Federal Debt Crisis: What It Means For Homebuyers

Table of Contents

Rising Mortgage Interest Rates and the Federal Debt Crisis

The federal debt crisis and rising mortgage interest rates are inextricably linked. Increased government borrowing necessitates higher interest rates, making it more expensive to finance a home.

The Connection Between Government Debt and Interest Rates

The fundamental relationship is simple: increased government borrowing increases the demand for loans. This increased demand, in turn, drives up interest rates across the board, including mortgage rates.

- Increased demand for loans drives up rates: When the government borrows heavily, it competes with private borrowers for available funds, creating higher demand and pushing rates upward.

- The Federal Reserve's response to inflation, often fueled by debt, impacts rates: To combat inflation (which can be exacerbated by increased government spending and debt), the Federal Reserve often raises interest rates. This “tightening” monetary policy makes borrowing more expensive, impacting mortgage rates.

- Explain the concept of the yield curve and its implications for mortgage rates: The yield curve illustrates the relationship between interest rates and the time to maturity of debt. A steeper yield curve often predicts higher future interest rates, which can impact mortgage rates. A flattening or inverted yield curve can signal an economic slowdown, but this is complex and best discussed with a financial professional.

The Impact on Affordability

Higher mortgage rates directly reduce purchasing power for homebuyers. Even a small percentage point increase can significantly increase monthly payments and reduce the amount buyers can afford.

- Provide examples of how much more expensive a mortgage becomes with even a small percentage point increase: A 0.5% increase on a $300,000 mortgage can add hundreds of dollars to the monthly payment over the life of the loan.

- Discuss the shrinking pool of affordable homes: Rising rates make it more difficult for many to afford homes, shrinking the pool of available and affordable options. This is especially true in competitive markets.

- Mention the impact on first-time homebuyers: First-time homebuyers, often relying on smaller down payments and higher loan-to-value ratios, are particularly vulnerable to rising interest rates.

Navigating the Housing Market During a Federal Debt Crisis

Despite the challenges, it's still possible to navigate the housing market during a federal debt crisis. Proactive planning and strategic decision-making are key.

Strategies for Homebuyers in a High-Interest-Rate Environment

Several strategies can help homebuyers succeed despite higher rates.

- Consider adjustable-rate mortgages (ARMs) and their risks: ARMs offer lower initial rates but can become significantly more expensive if interest rates rise. Carefully weigh the risks and benefits.

- Explore government-backed loans (FHA, VA) and their eligibility requirements: Government-backed loans may offer more favorable terms, but they come with specific eligibility requirements.

- Improve your credit score to qualify for better rates: A higher credit score translates to lower interest rates, making a significant difference in monthly payments.

- Save a larger down payment to reduce the loan amount and monthly payments: A larger down payment reduces the loan amount, resulting in lower interest payments.

Understanding Market Volatility

Uncertainty surrounding the federal debt can lead to housing market volatility.

- Discuss potential price corrections or slowdowns in market growth: Economic uncertainty can lead to price corrections or slower market growth, potentially presenting both challenges and opportunities.

- Explain the importance of careful market analysis before purchasing: Thorough research and understanding local market trends are vital before making a purchase decision.

- Recommend consulting with a financial advisor and real estate professional: Professionals can provide valuable insights and guidance during uncertain times.

Long-Term Implications of the Federal Debt Crisis on Homeownership

The long-term effects of the federal debt crisis on homeownership remain uncertain.

Potential for Future Policy Changes

Government intervention could significantly impact the housing market.

- Mention possible changes to mortgage regulations or tax benefits: Future policy changes could alter the landscape of mortgage availability and affordability.

- Highlight the uncertainty surrounding long-term economic forecasts: Predicting the long-term economic impacts of the debt crisis is challenging, making long-term planning crucial.

The Importance of Financial Planning

Careful financial planning is crucial in the current economic climate.

- Discuss the importance of budgeting and debt management: A solid financial foundation is essential to navigate economic uncertainty.

- Recommend saving for a larger emergency fund: An emergency fund provides a financial safety net during unexpected economic downturns.

- Stress the long-term commitment of homeownership: Homeownership is a significant long-term commitment, requiring careful planning and consideration.

Conclusion

The federal debt crisis presents significant challenges for prospective homebuyers. Rising interest rates directly impact affordability, making it more difficult to enter the housing market. However, by understanding the connection between the federal debt and mortgage rates, and by employing strategic planning, homebuyers can navigate these complexities. Careful financial planning, market analysis, and consultation with experts are crucial. Don't let the federal debt crisis derail your dreams of homeownership; arm yourself with knowledge and take proactive steps to achieve your goals. Learn more about mitigating the impact of the federal debt crisis on your home purchase today!

