Exclusive Insights: Goldman Sachs' Strategies For Managing Trump-Era Tariffs

Table of Contents

Proactive Risk Assessment and Mitigation

Goldman Sachs' response to the escalating trade war wasn't reactive; it was proactive. Their approach centered on anticipating and mitigating the risks posed by these tariffs well in advance of their implementation.

Early Identification of Tariff Risks

Goldman Sachs likely employed sophisticated analytics and economic modeling to predict the impact of potential tariffs on its clients' businesses. This involved:

- Analyzing detailed import/export data to pinpoint vulnerable supply chains.

- Monitoring industry-specific regulations and trade negotiation updates for early warning signs.

- Utilizing proprietary economic models to forecast the potential impact of various tariff scenarios on different sectors.

Scenario planning was crucial. By anticipating various tariff outcomes—from minor adjustments to widespread trade disruptions—Goldman Sachs helped clients prepare for a range of possibilities, minimizing the impact of unexpected developments.

Developing Contingency Plans

For each client, Goldman Sachs likely worked to develop tailored contingency plans to minimize negative impacts. These could have included:

- Sourcing from alternative countries: Identifying and vetting suppliers in regions less affected by tariffs (nearshoring, reshoring).

- Adjusting pricing strategies: Optimizing pricing models to absorb some of the increased costs imposed by tariffs.

- Investing in automation: Reducing reliance on labor-intensive processes to offset increased import costs.

The emphasis was on proactive measures, recognizing that reacting to tariffs after their implementation often proves far more costly and less effective.

Diversification Strategies for Tariff Resilience

Recognizing the limitations of solely mitigating existing risks, Goldman Sachs likely emphasized diversification as a key strategy to enhance long-term resilience against future trade uncertainties.

Supply Chain Diversification

Goldman Sachs likely advised clients to diversify their supply chains, reducing reliance on single sources or regions vulnerable to tariffs. This involved exploring various options:

- Nearshoring: Shifting production to countries geographically closer to the target market.

- Reshoring: Bringing manufacturing back to the domestic market.

- Exploring new markets: Identifying alternative suppliers in regions with more favorable trade relationships.

Diversifying supply chains, while offering significant protection against trade disruptions, presents complexities and costs, including logistical challenges, increased transportation expenses, and the need for thorough due diligence on new suppliers.

Market Diversification

Beyond supply chains, Goldman Sachs likely pushed clients to diversify their markets to lessen dependence on regions heavily impacted by tariffs. This could involve:

- Expanding into emerging markets: Capitalizing on growth opportunities in developing economies less affected by trade disputes.

- Focusing on regions with favorable trade agreements: Leveraging existing trade pacts to minimize tariff impacts.

Effective market diversification requires thorough market research, a keen understanding of local regulations, and a robust risk assessment framework to identify and mitigate potential challenges in new markets.

Lobbying and Policy Engagement

Goldman Sachs' expertise extended beyond financial strategies. Their understanding of political landscapes and policy influence likely played a crucial role in helping clients navigate the complex regulatory environment.

Advocacy for Trade Policy Changes

Goldman Sachs may have engaged in lobbying efforts to influence trade policy and mitigate the impact of tariffs. These activities could have included:

- Engaging directly with government officials to advocate for specific policy changes.

- Supporting industry associations involved in lobbying efforts to represent their clients' interests.

Transparency and ethical considerations are paramount in such engagements. Goldman Sachs would undoubtedly operate within the bounds of legal and ethical guidelines, ensuring full disclosure of their lobbying activities.

Leveraging Political Expertise

Goldman Sachs' deep understanding of political landscapes proved invaluable in helping clients anticipate and adapt to shifting regulatory environments. This included:

- Analyzing election outcomes and their potential impact on trade policy.

- Predicting regulatory changes based on shifts in political power dynamics.

Political risk assessment became an essential component of business decision-making during the period of significant trade uncertainty.

