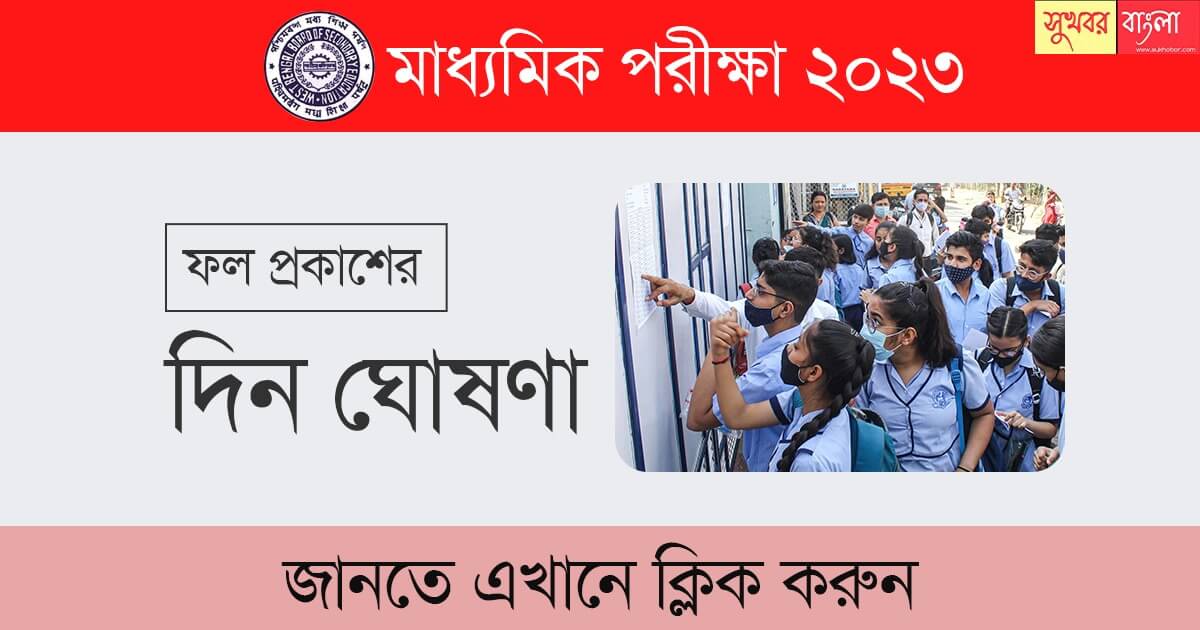

Federal Reserve's Cautious Approach To Interest Rate Reductions

Table of Contents

Inflation Remains a Primary Concern

The Federal Reserve's primary mandate is price stability. Persistent inflationary pressures continue to be a major obstacle to achieving this goal. The ongoing challenges posed by inflation require a careful and considered response, making swift interest rate reductions unlikely.

Persistent Inflationary Pressures

Inflation remains significantly above the Fed's target of 2%. Several factors contribute to these persistent inflationary pressures. The inflation rate, as measured by various indices, continues to reflect the impact of these factors. The Fed closely monitors its preferred inflation gauge, the Personal Consumption Expenditures (PCE) index.

- High energy prices and supply chain disruptions: The lingering effects of the pandemic and geopolitical instability have resulted in volatile energy prices and persistent supply chain bottlenecks, pushing up the cost of goods and services.

- Strong wage growth: While positive for workers, robust wage growth can fuel further inflation if it outpaces productivity gains. This creates a wage-price spiral, where higher wages lead to higher prices, which in turn lead to demands for even higher wages.

- The Fed's preferred inflation gauge (PCE) is still above target: Despite recent decreases, the PCE index remains above the Fed's 2% target, indicating that inflation hasn't cooled sufficiently to justify aggressive interest rate reductions.

The Federal Reserve must carefully consider these factors and their impact on the overall price stability before implementing any significant interest rate reductions using monetary policy tools.

Concerns About Economic Slowdown vs. Recession

The Federal Reserve faces a delicate balancing act. While combating inflation is paramount, the risk of triggering a recession through overly aggressive interest rate hikes is equally concerning. The goal is a "soft landing"—slowing economic growth enough to curb inflation without causing a widespread economic downturn.

Balancing the Risk of Recession

Recent economic data paint a mixed picture. While economic growth has slowed, it hasn't yet fallen into a full-blown recession. However, the lagged effect of interest rate hikes means the full impact of past increases may not yet be felt. This uncertainty makes the Fed cautious about implementing interest rate reductions prematurely.

- Recent economic data showing slowing growth but not a full-blown recession: Indicators like GDP growth, consumer spending, and employment figures are closely scrutinized for signs of a recession.

- The lagged effect of interest rate hikes on the economy: Monetary policy actions don't have an immediate impact; there's a time lag before their effects are fully felt throughout the economy.

- Debate among economists regarding the likelihood of a "soft landing": Economists disagree on the probability of achieving a soft landing, with some expressing concern about the risk of a recession.

