Elon Musk's SpaceX Holdings Exceed Tesla Stake By $43 Billion

Table of Contents

SpaceX Valuation Surges Past Tesla

The recent surge in SpaceX's valuation has catapulted it beyond Tesla in Elon Musk's portfolio. This unprecedented shift is a testament to SpaceX's remarkable achievements and the growing investor confidence in its future.

Factors Driving SpaceX's Increased Valuation

Several key factors have contributed to SpaceX's skyrocketing valuation:

-

Successful launches and growing contract wins: SpaceX has consistently delivered successful launches for NASA, the Department of Defense, and numerous private companies, solidifying its reputation as a reliable and innovative space launch provider. These contracts represent significant revenue streams and bolster investor confidence. The sheer volume of successful launches and the reliability of its Falcon 9 and Falcon Heavy rockets are key factors.

-

Advancements in reusable rocket technology: SpaceX's pioneering work in reusable rocket technology has drastically reduced launch costs, making space exploration more accessible and economically viable. This technological leap has given SpaceX a significant competitive advantage and significantly improved its profitability.

-

Starlink's rapid expansion and growing subscriber base: Starlink, SpaceX's satellite internet constellation, is experiencing explosive growth, attracting millions of subscribers worldwide. This rapidly expanding subscriber base generates substantial revenue and demonstrates the commercial viability of SpaceX's broader vision. The potential for global internet access via Starlink is a major driver of its valuation.

-

Increasing investor confidence in SpaceX's long-term goals: SpaceX's ambitious long-term goals, including the eventual colonization of Mars, resonate deeply with investors who see the company as a transformative force in the future of space exploration. This ambitious vision attracts both financial and human capital, driving its valuation upwards.

Tesla's Valuation and Market Fluctuations

While SpaceX's valuation soars, Tesla's has experienced more volatility. Several factors have influenced Tesla's market performance:

-

Recent market volatility: The broader market's volatility has impacted Tesla's stock price, reflecting broader economic concerns. This external factor, unrelated to Tesla's internal performance, has significantly influenced its valuation.

-

Competition in the electric vehicle market: The electric vehicle market is becoming increasingly competitive, with established automakers investing heavily in their own EV offerings. This increased competition presents challenges for Tesla's market dominance.

-

Impact of economic factors and supply chain disruptions: Global economic factors and supply chain disruptions have affected Tesla's production and sales, influencing its overall performance and investor sentiment.

-

Musk's tweets and pronouncements: Elon Musk's public pronouncements and social media activity have at times impacted Tesla's stock price significantly, highlighting the importance of communication management in a publicly traded company.

Musk's Portfolio Diversification and Strategic Investments

Elon Musk's portfolio diversification strategy reflects the wisdom of spreading investments across various sectors.

The Importance of Diversification for High-Net-Worth Individuals

Diversification is a cornerstone of sound financial management, particularly for high-net-worth individuals:

-

Reducing risk: Diversification mitigates risk by spreading investments across different asset classes and industries. A decline in one area may be offset by gains in another, providing stability.

-

Balancing high-growth, high-risk ventures with more stable investments: This balanced approach allows high-net-worth individuals to pursue high-growth opportunities while also maintaining a level of financial security.

-

Long-term investment strategies for wealth preservation and growth: Long-term strategies focused on sustainable growth are crucial for wealth preservation and future generations.

Musk's Other Holdings and Investments

While SpaceX and Tesla dominate Musk's public holdings, he also has interests in other ventures, including The Boring Company and Neuralink. These diverse investments further demonstrate his diversification strategy and commitment to technological innovation.

Future Outlook for SpaceX and Tesla

The future prospects for both SpaceX and Tesla remain bright, although with different challenges and opportunities.

SpaceX's Long-Term Growth Potential

SpaceX's future growth potential is substantial:

-

Expansion of Starlink's global coverage: The continued expansion of Starlink's global satellite internet coverage will drive substantial revenue growth.

-

Continued government and private sector contracts: SpaceX's strong relationships with governments and private companies ensure a steady flow of lucrative contracts.

-

Progress towards Mars colonization: The pursuit of Mars colonization, though long-term, represents a significant driver of innovation and future growth for the company.

-

Development of new space technologies: Continuous innovation in space technology will maintain SpaceX's competitive edge and open up new opportunities.

Tesla's Continued Dominance in the EV Market

Tesla faces challenges but also possesses significant opportunities:

-

New vehicle launches and model upgrades: Tesla's ongoing development and launch of new vehicles will keep it at the forefront of the electric vehicle market.

-

Expansion into new markets and geographical regions: Expansion into new markets will fuel growth and increase market share.

-

Advancements in battery technology and autonomous driving capabilities: Technological advancements in battery technology and autonomous driving capabilities will maintain Tesla's competitive edge.

-

Addressing challenges and competition in the EV market: Addressing the challenges of increased competition and supply chain issues will be crucial for Tesla's continued success.

Conclusion

Elon Musk's SpaceX holdings surpassing his Tesla stake by $43 billion highlights the remarkable growth of the space exploration company and the fluctuating nature of the stock market. This significant shift underscores the importance of diversification in high-net-worth portfolios and the immense potential of both SpaceX and Tesla in their respective sectors. The future trajectories of both companies are closely tied to technological advancements, market conditions, and continued innovation. The divergence in their valuations reveals the distinct market forces shaping the space exploration and electric vehicle industries.

Call to Action: Stay informed on the latest developments in Elon Musk's investments and the ongoing competition in the space exploration and electric vehicle markets. Follow our updates for more in-depth analyses of Elon Musk's SpaceX holdings and Tesla's market performance. Understanding the dynamics of these influential companies is crucial for navigating the evolving investment landscape.

