Evaluating Uber Technologies (UBER) As An Investment

Table of Contents

Uber's Business Model and Revenue Streams

Uber's success stems from its multifaceted business model, generating revenue from various streams.

Ride-Sharing Dominance

Uber's global reach and brand recognition are significant competitive advantages. Its network effect—more drivers attract more riders, and vice-versa—creates a powerful barrier to entry for competitors.

- Market Share: Uber holds a substantial market share in many regions globally, although the exact figures vary depending on the specific market and competitor analysis. Analyzing these market share statistics is crucial for evaluating its long-term growth potential.

- Geographic Reach: Uber operates in numerous countries across the globe, providing a diversified revenue base and significant growth opportunities in emerging markets.

- Competitive Advantage: Beyond network effects, Uber's technological prowess, strong branding, and extensive driver network contribute to its competitive edge in the ridesharing market.

Uber Eats and Food Delivery

Uber Eats has become a significant revenue contributor, competing directly with established food delivery giants. Its integration with the Uber app provides a convenient platform for users.

- Market Share in Food Delivery: While facing stiff competition from companies like DoorDash and Grubhub, Uber Eats maintains a substantial portion of the food delivery market share in many areas.

- Growth Rate: The growth rate of Uber Eats varies regionally but continues to contribute significantly to the company's overall revenue. Analyzing this growth rate against competitor performance is vital.

- Profitability Margins: Uber Eats’ profitability margins are under scrutiny, requiring analysis of operational efficiency and pricing strategies to determine its long-term success. Analyzing profitability margins is a key factor in evaluating its financial health.

- Key Competitors: Understanding the competitive landscape and the strategies of competitors like DoorDash and Grubhub is key to assessing Uber Eats’ potential for future growth.

Freight and Logistics

Uber Freight represents a relatively newer but potentially lucrative segment. This division leverages technology to connect shippers with carriers, streamlining the freight transportation process.

- Market Size: The freight transportation market is massive, presenting a significant opportunity for expansion and revenue generation for Uber Freight.

- Growth Prospects: While still developing, Uber Freight demonstrates considerable growth potential, capitalizing on technological advancements to optimize logistics and supply chain management.

- Competitive Landscape: This segment is highly competitive, with established players presenting a significant challenge to Uber Freight's market penetration.

- Challenges: Factors such as driver shortages, regulatory hurdles, and fuel price fluctuations pose challenges to Uber Freight's growth.

