Falling Iron Ore Prices: Analyzing China's Steel Industry Slowdown

Table of Contents

China's Construction Sector Slowdown and its Impact on Steel Demand

China's booming construction sector has historically been a major driver of steel demand. However, recent years have witnessed a significant slowdown, directly impacting iron ore prices. This reduction in demand is a consequence of several interconnected factors.

Reduced Infrastructure Spending

- The Chinese government has implemented strict measures to curb excessive debt accumulation across various sectors. This has led to a noticeable reduction in infrastructure projects.

- High-speed rail expansions, new highway constructions, and large-scale urban development initiatives have been scaled back or delayed.

- Government policies prioritizing debt reduction over rapid expansion have significantly impacted funding for these steel-intensive projects.

- This reduced investment translates directly into decreased demand for steel, impacting the price of iron ore, a crucial component in steel production.

Weakening Real Estate Market

- China's real estate sector, another major consumer of steel, is facing considerable headwinds.

- An oversupply of housing units in certain regions has led to falling property prices and reduced construction activity.

- Tighter lending policies aimed at mitigating financial risks have further constrained the sector's ability to invest in new projects.

- This weakening real estate market contributes significantly to the overall decrease in steel demand and, consequently, the falling iron ore prices.

Shifting Economic Priorities

- China's economic focus is increasingly shifting towards sustainable development and green technologies.

- This transition involves a reduced reliance on heavy industries, including steel production, which is traditionally energy-intensive and environmentally impactful.

- The emphasis on renewable energy sources and environmentally friendly construction materials directly impacts the demand for traditional steel.

- This strategic shift away from steel-intensive industries is a long-term factor contributing to the lower demand and consequently, the depressed prices of iron ore.

Global Economic Uncertainty and its Influence on Steel Prices

The slowdown in China's steel industry is not occurring in isolation. Global economic headwinds are further exacerbating the situation, creating a perfect storm for falling iron ore prices.

Global Recession Fears

- Growing concerns about a global recession are impacting steel demand worldwide. Inflationary pressures and rising interest rates are dampening economic activity.

- The decreased global demand directly affects China's steel exports, further depressing prices. International clients are reducing their orders, contributing to the oversupply in the global steel market.

- This reduced global appetite for steel puts downward pressure on prices, impacting the demand and price of iron ore.

Increased Competition in the Steel Market

- China faces increased competition in the global steel market from other major producers like India, Japan, and South Korea.

- These nations are increasing their steel production capacity, adding to the global supply and intensifying price competition.

- This heightened competition puts pressure on Chinese steel producers, making it harder to maintain high prices and impacting their purchasing of iron ore.

Supply Side Factors Affecting Iron Ore Prices

While demand-side factors play a crucial role, supply-side dynamics also influence falling iron ore prices.

