Falling Inflation Eases BOE Rate Cut Pressure, Boosts Pound

Table of Contents

Inflation Slowdown: A Key Factor in BOE's Decision Making

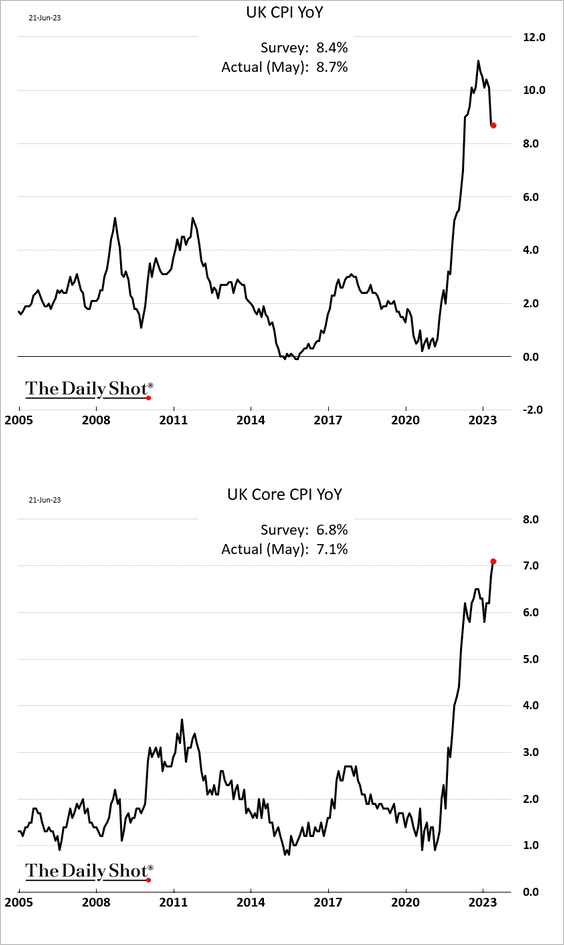

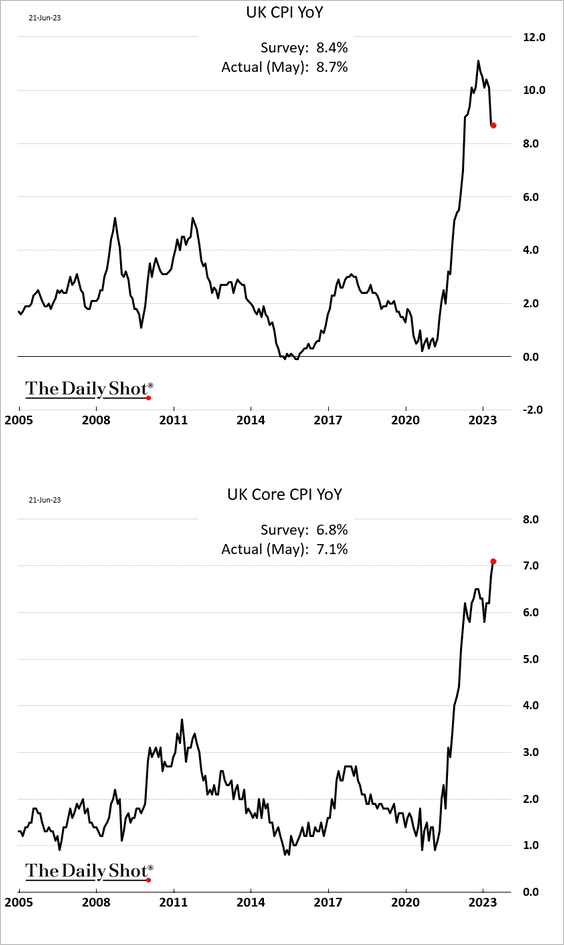

The recent slowdown in inflation is a pivotal factor influencing the BOE's monetary policy decisions. Analyzing the latest CPI and RPI data reveals a significant deceleration in the rate of price increases.

CPI and RPI Data: A Deep Dive

The UK's Consumer Price Index (CPI) and Retail Price Index (RPI) figures paint a picture of easing inflationary pressures.

- CPI: The CPI for [Insert Month, Year] showed a [Insert Percentage]% increase compared to the same period last year, down from [Insert Percentage]% in [Insert Previous Month/Year].

