Euro And European Futures Surge: Swissquote Bank Analysis And Market Outlook

Table of Contents

Economic Factors Driving the Euro and European Futures Surge

Several robust economic factors have contributed to the recent surge in Euro and European futures. Understanding these underlying trends is crucial for investors seeking to capitalize on market opportunities.

Strong Eurozone Economic Data

Positive economic indicators from the Eurozone have significantly boosted investor confidence, fueling the rise in Euro and European futures. This positive economic outlook is reflected in several key areas:

- GDP Growth: Recent quarters have shown robust GDP growth exceeding initial forecasts, indicating a healthy and expanding Eurozone economy.

- Inflation Figures: While inflation remains a concern, recent data suggests a cooling trend, easing inflationary pressures and reducing the need for aggressive interest rate hikes.

- Employment Rates: Unemployment figures have remained low, pointing towards a strong labor market and increased consumer spending.

These data points directly impact Euro and European futures by signaling a stable and growing economy, attracting further investment and driving up prices. The strength of the Euro is directly tied to the health of the Eurozone economy, leading to increased demand for Euro-denominated assets.

Easing Inflationary Pressures

Decreasing inflation rates are playing a pivotal role in the positive performance of the Euro and European futures markets. The impact is multifaceted:

- Inflation Metrics: The Harmonized Index of Consumer Prices (HICP), a key inflation metric for the Eurozone, has shown a consistent decline in recent months.

- Monetary Policy: The European Central Bank's (ECB) monetary policy, while still cautious, is showing signs of a less aggressive stance on interest rate hikes, reflecting the easing inflationary pressures.

Lower inflation improves investor sentiment, as it reduces the uncertainty associated with higher prices and potential erosion of returns. This positive outlook encourages investment in Euro and European futures, contributing to the recent surge.

Improved Consumer and Business Confidence

Positive sentiment among consumers and businesses is another crucial driver of the current market growth. This increased confidence translates directly into increased economic activity:

- Consumer Confidence Indices: Surveys consistently reveal rising consumer confidence, indicating increased willingness to spend and invest.

- Business Sentiment Surveys: Business sentiment indicators show optimism regarding future growth and profitability, leading to increased investment and job creation.

This improved market sentiment reflects the overall positive economic outlook, creating a virtuous cycle of growth that further fuels the rise in Euro and European futures.

Geopolitical Influences on Euro and European Futures

Geopolitical factors also play a significant role in shaping the performance of the Euro and European futures markets. Recent developments have created a more stable and predictable environment:

Stabilization in Geopolitical Risks

Reduced geopolitical uncertainties have contributed significantly to the positive market sentiment. This stability encourages investment:

- Decreased Global Uncertainty: A reduction in certain global conflicts and tensions has lessened the overall uncertainty impacting global markets.

- Increased Political Stability: Increased political stability within the Eurozone itself has boosted investor confidence.

This decrease in geopolitical risk allows investors to focus on the underlying economic fundamentals, contributing to the bullish trend in Euro and European futures.

EU Policy Initiatives and their Market Impact

European Union policies also influence the Euro and European futures markets. Recent initiatives have had a positive impact:

- EU Recovery Fund: The disbursement of funds from the EU Recovery and Resilience Facility has boosted economic activity in several member states.

- Green Transition Policies: While requiring investment, policies supporting a green transition are seen as long-term positive for economic growth and sustainability.

These policy initiatives signal a proactive approach to addressing economic challenges and fostering long-term growth, supporting the positive outlook for Euro and European futures.

Swissquote Bank's Market Outlook and Trading Strategies

Swissquote Bank, a leading financial institution, offers valuable insights into the current market trends and potential trading strategies.

Swissquote Bank's Analysis of Current Market Trends

Swissquote Bank's analysis points towards a continued positive outlook for the Euro and European futures market, citing the strong economic data and easing geopolitical risks as key drivers. Their assessment emphasizes:

- Continued Economic Growth: Swissquote Bank anticipates sustained economic growth within the Eurozone.

- Gradual Inflation Decrease: They foresee a continued, albeit gradual, decrease in inflation rates.

- Stable Geopolitical Environment: They project a continuation of the current relatively stable geopolitical environment.

These key findings underpin their positive outlook for the Euro and European futures market.

Potential Investment Opportunities and Risks

Based on their analysis, Swissquote Bank suggests several potential investment opportunities, while also highlighting associated risks:

- Long Positions in Euro Futures: This strategy aims to profit from the anticipated continued rise in Euro value. However, unforeseen economic shocks or geopolitical events could pose risks.

- Strategic Allocation to European Equity Futures: This strategy offers diversified exposure to the European economy, although market volatility remains a concern.

Careful risk management, including diversification and stop-loss orders, is crucial when implementing these strategies.

