Evaluating Palantir After A 30% Market Correction.

Table of Contents

Analyzing Palantir's Fundamentals After the Correction

The recent market correction necessitates a close examination of Palantir's financial health and the sustainability of its business model. Understanding its fundamentals is crucial for determining whether the current stock price reflects its true value.

Revenue Growth and Profitability

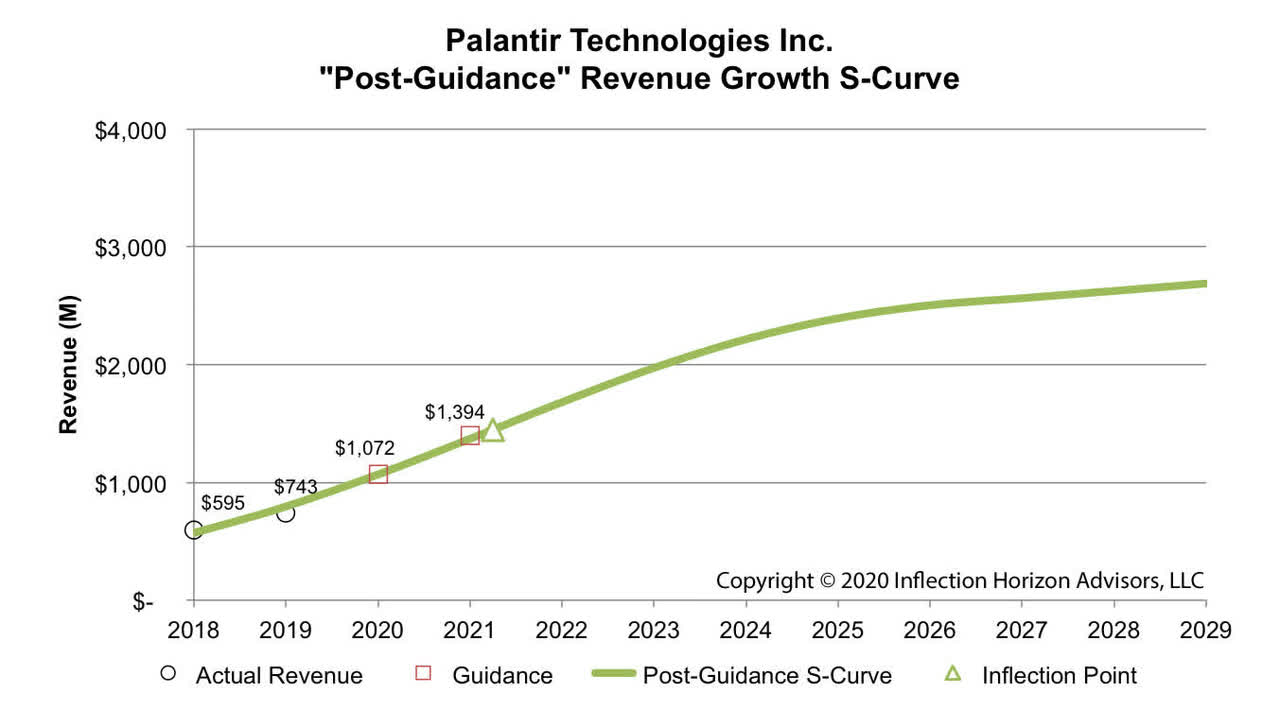

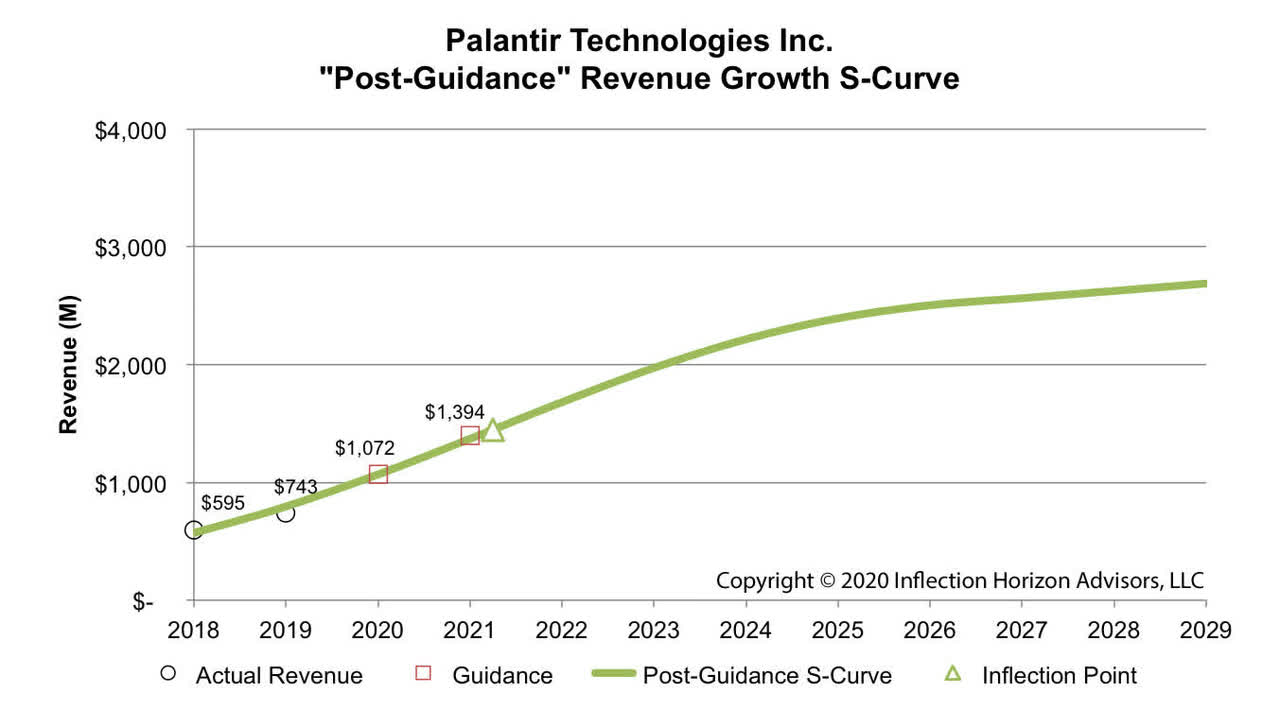

Palantir's recent financial performance reveals a mixed bag. While the company demonstrates impressive year-over-year revenue growth, profitability remains a key concern for many investors.

- Year-over-Year Growth: [Insert recent year-over-year revenue growth data here. Source the data]. This growth is driven by a combination of increasing government contracts and expansion into the commercial sector.

- Revenue Drivers: Government contracts traditionally constitute a larger portion of Palantir's revenue. [Insert percentage breakdown of government vs. commercial revenue. Source the data]. Analyzing the growth rate of each segment is critical for assessing future performance.

- Profitability Trends: Palantir's operating expenses have [increased/decreased – insert data and source]. This trend, combined with revenue growth, affects its overall profitability margins. [Insert data on operating margins and net income margins, with sources]. Understanding the trajectory of these margins is essential for evaluating long-term sustainability.

Government Contracts and Future Outlook

Government contracts form a significant part of Palantir's revenue stream. The stability and future prospects of these contracts are crucial for the company's overall financial health.

- Geopolitical Landscape: The current geopolitical climate [insert relevant geopolitical factors impacting government spending on data analytics]. These factors may influence the number and size of future government contracts awarded to Palantir.

- Pipeline of Potential Contracts: Palantir actively pursues new government contracts. The strength of their pipeline [insert information about the company's pipeline of potential contracts if available, and source]. A robust pipeline suggests a positive outlook for future revenue growth.

