Economists Forecast Bank Of Canada Interest Rate Cuts Due To Tariff Impacts On Employment

Table of Contents

Tariffs and Their Impact on Canadian Employment

Tariffs, essentially taxes imposed on imported goods, significantly increase the cost of these products for Canadian businesses and consumers. This mechanism has far-reaching consequences. Increased costs for imported materials directly impact businesses' production costs, making Canadian goods less competitive in both domestic and international markets. This reduced competitiveness can lead to a decrease in sales, forcing businesses to cut costs, often resulting in layoffs and hiring freezes. Furthermore, higher prices for consumers lead to decreased spending, creating a ripple effect throughout the economy.

Specific sectors are bearing the brunt of these effects. The automotive industry, for instance, relies heavily on imported parts, making it particularly vulnerable to tariff increases. Similarly, the manufacturing and agriculture sectors are facing significant challenges due to increased input costs and reduced export opportunities.

- Increased production costs: Higher prices for imported raw materials and components directly increase the cost of producing goods.

- Reduced competitiveness: Canadian businesses struggle to compete with cheaper imports or exports from countries unaffected by tariffs.

- Layoffs and hiring freezes: Businesses respond to decreased profitability by reducing their workforce.

- Decreased consumer spending: Higher prices for goods and services lead consumers to reduce their spending.

Data from [insert source, e.g., Statistics Canada] shows a [insert specific statistic, e.g., 2% decrease] in employment within the manufacturing sector since the implementation of new tariffs. Further research from [insert source, e.g., a reputable economic journal] highlights the correlation between tariff increases and job losses in the automotive sector.

Economic Indicators Showing the Need for Interest Rate Cuts

Several key economic indicators are flashing warning signs, signaling the need for intervention by the Bank of Canada. The slowing GDP growth, a direct consequence of reduced business investment and consumer spending, is a significant concern. Furthermore, rising unemployment claims clearly indicate a weakening labor market. The combination of these factors points towards potential deflationary pressures, a situation where prices fall and economic activity stagnates. This is further exacerbated by weakening consumer confidence, as uncertainty about the future leads to decreased spending and investment.

- Slowing GDP growth: Economic activity is slowing down due to decreased business investment and consumer spending.

- Rising unemployment claims: More Canadians are filing for unemployment benefits, reflecting job losses in affected sectors.

- Potential deflationary pressures: Falling prices discourage investment and can lead to a prolonged economic downturn.

- Weakening consumer confidence: Uncertainty and concerns about the future lead to reduced spending.

(Insert a chart or graph visually representing the trends in GDP growth, unemployment rate, and inflation, properly sourced.)

Economists' Predictions and the Bank of Canada's Response

Economists widely predict that the Bank of Canada will lower interest rates in response to the deteriorating economic conditions. The rationale behind these predicted cuts is to stimulate economic activity by making borrowing cheaper for businesses and consumers. Lower interest rates encourage investment, boosting business activity and potentially creating jobs. While the Bank of Canada may consider alternative measures, such as targeted fiscal stimulus, interest rate cuts remain the most likely immediate response.

- Projected interest rate cut percentages: Economists forecast a rate cut of [insert percentage] in the coming months.

- Timing of potential rate cuts: The cuts are expected to occur within [insert timeframe, e.g., the next quarter].

- Potential impact on the Canadian dollar: Lower interest rates may weaken the Canadian dollar, impacting both imports and exports.

- Concerns about inflation and potential risks: While stimulating growth is the primary goal, the Bank of Canada will carefully monitor inflationary pressures.

While no official statement has been released by the Bank of Canada at the time of writing, recent comments from [mention a relevant official or source] suggest a willingness to act decisively to address the current economic challenges.

Potential Long-Term Economic Consequences

The long-term economic consequences of both the tariffs and the anticipated interest rate cuts are complex and multifaceted. While interest rate cuts aim to stimulate short-term growth, they also carry potential risks. Increased borrowing may lead to higher consumer debt in the long run, potentially creating financial instability. Furthermore, if the rate cuts are insufficient to counteract the effects of the tariffs, the long-term impact on employment could be significant. On the other hand, if successful, the cuts could prevent a more severe economic downturn. Alternative solutions, such as targeted government support for affected industries or renegotiation of trade agreements, should also be explored.

- Impact on investment and business growth: Lower interest rates can encourage investment, but the effects of tariffs could counteract this.

- Effects on consumer debt: Easy borrowing may lead to an increase in household debt, potentially creating financial vulnerability.

- Long-term implications for employment: The success of the rate cuts in creating jobs will depend on several factors.

- Potential for inflationary pressures down the line: Stimulative monetary policy can lead to higher inflation in the long term.

Conclusion: Summarizing the Forecast of Bank of Canada Interest Rate Cuts

The connection between escalating tariffs, declining employment figures, and the predicted interest rate cuts by the Bank of Canada is undeniable. Economists' forecasts are based on a convergence of indicators showcasing a weakening economy. The potential long-term consequences of both the tariffs and the Bank of Canada's response require careful monitoring and consideration of alternative strategies. Understanding these economic factors is crucial for navigating the current financial landscape. Stay updated on the latest forecasts and the Bank of Canada's response to tariff impacts on Canadian employment. Understanding these economic factors is crucial for navigating the current financial landscape.

Featured Posts

-

Arsenal Target Premier League Player Ornsteins Report

May 14, 2025

Arsenal Target Premier League Player Ornsteins Report

May 14, 2025 -

Potapova Upsets Zheng Qinwen At Madrid Open

May 14, 2025

Potapova Upsets Zheng Qinwen At Madrid Open

May 14, 2025 -

Federer Vs Dokovic Poredenje Rekorda I Uspeha

May 14, 2025

Federer Vs Dokovic Poredenje Rekorda I Uspeha

May 14, 2025 -

Walmart Canned Bean Recall Products Affected And Safety Concerns

May 14, 2025

Walmart Canned Bean Recall Products Affected And Safety Concerns

May 14, 2025 -

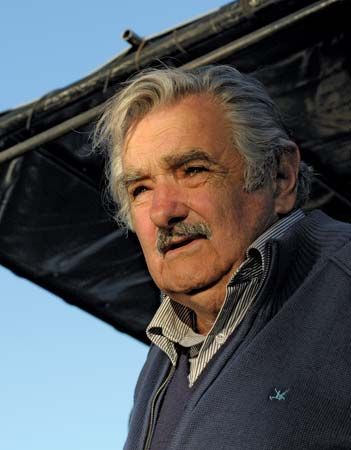

Jose Mujica 1935 2024 Recordando Al Presidente Que Cambio Uruguay

May 14, 2025

Jose Mujica 1935 2024 Recordando Al Presidente Que Cambio Uruguay

May 14, 2025