Edenred's AMF CP Document 2025E1029244: A Practical Overview

Table of Contents

Key Highlights from Edenred's AMF CP Document 2025E1029244

The Edenred AMF CP document 2025E1029244 presents a detailed picture of the company's financial performance. A close examination reveals key trends and developments impacting Edenred's financial performance. While specific figures would require referencing the document itself, we can highlight typical areas covered:

-

Revenue Growth: The document will detail Edenred's revenue figures, analyzing growth across different segments and geographical regions. This section will often break down revenue by product type and service offered, providing insights into market share and overall business performance. Keywords like "Edenred financial performance," "revenue growth," and "key performance indicators (KPIs)" are crucial here.

-

Profitability Analysis: The document will likely include detailed information on Edenred's profitability, including gross profit margin, operating income, and net income. Analyzing these figures helps assess the company's efficiency and its ability to generate profits. Investors will find details on profitability ratios and explanations of significant variations from previous periods.

-

Strategic Initiatives: This section will likely detail Edenred's key strategic initiatives and their impact on financial performance. Any mergers, acquisitions, or divestitures impacting revenue or profitability will be thoroughly discussed, along with their projected long-term impact. Understanding these initiatives is crucial for assessing future growth potential.

-

Key Financial Metrics: The report typically provides a comprehensive summary of key financial metrics, allowing for a thorough analysis of Edenred's financial health and performance. These often include metrics such as Earnings Per Share (EPS), Return on Equity (ROE), and Debt-to-Equity Ratio.

Analysis of Edenred's Financial Health and Stability

The AMF CP document 2025E1029244 offers valuable insights into Edenred's financial health and stability. Key aspects to consider include:

- Liquidity and Solvency: The document provides a detailed analysis of Edenred's liquidity position (ability to meet short-term obligations) and solvency (ability to meet long-term obligations). This assessment includes key financial ratios like the current ratio and quick ratio, providing insights into the company's ability to manage its financial resources. Keywords like "financial stability," "liquidity ratio," and "debt-to-equity ratio" will be found here.

- Debt Levels: Edenred's debt levels, including the types of debt and their maturities, are typically disclosed. Analysis of these levels alongside interest expense provides a critical assessment of the company's financial risk profile. Understanding the company's debt management strategy is crucial for evaluating long-term financial health.

- Risk Management: The document usually highlights Edenred's risk management strategies and their effectiveness in mitigating various financial and operational risks. This section is important for investors wanting to understand how Edenred manages potential threats to its business. Keywords like "risk management" and "credit rating" are important here.

Compliance and Regulatory Aspects of the AMF CP Document

The AMF (Autorité des marchés financiers) plays a vital role in regulating French companies, ensuring transparency and accountability in financial markets. Edenred's AMF CP document 2025E1029244 demonstrates its commitment to compliance:

- AMF Regulations: This section details how Edenred adheres to the specific requirements and reporting standards mandated by the AMF. This includes specific reporting formats, deadlines, and disclosure requirements. Keywords like "AMF regulations," "French corporate governance," and "regulatory compliance" are central to this section.

- Financial Reporting Standards: The document adheres to internationally recognized financial reporting standards (IFRS), ensuring consistency and comparability with other publicly traded companies. Understanding these standards is crucial for interpreting the financial data presented.

- Corporate Governance: The document sheds light on Edenred's corporate governance practices, including its board composition, audit committee activities, and internal control systems. This demonstrates the company's commitment to good governance and transparency.

Impact of the AMF CP Document on Investors and Stakeholders

The Edenred AMF CP document 2025E1029244 has significant implications for various stakeholders:

- Investment Decisions: The document provides critical information for investors to make informed investment decisions. Analysis of the financial data, combined with an understanding of the company's strategic direction and risk profile, allows investors to assess the potential returns and risks associated with investing in Edenred.

- Stakeholder Engagement: The information disclosed is relevant to a broader range of stakeholders, including employees, customers, and suppliers. The financial performance and the company's strategic direction directly affect their interests.

- Corporate Social Responsibility: Many AMF filings include information related to a company's commitment to environmental, social, and governance (ESG) factors. This is important for stakeholders interested in the company’s ethical and sustainable practices. Keywords like "investor relations," "stakeholder engagement," and "corporate social responsibility" are relevant here.

Conclusion: Navigating Edenred's AMF CP Document 2025E1029244

Edenred's AMF CP document 2025E1029244 provides a wealth of information crucial for understanding the company's financial performance, regulatory compliance, and strategic direction. This overview highlights the key aspects of the document, emphasizing its importance for investors and other stakeholders. The document offers a clear picture of Edenred's financial health, its adherence to AMF regulations, and its future outlook. To gain a comprehensive understanding of Edenred's financial performance and strategic plans, we strongly encourage you to download and carefully review the complete Edenred AMF CP document 2025E1029244. You can access this important document via the official Edenred website or the AMF website. Understanding this critical Edenred financial report is key to informed decision-making.