- Competition: The government contracting space is competitive. Palantir faces competition from [list key competitors and their strengths]. Analyzing the competitive landscape is essential for assessing Palantir's ability to secure future contracts.

Commercial Market Penetration and Growth

Palantir's expansion into the commercial market is vital for long-term growth and diversification away from its reliance on government contracts.

- Key Commercial Clients: Palantir has secured contracts with [list some key commercial clients]. The diversity and size of these clients indicate the strength of its commercial market penetration.

- Market Share Growth: Palantir's market share in the commercial data analytics sector [insert data on market share growth if available, and source]. This data reflects its competitiveness and growth potential in this segment.

- Challenges and Opportunities: The commercial market presents both challenges and opportunities. Palantir faces competition from established players, while the opportunity to serve a broader range of clients is significant. [Discuss specific challenges and opportunities based on available data]. A comparison of Palantir's offerings with those of competitors is essential for evaluating its competitive advantage.

Evaluating the Market Sentiment and Investor Confidence

The 30% market correction has undoubtedly impacted investor sentiment towards Palantir. Understanding this sentiment is crucial for assessing the current investment opportunity.

Impact of the Market Correction on Investor Sentiment

The market correction has led to increased volatility in PLTR stock.

- Stock Price Volatility: [Include data on stock price volatility, trading volume, and short interest. Source the data]. High volatility often reflects uncertainty in the market.

- Analyst Ratings: Analyst ratings for Palantir have [increased/decreased – insert data and source]. Changes in analyst ratings reflect shifts in market sentiment and expectations.

- Social Media Sentiment: Social media discussions about Palantir reveal [describe the prevailing sentiment from credible sources]. Social media sentiment, while not definitive, can offer insights into investor perspectives.

Assessing the Risk and Reward Profile

Investing in Palantir, even after the correction, involves inherent risks and potential rewards. A balanced assessment is crucial.

