Extreme Price Hike: Broadcom's VMware Proposal Angers AT&T

Table of Contents

The Details of Broadcom's VMware Acquisition Proposal and its Controversial Price Tag

The Proposed Acquisition Price

Broadcom's offer to acquire VMware represents a substantial premium over VMware's market valuation. The proposed acquisition price of $61 billion represents a significant increase compared to VMware's previous trading price, sparking debate about whether this price reflects a fair market value or an inflated price driven by Broadcom's strategic goals.

- The proposed price represents a [Insert Percentage]% increase compared to VMware's pre-announcement stock price.

- This represents a significant financial commitment for Broadcom, potentially impacting their future investment strategies.

- Analysts are divided on whether the acquisition cost justifies the potential long-term benefits.

Broadcom's Rationale Behind the Acquisition

Broadcom's stated rationale for acquiring VMware centers on achieving significant synergies, expanding into new markets, and strengthening its overall technological portfolio. The acquisition is seen as a strategic move to bolster their position in the enterprise software and infrastructure market.

- Broadcom aims to integrate VMware's virtualization technologies with its existing semiconductor and infrastructure solutions.

- This integration promises to offer enhanced capabilities for clients, creating a more comprehensive and integrated solution.

- Broadcom expects the acquisition to lead to significant cost savings through operational efficiencies.

Market Reactions to the Proposed Price

The announcement of the Broadcom VMware acquisition was met with mixed reactions from investors, analysts, and competitors. While some viewed the deal as a strategic masterstroke, others expressed concern over the inflated price and potential antitrust issues.

- Broadcom's stock price experienced [Insert Stock Movement Percentage]% [Increase/Decrease] following the announcement.

- VMware's stock price saw a [Insert Stock Movement Percentage]% [Increase/Decrease] in response to the acquisition offer.

- Financial analysts offered varied opinions, with some praising the strategic potential and others questioning the financial viability of the deal given the high acquisition cost.

AT&T's Outrage and Concerns Regarding the Broadcom VMware Deal

AT&T's Public Response

AT&T has publicly voiced strong concerns regarding the Broadcom VMware deal, citing potential negative impacts on competition and pricing within the telecom sector. The company fears the acquisition could lead to reduced competition, potentially resulting in higher prices for telecom services.

- AT&T executives have expressed concerns about the potential for market consolidation and reduced choice for customers.

- The company has emphasized the importance of fair competition in ensuring innovation and affordable services.

- AT&T's statement highlighted potential negative impacts on its existing infrastructure and operational costs.

Potential Antitrust Implications

The Broadcom VMware acquisition faces significant antitrust scrutiny. Regulatory bodies will likely investigate the potential for reduced competition and monopolistic practices resulting from the deal.

- Antitrust laws, such as the [Mention relevant laws and regulations], will be central to the regulatory review process.

- The investigation could result in the deal being blocked, requiring significant concessions from Broadcom, or even a complete rejection.

- The outcome of the antitrust review will significantly influence the future of the telecom landscape.

AT&T's Strategic Position and Dependence on VMware

AT&T's extensive use of VMware technologies makes it particularly vulnerable to the potential changes resulting from the Broadcom acquisition. The deal could significantly impact AT&T's operational efficiency and strategic plans.

- AT&T relies heavily on VMware's virtualization technologies for its network infrastructure.

- The acquisition could lead to increased costs for AT&T's VMware licensing and support services.

- AT&T is likely exploring alternative virtualization solutions as a contingency plan.

Broader Implications of the Broadcom VMware Deal for the Telecom Sector

Impact on Competition

The Broadcom VMware deal has the potential to significantly reshape the competitive landscape of the telecom industry. The acquisition could lead to reduced competition, potentially resulting in higher prices and fewer choices for consumers.

- Market consolidation could give Broadcom excessive market power, potentially stifling innovation.

- Smaller telecom companies could face increased challenges in competing with a larger, more integrated Broadcom.

- This could translate into higher prices and reduced service quality for consumers.

Implications for Innovation

The potential impact on innovation within the telecom sector is a major concern. The acquisition could lead to reduced investment in research and development, ultimately slowing down technological advancements.

- Reduced competition could lead to less innovation driven by the pressure to offer better products and services.

- This could result in slower adoption of new technologies and hinder overall industry progress.

- The potential for monopolistic practices could stifle creativity and reduce the diversity of solutions available to consumers.

