European Midday Briefing: Stock Market Dip On PMI Data

Table of Contents

PMI Data Highlights: A Closer Look at the Numbers

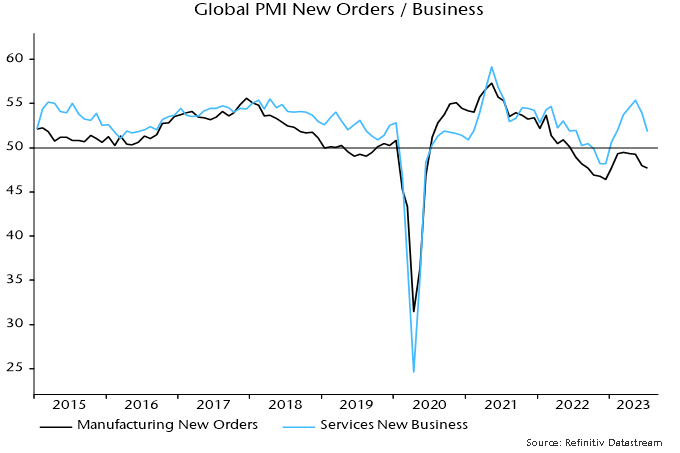

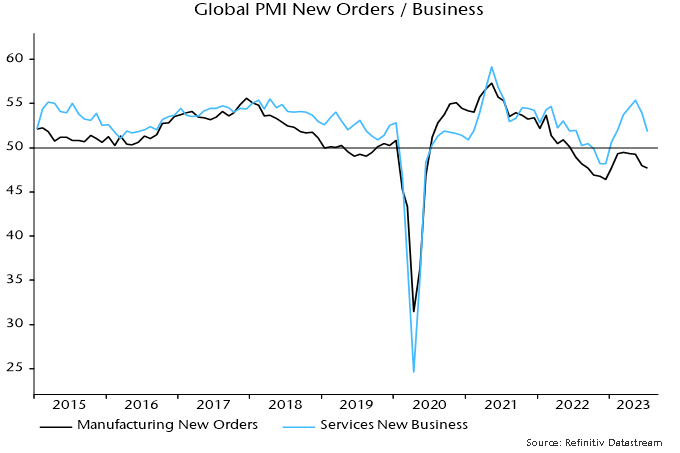

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers in various sectors. A PMI above 50 generally signals expansion, while a reading below 50 indicates contraction. Today's data reveals a mixed picture across the European Union.

-

Manufacturing PMI: The Eurozone manufacturing PMI fell to 46.5%, a significant drop from last month's 48.1% and marking a continued contraction in the sector. This underscores persistent challenges facing European manufacturers, including high energy costs and weakening global demand.

-

Services PMI: While the manufacturing sector struggles, the services PMI remained relatively stable at 51.2%, showing resilience despite broader economic concerns. This suggests that the services sector is currently providing some support to the overall economy.

-

Composite PMI: The composite PMI, which combines manufacturing and services, fell below the crucial 50% threshold to 49.8%, signaling a potential economic slowdown across the Eurozone. This overall figure is a key concern for investors.

Geographic Breakdown:

-

Germany: Germany, Europe's largest economy, saw a particularly sharp decline in its manufacturing PMI, reflecting ongoing struggles within its industrial sector.

-

France: France's PMI data showed more resilience, though still indicating a slowing economy compared to previous months.

-

UK: The UK’s PMI data mirrored the broader European trend, highlighting a weakening economy across the continent.

Market Reaction: Stock Indices and Sectoral Performance

The release of the weaker-than-expected PMI data immediately triggered a sell-off in European stock markets. By midday, major indices showed significant declines:

-

DAX (Germany): The DAX fell by 1.8%, reflecting the particularly poor performance of German manufacturing.

-

CAC 40 (France): The CAC 40 experienced a more moderate decline of 1.2%, indicating a less severe impact in France compared to Germany.

-

FTSE 100 (UK): The FTSE 100 dipped by 1.5%, mirroring the overall negative sentiment across European markets.

Sectoral Analysis:

-

The energy sector was particularly hard hit, with a 2.5% drop, reflecting concerns about weakening demand linked to the overall economic slowdown.

-

Technology stocks showed some resilience, with a smaller decline of 0.8%, possibly indicating that investors see the sector as less susceptible to immediate economic headwinds.

-

Several key companies reported negative impacts. For example, Volkswagen experienced a significant drop due to their exposure to the struggling automotive sector.

Analyst Reactions and Market Outlook

Financial analysts have offered mixed reactions to the PMI data and its implications.

-

Bearish Sentiment: Many analysts express concern about the possibility of a prolonged economic slowdown, forecasting further market declines in the short term. Concerns are growing over the potential for a recession.

-

Cautious Optimism: Some analysts believe this dip presents a buying opportunity for long-term investors, highlighting the potential for recovery in the coming months. They point to the relative strength of the services sector as a potential buffer.

-

Inflationary Pressures: The prevailing sentiment is that persistent inflation and rising interest rates continue to contribute to market uncertainty, creating a complex economic landscape.

Conclusion: European Midday Briefing – Key Takeaways and Next Steps

Today's PMI data paints a picture of a weakening European economy, particularly within the manufacturing sector. This has led to a significant midday dip in European stock markets, with various sectors impacted to different degrees. While some analysts express concern about further declines, others see it as a temporary setback and a possible buying opportunity. The overall market outlook remains uncertain, with inflation and interest rates remaining key factors. Stay informed on market developments by subscribing to our future European Midday Briefings or following us for daily updates on PMI data and its impact on the European stock market and for other vital European market updates. Understanding these daily European stock market briefings is crucial for informed investment decisions.

Featured Posts

-

Oscar Piastris Pole Position A Bahrain Gp Surprise

May 23, 2025

Oscar Piastris Pole Position A Bahrain Gp Surprise

May 23, 2025 -

Grand Ole Opry Royal Albert Hall Broadcast Marks International Expansion

May 23, 2025

Grand Ole Opry Royal Albert Hall Broadcast Marks International Expansion

May 23, 2025 -

Box Office Battle Stitchpossible Weekend And The Potential For Record Breaking 2025

May 23, 2025

Box Office Battle Stitchpossible Weekend And The Potential For Record Breaking 2025

May 23, 2025 -

Royal Albert Hall To Host Grand Ole Opry Event Date And Lineup Announced

May 23, 2025

Royal Albert Hall To Host Grand Ole Opry Event Date And Lineup Announced

May 23, 2025 -

Employee Quits Pub Landlord Unleashes Profanity Laced Attack Video Surfaces

May 23, 2025

Employee Quits Pub Landlord Unleashes Profanity Laced Attack Video Surfaces

May 23, 2025