Exploring The $67 Million Ethereum Liquidation: Market Analysis And Outlook

Table of Contents

Understanding the $67 Million Ethereum Liquidation Event

This significant Ethereum liquidation event unfolded on [Insert Date and Time of Event], triggered by [Insert Briefly the Circumstances - e.g., a sudden price drop following negative news]. The event primarily involved [mention exchanges or platforms if known] and a large number of leveraged traders holding substantial ETH positions.

In the cryptocurrency market, a "liquidation" occurs when a trader's margin account, used for leveraged trading, falls below the required maintenance margin. This forces the exchange to automatically sell the trader's assets (in this case, ETH) to cover losses, potentially leading to cascading effects. In the context of Ethereum, this liquidation involved the forced selling of a significant amount of ETH, impacting the price and market sentiment.

- Date and time of the event: [Insert Date and Time]

- Approximate amount liquidated: $67 million

- Primary reasons for the liquidation: [Specific reasons, e.g., rapid price drop due to market sell-off, high leverage ratios]

- Impact on ETH price: [Describe short-term volatility and longer-term price trends. Include specific percentage changes if available.]

Market Analysis: Ripple Effects of the Ethereum Liquidation

The $67 million Ethereum liquidation didn't exist in a vacuum. Its ripple effects reverberated throughout the broader cryptocurrency market. While the immediate impact was felt most strongly by ETH, it also influenced the prices of other cryptocurrencies, particularly those with a high correlation to Ethereum. This event highlighted the interconnectedness of the crypto market and the potential for contagion.

The impact on decentralized finance (DeFi) protocols utilizing ETH was also significant. Many DeFi platforms experienced increased volatility and some saw temporary disruptions due to the sudden influx of ETH being sold into the market. Lending and borrowing protocols were especially affected, with some experiencing margin calls of their own.

- Correlation with other cryptocurrencies' price movements: [Explain the degree of correlation observed and which cryptocurrencies were most affected.]

- Impact on DeFi lending and borrowing platforms: [Describe the specific effects on DeFi platforms like Aave, Compound, etc.]

- Changes in trading volume after the liquidation: [Discuss whether trading volume increased or decreased after the event and why.]

Identifying Contributing Factors to the Ethereum Liquidation

Several factors contributed to the $67 million Ethereum liquidation. Understanding these factors is crucial for mitigating future risks.

High leverage played a pivotal role. Traders using significant leverage amplified their potential gains, but also exponentially increased their risk of liquidation during price volatility. Algorithmic trading, with its automated responses to market conditions, also likely contributed to the speed and scale of the liquidation. Furthermore, broader macroeconomic factors, such as [mention any relevant factors like regulatory uncertainty or economic downturns], likely influenced market sentiment, increasing susceptibility to rapid price swings.

- Market sentiment and news events: [Discuss any significant news events or changes in investor sentiment that may have preceded the event.]

- Impact of leverage trading: [Explain how high leverage ratios increased the vulnerability of traders.]

- Role of algorithmic trading bots: [Discuss the potential influence of automated trading bots in accelerating the liquidation process.]

- Macroeconomic factors influencing the market: [Connect the event to broader economic trends and their effects on investor behavior.]

Future Outlook: Implications and Predictions for Ethereum

While the $67 million Ethereum liquidation highlighted inherent risks, it's crucial to avoid overly pessimistic conclusions. Ethereum's underlying technology and vibrant ecosystem remain strong. However, the event serves as a stark reminder of the importance of risk management in the crypto market.

The potential for further large-scale liquidations remains, especially during periods of high volatility or unexpected market events. The key factors to watch include changes in market sentiment, regulatory developments, and macroeconomic conditions. The resilience of the Ethereum network itself is expected to remain strong, but individual investor behavior and leveraged positions will continue to be major risk factors.

- Short-term and long-term price predictions for ETH: [Offer cautious predictions based on the analysis. Avoid making definitive statements.]

- Potential for future large-scale liquidations: [Highlight factors that could trigger similar events in the future.]

- Impact on investor confidence and market sentiment: [Discuss the potential for increased caution or reduced risk appetite among investors.]

Conclusion: Lessons Learned from the $67 Million Ethereum Liquidation

The $67 million Ethereum liquidation serves as a valuable case study in the complexities of the cryptocurrency market. Understanding the mechanics of Ethereum liquidations, the contributing factors, and the broader market impacts is crucial for both investors and market participants. The event underscores the need for prudent risk management, particularly when using leverage.