Featured Posts

-

Hollywood At A Standstill The Writers And Actors Strike Explained

May 09, 2025

Hollywood At A Standstill The Writers And Actors Strike Explained

May 09, 2025 -

Police Investigating Threats To The Safety Of Kate And Gerry Mc Cann

May 09, 2025

Police Investigating Threats To The Safety Of Kate And Gerry Mc Cann

May 09, 2025 -

Vozmuschenie Kinga Pisatel Atakoval Trampa I Maska

May 09, 2025

Vozmuschenie Kinga Pisatel Atakoval Trampa I Maska

May 09, 2025 -

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 09, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 09, 2025 -

Oilers Cautious Approach Draisaitl Out Vs Winnipeg

May 09, 2025

Oilers Cautious Approach Draisaitl Out Vs Winnipeg

May 09, 2025

Latest Posts

-

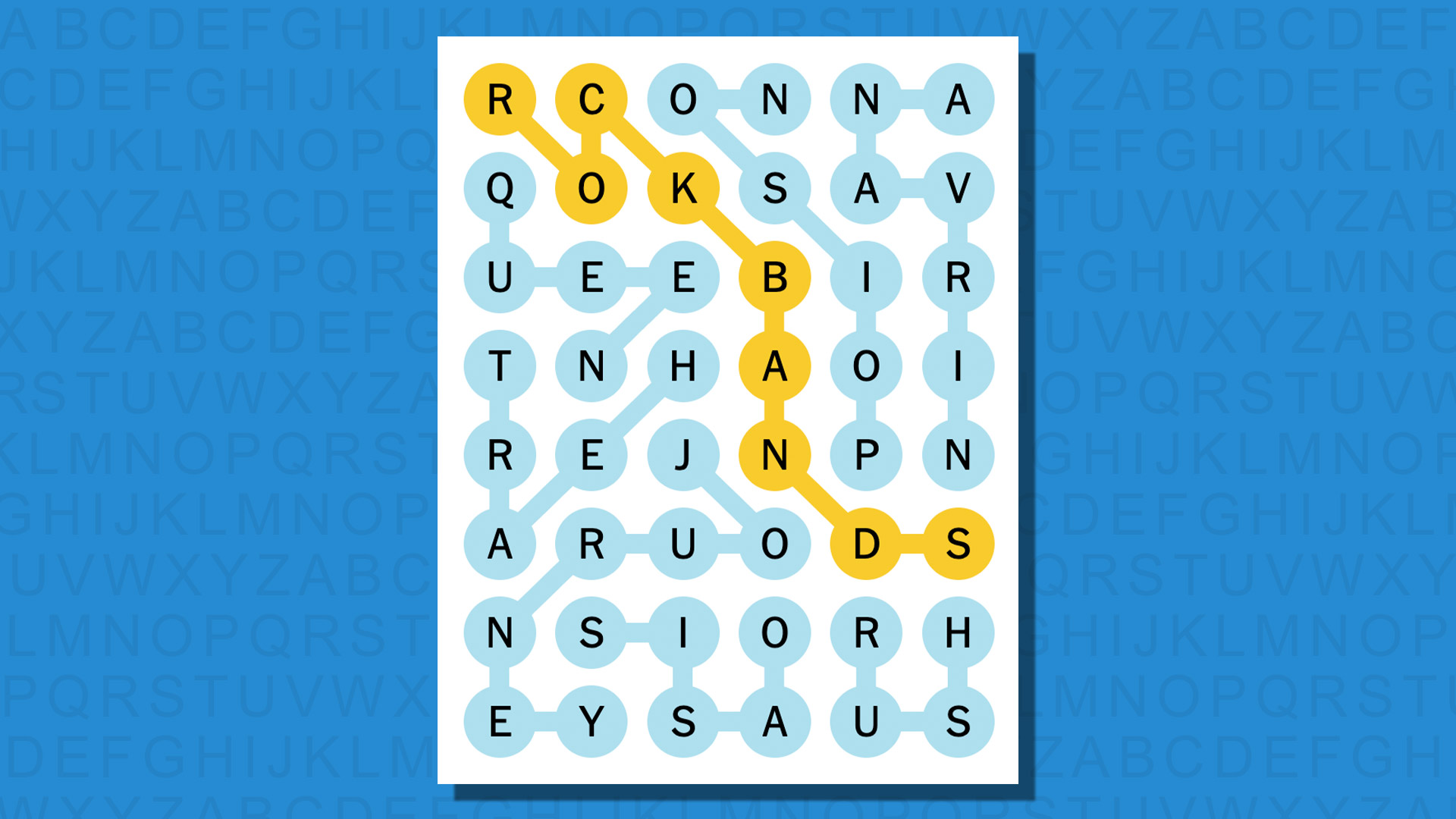

Nyt Strands Game 349 Hints And Solutions For February 15th

May 09, 2025

Nyt Strands Game 349 Hints And Solutions For February 15th

May 09, 2025 -

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 09, 2025

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 09, 2025 -

The Trump Pirro Fox News Connection Implications Of The Dc Prosecutor Appointment

May 09, 2025

The Trump Pirro Fox News Connection Implications Of The Dc Prosecutor Appointment

May 09, 2025 -

Nyt Strands Thursday February 20th Answers And Helpful Hints

May 09, 2025

Nyt Strands Thursday February 20th Answers And Helpful Hints

May 09, 2025 -

Jeanine Pirros Appointment As Dc Prosecutor Analyzing Trumps Decision And Fox News Connection

May 09, 2025

Jeanine Pirros Appointment As Dc Prosecutor Analyzing Trumps Decision And Fox News Connection

May 09, 2025