Federal Election And The Canadian Dollar: A Potential Decline

Table of Contents

Historical Precedents: Election Uncertainty and CAD Performance

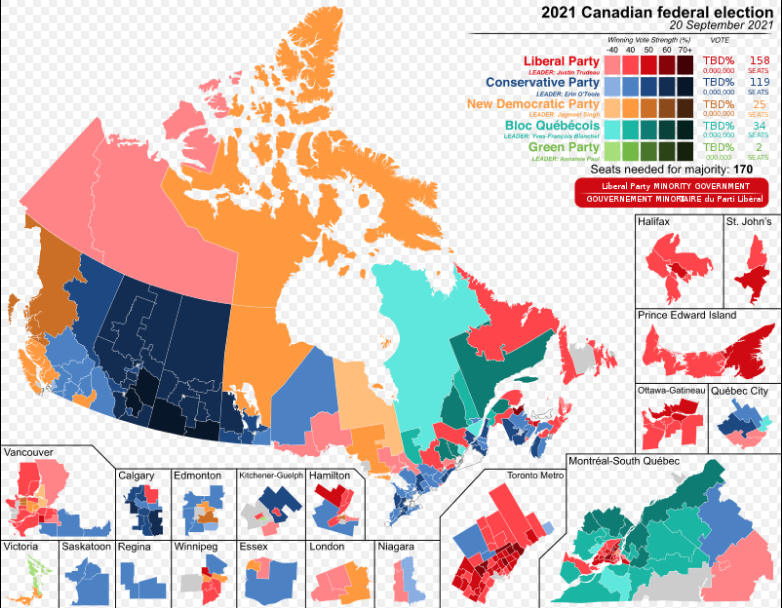

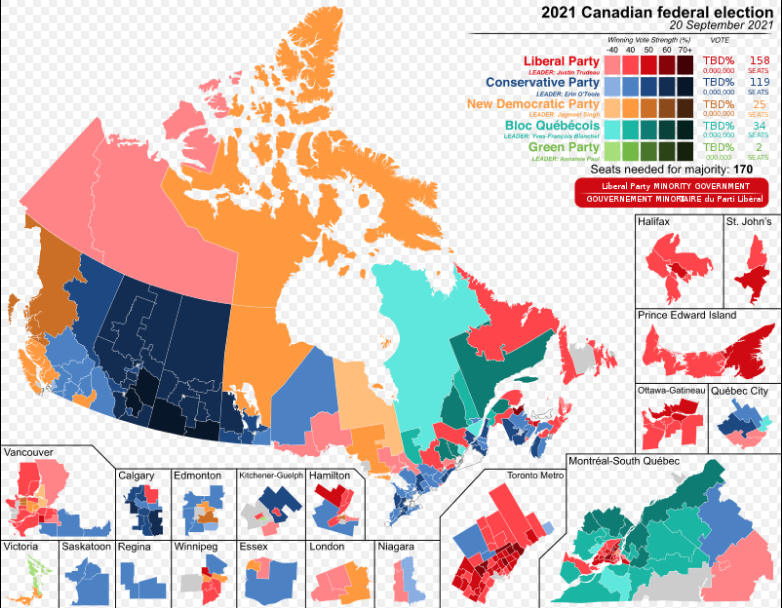

Understanding the historical relationship between federal elections and the CAD is crucial. Analyzing past election cycles reveals patterns that can offer insights into potential future trends.

Past Election Cycles and Currency Fluctuations

Examining past elections provides valuable data.

- 2015 Election: The election of the Liberal government saw a period of relative stability for the CAD, initially, followed by gradual strengthening.

- 2011 Election: The re-election of the Conservative government led to a period of mixed performance for the CAD, influenced by both domestic and global factors.

- 2006 Election: The Conservative victory resulted in a strengthening CAD initially, driven by investor confidence in the new government's economic policies.

These examples highlight the varied responses of the CAD to different election outcomes. Economic policies introduced after elections significantly impacted the currency's trajectory. For instance, significant infrastructure spending can boost the CAD in the long term, while drastic tax cuts might weaken it due to inflationary pressures. Analyzing this historical data, combined with charts illustrating CAD performance around past elections, provides a clearer picture of potential future volatility.

Investor Sentiment and Market Volatility

Election uncertainty significantly impacts investor confidence, driving CAD volatility.

- Policy Uncertainty: The lack of clarity surrounding the policies of a potential new government creates uncertainty, making investors hesitant to commit capital.

