Federal Debt And The Mortgage Market: A Looming Crisis?

Table of Contents

The Mechanics of Federal Debt and Mortgage Rates

The connection between federal debt and mortgage rates is primarily driven by the government's borrowing needs. When the government borrows heavily to finance its spending, it increases the overall demand for funds in the financial market. This increased demand competes with private sector borrowing, including mortgages. As a result, interest rates tend to rise.

The Federal Reserve (the Fed), the central bank of the United States, plays a crucial role in managing this dynamic. The Fed utilizes monetary policy tools, such as adjusting the federal funds rate (the target rate banks charge each other for overnight loans), to influence interest rates. However, the Fed's ability to control interest rates is not absolute, particularly when government borrowing is exceptionally high. Excessive government borrowing can put upward pressure on interest rates, even with the Fed's intervention.

- Increased demand for funds from the government competes with private sector borrowing, pushing up interest rates across the board.

- Higher interest rates make mortgages significantly more expensive, impacting affordability for potential homebuyers.

- Potential impact on inflation: Increased government spending, financed through borrowing, can fuel inflation. The Fed may then raise interest rates to combat inflation, further impacting mortgage rates.

The Impact of Rising Interest Rates on Homebuyers

Rising interest rates stemming from increased federal debt directly impact the housing market and homebuyers' ability to purchase a home. Higher mortgage rates translate to significantly larger monthly payments, reducing the affordability of homes for many potential buyers. This can lead to a decrease in demand and potentially trigger a slowdown or even a decline in home sales.

- Increased mortgage payments strain household budgets, potentially limiting other spending and impacting the overall economy.

- Reduced demand leads to a potential price correction in the housing market, as sellers may need to lower prices to attract buyers in a less competitive market.

- Impact on the construction industry: A decline in home sales can negatively affect the construction industry, leading to job losses and reduced economic activity.

The Role of Government-Backed Mortgage Programs

Government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac play a vital role in the mortgage market, providing liquidity and stability. However, these GSEs are vulnerable to rising interest rates and potential defaults. If interest rates rise sharply, more borrowers may struggle to make their mortgage payments, increasing the risk of defaults.

- Increased defaults on government-backed mortgages could strain government resources and potentially require further taxpayer bailouts.

- Potential for increased taxpayer burden: Government intervention to support GSEs or mitigate widespread defaults could place a substantial burden on taxpayers.

- The risk of a cascading effect: A significant crisis in the mortgage market could trigger a cascading effect, impacting other parts of the financial system.

Alternative Scenarios and Mitigation Strategies

The future interplay between federal debt and the mortgage market presents several potential scenarios:

- Scenario 1: Moderate increase in interest rates with manageable consequences for the housing market and the broader economy.

- Scenario 2: Significant rise in interest rates leading to a slowdown in the housing market, reduced construction activity, and a potential recession.

- Scenario 3: Severe crisis requiring substantial government intervention and potentially leading to a prolonged economic downturn.

To mitigate the risks, several strategies could be implemented:

- Fiscal consolidation: Implementing measures to reduce the federal budget deficit and control the growth of federal debt is crucial.

- Responsible monetary policy: The Federal Reserve needs to carefully manage interest rates, balancing inflation control with the need to support economic growth.

- Reforms to mortgage lending practices: Improving lending standards and promoting responsible lending could help reduce the risk of defaults and protect consumers.

Conclusion: Addressing the Federal Debt and Mortgage Market Crisis

The interconnectedness of federal debt and the mortgage market presents significant challenges and risks. Failure to address the rapidly growing federal debt could lead to higher interest rates, decreased affordability of homes, and potential instability in the housing market and the broader financial system. The potential consequences of inaction are severe and could have long-lasting impacts on the US economy.

To prevent a crisis, proactive measures are needed. Stay informed about the evolving situation regarding federal debt and the mortgage market. Encourage responsible borrowing and investing. Promote public awareness of this issue among policymakers and the public. Further research into the complex dynamics between government borrowing, interest rates, and housing market stability is critical for informed decision-making and effective policy development. Understanding the relationship between federal debt and the housing market is crucial for navigating the current economic climate.

Featured Posts

-

Itb Berlin 2024 Kuzey Kibris Gastronomisi Duenyaya Tanitildi

May 19, 2025

Itb Berlin 2024 Kuzey Kibris Gastronomisi Duenyaya Tanitildi

May 19, 2025 -

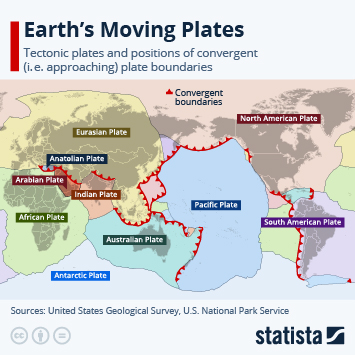

Hollywoods Tectonic Plates Shift Kristen Stewarts Influence

May 19, 2025

Hollywoods Tectonic Plates Shift Kristen Stewarts Influence

May 19, 2025 -

Universities To Sue After Senate Education Budget Cuts

May 19, 2025

Universities To Sue After Senate Education Budget Cuts

May 19, 2025 -

Understanding Teahs Choices In The Trial Unveiling Parental Mysteries

May 19, 2025

Understanding Teahs Choices In The Trial Unveiling Parental Mysteries

May 19, 2025 -

Actor Mark Rylance Speaks Out Against Music Festivals Effect On London Parks

May 19, 2025

Actor Mark Rylance Speaks Out Against Music Festivals Effect On London Parks

May 19, 2025