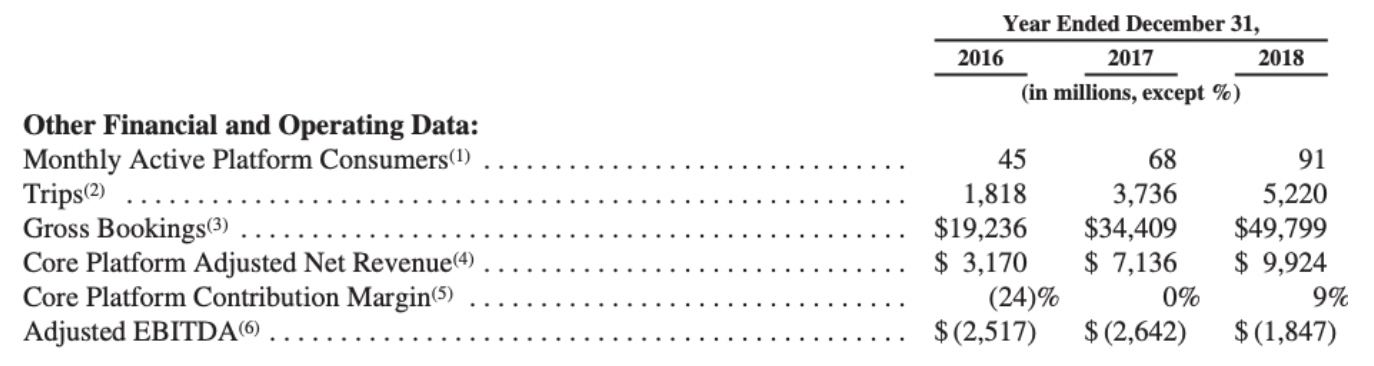

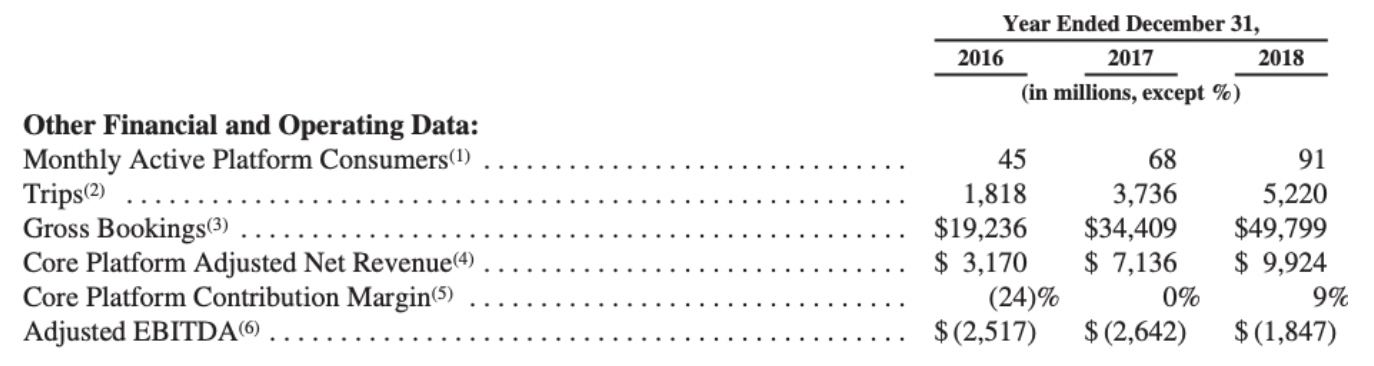

Financial Performance and Key Metrics

Analyzing Uber's financial performance reveals its financial health and growth trajectory.

Revenue Growth and Profitability

Uber's revenue growth has been substantial, but profitability remains a key area of focus for investors.

- Year-over-Year Revenue Growth: Examine the historical revenue growth rates to assess the company’s growth trajectory and sustainability.

- Net Income: Tracking net income over time offers insights into the company’s profitability after accounting for all expenses.

- Operating Margin: This ratio reveals Uber’s operating efficiency and profitability from its core operations.

- Debt-to-Equity Ratio: This metric assesses the financial risk associated with Uber’s capital structure.

Cash Flow and Liquidity

Understanding Uber's cash flow and liquidity is crucial for assessing its ability to meet its obligations and invest in future growth.

- Free Cash Flow: This reflects the cash generated by Uber’s operations after accounting for capital expenditures, indicative of its capacity for reinvestment and dividend payments.

- Operating Cash Flow: This shows the cash generated from Uber's core business operations.

- Debt Levels: High debt levels can negatively impact a company's financial stability and flexibility.

- Liquidity Ratios: These ratios assess Uber's ability to meet its short-term financial obligations.

Risks and Challenges Facing Uber

Despite its success, Uber faces significant challenges.

Regulatory Hurdles and Legal Battles

Uber operates in a heavily regulated industry, leading to ongoing legal and regulatory challenges globally.

- Examples of Regulatory Issues: These include labor laws concerning driver classification, licensing requirements, and safety regulations, which impact operational costs and profitability.

- Potential Fines and Legal Costs: Legal battles and regulatory fines can significantly impact Uber’s financial performance and investor confidence.

Intense Competition

The ride-sharing and food delivery markets are fiercely competitive, with established players and new entrants constantly vying for market share.

- Major Competitors: Companies like Lyft, DoorDash, and Grubhub pose significant competitive pressures on Uber’s market share in various segments.

- Pricing Wars: Competitive pricing strategies can squeeze profit margins and impact overall profitability.