- Potential for Minority Government: A minority government can lead to political instability and policy gridlock, increasing market uncertainty and negatively impacting the CAD.

- Currency Speculation and Hedging: During election periods, currency speculation increases as traders attempt to profit from anticipated fluctuations. Companies also engage in hedging strategies to mitigate potential losses.

Potential Policy Impacts on the Canadian Dollar

Different political parties' proposed policies have varying potential impacts on the CAD.

Fiscal Policy Changes and the CAD

Fiscal policy changes significantly influence the CAD.

- Spending Plans: Large-scale infrastructure spending programs can boost economic growth, potentially strengthening the CAD. Conversely, excessive spending leading to increased national debt may weaken it.

- Tax Policies: Tax cuts can stimulate the economy, potentially strengthening the CAD in the short term but might lead to inflation and weaken it in the long term. Increased taxes can have the opposite effect.

- Credit Rating Impacts: A government's fiscal policy directly impacts its credit rating. A downgrade can negatively affect investor confidence, leading to CAD depreciation.

Monetary Policy Implications

The Bank of Canada's response to election outcomes significantly influences interest rates and the CAD.

- Interest Rate Adjustments: Depending on the economic outlook following the election (inflation, growth rates etc.), the Bank of Canada may adjust interest rates. Rate hikes usually strengthen the CAD, while cuts weaken it.

- Bank of Canada Mandate: The Bank of Canada aims to maintain price stability and full employment. The election outcome and subsequent economic shifts will influence how it balances these goals and adjusts its monetary policies, ultimately affecting the CAD.

Global Economic Factors and the CAD

Beyond domestic policy, global economic conditions significantly influence the CAD, regardless of the election outcome.

International Trade and the CAD

Global economic factors such as international trade significantly affect the Canadian economy and the CAD.

- Global Supply Chains: Disruptions to global supply chains impact commodity prices and exports, affecting the CAD.

- Commodity Prices (Especially Oil): Canada is a major commodity exporter, and fluctuations in oil prices directly impact the CAD.

- Strength of the US Dollar: The US dollar remains a dominant force in global markets, and its strength directly impacts the CAD's value.

Geopolitical Risks and the CAD

Geopolitical events add another layer of complexity.

- Global Conflicts: Global conflicts and political instability can create uncertainty in global markets, negatively impacting investor sentiment and weakening the CAD.

- Trade Wars: Trade disputes and protectionist measures can significantly impact Canadian exports and the CAD's value.

Conclusion: Navigating the Federal Election and the Canadian Dollar

The upcoming federal election presents significant uncertainty for the Canadian dollar. The analysis of historical trends, potential policy changes, and global economic factors indicates a potential for CAD decline, depending on the election outcome and subsequent government policies. The Bank of Canada's response will play a crucial role. Different scenarios, from robust economic growth to fiscal challenges, can significantly influence the CAD's trajectory.

Key Takeaways: The CAD's performance is intricately linked to the federal election. Investor sentiment, policy uncertainty, and global economic conditions will all play significant roles. Understanding the potential impacts of different policy scenarios is crucial.

Call to Action: Monitor the Federal Election and Canadian Dollar closely. Understand the potential impacts of the Federal Election on the CAD. Stay informed about the Canadian dollar's volatility during the election and consult with financial advisors for personalized advice. The relationship between the Federal Election and the Canadian Dollar is complex and requires diligent observation.

Featured Posts

-

Horrific Accident Video Captures Aftermath Of Car Crash At Afterschool Program Several Children Killed

Apr 30, 2025

Horrific Accident Video Captures Aftermath Of Car Crash At Afterschool Program Several Children Killed

Apr 30, 2025 -

L Eredita Di Mario Nanni Giornalismo Parlamentare E Impegno Civile

Apr 30, 2025

L Eredita Di Mario Nanni Giornalismo Parlamentare E Impegno Civile

Apr 30, 2025 -

Cong Nhan Dien Luc Mien Nam Xay Dung Mach 3 500k V Hanh Trinh Day Tu Hao

Apr 30, 2025

Cong Nhan Dien Luc Mien Nam Xay Dung Mach 3 500k V Hanh Trinh Day Tu Hao

Apr 30, 2025 -

Irishmans Eurovision Win A Historic Armenian Song

Apr 30, 2025

Irishmans Eurovision Win A Historic Armenian Song

Apr 30, 2025 -

Luto En El Futbol Argentino Fallece Joven Referente De Afa

Apr 30, 2025

Luto En El Futbol Argentino Fallece Joven Referente De Afa

Apr 30, 2025