Conclusion

The surge in Euro and European futures is driven by a confluence of factors, including strong Eurozone economic data, easing inflationary pressures, improved consumer and business confidence, and a stabilization of geopolitical risks. Swissquote Bank's analysis reinforces this positive outlook, suggesting continued growth potential. However, it's crucial to remember that market conditions can change rapidly, and risk management is essential.

Call to Action: Stay informed about the dynamic Euro and European futures market. Learn more about Swissquote Bank's expert analysis and trading tools to capitalize on current opportunities. Visit [link to Swissquote Bank website] to explore your investment options in Euro and European futures.

Featured Posts

-

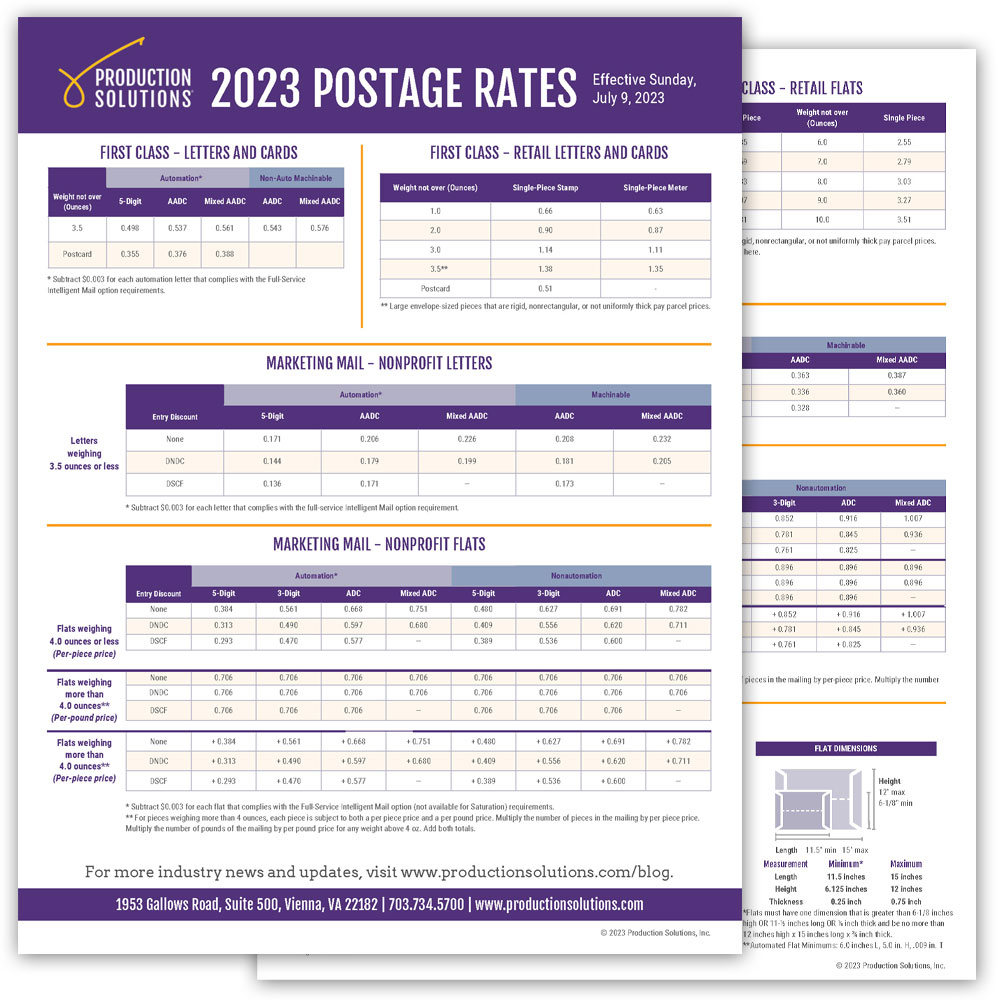

Postage Stamp Price Increase First Class Now 1 70

May 19, 2025

Postage Stamp Price Increase First Class Now 1 70

May 19, 2025 -

Portugal Adjusts Power Import Limits After Spain Blackout

May 19, 2025

Portugal Adjusts Power Import Limits After Spain Blackout

May 19, 2025 -

Cne Confirma Elecciones Primarias En 2025

May 19, 2025

Cne Confirma Elecciones Primarias En 2025

May 19, 2025 -

Cassidy Hutchinsons Memoir Key Witness To The January 6th Hearings To Detail Events This Fall

May 19, 2025

Cassidy Hutchinsons Memoir Key Witness To The January 6th Hearings To Detail Events This Fall

May 19, 2025 -

Brett Goldstein Premiere Date Revealed For The Second Best Night Of Your Life

May 19, 2025

Brett Goldstein Premiere Date Revealed For The Second Best Night Of Your Life

May 19, 2025