Economists Weigh In: Understanding The Bank Of Canada's Rate Decision

Table of Contents

The Bank of Canada's Rationale: Inflation and Economic Growth

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. Its recent interest rate decision was fundamentally driven by the interplay between inflation and GDP growth. The Bank's actions are guided by its inflation target, typically aiming for 2%.

-

Current inflation figures and comparison to target rate: Recent inflation data showed [Insert actual recent inflation figures here, e.g., a rate of 3.5%], exceeding the Bank's target. This elevated inflation, driven by factors such as [mention contributing factors like supply chain issues, energy prices, etc.], necessitates proactive measures to cool the economy.

-

Recent GDP growth data and forecasts: While GDP growth has [insert recent GDP growth data, e.g., shown moderate growth], the Bank's projections suggest [insert projected growth rates and potential slowing]. Balancing robust growth with inflation control is a delicate balancing act.

-

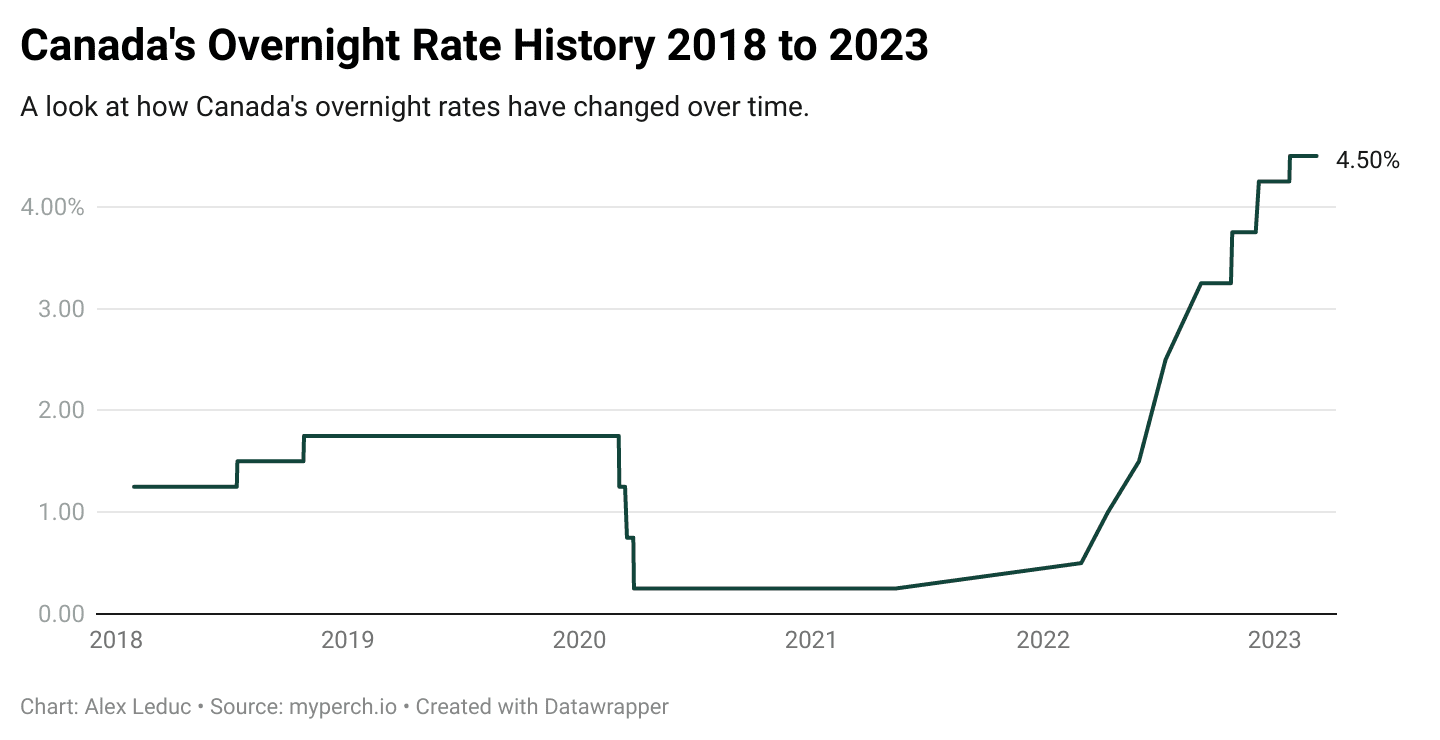

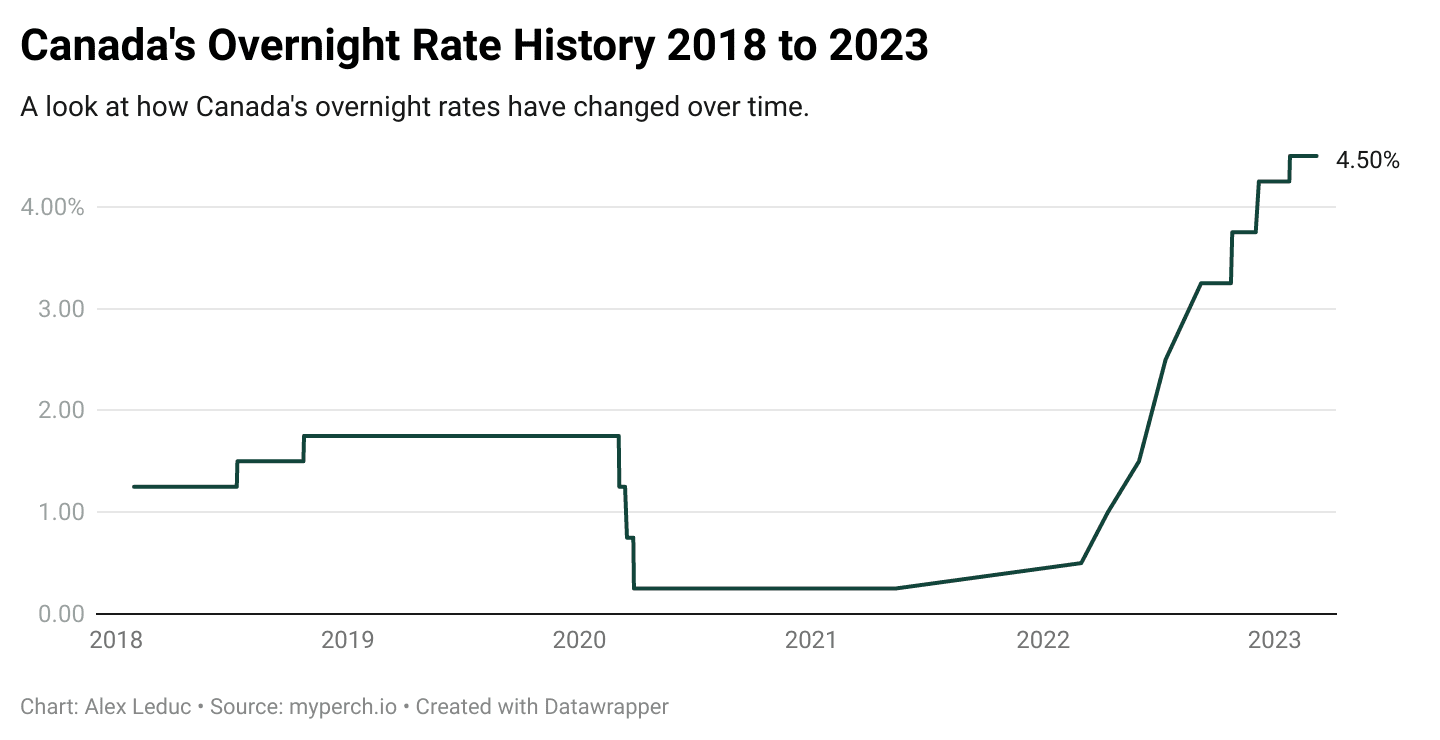

Explanation of the Bank's inflation control mandate: The Bank utilizes various monetary policy tools to influence inflation. Its primary tool is the overnight rate, which affects borrowing costs across the economy.

-

Discussion of the tools used by the Bank of Canada (e.g., overnight rate, quantitative easing): In this instance, the Bank's [mention whether it raised or lowered rates, and by how much] the overnight rate, signaling its commitment to curbing inflation. Quantitative easing (QE) measures, previously employed, may or may not still be in play depending on the specific decision - discuss here if applicable.

Expert Opinions: A Divergence of Views

Economists' opinions on the Bank of Canada's latest interest rate decision are varied. While some applaud the move as necessary to control inflation, others express concern about its potential impact on economic growth and employment.

-

Summary of opinions from leading economists: [Insert quotes and summaries of opinions from prominent Canadian economists. Mention specific economists by name and their affiliations if possible. For example: "Professor X from the University of Y believes the rate hike is a prudent measure to address persistent inflation," while "Economist Z from the Canadian Economic Association expresses concern about the potential negative consequences for the housing market."]

-

Breakdown of differing viewpoints on the effectiveness of the rate decision: Some economists argue that the rate adjustment is insufficient to curb inflation effectively, while others warn that a more aggressive approach could trigger a recession. The debate centers around the effectiveness of monetary policy in the current economic climate.

-

Analysis of the market's reaction to the announcement: The financial markets responded to the announcement with [describe market reactions – for example, a slight dip in the stock market, fluctuations in the Canadian dollar]. This reaction reflects investor sentiment and expectations about the future economic outlook.