- RPI: The RPI for [Insert Month, Year] registered a [Insert Percentage]% increase year-on-year, a notable decrease from [Insert Percentage]% in [Insert Previous Month/Year].

- Contributing factors include a decrease in energy prices, improvements in global supply chains, and a potential easing of demand. These factors have collectively contributed to a more manageable inflation rate in the UK. The decline in the UK inflation rate is a significant development.

BOE's Response to Lower Inflation

The lower-than-expected inflation figures have significantly influenced the BOE's stance on interest rate cuts. The possibility of a rate cut is now less likely.

- The BOE might choose to pause further interest rate hikes, a significant shift from previous expectations of continued increases.

- Market speculation now leans towards a more cautious approach, with many analysts predicting a period of stability in interest rates. This reduced expectation of rate cuts is directly impacting the pound's value.

- The central bank's next monetary policy committee meeting will be closely watched for confirmation of this shift in strategy.

The Pound's Positive Response to Reduced Rate Cut Pressure

The reduced pressure for BOE rate cuts has resulted in a strengthening of the pound against major global currencies.

GBP Strength Against Major Currencies

Since the release of the positive inflation data, the GBP has shown noticeable appreciation.

- GBP to USD: The GBP has strengthened against the US dollar, reaching [Insert Exchange Rate] – a [Insert Percentage]% increase since [Insert Date].

- GBP to EUR: Similarly, the pound has gained ground against the euro, currently trading at [Insert Exchange Rate] – a [Insert Percentage]% improvement compared to [Insert Date].

- [Include a chart or graph visually representing the GBP's performance against USD and EUR]. This visual representation will significantly improve the article's effectiveness.

Impact on UK Economy and Businesses

A stronger pound has significant implications for UK businesses involved in international trade.

- Exports: UK exports become more expensive for international buyers, potentially reducing demand.

- Imports: Imports become cheaper, benefiting consumers and businesses reliant on imported goods.

- The overall impact on the UK trade balance remains complex, with both positive and negative consequences for different sectors.

- A stronger pound can also attract foreign investment and boost tourism, supporting economic growth.

Looking Ahead: Future Inflation Forecasts and BOE Policy

Predicting future inflation and BOE policy requires careful consideration of various factors.

Expert Predictions and Market Sentiment

Economists and financial analysts offer diverse perspectives on the future trajectory of inflation and BOE policy.

- Some analysts predict a continued decline in inflation, leading to a sustained period of stable interest rates.

- Others anticipate a potential resurgence in inflationary pressure, prompting the BOE to reconsider interest rate hikes.

- Market sentiment remains cautiously optimistic, reflecting the current positive economic indicators.

Potential Risks and Unforeseen Factors

Several factors could potentially disrupt the current positive trend.

- Geopolitical events, particularly those impacting energy prices, could trigger renewed inflationary pressures.

- Unexpected shifts in global supply chains or unforeseen economic shocks could also influence the BOE's monetary policy decisions.

Conclusion: Falling Inflation and the Pound's Future

Falling inflation has undeniably eased the pressure on the BOE to implement rate cuts, resulting in a strengthening of the pound. The interplay between inflation, interest rates, and currency values remains a crucial factor influencing the UK economy. The relationship between falling inflation, reduced BOE rate cut pressure, and a stronger pound is significant for the UK's economic health.

To stay informed about the ongoing impact of falling inflation on the BOE's decisions and the GBP's performance, subscribe to our regular updates or follow leading financial news sources. Continue monitoring the BOE rate cut pressure and its effects on the pound exchange rate to make informed financial decisions.

Featured Posts

-

Komplettes Line Up Fuer San Hejmo Konzert In Essen Veroeffentlicht

May 24, 2025

Komplettes Line Up Fuer San Hejmo Konzert In Essen Veroeffentlicht

May 24, 2025 -

Lucky Zodiac Signs April 14 2025 Horoscope Predictions

May 24, 2025

Lucky Zodiac Signs April 14 2025 Horoscope Predictions

May 24, 2025 -

Exclusive Neal Mc Donough Discusses Damien Darhk And Future Dc Projects

May 24, 2025

Exclusive Neal Mc Donough Discusses Damien Darhk And Future Dc Projects

May 24, 2025 -

8 Stock Market Increase On Euronext Amsterdam Following Tariff Announcement

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam Following Tariff Announcement

May 24, 2025 -

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen

May 24, 2025

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen

May 24, 2025