Expensive Offshore Wind Farms: Why Energy Firms Are Turning Away

Table of Contents

Soaring Capital Expenditure (CAPEX): The Primary Deterrent

The primary reason behind the hesitation is the sheer magnitude of upfront investment required for offshore wind farm construction. These projects are incredibly capital-intensive, demanding billions of dollars in initial investment. This high CAPEX acts as a significant barrier to entry for many energy companies.

Several cost drivers contribute to this exorbitant CAPEX:

- High cost of specialized equipment: Offshore wind turbines are significantly larger and more sophisticated than their onshore counterparts, demanding substantial investment in specialized manufacturing and installation. The cost of foundations, designed to withstand extreme marine conditions, also adds significantly to the overall expense. Specialized vessels capable of transporting and installing these massive components are themselves expensive to charter.

- Complex and lengthy permitting processes: Obtaining the necessary permits and approvals for offshore wind farm projects is a lengthy and complex process, often involving multiple regulatory bodies and stakeholders. These delays directly translate to increased costs due to extended project timelines and potential interest payments.

- Subsea cable installation and grid connection expenses: Connecting offshore wind farms to the onshore electricity grid requires extensive subsea cable installation, a technically challenging and costly undertaking. The cost of land-based grid upgrades to handle the influx of renewable energy further exacerbates the financial burden.

- Inflationary pressures: Recent inflationary pressures have significantly impacted the cost of materials, labor, and transportation, further driving up the overall CAPEX for offshore wind projects.

For example, the Vineyard Wind project off the coast of Massachusetts experienced significant cost overruns, highlighting the challenges associated with budgeting for these complex projects. Similar instances across Europe and Asia underscore the precarious financial landscape of offshore wind development.

Uncertain Regulatory Environments and Policy Risks

Navigating the regulatory landscape presents another significant hurdle. Inconsistent government policies and permitting procedures across different regions create uncertainty and risk for investors. This unpredictability makes it challenging to accurately assess and manage project costs and timelines.

Key regulatory hurdles include:

- Lengthy environmental impact assessments and approvals: Rigorous environmental reviews are essential but often lead to extensive delays, adding to project costs and uncertainty.

- Changes in government subsidies and support schemes: Fluctuations in government support, including tax incentives and feed-in tariffs, can dramatically impact project viability and investor confidence.

- Conflicts with other marine users: Offshore wind farms can potentially conflict with other marine activities such as fishing and shipping, leading to delays and legal challenges.

- Grid connection challenges and limited transmission capacity: Securing grid connection for offshore wind farms can be a major bottleneck, especially in areas with limited transmission capacity.

Several projects have been delayed or even cancelled due to regulatory uncertainty, demonstrating the critical importance of stable and predictable policies for attracting investment in the sector.

Technological Challenges and Operational Risks

Offshore wind farms operate in harsh marine environments, presenting unique technological and operational challenges. These challenges directly impact the cost and profitability of these projects.

Operational risks include:

- Maintenance and repair difficulties: Maintaining and repairing offshore wind turbines in challenging weather conditions is expensive and logistically complex. Specialized vessels and highly skilled personnel are required, increasing operational costs.

- Potential for damage from storms and extreme weather events: Offshore wind farms are vulnerable to extreme weather events, which can cause damage to turbines and other infrastructure, leading to costly repairs and downtime.

- Specialized vessels and skilled labor: The specialized vessels and skilled labor needed for construction, maintenance, and repair are in high demand, driving up costs.

- Longer lead times for component sourcing and repairs: The sourcing of components and the repair of damaged equipment can take significantly longer for offshore wind farms compared to onshore projects, resulting in extended downtime and added costs.

These technological and operational complexities contribute to the overall project cost and increase the financial risk associated with offshore wind farm development.

Financing Challenges and Investor Sentiment

The high costs and inherent risks associated with offshore wind are impacting investor confidence and making it challenging to secure project financing.

Key financing challenges include:

- Difficulty securing project financing: The perceived high risk associated with offshore wind projects makes it difficult to attract investors and secure loans at favorable rates.

- Increased borrowing costs: Inflation and global economic uncertainty have led to increased borrowing costs, making it more expensive to finance offshore wind projects.