Regulatory Responses and Future Outlook

The outcome of the Broadcom VMware acquisition hinges on regulatory approval. The deal faces significant regulatory hurdles, and the timeline for approval remains uncertain.

- Regulatory bodies will carefully scrutinize the antitrust implications and potential impact on the market.

- The deal might be subject to conditions, such as divestitures or behavioral remedies, to address antitrust concerns.

- If the deal is blocked, Broadcom may need to reconsider its strategic plans, potentially impacting the broader technological landscape.

Conclusion: The Future of the Broadcom VMware Acquisition and its Price Implications

The Broadcom VMware acquisition, characterized by an extreme price hike, faces significant opposition from key players like AT&T and potential antitrust challenges. The deal's implications for the telecom industry are far-reaching, potentially affecting competition, innovation, and pricing for consumers. The future of the Broadcom VMware acquisition remains uncertain, pending regulatory approvals and further developments. Stay updated on the Broadcom VMware deal and learn more about the price hike to understand its potential impact on the telecom sector. Follow the developments closely to understand the implications for the future of this crucial industry.

Featured Posts

-

China And Us Trade A Race Against Time To Meet Trade Deal Target

May 26, 2025

China And Us Trade A Race Against Time To Meet Trade Deal Target

May 26, 2025 -

Journaliste Belge Hugo De Waha Laureat De La Bourse Payot

May 26, 2025

Journaliste Belge Hugo De Waha Laureat De La Bourse Payot

May 26, 2025 -

Salon Yevani A Critical Look At The Herzliya Restaurant The Jerusalem Post

May 26, 2025

Salon Yevani A Critical Look At The Herzliya Restaurant The Jerusalem Post

May 26, 2025 -

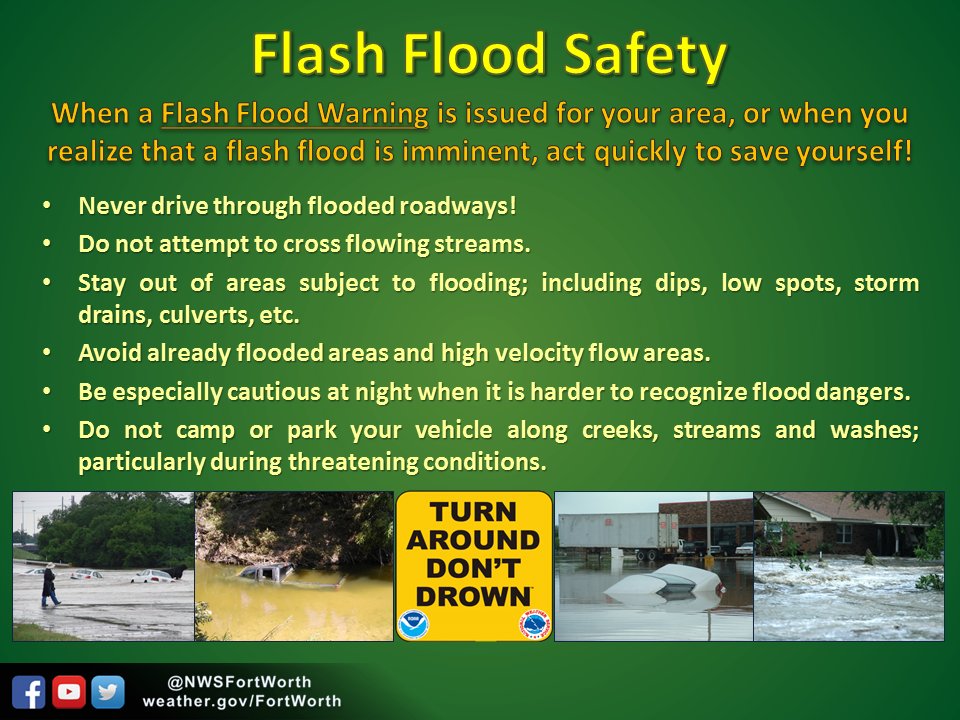

What Constitutes A Flash Flood Emergency A Guide To Safety

May 26, 2025

What Constitutes A Flash Flood Emergency A Guide To Safety

May 26, 2025 -

Albert De Monaco Un Nou Capitol A La Seva Vida Sentimental

May 26, 2025

Albert De Monaco Un Nou Capitol A La Seva Vida Sentimental

May 26, 2025