To mitigate risk associated with Ethereum trading, investors should carefully assess their risk tolerance, avoid excessive leverage, and stay informed about market trends. Understanding the dynamics of Ethereum liquidations is vital for making informed decisions. Stay updated on the latest Ethereum liquidation events and insights by subscribing to our newsletter! Understanding the nuances of Ethereum liquidations will help you navigate the ever-evolving crypto market.

Featured Posts

-

29 Years Of Service Ryan Gentrys Coast Guard Legacy In The Outer Banks

May 08, 2025

29 Years Of Service Ryan Gentrys Coast Guard Legacy In The Outer Banks

May 08, 2025 -

Counting Crows Las Vegas Strip Concert Announced

May 08, 2025

Counting Crows Las Vegas Strip Concert Announced

May 08, 2025 -

Inter Milan Contract Expiry The Situation Of Four Key Players In 2026

May 08, 2025

Inter Milan Contract Expiry The Situation Of Four Key Players In 2026

May 08, 2025 -

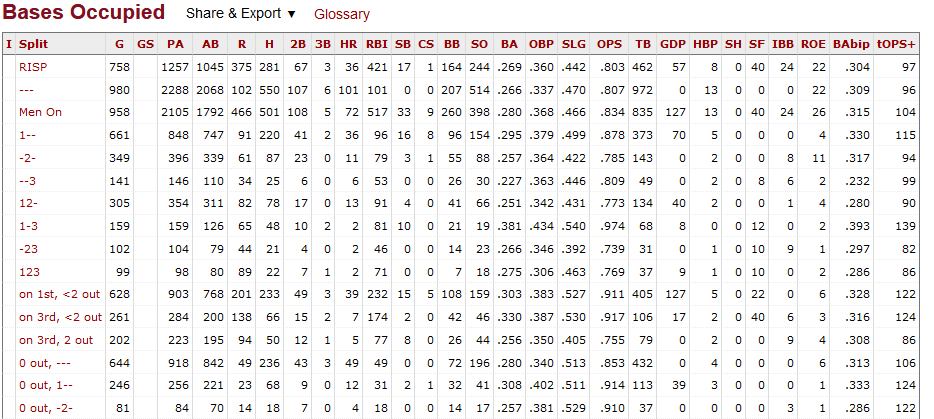

Angels Offensive Collapse 13 Strikeouts In Series Loss To Twins

May 08, 2025

Angels Offensive Collapse 13 Strikeouts In Series Loss To Twins

May 08, 2025 -

Oscars Biggest Snubs Films And Performances That Deserved Better

May 08, 2025

Oscars Biggest Snubs Films And Performances That Deserved Better

May 08, 2025

Latest Posts

-

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 08, 2025

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 08, 2025 -

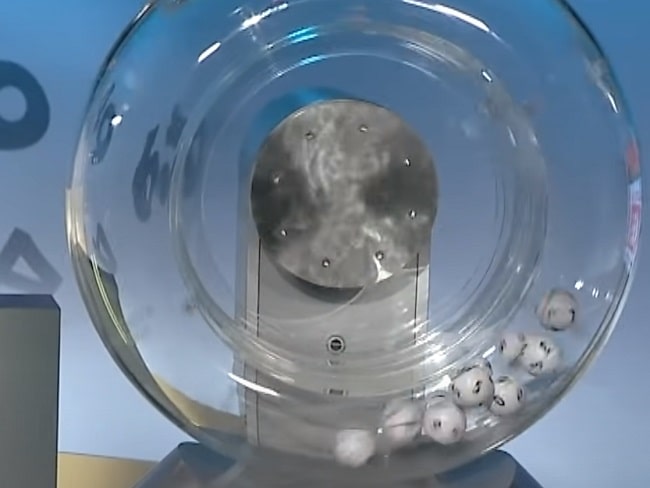

Find The Winning Numbers Lotto And Lotto Plus April 2nd 2025

May 08, 2025

Find The Winning Numbers Lotto And Lotto Plus April 2nd 2025

May 08, 2025 -

6aus49 Lotto Ziehungsergebnis 12 April 2025

May 08, 2025

6aus49 Lotto Ziehungsergebnis 12 April 2025

May 08, 2025 -

Ueberpruefung Ihrer Lotto 6aus49 Tipps Ziehung Vom 19 April 2025

May 08, 2025

Ueberpruefung Ihrer Lotto 6aus49 Tipps Ziehung Vom 19 April 2025

May 08, 2025 -

Lotto And Lotto Plus Results Wednesday 2nd April 2025

May 08, 2025

Lotto And Lotto Plus Results Wednesday 2nd April 2025

May 08, 2025