The possibility of a recession significantly impacts the Federal Reserve's approach to interest rate reductions, requiring a careful evaluation of economic indicators and their potential implications.

Data Dependency and Gradualism

The Federal Reserve is committed to a data-driven approach. Future interest rate decisions will depend heavily on upcoming economic data releases. This commitment to data-driven decision-making translates into a preference for gradual adjustments in monetary policy.

The Fed's Data-Driven Approach

The Federal Open Market Committee (FOMC) meticulously analyzes a wide range of economic indicators before making decisions about interest rate policy. Gradual interest rate reductions allow the Fed to monitor the impact of its actions and adjust course if necessary.

- Upcoming economic data releases will significantly influence future decisions: Key indicators like employment data, inflation reports, and consumer spending figures will shape the FOMC's thinking.

- The Fed prefers a cautious, incremental approach to avoid unintended consequences: Sudden and drastic changes in interest rates can destabilize the economy, so a gradual approach minimizes such risks.

- Emphasis on monitoring employment data, consumer spending, and other key indicators: The Fed's decision-making relies on a comprehensive assessment of diverse economic indicators rather than focusing on a single metric.

This data-driven, gradual approach to monetary policy is crucial in navigating the current economic complexity and ensuring effective management of interest rate reductions.

Global Economic Uncertainty

The Federal Reserve operates within a globalized economy. International events and geopolitical risks significantly influence the US economy and, consequently, the Fed's decisions regarding interest rate reductions.

International Factors Affecting Interest Rate Decisions

Geopolitical instability, global supply chain disruptions, and international economic conditions all play a role in the Fed's deliberations.

- Geopolitical instability can add to inflationary pressures and economic uncertainty: Conflicts and tensions abroad can disrupt global supply chains, increasing prices and creating uncertainty.

- Global supply chain issues continue to impact the US economy: These disruptions can lead to shortages, higher prices, and reduced economic activity.

- The Fed monitors international economic conditions closely: The interconnectedness of the global economy requires the Fed to consider international factors when making its decisions.

The complexity of the global economy emphasizes the need for a cautious approach to interest rate reductions, factoring in international influences and potential spillover effects.

Conclusion

The Federal Reserve's cautious approach to interest rate reductions is driven by several key factors: persistent inflation, concerns about a potential economic slowdown, a commitment to a data-driven strategy, and the ongoing impact of global economic uncertainty. Understanding these complexities is vital to grasping the nuances of monetary policy. The Fed's primary goal is to achieve a sustainable economic outcome – balancing price stability with economic growth. This requires a careful and measured approach, prioritizing stability over rapid changes.

Key Takeaways: The current economic landscape demands a cautious approach to interest rate reductions. The Fed's data-driven strategy, sensitivity to recessionary risks, and awareness of global economic interdependencies underpin their deliberate pace.

Call to Action: Stay informed about future developments and the Fed's decisions regarding interest rate reductions by following reputable financial news sources and monitoring the Federal Reserve's official communications. Understanding the implications of interest rate reductions is crucial for businesses and individuals alike. Keep abreast of the Fed's actions to effectively navigate the economic landscape and prepare for potential shifts in monetary policy.

Featured Posts

-

Leon Draisaitl Injury Update Oilers Star Expected Back For Playoffs

May 09, 2025

Leon Draisaitl Injury Update Oilers Star Expected Back For Playoffs

May 09, 2025 -

Analysis Attorney Generals Fentanyl Demonstration And Its Impact

May 09, 2025

Analysis Attorney Generals Fentanyl Demonstration And Its Impact

May 09, 2025 -

Franco Colapinto Sponsors Accidental F1 News Reveal During Live Broadcast

May 09, 2025

Franco Colapinto Sponsors Accidental F1 News Reveal During Live Broadcast

May 09, 2025 -

Indian Stock Market Rally Sensex At 1 400 Points Nifty 50 Above 23 800

May 09, 2025

Indian Stock Market Rally Sensex At 1 400 Points Nifty 50 Above 23 800

May 09, 2025 -

Madhyamik 2025 Result Date Merit List And Passing Percentage

May 09, 2025

Madhyamik 2025 Result Date Merit List And Passing Percentage

May 09, 2025

Latest Posts

-

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025 -

Wynne Evans Health Scare Recent Illness And Potential Stage Comeback

May 09, 2025

Wynne Evans Health Scare Recent Illness And Potential Stage Comeback

May 09, 2025 -

Spring Style Elevated Elizabeth Stewarts Collaboration With Lilysilk

May 09, 2025

Spring Style Elevated Elizabeth Stewarts Collaboration With Lilysilk

May 09, 2025 -

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 09, 2025

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 09, 2025 -

Star Stylist Elizabeth Stewart And Lilysilks Spring Collaboration A Luxurious New Collection

May 09, 2025

Star Stylist Elizabeth Stewart And Lilysilks Spring Collaboration A Luxurious New Collection

May 09, 2025