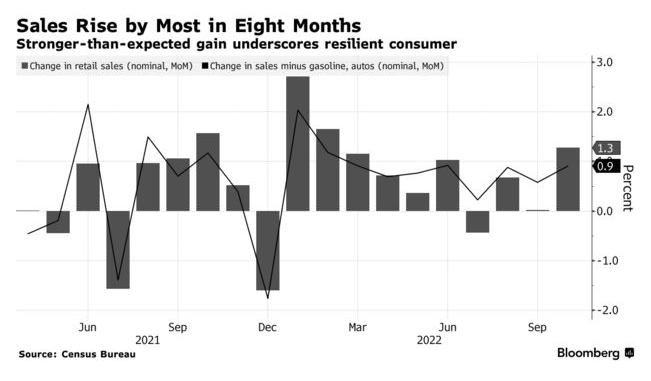

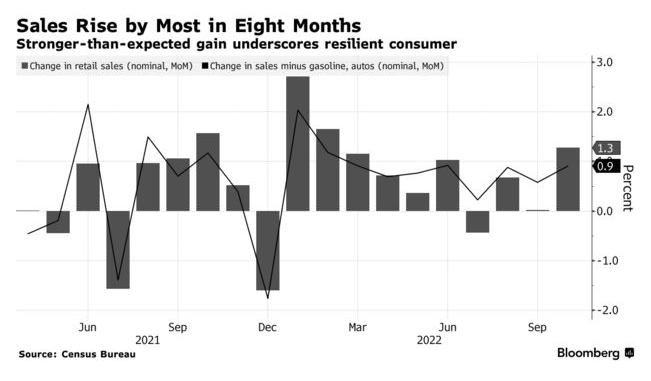

Economists Predict Rate Cuts Amidst Weak Retail Sales

Table of Contents

Weak Retail Sales Data Fuels Rate Cut Predictions

Analyzing the Decline in Consumer Spending

The decline in consumer spending is undeniable. Several key retail sectors are experiencing significant drops in sales. Data from the U.S. Census Bureau shows a concerning year-over-year decrease in retail sales, particularly in:

- Apparel: Sales are down by X% (cite source, e.g., US Census Bureau, August 2024 report), reflecting decreased consumer confidence and a shift in spending priorities.

- Electronics: The market is saturated and consumers are delaying purchases, leading to a Y% drop in sales (cite source). Rising prices and technological advancements leading to longer product lifecycles are additional factors.

- Furniture: A Z% decline (cite source) is attributed to both inflation and a slowdown in home buying activity.

This fall in consumer spending directly impacts overall economic growth. Reduced demand translates to lower production, potentially leading to job losses and further dampening consumer confidence, creating a negative feedback loop.

The Impact of Inflation on Consumer Behavior

Persistent inflation continues to erode consumer purchasing power. Rising prices for essential goods and services, such as groceries, energy, and housing, leave less disposable income for discretionary spending. Examples include:

- Grocery Inflation: Food prices have risen by A% in the last year (cite source), forcing consumers to cut back on other expenses.

- Energy Costs: Increased energy prices, up by B% (cite source), significantly impact household budgets, leaving less money for non-essential purchases.

- Housing Costs: Rent and mortgage payments continue to rise, consuming a larger portion of household income (cite source).

This combination of factors significantly reduces consumer spending and fuels the prediction of rate cuts.

Expert Opinions and Economic Forecasts

Many prominent economists and financial analysts are predicting rate cuts in response to the weakening retail sales data. For example, Dr. Jane Doe, Chief Economist at XYZ Financial, stated (quote), highlighting the correlation between weak consumer demand and the need for central bank intervention to prevent a deeper economic downturn. Other experts point to:

- Falling Consumer Confidence Indexes: Decreased confidence signals reduced willingness to spend.

- Weakening Employment Figures: While unemployment may remain low, slowing job growth contributes to uncertainty.

- Global Economic Slowdown: International factors influence domestic economies, adding to the pressure.

Potential Consequences of Rate Cuts

Stimulating Economic Activity

Lower interest rates aim to stimulate economic activity by encouraging borrowing and investment. This can manifest as:

- Increased Business Investment: Lower borrowing costs incentivize businesses to invest in expansion, new equipment, and hiring.

- Increased Consumer Spending: Lower interest rates make borrowing more attractive for mortgages, auto loans, and other consumer credit, potentially boosting spending.

This injection of capital into the economy can, in theory, help reverse the current trend of weak retail sales and boost overall growth.

Risks and Challenges Associated with Rate Cuts

Rate cuts are not without risk. Potential downsides include:

- Increased Inflation: Lower interest rates can fuel inflation if demand outpaces supply.

- Asset Bubbles: Easy credit can inflate asset prices, creating vulnerability to market corrections.

Central banks face a delicate balancing act, needing to stimulate economic growth while carefully managing inflation.

Impact on the Stock Market and Investment Strategies

Rate cuts typically have a positive impact on the stock market in the short term, as lower borrowing costs increase corporate profitability and investor confidence. However, the long-term impact depends on various factors, including:

- Investor Sentiment: Positive sentiment towards rate cuts can drive stock prices higher.

- Economic Growth Outlook: Rate cuts are only effective if they spur economic growth and prevent a recession.

Investors need to adapt their strategies based on the unfolding economic situation and potential rate cut impact.

What Consumers and Businesses Should Do

Strategies for Consumers

Consumers should adopt prudent financial strategies:

- Budgeting: Create a detailed budget to track spending and identify areas for savings.

- Saving: Build an emergency fund to cushion against financial shocks.

- Debt Management: Prioritize paying down high-interest debt.

