European Futures Trading Update From Swissquote Bank

Table of Contents

Major Market Movers Influencing European Futures Trading

The European futures market is heavily influenced by a complex interplay of geopolitical events and economic indicators. Understanding these key drivers is paramount for effective trading strategies. Currently, several factors are significantly shaping the landscape of European futures trading.

-

Impact of the ongoing war in Ukraine: The ongoing conflict continues to disrupt supply chains, impacting energy prices and creating uncertainty across various sectors, significantly influencing agricultural futures and energy contracts. This volatility presents both risks and opportunities for traders skilled in navigating geopolitical uncertainty.

-

Energy price fluctuations and their effect on various futures contracts: Fluctuations in natural gas and oil prices, driven by geopolitical tensions and supply constraints, have a ripple effect across numerous futures contracts. Traders must closely monitor these price movements and their impact on related sectors.

-

Economic data releases (e.g., CPI, GDP) and their market influence: Key economic indicators, such as Consumer Price Index (CPI) and Gross Domestic Product (GDP) reports, provide crucial insights into the health of the European economy. These releases often cause significant market volatility, presenting opportunities for astute traders.

-

Impact of the European Central Bank's monetary policy decisions: The European Central Bank's (ECB) monetary policy decisions, including interest rate changes and quantitative easing programs, directly affect the value of the Euro and consequently influence the performance of various futures contracts. Understanding the ECB's stance is vital for effective trading.

Analysis of Key European Futures Contracts

Several key futures contracts traded on major European exchanges offer diverse trading opportunities. Let's examine some of the most prominent ones:

-

Overview of DAX (German stock market index) futures: DAX futures track the performance of the German stock market, offering exposure to a major European economy. Understanding the underlying factors influencing the German economy is essential for trading DAX futures effectively.

-

Analysis of EURO STOXX 50 futures: EURO STOXX 50 futures provide exposure to the 50 largest companies in the Eurozone, offering a broader view of the Eurozone's economic performance. Analyzing macroeconomic factors impacting the Eurozone is crucial for successful trading.

-

Discussion on FTSE 100 (UK stock market index) futures: FTSE 100 futures mirror the performance of the UK's leading companies. Brexit-related developments and the UK's economic trajectory significantly influence the performance of these futures.

-

Commentary on agricultural futures (e.g., wheat, corn): Agricultural futures, particularly wheat and corn, are significantly affected by weather patterns, global demand, and geopolitical factors. Analyzing these factors is essential for successful trading in this sector.

-

Mention of other relevant European futures contracts and their recent performance: Other important contracts include those on interest rates, bonds, and various commodities, each with unique characteristics and sensitivities to different market forces.