Conclusion: Key Takeaways and Call to Action

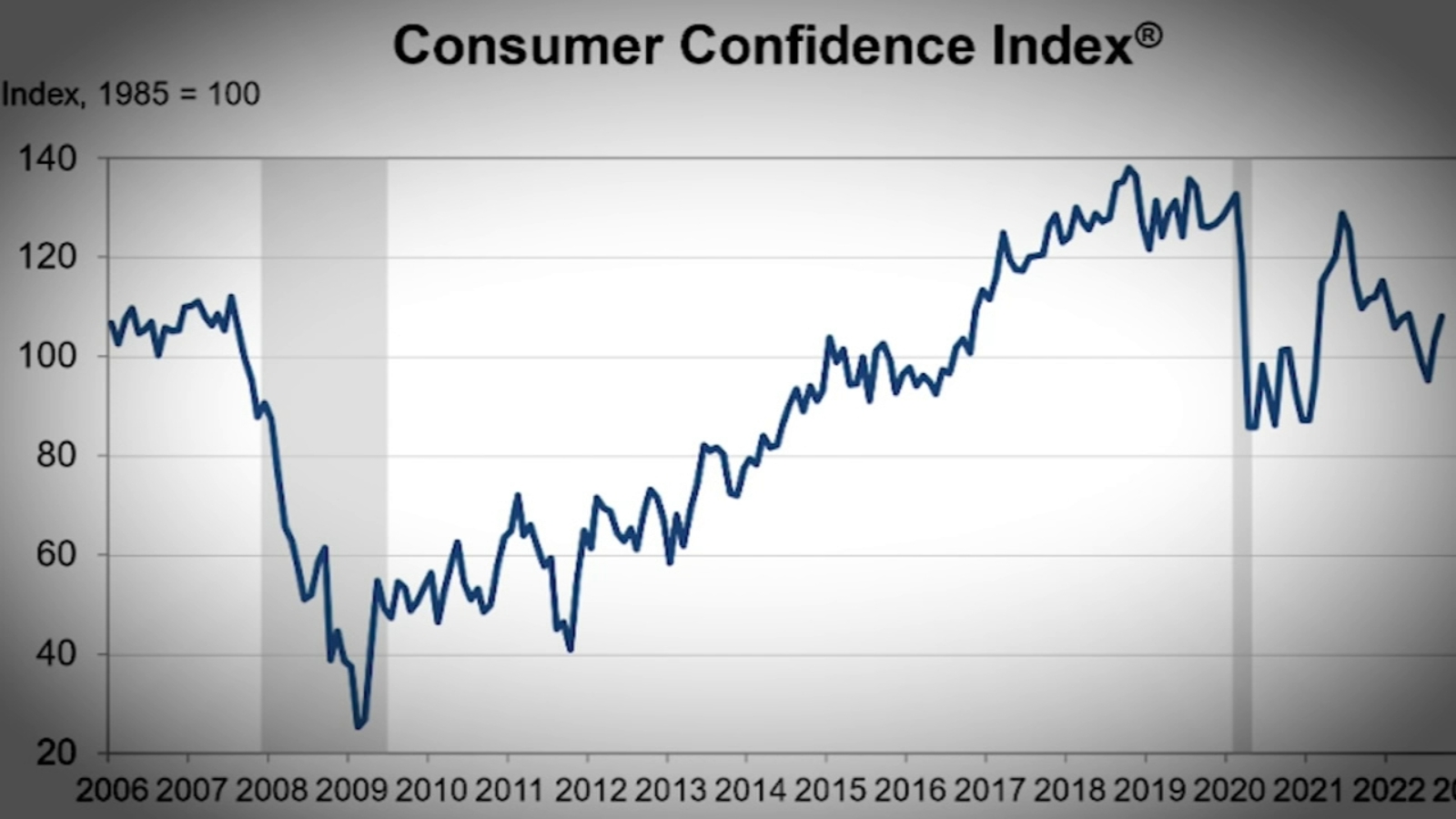

Goldman Sachs' strategies for managing Trump-era tariffs highlight the importance of proactive risk assessment, diversification, and effective policy engagement. By combining sophisticated analytics, contingency planning, and deep political insight, they helped their clients navigate a challenging period of trade uncertainty.

