EUR/USD Exchange Rate: Lagarde's Plan To Boost The Euro's International Standing

Table of Contents

Lagarde's Monetary Policy Initiatives and their Impact on the EUR/USD

Interest Rate Hikes and their Effect on the Euro

The ECB's recent interest rate hikes represent a significant shift in monetary policy. Driven by stubbornly high inflation within the Eurozone, these hikes aim to cool down the economy and bring inflation back to the ECB's target of 2%.

- Increased Attractiveness to Investors: Higher interest rates make Euro-denominated assets more appealing to international investors seeking higher returns. This increased demand for Euros can strengthen the currency against the dollar.

- Potential for Capital Inflows: The expectation of higher returns can lead to significant capital inflows into the Eurozone, further boosting the EUR/USD exchange rate.

- Risks of Economic Slowdown: Aggressive interest rate hikes carry the risk of slowing economic growth, potentially leading to a recession. This could negatively impact the Euro if investor confidence falters. The delicate balance between controlling inflation and maintaining economic growth is a key challenge for the ECB.

- Keywords: ECB interest rates, inflation, foreign investment, Eurozone economy, economic growth, monetary tightening, EUR/USD forecast.

ECB's Quantitative Tightening (QT) Program and its Influence on the EUR/USD

The ECB's quantitative tightening (QT) program complements its interest rate hikes. By reducing its balance sheet—the assets held by the central bank—the ECB aims to reduce the money supply in the Eurozone.

- Curbing Inflation: Reducing the money supply is a classic method for controlling inflation. By limiting the amount of money in circulation, the ECB hopes to reduce inflationary pressures.

- Impact on Liquidity: QT can reduce liquidity in the financial markets, potentially impacting the EUR/USD exchange rate through changes in borrowing costs and investor sentiment. Reduced liquidity can lead to increased volatility.

- Balancing Act: Similar to interest rate hikes, the ECB must carefully manage the pace of QT to avoid negatively impacting economic growth. Too aggressive a reduction in liquidity could trigger a market downturn.

- Keywords: Quantitative tightening, monetary policy, liquidity, money supply, inflation control, ECB balance sheet, EUR/USD volatility.

Strengthening the Eurozone's Economic Fundamentals

Lagarde’s strategy extends beyond monetary policy. She emphasizes structural reforms within the Eurozone to enhance its long-term economic competitiveness and stability. This approach aims to improve investor confidence, indirectly boosting the Euro.

- Labor Market Reforms: Improving labor market flexibility and efficiency can enhance productivity and attract foreign investment.

- Fiscal Consolidation: Sound fiscal policies within Eurozone member states are crucial for long-term stability. Reducing public debt and improving budgetary discipline strengthens the Eurozone's overall economic health.

- Investment in Innovation: Investing in research and development and fostering innovation can enhance the competitiveness of Eurozone businesses and attract investment.

- Keywords: Eurozone economy, economic competitiveness, structural reforms, investor confidence, economic stability, EUR/USD trading.

Geopolitical Factors and their Influence on the EUR/USD Exchange Rate

The War in Ukraine and Energy Security

The ongoing war in Ukraine significantly impacts the Eurozone economy, creating uncertainty and affecting the EUR/USD exchange rate. The energy crisis stemming from reduced Russian gas supplies poses a considerable challenge.

- Energy Prices: High energy prices increase production costs and fuel inflation, putting downward pressure on the Euro.

- Economic Uncertainty: The war creates uncertainty about the future economic outlook, potentially reducing investor confidence and weakening the Euro against the dollar.

- Keywords: Ukraine war, energy crisis, energy security, geopolitical risk, EUR/USD volatility, forex trading.

The US Dollar's Role as a Safe Haven Currency

During times of global uncertainty, investors often flock to the US dollar, a perceived safe haven currency. This increased demand for the dollar can weaken the Euro.

- Risk Aversion: Global uncertainty boosts risk aversion, leading investors to shift their assets toward perceived safer options like the US dollar.

- Counteracting the Trend: Lagarde's policies aim to mitigate this effect by improving the Eurozone's economic fundamentals and creating a more stable investment environment.

- Keywords: Safe haven currency, US dollar strength, global uncertainty, risk aversion, EUR/USD pairs.