- Market Share Battles: Continuous competition for market share necessitates significant investments in technology and marketing.

- Technological Innovation: The need for continuous technological innovation to stay competitive adds to operational costs and risks.

Economic Downturns and Consumer Spending

Uber's business is sensitive to economic fluctuations, as consumer spending on discretionary services like ride-sharing and food delivery is often affected during economic downturns.

- Sensitivity to Economic Cycles: During economic recessions, consumer demand for ride-sharing and food delivery may decline, impacting Uber's revenue and profitability.

- Impact on Consumer Spending: Decreased consumer spending directly impacts the demand for Uber’s services, posing a significant financial risk.

- Potential for Reduced Demand: Economic downturns can result in reduced demand, impacting the utilization of Uber's services and impacting driver earnings and company revenue.

Future Growth Opportunities

Despite the challenges, Uber possesses considerable potential for future growth.

Expansion into New Markets

Untapped markets globally present opportunities for Uber to expand its reach and diversify its revenue streams.

- Emerging Markets: Expanding into developing economies with growing populations and increasing smartphone penetration offers significant growth prospects.

- International Expansion Plans: Uber’s ongoing efforts in international market penetration are a key driver for future growth.

- Market Penetration Strategies: Effective market penetration strategies are crucial for success in new markets, requiring local adaptation and understanding of consumer behavior.

Technological Advancements

Technological advancements, such as autonomous vehicles and AI-powered services, offer significant growth opportunities.

- Autonomous Vehicles: The development and deployment of autonomous vehicles could significantly impact Uber’s operational efficiency and reduce costs.

- AI-Powered Services: The use of AI and machine learning can optimize pricing strategies, improve driver dispatching, and enhance customer experience.

- Improved Efficiency: Technology can play a critical role in improving operational efficiency across all Uber’s business segments.

- Innovation in Logistics: Uber's investments in logistics technology aim to optimize the supply chain and enhance efficiency in freight transportation.

Conclusion: Should You Invest in Uber (UBER)?

Evaluating Uber Technologies (UBER) as an Investment requires a thorough assessment of its multifaceted business model, strong revenue streams, and significant growth potential. However, investors must also acknowledge the risks associated with intense competition, regulatory hurdles, and economic sensitivity. While Uber demonstrates significant growth potential in ride-sharing, food delivery, and freight, the challenges are considerable. This analysis suggests a balanced approach—considering both the opportunities and risks before making any investment decision. Before investing in Uber Technologies (UBER), conduct your own thorough research, consulting financial advisors and exploring additional resources for in-depth analysis. Remember, careful consideration is paramount before investing in any stock.

Featured Posts

-

Experience Nyc The Ultimate Guide To The Five Boro Bike Tour

May 18, 2025

Experience Nyc The Ultimate Guide To The Five Boro Bike Tour

May 18, 2025 -

Ego Nwodims Weekend Update Snls Most Uncomfortable Moment

May 18, 2025

Ego Nwodims Weekend Update Snls Most Uncomfortable Moment

May 18, 2025 -

Skandalas Kanye Westas Paviesino Biancos Censori Intymias Nuotraukas

May 18, 2025

Skandalas Kanye Westas Paviesino Biancos Censori Intymias Nuotraukas

May 18, 2025 -

Bowen Yang Pleads With Lorne Michaels A New Jd Vance For Snl

May 18, 2025

Bowen Yang Pleads With Lorne Michaels A New Jd Vance For Snl

May 18, 2025 -

Tom Clancys The Division 2 Anniversary Six Years Of Updates And Content

May 18, 2025

Tom Clancys The Division 2 Anniversary Six Years Of Updates And Content

May 18, 2025

Latest Posts

-

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025 -

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Daily Lotto 29 April 2025 Results

May 18, 2025

Daily Lotto 29 April 2025 Results

May 18, 2025 -

Daily Lotto Monday 28 April 2025 Results

May 18, 2025

Daily Lotto Monday 28 April 2025 Results

May 18, 2025 -

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025