Elon Musk's SpaceX Stake Surges: Now Worth $43 Billion More Than Tesla Holdings

Table of Contents

SpaceX Valuation Soars: A Detailed Look at the Numbers

Recent reports suggest a dramatic increase in SpaceX's valuation. While SpaceX is a privately held company and precise figures aren't publicly released with the same frequency as Tesla's, various financial news outlets and investment analyses estimate its worth to have climbed substantially. Sources like Bloomberg and Reuters have cited figures placing SpaceX's valuation well above Tesla's current market capitalization.

- Specific figures: While exact numbers are fluid and depend on the source and valuation method, estimates place SpaceX's valuation at over $150 billion, exceeding Tesla's market cap by a significant margin (as of October 26, 2023). This represents a massive increase from previous valuations.

- Comparison with Tesla: This dramatic shift marks a pivotal moment, with SpaceX’s valuation significantly surpassing Tesla's, previously the cornerstone of Musk's vast fortune.

- Contributing factors: This increase isn't accidental. Successful Falcon 9 and Falcon Heavy launches, coupled with the massive success of Starlink, securing lucrative contracts with NASA and other government agencies, and successful private investment rounds have all contributed to the boost.

- Private investment rounds: Recent private investment rounds have injected significant capital into SpaceX, inflating its valuation and solidifying its position as a leading player in the space industry.

Factors Driving SpaceX's Growth and Outperformance of Tesla

SpaceX's remarkable growth and its outperformance of Tesla can be attributed to several key factors. While Tesla faces challenges such as supply chain disruptions and increased competition, SpaceX has consistently delivered on its ambitious goals.

- Innovation in reusable rocket technology: SpaceX's pioneering work in reusable rocket technology has dramatically reduced launch costs, making space travel more accessible and economically viable. This is a key differentiator from competitors.

- Expanding satellite internet services (Starlink): Starlink, SpaceX's satellite internet constellation, is a game-changer. Its global reach and potential to provide high-speed internet to underserved areas are driving immense revenue and attracting significant investor interest.

- Securing lucrative government contracts: SpaceX has secured numerous contracts with government agencies like NASA, solidifying its position as a key player in space exploration and defense. These contracts provide a stable revenue stream.

- Private sector partnerships and collaborations: Collaborations with private sector companies broaden SpaceX's reach and application in various fields, boosting innovation and revenue.

- Contrast with Tesla's recent performance: While Tesla remains a dominant force in the electric vehicle market, it's faced headwinds including supply chain issues, economic slowdowns, and intense competition from other EV manufacturers. SpaceX's relative stability and rapid growth stand in stark contrast.

The Starlink Factor: A Game-Changer in Space-Based Internet

Starlink's contribution to SpaceX's valuation cannot be overstated. This ambitious project aims to provide global broadband internet access through a constellation of thousands of satellites.

- Number of subscribers and revenue projections: Starlink boasts millions of subscribers and projections indicate exponentially increasing revenue streams in the coming years.

- Global reach and expansion plans: Starlink's global reach and ongoing expansion into new markets ensures its continued growth and market dominance in the space-based internet sector.

- Competitive advantages: Starlink offers high-speed internet access in areas with limited or no connectivity, giving it a competitive edge over traditional internet providers.

- Potential for future revenue streams: The potential for future revenue streams from Starlink is enormous, extending beyond residential and commercial use to encompass applications in various industries.

Implications for Elon Musk's Net Worth and Investment Strategies

The shift in the balance of power between SpaceX and Tesla significantly impacts Elon Musk's net worth and investment strategies.

- Reassessment of his wealth ranking: This valuation surge solidifies Musk's position among the world's wealthiest individuals, even considering the fluctuating nature of these rankings.

- Potential investment implications: The increased valuation of SpaceX might influence Musk's investment priorities, potentially diverting resources to further development in space exploration and related technologies.

- Portfolio diversification: Although Tesla remains a significant asset, the growth of SpaceX demonstrates a successful diversification strategy, reducing reliance on a single company.

- Shift in public perception and investor confidence: The success of SpaceX bolsters public perception of Musk’s business acumen and enhances investor confidence in his future ventures.

Conclusion

The remarkable increase in SpaceX's valuation, surpassing that of Tesla in Elon Musk's portfolio, marks a significant turning point. The success of Starlink and SpaceX's innovative approach to space exploration have been key drivers. This shift highlights the dynamism of Musk's investments and the evolving landscape of the space exploration and technological industries.

Call to Action: Stay informed about the dynamic world of Elon Musk's investments. Follow our updates for continued analysis on the SpaceX valuation, Tesla's market performance, and the evolving landscape of the space exploration and technological industries. Learn more about the impact of SpaceX’s success on the future of Elon Musk’s investments and the space industry by subscribing to our newsletter!