Trading Strategies and Opportunities in the EUR/USD Market

Technical Analysis and Chart Patterns

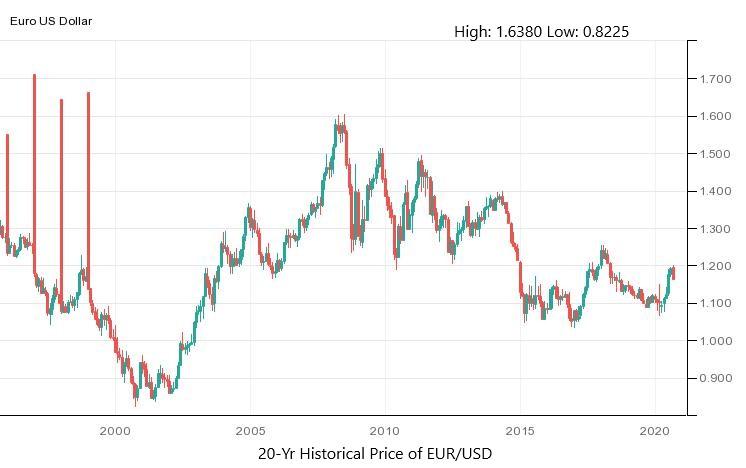

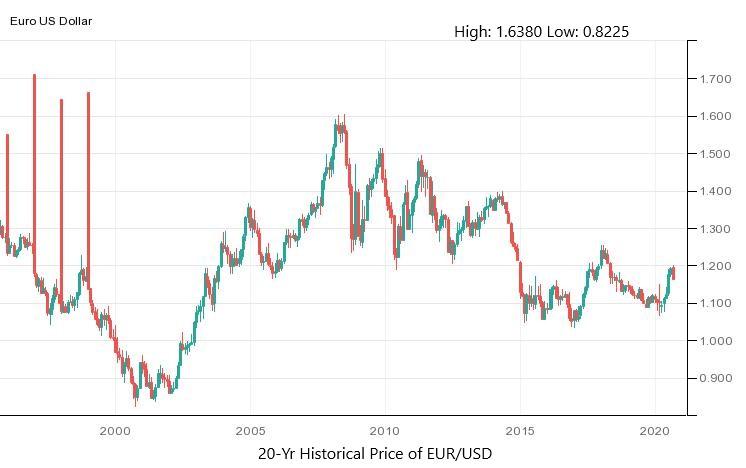

Technical analysis uses historical price and volume data to identify patterns and predict future price movements. In the EUR/USD market, traders use various indicators and chart patterns to identify potential trading opportunities. (Note: Detailed technical analysis strategies are beyond the scope of this article.)

- Keywords: Technical analysis, chart patterns, trading strategies, forex trading, EUR/USD chart, price action.

Fundamental Analysis and Economic Indicators

Fundamental analysis focuses on macroeconomic indicators to predict EUR/USD price movements. Traders monitor data like inflation rates, interest rates, GDP growth, and employment figures to gauge the relative strength of the Euro and the dollar.

- Keywords: Fundamental analysis, economic indicators, macroeconomic data, forex trading, EUR/USD forecast, economic calendar.

Conclusion

Lagarde's plan to enhance the Euro's international standing is a multi-pronged approach encompassing monetary policy adjustments, economic reforms, and navigating geopolitical headwinds. The success of her strategy will significantly shape the EUR/USD exchange rate. While interest rate hikes and QT aim to curb inflation and attract investment, geopolitical factors and the US dollar's safe-haven status remain potent forces. Understanding these dynamics is crucial for anyone involved in currency trading or making investment decisions related to the EUR/USD exchange rate. Stay informed about the latest developments in the EUR/USD market to make informed decisions regarding your trading and investment strategies. Continuously monitor the EUR/USD exchange rate and its underlying factors to optimize your approach.

Featured Posts

-

Indiana Pacers Vs Atlanta Hawks Game Details For March 8th Time Tv Stream

May 28, 2025

Indiana Pacers Vs Atlanta Hawks Game Details For March 8th Time Tv Stream

May 28, 2025 -

Jennifer Lopez To Host The American Music Awards In Las Vegas

May 28, 2025

Jennifer Lopez To Host The American Music Awards In Las Vegas

May 28, 2025 -

Adanali Ronaldodan Ronaldonun Cok Cirkinsin Demesine Cevap

May 28, 2025

Adanali Ronaldodan Ronaldonun Cok Cirkinsin Demesine Cevap

May 28, 2025 -

Cuaca Jawa Tengah 26 Maret Peringatan Hujan Di Semarang Siang Ini

May 28, 2025

Cuaca Jawa Tengah 26 Maret Peringatan Hujan Di Semarang Siang Ini

May 28, 2025 -

Angels Hold On For Fourth Straight Win

May 28, 2025

Angels Hold On For Fourth Straight Win

May 28, 2025

Latest Posts

-

On The Radar Jacqie Rivera And Other Must Hear Latin Artists

May 29, 2025

On The Radar Jacqie Rivera And Other Must Hear Latin Artists

May 29, 2025 -

Chiquis Latin Women In Music Impact Award Interview

May 29, 2025

Chiquis Latin Women In Music Impact Award Interview

May 29, 2025 -

Wplyw Decyzji O Dywidendzie Na Kurs Akcji Pcc Rokita

May 29, 2025

Wplyw Decyzji O Dywidendzie Na Kurs Akcji Pcc Rokita

May 29, 2025 -

Dywidenda Pcc Rokita Podsumowanie Decyzji I Perspektywy Dla Akcjonariuszy

May 29, 2025

Dywidenda Pcc Rokita Podsumowanie Decyzji I Perspektywy Dla Akcjonariuszy

May 29, 2025 -

Pcc Rokita Dywidenda Analiza Decyzji I Jej Skutkow

May 29, 2025

Pcc Rokita Dywidenda Analiza Decyzji I Jej Skutkow

May 29, 2025