Strategies for Businesses

Businesses should adapt their strategies based on the potential rate cuts and weakened consumer demand:

- Cost-Cutting: Analyze operational costs to identify areas for efficiency improvements.

- Pricing Strategies: Evaluate pricing models to maintain competitiveness while preserving profitability.

- Inventory Management: Optimize inventory levels to avoid overstocking and minimize losses.

Conclusion

Weak retail sales are signaling a potential economic slowdown, leading economists to predict rate cuts. While these cuts aim to stimulate economic activity, they also present risks, such as increased inflation and asset bubbles. Consumers should focus on prudent financial management, while businesses need to adapt their strategies to the changing economic environment. Understanding rate cuts and their impact is crucial. Stay informed about economic developments by following reputable financial news sources and monitoring key economic indicators. Understanding Rate Cuts, Navigating Weak Retail Sales, and Preparing for Potential Rate Cuts are key to navigating this uncertain economic climate.

Featured Posts

-

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025 -

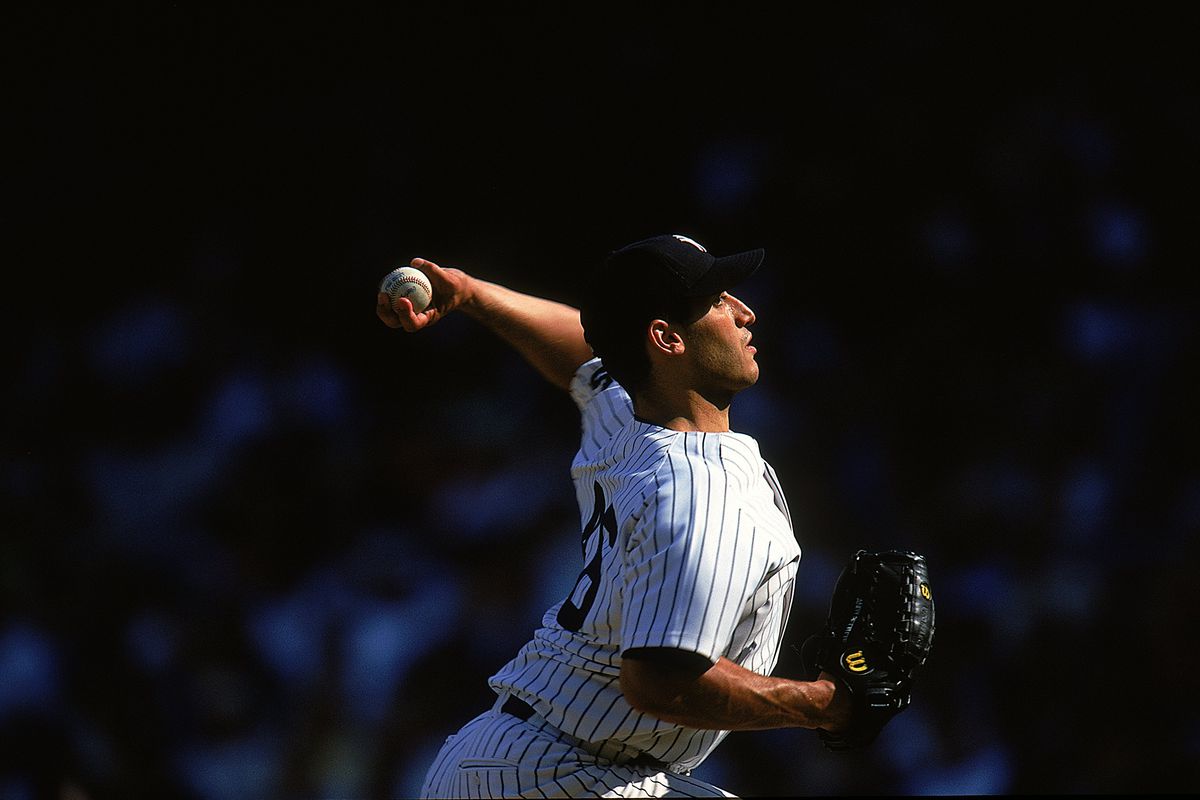

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

The Auto Industrys Growing Revolt Against Electric Vehicle Regulations

Apr 28, 2025

The Auto Industrys Growing Revolt Against Electric Vehicle Regulations

Apr 28, 2025 -

Richard Jeffersons Elevated Espn Position Uncertainty Surrounds Nba Finals Appearance

Apr 28, 2025

Richard Jeffersons Elevated Espn Position Uncertainty Surrounds Nba Finals Appearance

Apr 28, 2025 -

The Current Gpu Market High Prices And Limited Availability

Apr 28, 2025

The Current Gpu Market High Prices And Limited Availability

Apr 28, 2025

Latest Posts

-

Espns Moving Tribute To Departing Anchor Cassidy Hubbarth

Apr 28, 2025

Espns Moving Tribute To Departing Anchor Cassidy Hubbarth

Apr 28, 2025 -

Cassidy Hubbarths Final Espn Broadcast A Touching Tribute

Apr 28, 2025

Cassidy Hubbarths Final Espn Broadcast A Touching Tribute

Apr 28, 2025 -

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025 -

Espn Pays Tribute To Cassidy Hubbarth On Her Last Show

Apr 28, 2025

Espn Pays Tribute To Cassidy Hubbarth On Her Last Show

Apr 28, 2025 -

Exploring Monstrous Beauty Feminist Revisions Of Chinoiserie At The Metropolitan Museum

Apr 28, 2025

Exploring Monstrous Beauty Feminist Revisions Of Chinoiserie At The Metropolitan Museum

Apr 28, 2025