EU Targets Russian Gas: Spot Market Phaseout Plans

Table of Contents

The Driving Force Behind the Phaseout

The ongoing war in Ukraine and the subsequent sanctions imposed on Russia have dramatically accelerated the EU's efforts to reduce reliance on Russian energy supplies. This isn't just about immediate price volatility; it's a crucial step towards bolstering long-term energy security and reducing geopolitical vulnerability. The reliance on Russian pipeline gas has proven to be a significant geopolitical weakness, making the EU susceptible to energy blackmail. The shift away from this dependence is a matter of national security for many member states.

- Sanctions limiting Russian gas imports: The EU has implemented several rounds of sanctions targeting the Russian energy sector, directly impacting the volume of gas flowing into the bloc. These sanctions, while impacting the Russian economy, have also created challenges for EU member states.

- Increased energy price volatility due to Russian actions: Russia's manipulation of gas supplies has created significant price volatility in the European energy market, highlighting the vulnerability of relying on a single major supplier. This volatility has had a ripple effect across various sectors of the EU economy.

- Strategic need to diversify energy sources: The dependence on Russian gas has exposed the EU's lack of diversification in its energy sources. The phaseout is a crucial step in creating a more resilient and diversified energy mix.

- Strengthening energy independence as a geopolitical goal: Reducing dependence on Russian energy is a key element of the EU's broader strategy to enhance its geopolitical independence and reduce its vulnerability to external pressures. This is a long-term strategic objective with far-reaching consequences.

Strategies for Replacing Russian Spot Market Gas

The EU's strategy involves a multi-pronged approach to replace Russian gas, focusing on increased imports of Liquefied Natural Gas (LNG), developing alternative pipeline infrastructure, and boosting domestic renewable energy production and energy efficiency measures. Significant investments in gas storage capacity are also crucial to managing seasonal demand fluctuations. The transition will require substantial investment and careful planning.

- Increased LNG terminal capacity and imports from various suppliers: The EU is rapidly expanding its LNG import capacity, diversifying its sources to include countries like the US, Qatar, and Norway. This involves building new terminals and upgrading existing infrastructure.

- Development of new pipeline connections with alternative gas suppliers (e.g., Norway, Azerbaijan): The EU is exploring and developing new pipeline connections with alternative gas suppliers to reduce reliance on Russian pipelines. This strengthens energy security through diversification.

- Accelerated deployment of renewable energy sources (wind, solar, hydro): The EU is investing heavily in renewable energy sources to reduce its overall reliance on fossil fuels. This is a long-term strategy that is essential for achieving climate goals and energy independence.

- Implementation of energy efficiency programs across member states: Improving energy efficiency in buildings, industries, and transportation is crucial for reducing overall energy demand and lessening the reliance on gas imports. This involves a range of measures from building renovations to improvements in industrial processes.

- Investments in strategic gas storage to buffer against supply disruptions: Building up strategic gas reserves allows the EU to better withstand short-term supply disruptions and price volatility. This is a critical part of ensuring energy security during the transition period.

Challenges in Achieving a Complete Phaseout

The transition away from Russian gas is not without its challenges. These include potential supply chain bottlenecks, the need for significant infrastructure upgrades, the economic costs associated with transitioning to alternative energy sources, and potential political disagreements among EU member states. Careful management is crucial to ensure a smooth and effective transition.

- Potential for temporary gas shortages during the transition: The transition period may see temporary gas shortages in some regions, requiring careful management of demand and supply.

- High upfront investment costs for new infrastructure and renewable energy projects: The transition requires substantial upfront investments, potentially placing a strain on public finances.

- Balancing the speed of transition with economic and social impacts: Finding the right balance between the speed of the transition and its impact on the economy and citizens is a key challenge.

- Coordination challenges among diverse EU member states with differing energy needs: Ensuring coordination and cooperation among EU member states with varying energy needs and resources is essential for a successful phaseout.

The Economic Implications of the Phaseout

The shift away from Russian gas will inevitably have economic consequences. While reducing dependence on Russia enhances long-term energy security, there will be short-term price fluctuations and potential inflationary pressures. The EU is implementing policies to mitigate these effects, including market reforms designed to improve price transparency and competition. Careful management of the economic transition is paramount.