- Competition for limited investment capital: Offshore wind competes with other renewable energy technologies and infrastructure projects for a limited pool of investment capital.

- Lower returns compared to other renewable energy technologies: In some cases, the returns on investment in offshore wind may be lower compared to other renewable energy technologies, making it less attractive to investors.

Investor sentiment plays a crucial role in the development of new offshore wind projects. Negative perceptions about cost overruns and regulatory uncertainty can deter investment, slowing down the growth of this essential renewable energy source.

Conclusion: The Future of Expensive Offshore Wind Farms

The escalating costs of offshore wind farms are a significant concern for the industry. Soaring CAPEX, uncertain regulatory environments, technological challenges, and financing difficulties all contribute to the hesitancy of energy firms to invest. This is particularly concerning given the critical role offshore wind energy plays in mitigating climate change.

However, the transition to a clean energy future demands a robust offshore wind sector. Addressing the cost challenges requires a multi-pronged approach, including technological innovation, streamlined permitting processes, stable policy frameworks, and improved financing mechanisms. Understanding the issues surrounding expensive offshore wind farms is crucial for the future of renewable energy. Learn more about sustainable solutions to ensure the continued development of this vital energy source.

Featured Posts

-

The Bradley Cooper Leonardo Di Caprio Friendship Impact Of Gigi Hadid

May 04, 2025

The Bradley Cooper Leonardo Di Caprio Friendship Impact Of Gigi Hadid

May 04, 2025 -

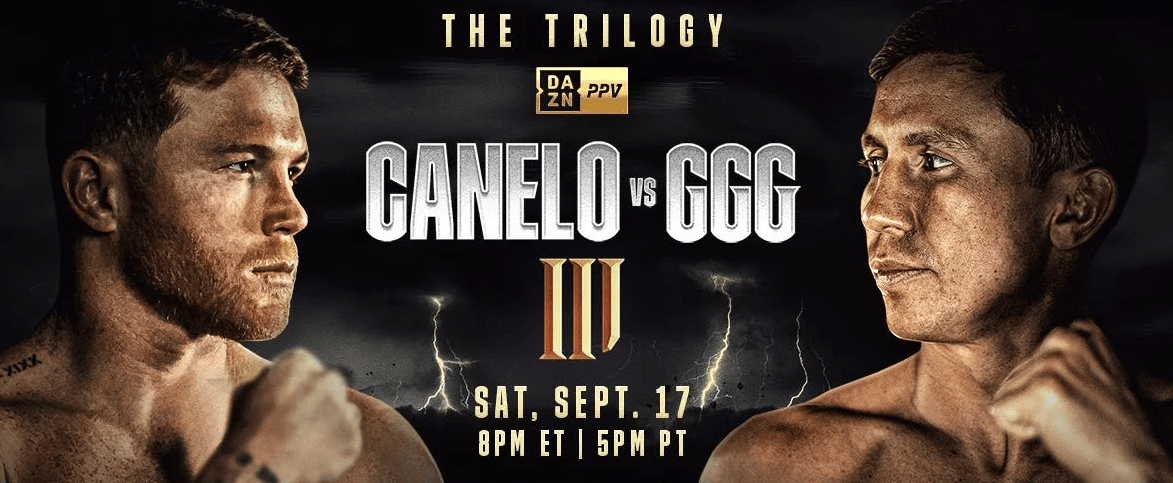

Bakole Ajagba Heavyweight Bout Added To Canelo Alvarezs May 3rd Fight Card

May 04, 2025

Bakole Ajagba Heavyweight Bout Added To Canelo Alvarezs May 3rd Fight Card

May 04, 2025 -

Corinthians X Palmeiras Onde Assistir Ao Vivo Horario E Escalacoes

May 04, 2025

Corinthians X Palmeiras Onde Assistir Ao Vivo Horario E Escalacoes

May 04, 2025 -

Canelo Vs Ggg Live Fight Where To Watch Results And Round By Round Updates

May 04, 2025

Canelo Vs Ggg Live Fight Where To Watch Results And Round By Round Updates

May 04, 2025 -

Corinthians X Internacional Data Horario Onde Assistir E Escalacoes Confirmadas

May 04, 2025

Corinthians X Internacional Data Horario Onde Assistir E Escalacoes Confirmadas

May 04, 2025