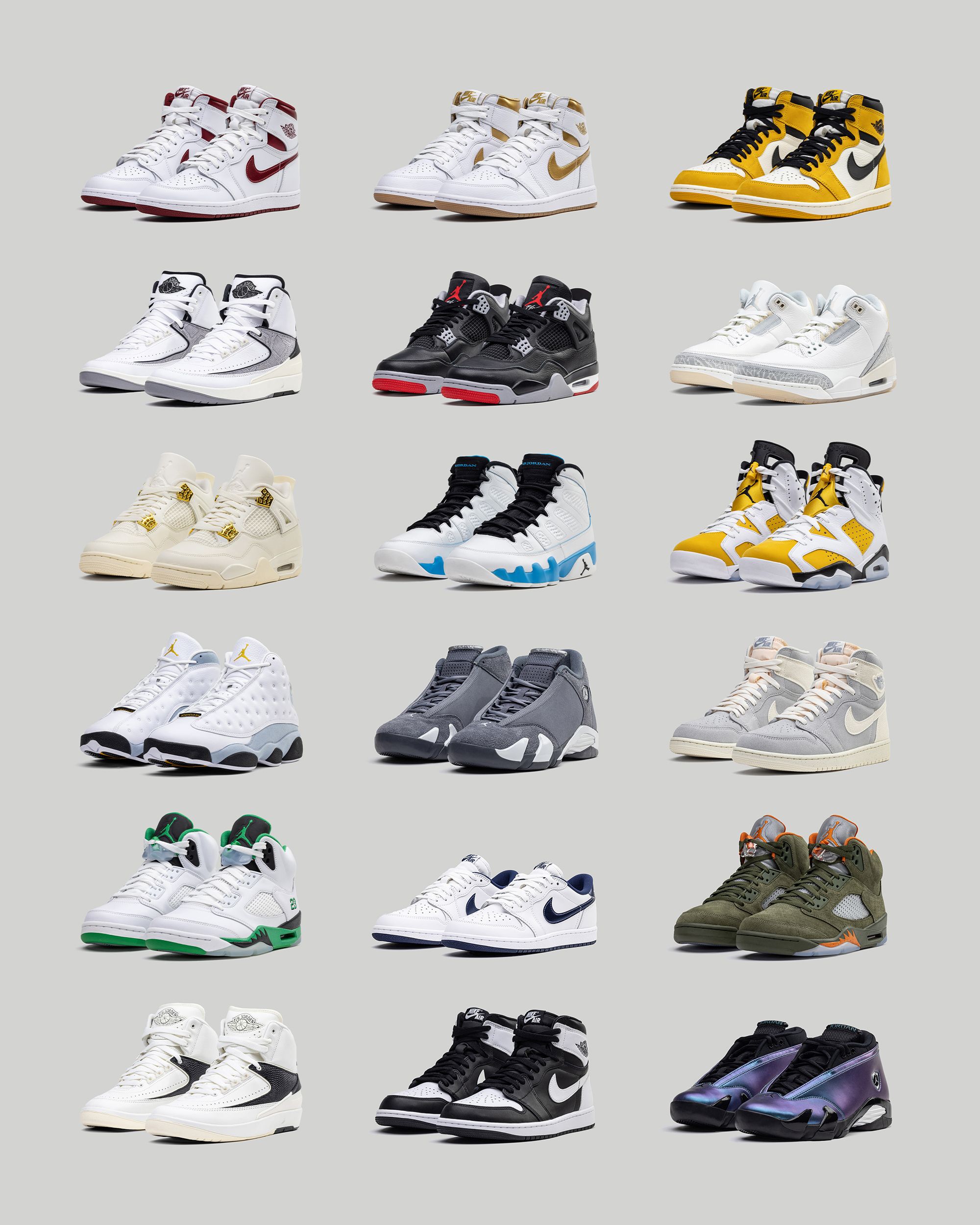

Air Jordans Dropping In May 2025 Release Calendar And Details

May 30, 2025

Air Jordans Dropping In May 2025 Release Calendar And Details

May 30, 2025 -

Upset In Madrid Potapova Triumphs Over Zheng Qinwen

May 30, 2025

Upset In Madrid Potapova Triumphs Over Zheng Qinwen

May 30, 2025