Falling Retail Sales Signal Potential Bank Of Canada Rate Cuts

Table of Contents

The Severity of the Retail Sales Decline and Its Indicators

Analyzing the Numbers

The 1.5% drop in retail sales represents a substantial contraction, particularly concerning given the already sluggish economic growth.

- Affected Sectors: The decline wasn't uniform across all sectors. Clothing sales fell by 2.2%, furniture sales dropped by 1.8%, and electronics sales experienced a significant 3% decrease. These sectors are particularly sensitive to interest rate changes and consumer confidence.

- Year-Over-Year Comparison: Comparing these figures to the previous year reveals a worrying trend. Retail sales growth has slowed considerably compared to 2022, indicating a sustained weakening in consumer spending.

- Regional Variations: While the national average shows a concerning decline, regional variations exist. Ontario and British Columbia experienced steeper drops than other provinces, suggesting localized economic challenges.

Underlying Causes

Several factors contribute to this alarming slump in retail sales.

- High Inflation: Persistent high inflation continues to erode consumer purchasing power, forcing households to cut back on discretionary spending. The elevated cost of living is a major deterrent to retail activity.

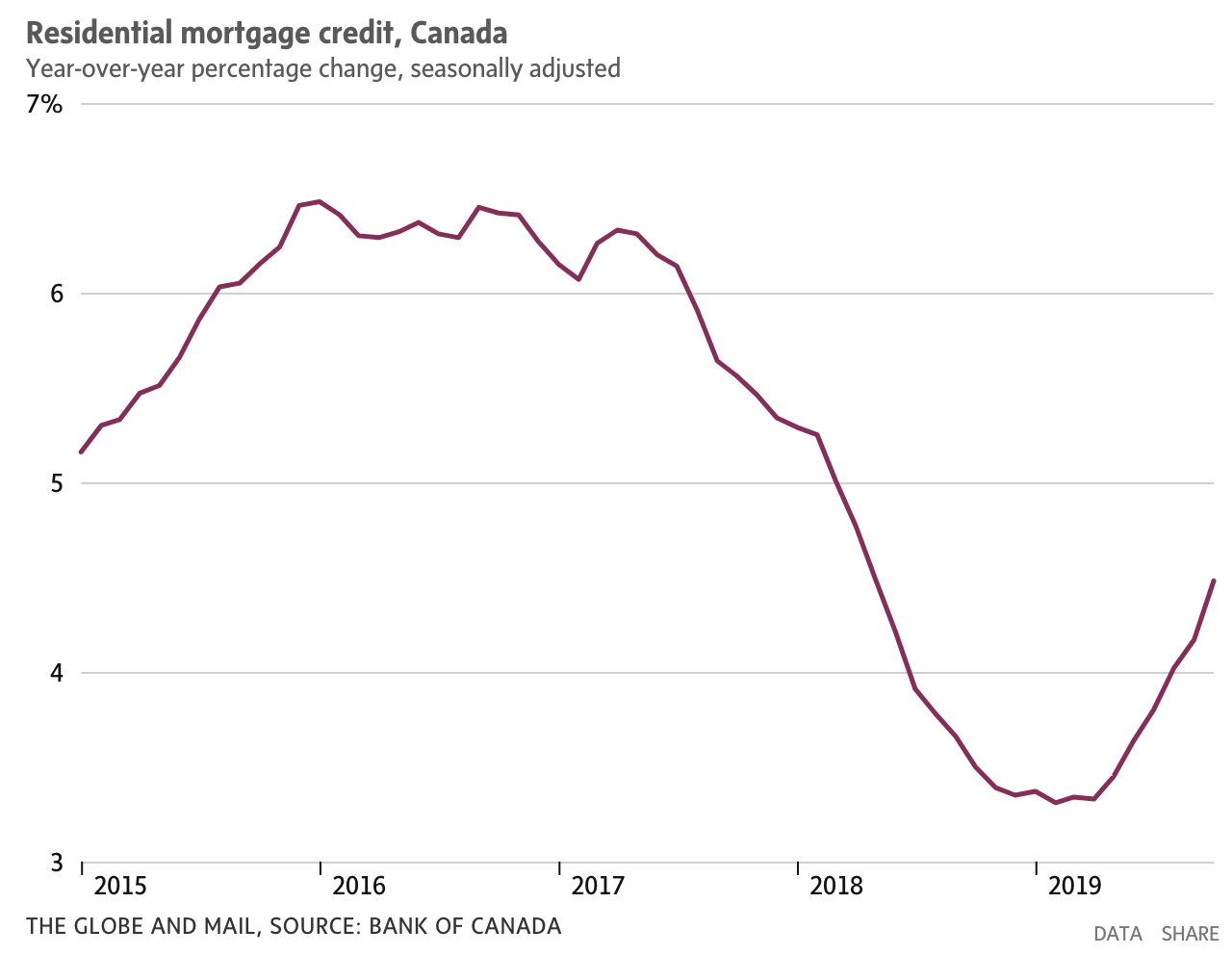

- Rising Interest Rates: The BoC's previous interest rate hikes, aimed at curbing inflation, have increased borrowing costs for consumers and businesses. Higher mortgage rates and loan payments are reducing disposable income and impacting investment decisions.

- Changing Consumer Behavior: Consumer behavior is shifting, with a greater emphasis on value and necessity purchases. Consumers are becoming more price-sensitive, seeking discounts and promotions.

- Global Economic Slowdown: The global economic climate also plays a role. Uncertainty in international markets and potential recessionary pressures in key trading partners are impacting Canadian businesses and consumer confidence.

The Bank of Canada's Current Monetary Policy Stance

Recent Rate Decisions

The BoC has maintained a hawkish stance in recent months, pausing interest rate hikes but signaling caution regarding future adjustments.

- Key Statements: In their recent statements, BoC officials have emphasized their commitment to controlling inflation, highlighting the need for continued vigilance in monitoring economic indicators.

- Inflation Targets: While inflation has shown signs of easing, it remains above the BoC's target range, leaving the possibility of future rate adjustments open.

Economic Indicators the BoC is Monitoring

The BoC considers several crucial economic indicators beyond retail sales when deciding on monetary policy.

- Key Indicators: GDP growth, employment rates, CPI and core inflation rates, and housing market data are closely scrutinized.