- Potential Risks: Risks include competition from established players, regulatory hurdles, and dependence on government contracts. [Elaborate on each risk and its potential impact].

- Potential Rewards: The potential rewards include substantial growth in the data analytics sector, further penetration into the commercial market, and increased profitability. [Elaborate on each reward and its potential impact]. Weighing these risks and rewards is essential for determining the investment’s suitability.

Comparing Palantir's Valuation to Peers

Comparing Palantir's valuation to its peers in the data analytics sector helps determine if the current price reflects its true worth.

- Valuation Metrics: [Compare Palantir's Price-to-Sales ratio and other relevant valuation metrics to those of its competitors. Source the data]. This comparison will help determine if PLTR is undervalued, fairly valued, or overvalued relative to its peers.

Conclusion

This evaluation of Palantir after its 30% market correction reveals a complex picture. While the company demonstrates strong revenue growth potential, concerns remain regarding profitability and reliance on government contracts. The market correction has significantly impacted investor sentiment, creating both risks and opportunities. A thorough comparison with competitors suggests [conclude whether Palantir appears undervalued, fairly valued, or overvalued based on the analysis].

Carefully evaluate Palantir's prospects and your own risk tolerance before making any investment decisions regarding PLTR stock. Remember that this analysis is for informational purposes only and does not constitute financial advice. Conduct your own thorough due diligence before investing in Palantir or any other security. Is Palantir stock a buying opportunity for you? Only you can answer that question after careful research.

Featured Posts

-

State Suspends Nc Daycare Full Report From Wfmy News 2

May 09, 2025

State Suspends Nc Daycare Full Report From Wfmy News 2

May 09, 2025 -

Melanie Griffith And Dakota Johnson Attend Materialists Film Screening

May 09, 2025

Melanie Griffith And Dakota Johnson Attend Materialists Film Screening

May 09, 2025 -

De Xuat Giai Phap Sau Vu Bao Mau Tat Tre O Tien Giang Bao Ve Tre Em Hieu Qua Hon

May 09, 2025

De Xuat Giai Phap Sau Vu Bao Mau Tat Tre O Tien Giang Bao Ve Tre Em Hieu Qua Hon

May 09, 2025 -

Find Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025

Find Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025 -

Stiven King Rezko Vyskazalsya O Trampe I Maske

May 09, 2025

Stiven King Rezko Vyskazalsya O Trampe I Maske

May 09, 2025

Latest Posts

-

The Nottingham Attack Survivors Powerful Testimony

May 10, 2025

The Nottingham Attack Survivors Powerful Testimony

May 10, 2025 -

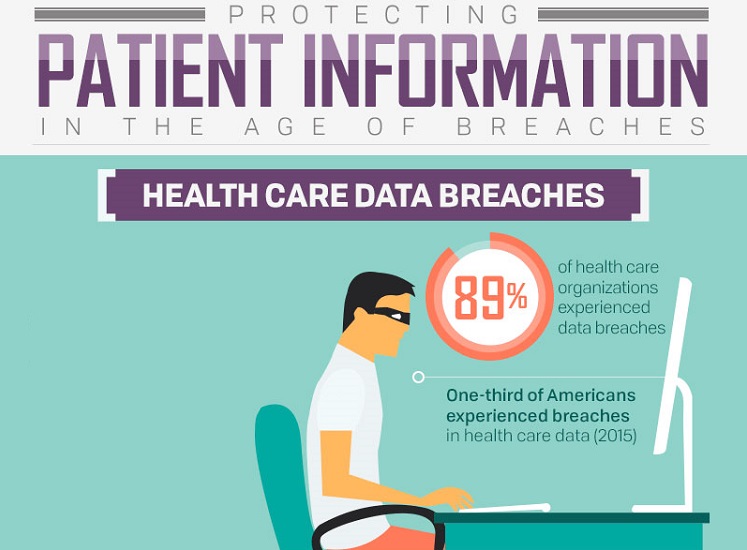

Nottingham Hospital Data Breach Families Anger Over Access To A And E Records

May 10, 2025

Nottingham Hospital Data Breach Families Anger Over Access To A And E Records

May 10, 2025 -

Nottingham Attack Survivors Emotional Account Of The Tragedy

May 10, 2025

Nottingham Attack Survivors Emotional Account Of The Tragedy

May 10, 2025 -

Understanding Wynne And Joanna All At Sea Character Development And Plot

May 10, 2025

Understanding Wynne And Joanna All At Sea Character Development And Plot

May 10, 2025 -

Nottingham Attack Victim Records Accessed By 90 Nhs Staff Privacy Concerns Raised

May 10, 2025

Nottingham Attack Victim Records Accessed By 90 Nhs Staff Privacy Concerns Raised

May 10, 2025