-

Discussion of potential long-term economic consequences: The long-term consequences of this decision are uncertain, depending on the interplay of various economic factors, including global economic conditions and future inflation data.

Impact on Key Sectors: Housing, Employment, and Investment

The Bank of Canada's rate decision will likely have significant repercussions across various sectors of the Canadian economy.

-

Potential effects on the housing market (prices, mortgage rates): Higher interest rates typically lead to higher mortgage rates, potentially cooling down the overheated housing market and affecting housing affordability.

-

Predicted impact on employment rates and job creation: A rate hike could potentially slow down job creation, although the impact will depend on the overall strength of the economy.

-

Analysis of the impact on business investment and confidence: Businesses may postpone investment decisions due to higher borrowing costs, potentially impacting economic growth.

-

Discussion of the likely impact on consumer spending patterns: Higher interest rates can reduce consumer spending as borrowing becomes more expensive, affecting overall economic demand.

Looking Ahead: Future Monetary Policy Predictions

Predicting future monetary policy is inherently challenging, but the Bank of Canada's recent decision offers some insights.

-

Predictions for future interest rate movements: Based on current economic indicators, [insert predictions regarding potential future rate increases or decreases]. Further adjustments will likely depend on inflation data and economic growth projections.

-

Analysis of factors that might influence future policy changes (e.g., inflation, economic growth): Future policy decisions will be heavily influenced by inflation trends, GDP growth, and global economic developments.

-

Discussion of potential risks to the Canadian economy: Risks include a potential recession triggered by aggressive rate hikes or persistent inflation despite monetary policy tightening.

-

Summary of the overall economic outlook: The outlook remains uncertain, with the Bank of Canada's actions aimed at balancing inflation control with sustainable economic growth.

Conclusion

The Bank of Canada's recent interest rate decision is a multifaceted issue with wide-ranging consequences for the Canadian economy. While the stated goal is to manage inflation and foster sustainable economic growth, the varying expert opinions highlight the complexity of economic forecasting. The impact on key sectors, from housing to employment, will be substantial and requires ongoing monitoring.

Call to Action: Stay informed about future Bank of Canada interest rate decisions and their implications for your personal finances and investments. Understanding the Bank of Canada’s rate decisions is crucial for navigating the complexities of the Canadian economy. Continue to follow our analysis for valuable insights into the Bank of Canada's monetary policy and its impact on your financial future.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Surge

