Extreme VMware Price Hike: AT&T Faces 1,050% Cost Increase From Broadcom

Table of Contents

The Broadcom-VMware Acquisition and its Fallout

Broadcom's acquisition of VMware, finalized in late 2022, was one of the largest tech mergers in history. The deal, valued at approximately $61 billion, immediately raised concerns among VMware clients about potential price increases. Initial market analysis predicted potential disruption, but few anticipated the magnitude of the impact felt by AT&T. The acquisition sparked debates concerning potential monopolies and raised questions regarding regulatory approvals in various jurisdictions.

- Acquisition price and valuation: The $61 billion price tag reflects VMware's significant market position in virtualization technology.

- Regulatory approvals and potential hurdles: The merger faced scrutiny from regulatory bodies worldwide, raising concerns about potential anti-competitive practices.

- Broadcom's stated intentions for VMware: Broadcom initially emphasized its commitment to VMware's existing customers and products. However, the AT&T case casts doubt on these initial assurances.

Dissecting AT&T's 1,050% VMware Cost Increase

AT&T's experience represents a stark warning for businesses reliant on VMware solutions. The 1,050% VMware cost increase represents a dramatic price surge that is impacting the company's bottom line. While the exact details of AT&T's contract remain confidential, the scale of the increase suggests a significant recalibration of licensing terms post-acquisition. Several factors could contribute to this drastic change, including renegotiated contract terms, changes in licensing models, and perhaps even strategic pricing decisions by Broadcom.

- Specific VMware products affected: The breadth of VMware products impacted by this increase remains unclear, highlighting the potential risk across various aspects of AT&T's infrastructure.

- Contractual obligations and renewal terms: The specifics of AT&T's contract renewal are critical in understanding the rationale behind this massive increase.

- AT&T's potential options and responses: AT&T may explore options such as contract renegotiation, legal action, or a transition to alternative virtualization technologies.

Implications for the Telecom Industry and Beyond

The AT&T case is not isolated. The VMware price hike has significant implications for the entire telecom industry and other sectors heavily reliant on VMware virtualization. The potential for increased operating costs, reduced innovation, and ultimately, higher prices for consumers, is real. This incident may also set a concerning precedent for other software vendors, raising the specter of similar price gouging following future acquisitions.

- Potential for increased operating costs for telecom companies: This price surge could force telecom companies to re-evaluate their budgets and potentially impact investment in other crucial areas.

- Impact on innovation and investment in the sector: Increased costs could stifle innovation and reduce investment in new technologies and services within the telecom industry.

- The ripple effect on consumers: Ultimately, these increased costs may be passed on to consumers in the form of higher service prices.

Strategies for Mitigating VMware Cost Increases

Businesses must proactively address the potential for future VMware price hikes. Several strategies can help manage VMware costs effectively and reduce dependence on a single vendor. This includes focusing on cost optimization, exploring alternatives, and implementing robust contract management practices.

- Negotiating contracts and exploring alternative pricing models: Companies should carefully review their contracts and negotiate favorable terms before renewal.

- Optimizing VMware deployments for cost efficiency: Efficient resource utilization and optimization can significantly reduce VMware licensing costs.

- Considering open-source alternatives or cloud-based solutions: Exploring alternatives like open-source virtualization platforms or migrating to cloud-based solutions provides greater control and potentially lower costs.

Conclusion: Navigating the Extreme VMware Price Hike

The dramatic VMware price hike experienced by AT&T serves as a stark reminder of the risks associated with vendor lock-in and the potential for significant cost increases following major acquisitions. The implications for the telecom industry and other sectors are far-reaching, potentially impacting operating costs, innovation, and consumer prices. To avoid VMware price hikes, businesses must actively assess their VMware contracts, explore cost-saving strategies, and consider alternative solutions to ensure long-term cost control and operational flexibility. Proactive planning and diversification of IT infrastructure are crucial for managing VMware costs and mitigating the risk of future price surges.

Featured Posts

-

Fenerbahces Reactie Op Tadic Incident Keihard Optreden Geeist

May 20, 2025

Fenerbahces Reactie Op Tadic Incident Keihard Optreden Geeist

May 20, 2025 -

U S Missile Deployment A Source Of Growing Tension With China

May 20, 2025

U S Missile Deployment A Source Of Growing Tension With China

May 20, 2025 -

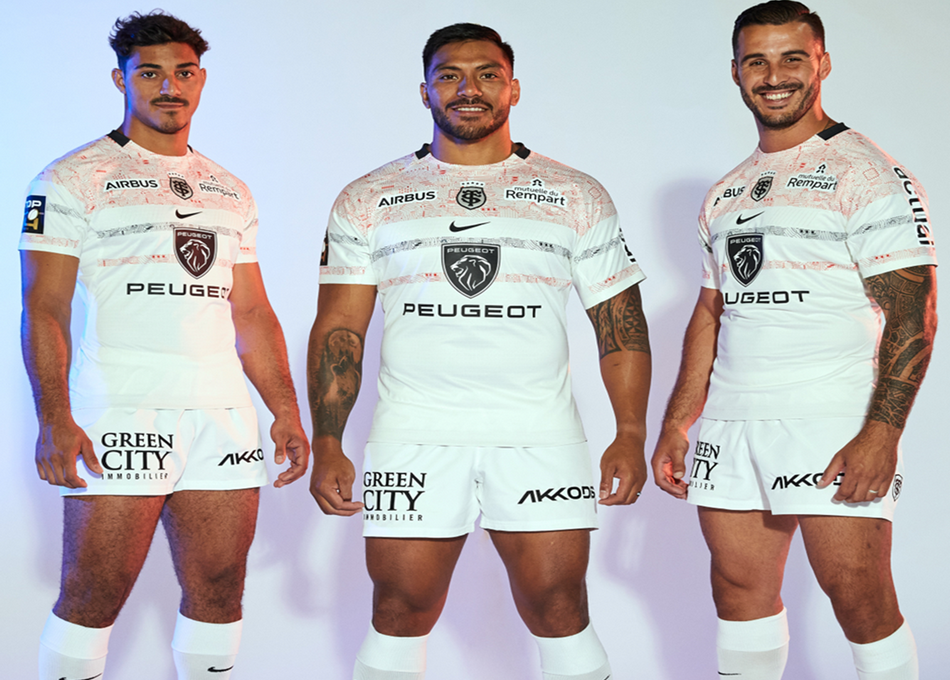

Jaminet Rembourse Le Stade Toulousain Le Detail De L Accord

May 20, 2025

Jaminet Rembourse Le Stade Toulousain Le Detail De L Accord

May 20, 2025 -

Exploring The Enduring Legacy Of Agatha Christies Hercule Poirot

May 20, 2025

Exploring The Enduring Legacy Of Agatha Christies Hercule Poirot

May 20, 2025 -

Big Bear Ai Bbai Stock Plummets Missed Revenue And Leadership Shakeup

May 20, 2025

Big Bear Ai Bbai Stock Plummets Missed Revenue And Leadership Shakeup

May 20, 2025