- Potential for temporary increases in gas prices: The transition may lead to temporary increases in gas prices, particularly in the short term, potentially impacting businesses and consumers.

- Impact on inflation and consumer spending: Rising energy prices can contribute to inflation and reduce consumer spending, necessitating government intervention to protect vulnerable households.

- Government support measures to cushion the economic impact on vulnerable households: Governments are implementing various measures to mitigate the impact of rising energy prices on vulnerable households, such as subsidies and targeted support programs.

- Importance of energy market reform to ensure fair pricing and competition: Reforming the energy market to promote transparency and competition is crucial to ensure fair prices and prevent market manipulation.

Conclusion

The EU's plan to phase out Russian gas from the spot market marks a pivotal moment in its pursuit of energy independence and enhanced security. While challenges remain in terms of supply, infrastructure, and economic impact, the strategic imperative to reduce reliance on a single, unreliable supplier is undeniable. The successful implementation of this plan requires a coordinated effort across EU member states, substantial investment in alternative energy sources, and proactive measures to mitigate potential economic fallout. The future of European energy security hinges on this decisive move to accelerate the EU's phaseout of Russian gas. Stay informed about the latest developments in the EU's energy strategy to ensure your business or household is prepared for the transition.

Featured Posts

-

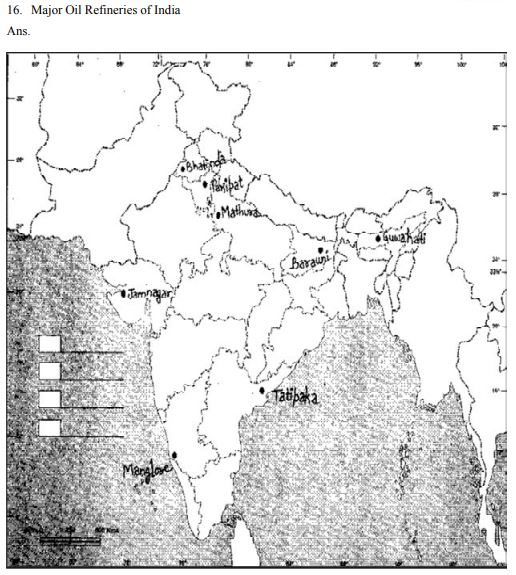

Saudi India Energy Partnership Two Major Oil Refineries In The Works

Apr 24, 2025

Saudi India Energy Partnership Two Major Oil Refineries In The Works

Apr 24, 2025 -

Fundraising Intensifies At Top Universities Amidst Trump Administration Challenges

Apr 24, 2025

Fundraising Intensifies At Top Universities Amidst Trump Administration Challenges

Apr 24, 2025 -

Village Roadshow And Alcon 417 5 Million Deal Finalized

Apr 24, 2025

Village Roadshow And Alcon 417 5 Million Deal Finalized

Apr 24, 2025 -

Zagonetka Tarantina Film S Travoltom Koji Nikada Nije Pogledao

Apr 24, 2025

Zagonetka Tarantina Film S Travoltom Koji Nikada Nije Pogledao

Apr 24, 2025 -

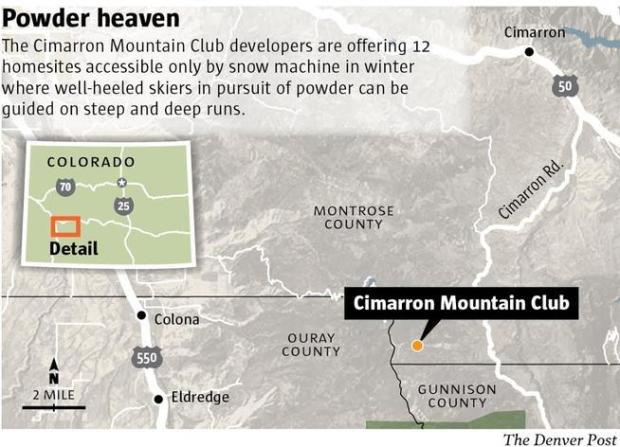

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025