Factors Contributing To D-Wave Quantum (QBTS) Stock's Monday Drop

Table of Contents

Market-Wide Downturn and Tech Sector Weakness

Monday's decline in D-Wave Quantum (QBTS) stock wasn't an isolated incident. The broader market experienced a downturn, with the tech sector particularly hard hit. Rising interest rates continue to put pressure on tech valuations, as investors become more risk-averse in a higher-interest-rate environment. This general negative sentiment impacted many tech companies, including D-Wave.

- Impact of rising interest rates on tech valuations: Higher interest rates increase borrowing costs for companies, reducing their profitability and making future growth less certain. This impacts investor confidence and leads to lower stock prices, especially in growth-oriented sectors like technology.

- General investor sentiment and risk aversion: A prevailing sense of caution and uncertainty in the market often leads investors to sell off riskier assets, including many tech stocks. This flight to safety can exacerbate downward price movements.

- Negative news affecting the tech sector: Negative news concerning specific tech companies or the tech sector as a whole can create a ripple effect, pulling down even relatively healthy companies. For instance, broader concerns about the overall economic outlook often impact investor sentiment regarding the entire tech sector. Consider the performance of major market indices like the NASDAQ Composite and the S&P 500 on Monday to further understand the broader market context.

Lack of Significant Recent Positive News for D-Wave

The absence of significant positive news surrounding D-Wave Quantum recently likely contributed to the stock's decline. Without positive catalysts to drive investor interest, the stock became more vulnerable to negative market forces.

- Recent earnings reports or financial updates: Any recent financial reports that failed to meet analyst expectations or showed signs of slowing growth could have negatively impacted investor confidence in D-Wave.

- Pending regulatory hurdles or competitive pressures: Concerns about regulatory hurdles or increased competition in the quantum computing space could also lead to investor uncertainty. The competitive landscape of the quantum computing industry is dynamic, and any perceived weakness in D-Wave's position could trigger selling pressure.

- Absence of major partnerships or contract announcements: A lack of significant partnerships or major contract wins can signal a lack of momentum, leading investors to question the company's future growth prospects. Strategic partnerships and large contracts are crucial for building credibility and attracting investment in the quantum computing industry.