Featured Posts

-

Becciu E Il Complotto Domani Pubblica Chat Incriminanti

Apr 30, 2025

Becciu E Il Complotto Domani Pubblica Chat Incriminanti

Apr 30, 2025 -

Appello Processo Becciu Il 22 Settembre Si Decide

Apr 30, 2025

Appello Processo Becciu Il 22 Settembre Si Decide

Apr 30, 2025 -

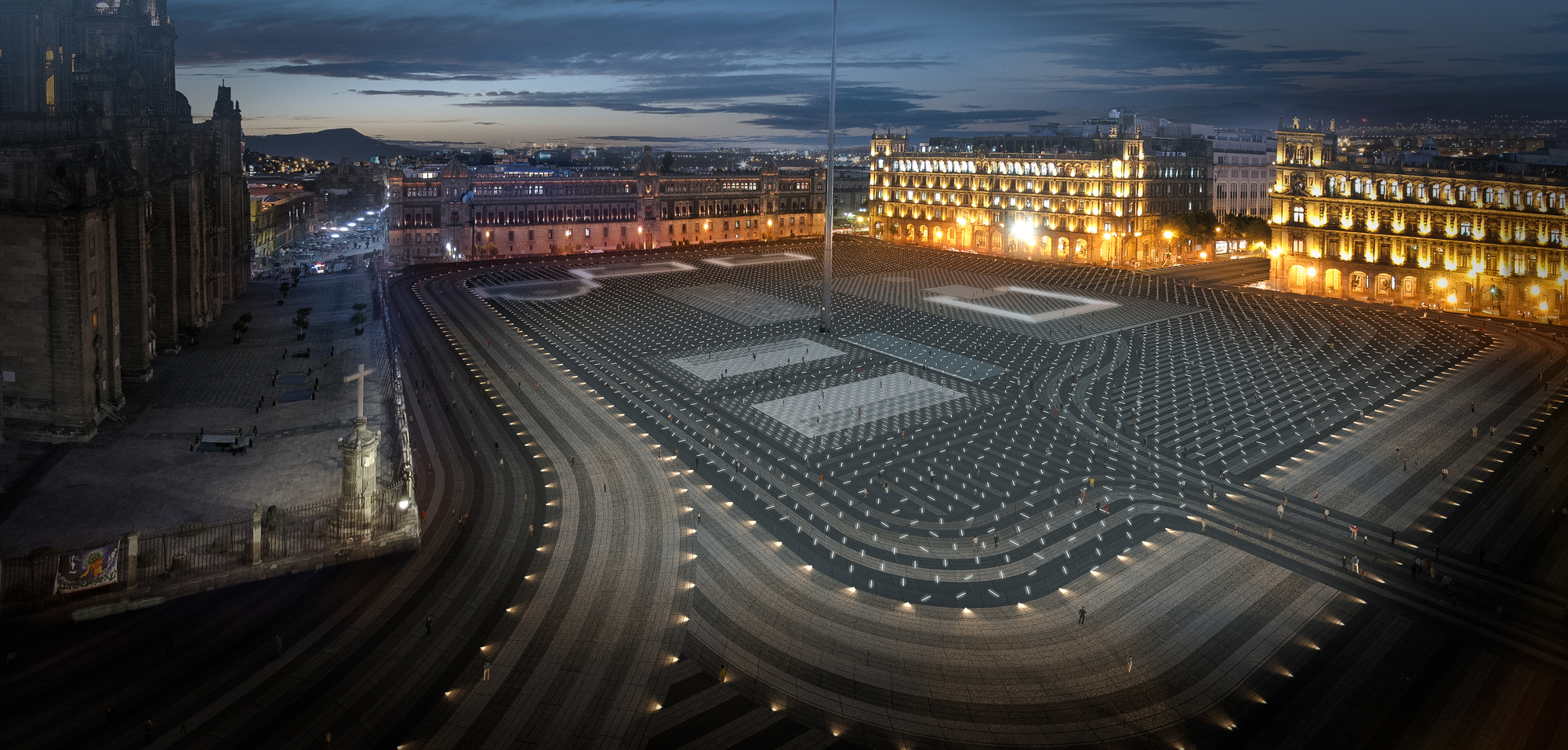

Clase De Boxeo En El Zocalo Una Galeria De Fotos De La Jornada

Apr 30, 2025

Clase De Boxeo En El Zocalo Una Galeria De Fotos De La Jornada

Apr 30, 2025 -

Gripna Prognoza Prof Iva Khristova Otkhvrlya Opaseniyata Za Vtora Vlna

Apr 30, 2025

Gripna Prognoza Prof Iva Khristova Otkhvrlya Opaseniyata Za Vtora Vlna

Apr 30, 2025 -

Inmates Death At San Diego County Jail Prompts Wrongful Death Lawsuit

Apr 30, 2025

Inmates Death At San Diego County Jail Prompts Wrongful Death Lawsuit

Apr 30, 2025