Apr 23, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Surge

Apr 23, 2025 -

Jackson Chourios Double Homer Propels Brewers To 8 2 Win Vs Reds

Apr 23, 2025

Jackson Chourios Double Homer Propels Brewers To 8 2 Win Vs Reds

Apr 23, 2025 -

Nine Home Runs In One Game Aaron Judge And The Yankees Make History

Apr 23, 2025

Nine Home Runs In One Game Aaron Judge And The Yankees Make History

Apr 23, 2025 -

Ontarios Internal Trade Reforms Increased Alcohol And Labour Market Freedom

Apr 23, 2025

Ontarios Internal Trade Reforms Increased Alcohol And Labour Market Freedom

Apr 23, 2025 -

Nine Home Runs Power Yankees To Victory Judge Leads The Charge

Apr 23, 2025

Nine Home Runs Power Yankees To Victory Judge Leads The Charge

Apr 23, 2025

Latest Posts

-

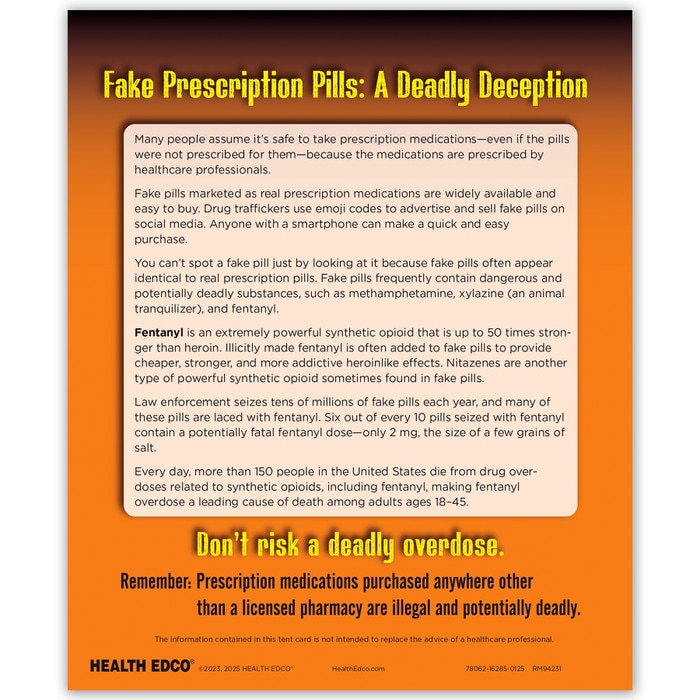

Attorney General Highlights Fake Fentanyl To Underscore Drug Crisis

May 10, 2025

Attorney General Highlights Fake Fentanyl To Underscore Drug Crisis

May 10, 2025 -

High Potentials Impressive Season Finale What Abc Must Have Thought

May 10, 2025

High Potentials Impressive Season Finale What Abc Must Have Thought

May 10, 2025 -

Attorney Generals Fentanyl Demonstration A Closer Look

May 10, 2025

Attorney Generals Fentanyl Demonstration A Closer Look

May 10, 2025 -

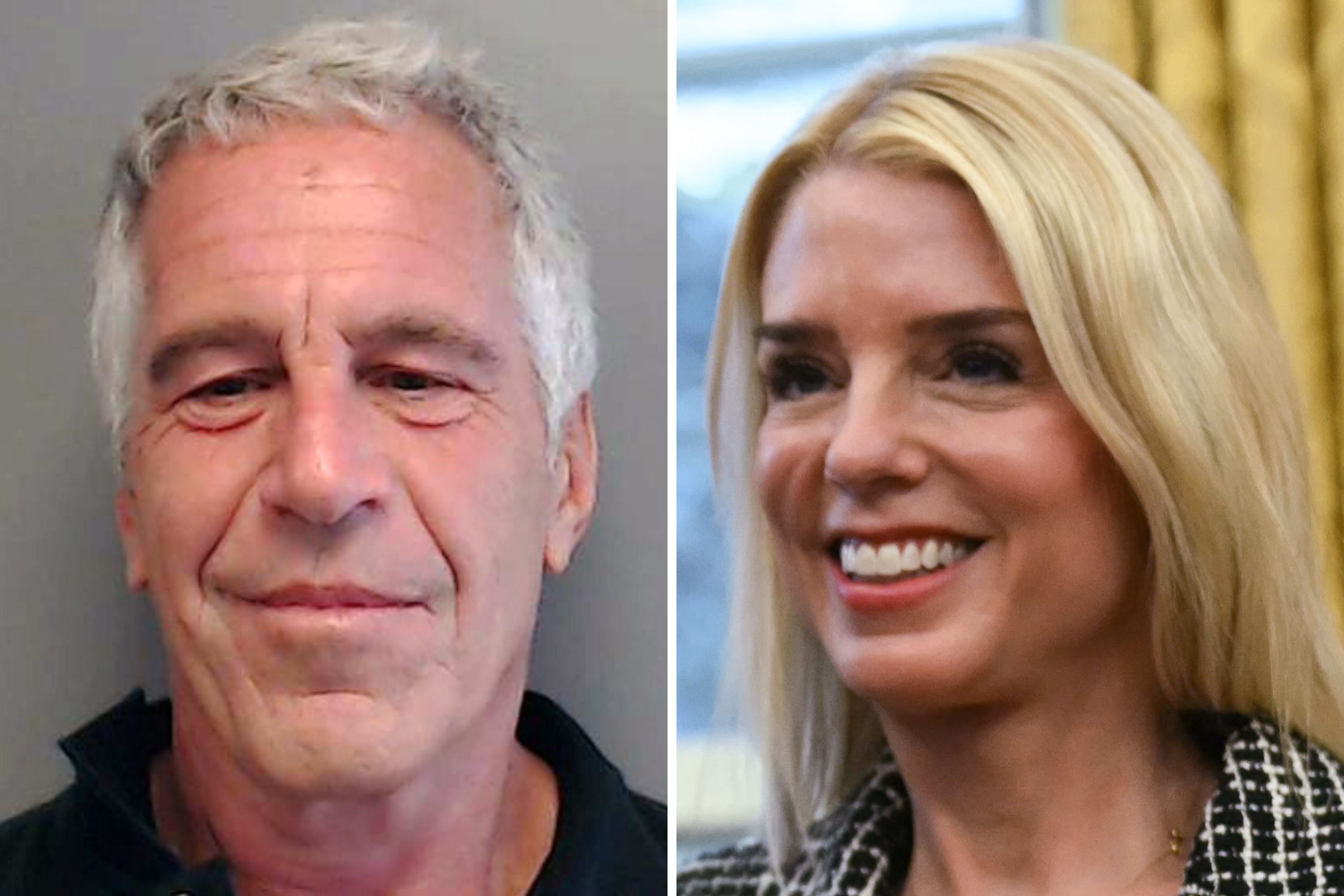

Update Pam Bondi And The Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025

Update Pam Bondi And The Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025 -

Pam Bondis Claims Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025

Pam Bondis Claims Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025