The key takeaway is clear: proactive and strategic planning is paramount in mitigating the risks associated with trade disputes and other economic uncertainties. Don't wait for crises to emerge; prepare for them. To learn more about navigating similar global trade challenges, explore resources on risk management, trade policy, and economic forecasting. Contact professionals for expert advice on managing future tariff implications, and leverage Goldman Sachs' strategies for managing tariffs—or similar approaches—to safeguard your business's future.

Featured Posts

-

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

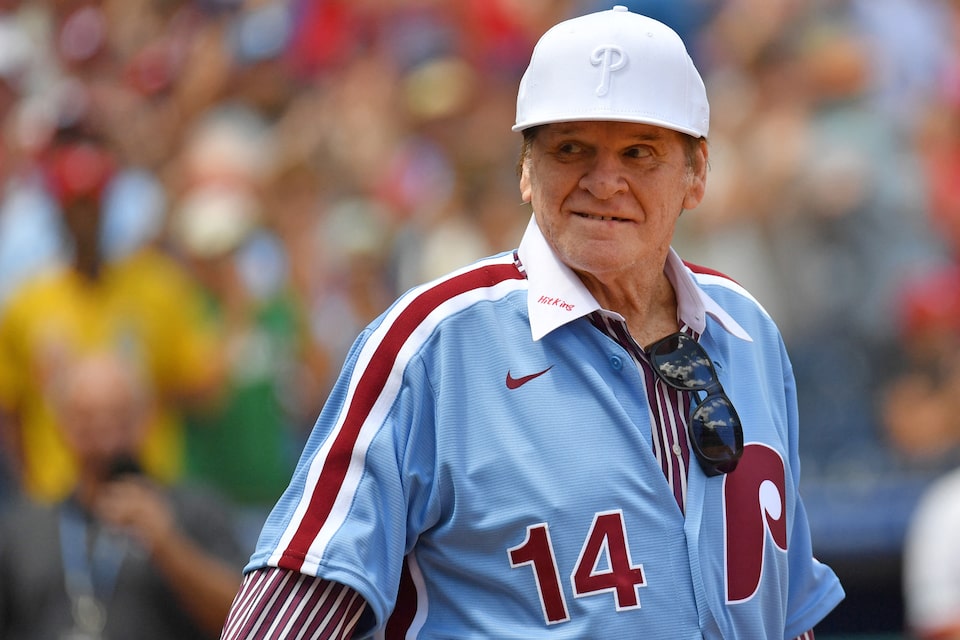

Trump Weighs Pardon For Pete Rose Understanding The Betting Ban Controversy

Apr 29, 2025

Trump Weighs Pardon For Pete Rose Understanding The Betting Ban Controversy

Apr 29, 2025 -

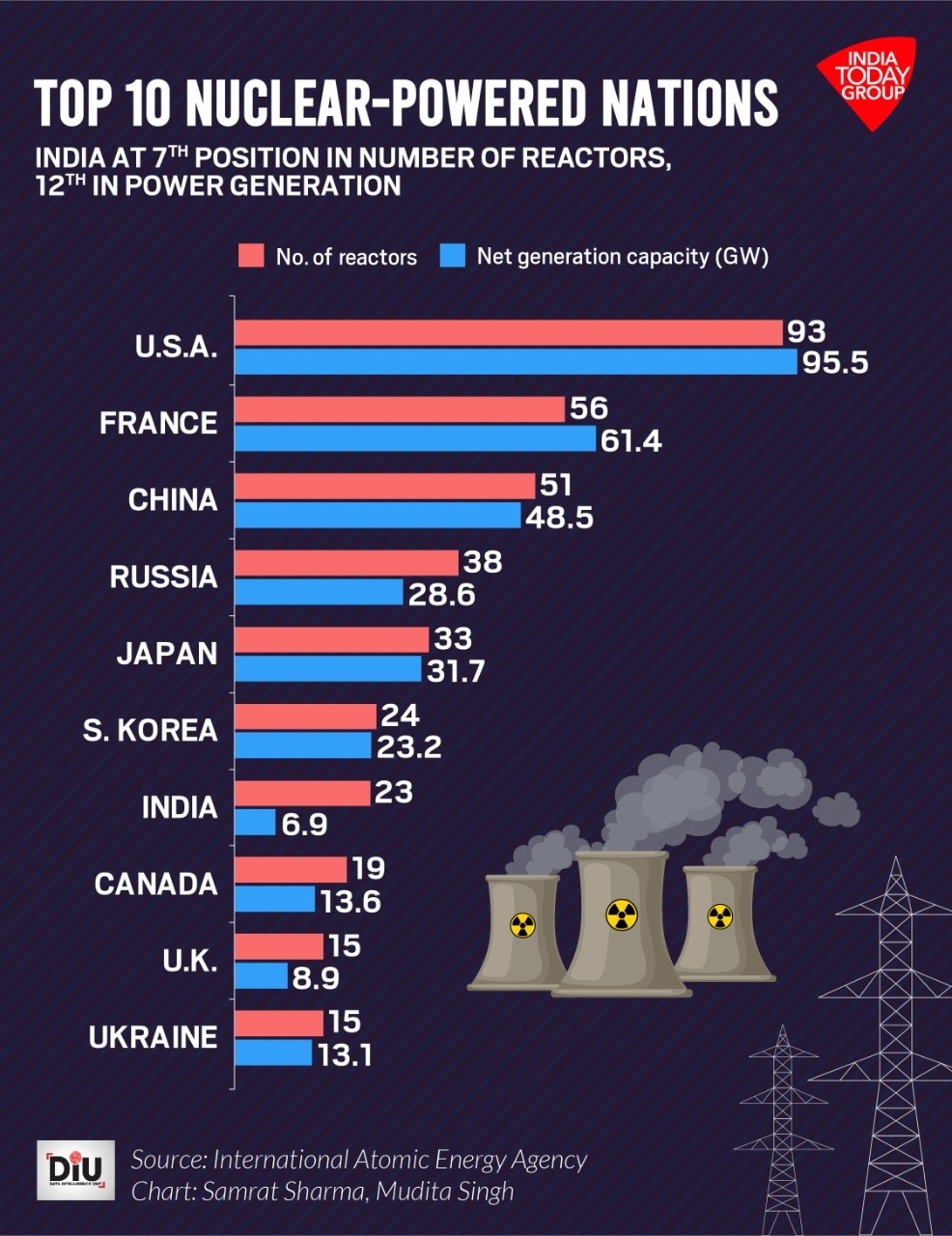

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025 -

Canadian Election 2024 Tariff And Annexation Fears Dominate

Apr 29, 2025

Canadian Election 2024 Tariff And Annexation Fears Dominate

Apr 29, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6 Falsehoods Allegations

Apr 29, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6 Falsehoods Allegations

Apr 29, 2025

Latest Posts

-

Papal Conclave Convicted Cardinals Voting Rights Under Scrutiny

Apr 29, 2025

Papal Conclave Convicted Cardinals Voting Rights Under Scrutiny

Apr 29, 2025 -

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025 -

Debate Surrounds Convicted Cardinals Participation In Papal Conclave

Apr 29, 2025

Debate Surrounds Convicted Cardinals Participation In Papal Conclave

Apr 29, 2025 -

Disgraced Cardinal Claims Right To Participate In Conclave

Apr 29, 2025

Disgraced Cardinal Claims Right To Participate In Conclave

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025