- Consumer Confidence: Consumer confidence indices provide valuable insights into future spending patterns and are key indicators for the BoC.

Predicting the Likelihood of Bank of Canada Rate Cuts

Analyst Opinions and Forecasts

Economists hold diverse views on the probability of imminent rate cuts.

- Expert Opinions: Some analysts believe that the recent decline in retail sales strengthens the case for rate cuts, while others remain cautious, citing persistent inflationary pressures.

- Forecasting Models: Various forecasting models offer diverse predictions, ranging from a single 25-basis point cut to multiple reductions over the next year.

Potential Timing and Magnitude of Rate Cuts

The timing and extent of potential rate cuts depend on several interwoven factors.

- Influencing Factors: The trajectory of inflation, GDP growth, and the evolution of the labor market will heavily influence the BoC’s decision.

- Scenario Analysis: Several scenarios are possible, ranging from a cautious approach with gradual rate reductions to more aggressive cuts if economic indicators deteriorate further.

Conclusion: Falling Retail Sales and the Implications for the Bank of Canada

The significant decline in retail sales underscores a weakening Canadian economy. The Bank of Canada's current stance, while cautious, leaves open the possibility of interest rate cuts. Analysts offer differing opinions on the timing and magnitude of such reductions. Potential rate cuts could stimulate economic activity by boosting consumer spending and investment, but they also risk exacerbating inflation if not carefully managed. The BoC must carefully balance these competing concerns. Staying informed about the evolving economic situation and the Bank of Canada's future decisions regarding interest rates is crucial. Stay tuned for updates on declining retail sales and their impact on Bank of Canada rate cuts. Follow [your publication] for the latest analysis.

Featured Posts

-

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 29, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 29, 2025 -

Negeri Sembilans Data Center Boom Investment And Infrastructure

Apr 29, 2025

Negeri Sembilans Data Center Boom Investment And Infrastructure

Apr 29, 2025 -

International Condemnation Of Israeli Aid Ban In Gaza Intensifies

Apr 29, 2025

International Condemnation Of Israeli Aid Ban In Gaza Intensifies

Apr 29, 2025 -

How You Tube Caters To Older Viewers Entertainment Needs

Apr 29, 2025

How You Tube Caters To Older Viewers Entertainment Needs

Apr 29, 2025 -

Minnesota Faces Attorney Generals Transgender Sports Ban Order

Apr 29, 2025

Minnesota Faces Attorney Generals Transgender Sports Ban Order

Apr 29, 2025

Latest Posts

-

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025 -

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025 -

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025 -

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025 -

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025