Featured Posts

-

Najveci Eurosongski Neuspjesi Hrvatske Top 10

May 19, 2025

Najveci Eurosongski Neuspjesi Hrvatske Top 10

May 19, 2025 -

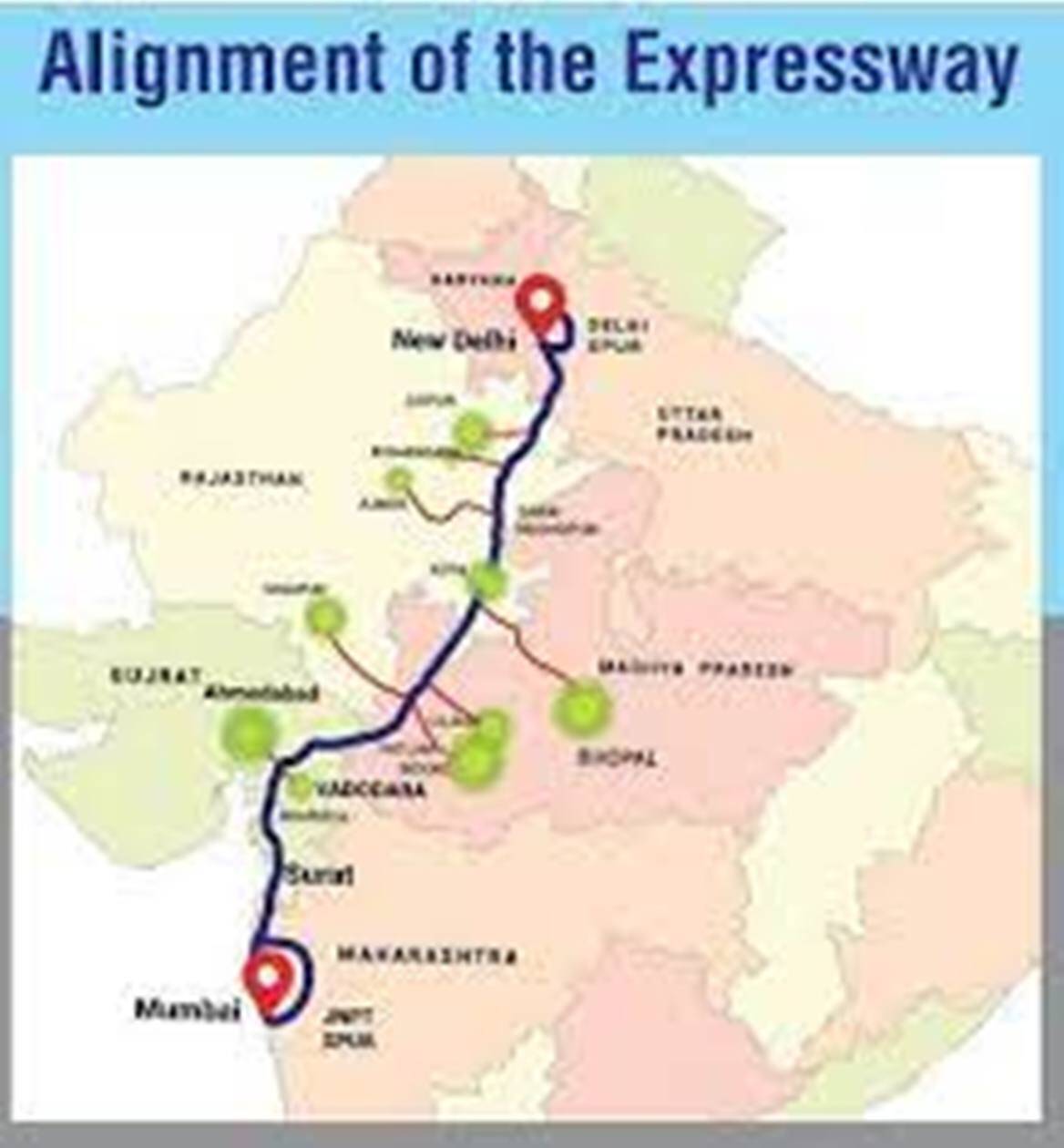

Uber Pet Transport New Service Launch In Delhi And Mumbai

May 19, 2025

Uber Pet Transport New Service Launch In Delhi And Mumbai

May 19, 2025 -

Saving Brockwell Park Festivals Preventing A Devastating Loss

May 19, 2025

Saving Brockwell Park Festivals Preventing A Devastating Loss

May 19, 2025 -

Understanding Chat Gpts New Ai Coding Agent A Comprehensive Guide

May 19, 2025

Understanding Chat Gpts New Ai Coding Agent A Comprehensive Guide

May 19, 2025 -

Decouvrir L Art Du Dessert Francais Recette Du Salami Au Chocolat De Sweet France

May 19, 2025

Decouvrir L Art Du Dessert Francais Recette Du Salami Au Chocolat De Sweet France

May 19, 2025