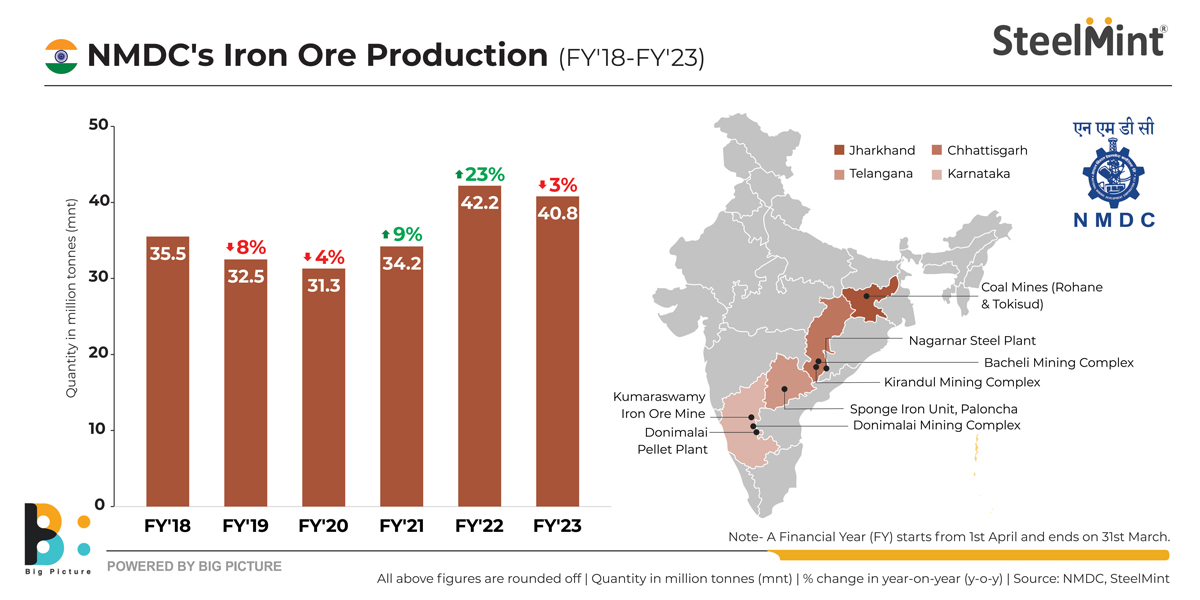

Increased Iron Ore Supply

- Major iron ore exporters like Australia and Brazil have been increasing their production capacity in recent years.

- This increased supply adds to the global oversupply, putting further downward pressure on prices.

- The higher volume of iron ore available in the market, even with reduced demand, directly contributes to the price decline.

Technological Advancements in Mining

- Technological advancements in mining have increased efficiency and lowered production costs for iron ore.

- Automation, improved extraction techniques, and better logistics have contributed to a higher supply of iron ore at a lower cost.

- This increased efficiency further contributes to the oversupply in the market and the decline in iron ore prices.

Conclusion

The fall in iron ore prices is a complex issue stemming from a confluence of factors. The slowdown in China's steel industry, driven by reduced construction spending, a weakening real estate market, and shifting economic priorities, is a primary driver. Simultaneously, global economic uncertainty and increased competition in the steel market are adding to the pressure. Finally, supply-side factors, such as increased iron ore production and technological advancements in mining, are further contributing to the price decline. These interconnected factors paint a picture of a challenging market environment for iron ore producers.

Key Takeaways: China's steel industry slowdown is the leading factor behind falling iron ore prices. Global economic uncertainty and increased steel production are further exacerbating the issue. The interplay of supply and demand is creating a difficult market for iron ore.

Call to Action: Stay informed about the dynamic developments in China's steel industry and the fluctuations in falling iron ore prices. Subscribe to our newsletter, follow us on social media, and check back regularly for updates on the China's steel industry slowdown and its impact on the global commodities market.

Featured Posts

-

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025 -

Mestarien Liiga Bayern Muenchen Inter Ja Psg Seuraavassa Vaiheessa

May 09, 2025

Mestarien Liiga Bayern Muenchen Inter Ja Psg Seuraavassa Vaiheessa

May 09, 2025 -

F1 Update Alpine Bosss Direct Message To Doohan

May 09, 2025

F1 Update Alpine Bosss Direct Message To Doohan

May 09, 2025 -

How To Watch Celebrity Antiques Road Trip A Complete Viewing Guide

May 09, 2025

How To Watch Celebrity Antiques Road Trip A Complete Viewing Guide

May 09, 2025 -

Wynne Evans Go Compare Future Uncertain After Strictly Scandal

May 09, 2025

Wynne Evans Go Compare Future Uncertain After Strictly Scandal

May 09, 2025

Latest Posts

-

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025

Understanding The Complex Relationship Between Mental Illness And Violent Crime

May 09, 2025 -

Mental Health Violence And The Media Deconstructing The Monster Narrative

May 09, 2025

Mental Health Violence And The Media Deconstructing The Monster Narrative

May 09, 2025 -

Severe Mental Illness And Violence Addressing The Academic Failures In Understanding

May 09, 2025

Severe Mental Illness And Violence Addressing The Academic Failures In Understanding

May 09, 2025 -

The Misrepresentation Of Mentally Ill Killers A Critical Analysis

May 09, 2025

The Misrepresentation Of Mentally Ill Killers A Critical Analysis

May 09, 2025 -

Nottingham Attack Survivors Break Silence Recount Ordeal

May 09, 2025

Nottingham Attack Survivors Break Silence Recount Ordeal

May 09, 2025