Featured Posts

-

Luxury Carmakers Face Headwinds In China Analyzing The Market Slowdown

May 09, 2025

Luxury Carmakers Face Headwinds In China Analyzing The Market Slowdown

May 09, 2025 -

Doohans Development Palmers Perspective On Alpines Reserve Driver Situation

May 09, 2025

Doohans Development Palmers Perspective On Alpines Reserve Driver Situation

May 09, 2025 -

The Tarlov Pirro Clash A Heated Debate On Us Canada Trade Relations

May 09, 2025

The Tarlov Pirro Clash A Heated Debate On Us Canada Trade Relations

May 09, 2025 -

Expected Announcement Trump And Britain Conclude Trade Negotiations

May 09, 2025

Expected Announcement Trump And Britain Conclude Trade Negotiations

May 09, 2025 -

Tensions Flare Joanna Page Confronts Wynne Evans On Bbc Show

May 09, 2025

Tensions Flare Joanna Page Confronts Wynne Evans On Bbc Show

May 09, 2025

Latest Posts

-

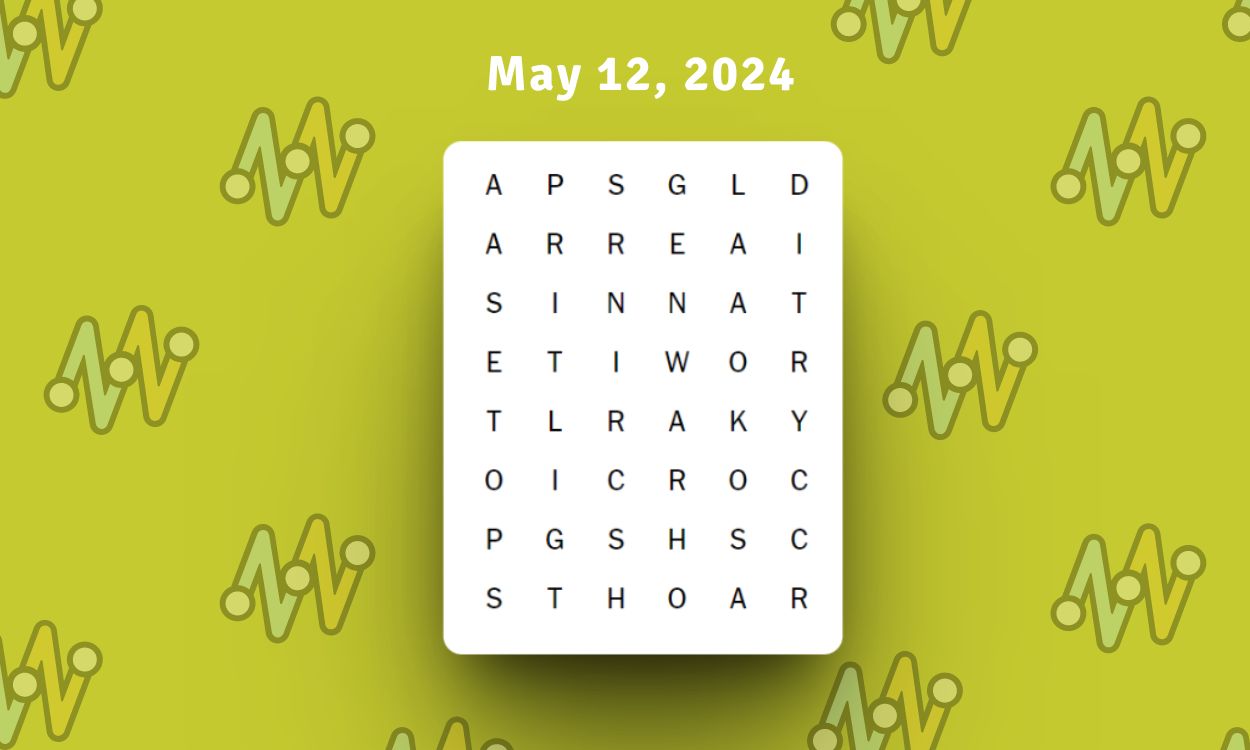

Unlock Todays Nyt Strands Puzzle April 12 2025 Hints And Strategies

May 09, 2025

Unlock Todays Nyt Strands Puzzle April 12 2025 Hints And Strategies

May 09, 2025 -

Nyt Wordle Solution April 12 2025 All Clues And Answers Explained

May 09, 2025

Nyt Wordle Solution April 12 2025 All Clues And Answers Explained

May 09, 2025 -

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For Saturdays Wordle

May 09, 2025

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For Saturdays Wordle

May 09, 2025 -

Nyt Strands Game 376 Solutions Friday March 14 Hints

May 09, 2025

Nyt Strands Game 376 Solutions Friday March 14 Hints

May 09, 2025 -

Nyt Strands March 12 2024 Game 374 Hints And Answers Guide

May 09, 2025

Nyt Strands March 12 2024 Game 374 Hints And Answers Guide

May 09, 2025