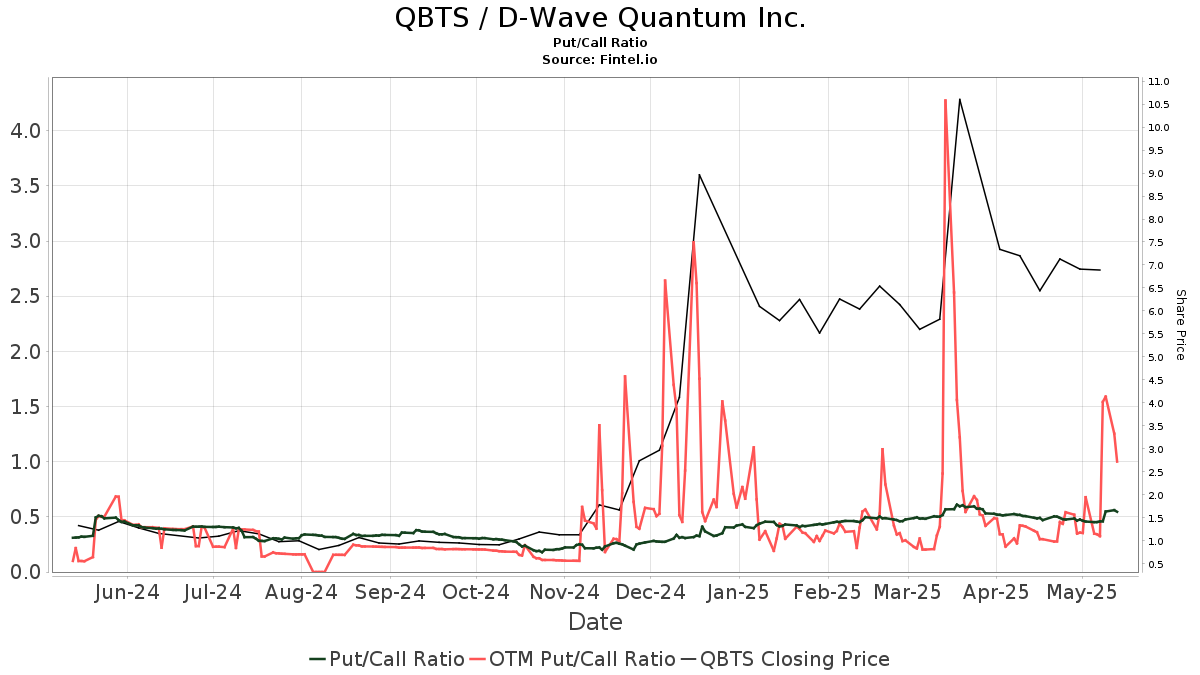

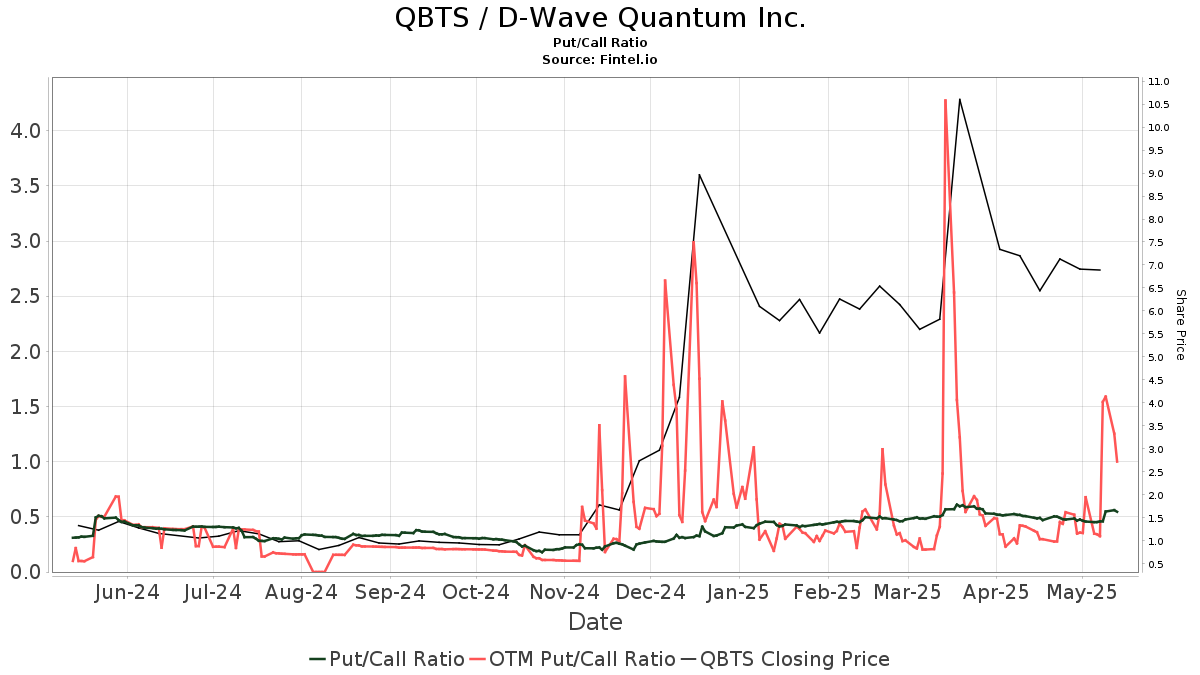

Profit-Taking and Investor Sentiment

Another contributing factor to Monday's drop could be profit-taking by investors who had previously purchased D-Wave stock at higher prices. This is a common occurrence in volatile markets, especially when a stock has seen a period of strong growth. Furthermore, investor sentiment towards quantum computing stocks in general may have played a role. The sector remains relatively nascent, and there’s a degree of uncertainty surrounding its long-term potential.

- Profit-taking and its impact on stock prices: When investors sell shares to realize profits, it creates selling pressure that can drive down the stock price, particularly in a market already exhibiting negative sentiment.

- Analyst downgrades or price target reductions: Any recent downgrades from analysts or reductions in price targets for QBTS stock could have further fueled selling pressure and contributed to the decline.

- Volatility of quantum computing stocks: Quantum computing stocks are generally considered more volatile than stocks in more established sectors, making them susceptible to larger price swings based on market sentiment and news events.

Specific News Affecting D-Wave (If Applicable)

[This section would include any specific company-related news that directly contributed to the drop. For example, a press release announcing a delay in a key project, a regulatory setback, or a disappointing earnings report would be discussed here with specific details and supporting evidence.]

Conclusion

D-Wave Quantum (QBTS) stock's Monday drop was likely a result of a confluence of factors: a broader market downturn impacting the tech sector, a lack of recent positive news for D-Wave, profit-taking by some investors, and potentially specific company-related news. Understanding the interplay between market context, company-specific performance, and overall investor sentiment is crucial when analyzing stock price fluctuations. The volatility inherent in the quantum computing sector further emphasizes the need for careful analysis and ongoing monitoring. Stay informed about future developments affecting D-Wave Quantum (QBTS) stock and the broader quantum computing market by regularly checking reputable financial news sources and conducting thorough research before making any investment decisions.

Featured Posts

-

Restorany I Ne Tolko Biznes Imperiya Rossiyskikh Figuristov

May 20, 2025

Restorany I Ne Tolko Biznes Imperiya Rossiyskikh Figuristov

May 20, 2025 -

Wwe Raw The Sami Zayn Seth Rollins And Bron Breakker Conflict

May 20, 2025

Wwe Raw The Sami Zayn Seth Rollins And Bron Breakker Conflict

May 20, 2025 -

End Of An Era Ryujinx Emulator Development Ceases After Nintendo Contact

May 20, 2025

End Of An Era Ryujinx Emulator Development Ceases After Nintendo Contact

May 20, 2025 -

Trump Administration Aerospace Deals Substance Vs Spectacle

May 20, 2025

Trump Administration Aerospace Deals Substance Vs Spectacle

May 20, 2025 -

Baggelis Giakoymakis Eksereynontas Tis Aities Tis Vias Kai Tis Adiaforias

May 20, 2025

Baggelis Giakoymakis Eksereynontas Tis Aities Tis Vias Kai Tis Adiaforias

May 20, 2025