Entertainment Stock Price Dip: Analyst Predictions And Recommendations

Table of Contents

Factors Contributing to the Entertainment Stock Price Dip

Several interconnected factors have contributed to the recent downturn in entertainment stock prices. Understanding these elements is crucial for forming an informed investment strategy.

-

Impact of Rising Inflation on Consumer Spending: Inflation significantly impacts consumer spending, particularly on discretionary items like entertainment. As prices rise, consumers are forced to prioritize essential expenses, reducing their spending on streaming services, movie tickets, and other forms of entertainment. This directly affects the revenue streams of entertainment companies.

-

The Intensifying "Streaming Wars" and Increased Competition: The competition among streaming platforms is fierce. The "streaming wars" are pushing companies to invest heavily in content creation, leading to increased production costs and potentially squeezing profit margins. This intense competition makes it harder for individual companies to maintain market share and profitability.

-

The Overall Economic Slowdown and Its Effect on Advertising Revenue: An economic slowdown leads to decreased advertising spending across all sectors, including entertainment. Many entertainment companies rely heavily on advertising revenue, and a decline in this area directly impacts their profitability and, subsequently, their stock prices.

-

The Influence of Rising Interest Rates on Investor Sentiment and Investment Decisions: Rising interest rates impact investor sentiment. Higher rates make borrowing more expensive for companies, and investors may shift their focus towards safer, higher-yield investments, leading to a sell-off in riskier assets like entertainment stocks.

-

Market Corrections and Their Influence on Even Fundamentally Strong Entertainment Stocks: Even fundamentally strong companies within the entertainment sector are susceptible to broader market corrections. These corrections can cause widespread sell-offs, regardless of a company's individual performance, creating short-term volatility.

Analyst Predictions for Entertainment Stock Recovery

While the current situation presents challenges, leading financial analysts offer varying perspectives on the potential for recovery in the entertainment sector.

-

Summary of Predictions from Leading Financial Analysts: Analyst predictions vary widely, with some forecasting a swift recovery, while others anticipate a more prolonged downturn. Many cite the inherent resilience of the entertainment industry and the continued demand for entertainment content as factors favoring a future rebound.

-

Analysis of Varying Price Targets and Projected Timelines: Price targets for various entertainment stocks differ significantly depending on the analyst and their assessment of the company's specific situation and the overall market conditions. Projected timelines for a return to previous highs range from several months to several years.

-

Factors that Could Accelerate or Hinder Recovery: Several factors could influence the speed of recovery. Successful new releases, innovative technological advancements like improved VR/AR experiences, and positive regulatory changes could accelerate growth. Conversely, prolonged economic downturns, escalating inflation, and continued intense competition could hinder recovery.

-

Specific Companies and Their Individual Analyst Predictions: For example, analysts are closely watching Disney's streaming strategy, Netflix's subscriber growth, and the performance of major gaming companies. Predictions for each company vary based on their individual financial health, competitive positioning, and future growth prospects.

Investment Recommendations for Navigating the Dip

Navigating this dip requires a strategic approach tailored to individual risk tolerance and investment goals.

-

Recommendations for Investors with Varying Risk Tolerances: Conservative investors might consider delaying further investments until greater market stability is established. Moderate investors might selectively add to existing positions in strong companies at discounted prices. Aggressive investors might see this as an opportunity to acquire undervalued growth stocks.

-

Strategies for Mitigating Risk: Diversification across various sub-sectors within the entertainment industry (e.g., gaming, streaming, film production) and broader asset classes is crucial for risk mitigation. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can also help reduce the impact of market volatility.

-

Potential for Long-Term Growth: Despite short-term volatility, the long-term growth potential of the entertainment industry remains significant. The ongoing evolution of technology and the persistent human desire for entertainment suggest a robust future for the sector.

-

Identifying Undervalued Entertainment Stocks: Value investing strategies can identify undervalued entertainment stocks with strong growth potential. Thorough due diligence, analyzing financial statements, and assessing competitive landscapes are critical for identifying such opportunities.

-

Advice on Holding vs. Selling: The decision to hold or sell existing entertainment stocks during a price dip depends on individual investment strategies and risk tolerance. A long-term perspective focused on the underlying value of the company is crucial in this decision-making process.

Specific Stock Examples and Their Potential

Analyzing individual stocks is beyond the scope of this general overview, but investors should conduct thorough research into companies like Disney, Netflix, Warner Bros. Discovery, and others. Consider examining each company's financial performance, competitive landscape, and future growth prospects based on industry reports and analyst assessments.

Conclusion

This article has explored the current entertainment stock price dip, analyzing contributing factors, reviewing analyst predictions, and offering investment recommendations. The downturn presents a complex situation demanding careful consideration of various economic and industry-specific factors. While the volatility may seem daunting, understanding the underlying dynamics and applying a well-defined investment strategy can help investors navigate this dip effectively.

Call to Action: The current dip in entertainment stocks presents both challenges and opportunities. By carefully considering the factors discussed and conducting thorough research, investors can potentially capitalize on this volatility and build a strong, diversified portfolio in the entertainment sector. Learn more about effective strategies for investing in entertainment stocks and make informed decisions based on the latest analyst predictions and market trends.

Featured Posts

-

Dpg Media Acquisition Of Rtl Approval Anticipated Within 45 Days

May 29, 2025

Dpg Media Acquisition Of Rtl Approval Anticipated Within 45 Days

May 29, 2025 -

Mennyit Erhet Egy Regi 100 Forintos Bankjegy

May 29, 2025

Mennyit Erhet Egy Regi 100 Forintos Bankjegy

May 29, 2025 -

Cuaca Jawa Timur Besok 24 Maret Perkiraan Dan Antisipasi Hujan

May 29, 2025

Cuaca Jawa Timur Besok 24 Maret Perkiraan Dan Antisipasi Hujan

May 29, 2025 -

16 Year Old Victim Of Gay Bashing Five Teen Arrests Made

May 29, 2025

16 Year Old Victim Of Gay Bashing Five Teen Arrests Made

May 29, 2025 -

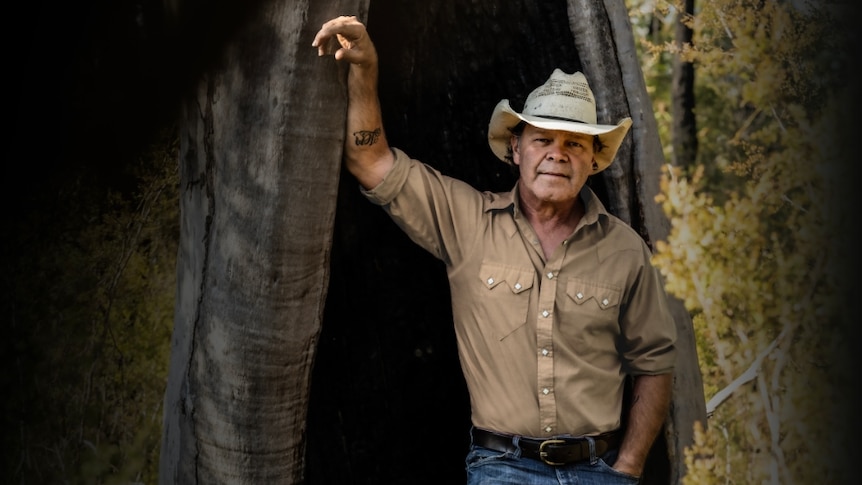

Queensland Music Awards 2025 Troy Cassar Daleys Triumph

May 29, 2025

Queensland Music Awards 2025 Troy Cassar Daleys Triumph

May 29, 2025