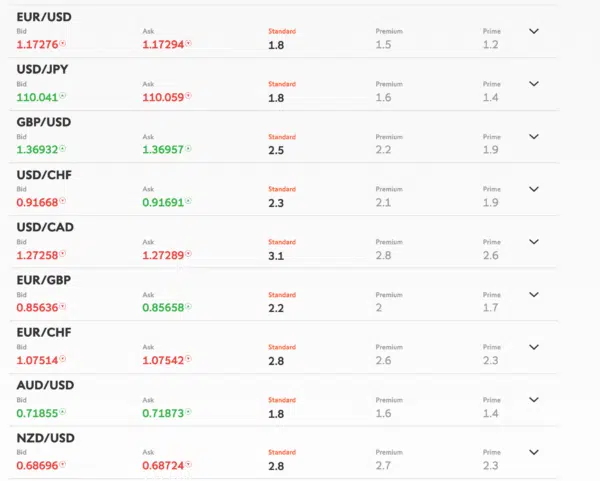

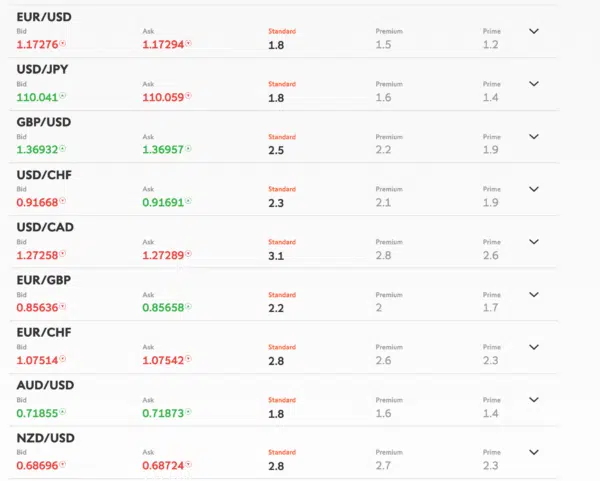

Swissquote Bank's Trading Platform and Tools for European Futures

Swissquote Bank provides a comprehensive platform tailored to the needs of sophisticated futures traders. Our platform offers several key advantages:

-

Competitive pricing and low commissions: We offer highly competitive pricing and low commissions, maximizing your profitability.

-

Advanced charting and analytical tools: Access cutting-edge charting tools and advanced analytical features to help you make informed trading decisions.

-

Access to real-time market data and news: Stay ahead of the curve with access to real-time market data and news feeds, ensuring you always have the most up-to-date information at your fingertips.

-

User-friendly interface and trading experience: Our intuitive platform is designed for ease of use, allowing you to focus on your trading strategies.

-

Robust risk management features: We offer comprehensive risk management tools to help you protect your capital and manage your exposure effectively.

Strategies and Tips for Successful European Futures Trading

Successful European futures trading requires a combination of knowledge, skill, and discipline. Here are some key strategies and tips:

-

Importance of risk management (stop-loss orders, position sizing): Implementing robust risk management strategies, such as stop-loss orders and careful position sizing, is crucial to mitigate potential losses.

-

Fundamental analysis vs. technical analysis for European futures: Employing both fundamental and technical analysis allows you to gain a comprehensive understanding of market trends and make well-informed decisions.

-

Diversification strategies for a balanced portfolio: Diversifying your portfolio across different futures contracts can help reduce risk and potentially improve returns.

-

Importance of staying informed about market news and events: Keeping abreast of relevant news and events impacting the European futures market is paramount for successful trading.

-

Advice on managing emotions in trading: Emotional discipline is crucial; avoid impulsive decisions based on fear or greed.

Conclusion

This update highlights the key market movers influencing European Futures Trading, provides analysis of key contracts, showcases the benefits of Swissquote Bank's trading platform, and offers crucial strategies for success. Staying informed about these factors is essential for navigating the complexities of this dynamic market. Leverage the insights provided here and capitalize on the opportunities within the European futures market. Ready to trade European futures and access the full potential of this dynamic market? Open an account with Swissquote Bank today and experience the difference! [Link to Swissquote Bank website]

Featured Posts

-

Solve The Nyt Mini Crossword April 18 2025 Answers And Hints

May 19, 2025

Solve The Nyt Mini Crossword April 18 2025 Answers And Hints

May 19, 2025 -

The Ultimate Guide To Orlandos Highest Rated Southern Eateries

May 19, 2025

The Ultimate Guide To Orlandos Highest Rated Southern Eateries

May 19, 2025 -

Growing Protests And Violence In Tripoli Libyas Response To Militia Power

May 19, 2025

Growing Protests And Violence In Tripoli Libyas Response To Militia Power

May 19, 2025 -

S Fur Nin 2025 Eurovision Soezcuelueyue Az Rbaycan Uecuen N L R Dem Kdir

May 19, 2025

S Fur Nin 2025 Eurovision Soezcuelueyue Az Rbaycan Uecuen N L R Dem Kdir

May 19, 2025 -

Eurovision 2025 Finish Time And Show Length

May 19, 2025

Eurovision 2025 Finish Time And Show Length

May 19, 2025