European Market Update: Tariff Relief Speculation And LVMH's Decline

Table of Contents

Tariff Relief Speculation Impacts the European Economy

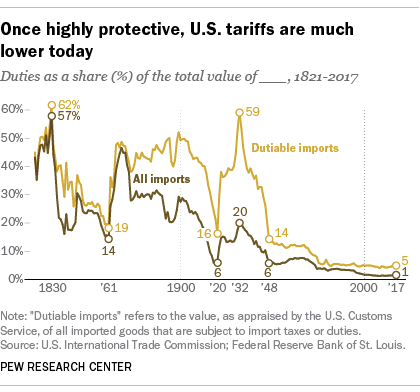

The current state of international trade negotiations is significantly impacting European businesses. Uncertainty surrounding tariffs, particularly those imposed by major trading partners, is creating instability and hindering long-term planning. Sectors heavily reliant on international trade, such as automobiles and luxury goods, are particularly vulnerable.

Tariff relief, should it materialize, could offer a significant boost to the European economy. However, the impact would be unevenly distributed across sectors.

- Impact on consumer spending: Reduced import prices could lead to increased consumer spending, stimulating economic growth. Conversely, uncertainty could lead to cautious spending habits.

- Effect on import/export prices: Tariff reductions would directly lower import prices, making European goods more competitive internationally.

- Potential for increased competition: Reduced tariffs could lead to increased competition from international players, putting pressure on European businesses to innovate and improve efficiency.

- Government response and policy adjustments: Government policies will need to adapt to the changing economic landscape, potentially involving adjustments to taxation and investment incentives.

LVMH's Decline: A Closer Look at the Luxury Sector

LVMH, a behemoth in the luxury goods sector, has recently experienced a decline in its financial performance. This raises concerns about the overall health of the luxury market and its sensitivity to global economic shifts. Several factors contribute to this downturn:

- Specific financial indicators: A closer look at LVMH's stock price, sales figures, and profit margins reveals a downward trend, indicating weakening demand for luxury goods.

- Impact on other luxury brands: LVMH's decline is not an isolated incident; it reflects broader challenges facing the entire luxury goods sector, suggesting a systemic issue rather than company-specific problems.

- Strategies LVMH might employ to recover: LVMH will likely focus on strategies like diversification, cost-cutting measures, and a renewed focus on key consumer segments to regain market share and profitability.

- Analysis of consumer behavior shifts affecting the luxury market: Shifting consumer preferences, including a greater focus on sustainability and ethical sourcing, are also impacting the luxury market, requiring brands to adapt their offerings and messaging.

Interconnectedness of Tariff Relief and LVMH’s Performance

The speculation surrounding tariff relief is directly relevant to LVMH's performance and the broader luxury sector. Luxury goods, often incorporating materials and components sourced globally, are particularly susceptible to tariff fluctuations.

- Analysis of LVMH's supply chains and their geographical distribution: LVMH's complex global supply chains are exposed to tariff risks. Changes in tariffs could significantly impact the cost of production and distribution.

- Potential impact of tariff changes on LVMH's sourcing and production: Reduced tariffs could lower input costs, potentially boosting LVMH's profitability.

- Comparison of LVMH's performance against other luxury conglomerates: Comparing LVMH's performance to competitors like Kering and Richemont provides context for assessing the industry's overall health and the specific challenges faced by LVMH.

- Long-term implications for the company’s strategy: LVMH’s future strategy will likely need to account for ongoing tariff uncertainty and the potential for future trade policy shifts.

Future Outlook for the European Market

The future outlook for the European market is complex, dependent on the resolution of trade disputes and the evolving dynamics of the luxury goods sector. Several scenarios are possible:

- Predictions for economic growth: Economic growth predictions for Europe will hinge on the successful resolution of trade tensions and the ability of major sectors to adapt to changing market conditions.

- Potential for industry consolidation: Increased competition and economic uncertainty could lead to industry consolidation, with mergers and acquisitions becoming more prevalent.

- Opportunities in emerging markets within Europe: Despite challenges, opportunities exist in emerging markets within Europe, requiring businesses to adapt their strategies to meet the specific needs of these consumer segments.

- Recommendations for investors and businesses operating in the European market: Investors should carefully consider the risks and rewards associated with investments in the European market, focusing on companies with strong resilience and adaptability. Businesses need to develop flexible and diversified strategies.

Conclusion: Summarizing the European Market Update

This European Market Update has highlighted the significant impact of tariff relief speculation on the European economy, with particular focus on the luxury sector and the decline of LVMH. The interconnectedness of global economic factors underscores the need for businesses to adopt robust, adaptable strategies. LVMH's challenges reflect broader issues facing the luxury industry, underscoring the importance of monitoring global trade developments and consumer behavior shifts. To stay informed about the ongoing European Market Update and its implications for your investments and business, subscribe to our newsletter or follow reputable market news sources. Closely monitoring developments in tariff negotiations and their effects on individual company performance is crucial for navigating this complex and evolving landscape.

Featured Posts

-

Exploring New Opportunities Bangladeshs Renewed Focus On The European Market

May 24, 2025

Exploring New Opportunities Bangladeshs Renewed Focus On The European Market

May 24, 2025 -

High Cost Of Living Impacts Canadian Auto Theft Prevention Measures

May 24, 2025

High Cost Of Living Impacts Canadian Auto Theft Prevention Measures

May 24, 2025 -

Depasser Les Cliches Le Francais Selon Mathieu Avanzi

May 24, 2025

Depasser Les Cliches Le Francais Selon Mathieu Avanzi

May 24, 2025 -

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025 -

Analyzing Stitchpossibles Weekend Performance Implications For The 2025 Box Office

May 24, 2025

Analyzing Stitchpossibles Weekend Performance Implications For The 2025 Box Office

May 24, 2025