Finance Loans 101: Your Complete Guide To Application, Interest Rates, EMIs, And Tenure

Table of Contents

Understanding the Finance Loan Application Process

Before diving into interest rates and EMIs, let's understand how to apply for a finance loan. The process varies slightly depending on the type of loan.

Types of Finance Loans

Finance loans encompass a wide range of financial products designed for various purposes:

- Personal Loans: Used for various personal expenses, from debt consolidation to home renovations. Applying for a personal loan involves providing details about your income and credit history. Keywords: personal loan application, personal loan interest rates.

- Auto Loans: Specifically designed for purchasing vehicles. The auto loan application process often requires information about the car you intend to buy. Keywords: auto loan application, auto loan interest rates.

- Home Loans (Mortgages): Large loans used to purchase property. A home loan application is a more extensive process, requiring detailed financial documentation and property appraisal. Keywords: home loan application, home loan interest rates.

- Business Loans: Loans intended to finance business operations, expansion, or equipment purchases. Business loan applications typically require comprehensive business plans and financial statements. Keywords: business loan application, small business loan.

Required Documents for a Loan Application

The specific documents needed vary by lender and loan type, but common requirements include:

- Valid government-issued photo identification (ID proof)

- Proof of income (pay stubs, tax returns)

- Proof of address (utility bills, bank statements)

- Bank statements demonstrating sufficient funds

- Credit report (for assessing creditworthiness)

Long-tail keywords like "documents required for a personal loan application" are vital for attracting users searching for specific information.

The Importance of Your Credit Score for Loan Eligibility

Your credit score plays a pivotal role in loan approval and interest rates. A higher credit score indicates lower risk to the lender, resulting in better loan terms. Keywords: credit score, loan eligibility, credit report, credit history.

- Improve your credit score before applying for a loan.

- Check your credit report for any errors.

- Pay your bills on time and consistently.

Step-by-Step Loan Application Process

The application process generally involves these steps:

- Choose a Lender: Research different lenders and compare their interest rates and terms. Keywords: best loan lenders, compare loan interest rates.

- Complete the Application: Fill out the online or in-person application form accurately and completely. Keywords: online loan application, loan application process.

- Provide Documentation: Submit the required documents as specified by the lender.

- Review and Approval: The lender will review your application and determine your eligibility.

- Loan Disbursement: Once approved, the loan amount will be disbursed to your account.

Decoding Interest Rates and Their Impact

Interest rates are a crucial component of any finance loan. Understanding them is key to managing your loan costs effectively.

Defining Interest Rates

Interest rates represent the cost of borrowing money. They are typically expressed as an annual percentage rate (APR). A higher APR means higher borrowing costs. Keywords: interest rates, loan interest, APR (Annual Percentage Rate).

Fixed vs. Variable Interest Rates

- Fixed Interest Rate Loans: The interest rate remains constant throughout the loan tenure, providing predictability in monthly payments. Keywords: fixed interest rate loan, fixed-rate mortgage.

- Variable Interest Rate Loans: The interest rate fluctuates based on market conditions. While potentially offering lower initial rates, they can lead to unpredictable monthly payments. Keywords: variable interest rate loan, adjustable-rate mortgage.

Factors Affecting Interest Rates

Several factors influence the interest rate you'll receive:

- Credit Score: A higher credit score usually leads to lower interest rates.

- Loan Amount: Larger loan amounts may come with higher interest rates.

- Loan Type: Different loan types (personal, auto, home) often have different interest rate ranges.

- Market Conditions: Prevailing economic conditions also influence interest rates. Keywords: loan interest rates factors, interest rate calculation.

Calculating Total Loan Cost

The total loan cost is the sum of the principal amount and the accumulated interest. It's crucial to calculate this to understand the true cost of borrowing. Keywords: loan repayment calculation, total loan cost, loan amortization schedule.

Understanding EMIs (Equated Monthly Installments)

EMIs are fixed monthly payments that cover both the principal and interest components of your loan.

Defining EMIs

An EMI is a structured repayment plan that simplifies loan repayment. Keywords: EMI calculation, equated monthly installments, loan EMI calculator.

EMI Calculation Formula

While the exact formula is complex, many online EMI calculators simplify the process. Keywords: EMI calculator online, how to calculate EMI. Simply input the loan amount, interest rate, and tenure to determine your monthly EMI.

Factors Affecting EMIs

Your monthly EMI is influenced by:

- Loan Amount: A higher loan amount results in higher EMIs.

- Interest Rate: Higher interest rates lead to higher EMIs.

- Loan Tenure: A longer loan tenure results in lower EMIs but higher overall interest paid. Keywords: EMI factors, loan tenure EMI.

Choosing the Right Loan Tenure

Loan tenure refers to the repayment period of your loan.

Defining Loan Tenure

The loan tenure determines the duration over which you'll repay the loan. A longer tenure leads to lower monthly EMIs but higher overall interest payments. Keywords: loan tenure, repayment period, loan duration.

Impact of Tenure on Total Interest Paid

Extending your loan tenure reduces your monthly payments, but you'll end up paying significantly more interest over the loan's life. Keywords: loan repayment schedule, loan amortization.

Finding the Optimal Loan Tenure

Finding the optimal tenure involves balancing affordability with minimizing overall interest paid. Consider your financial capabilities and long-term financial goals. Keywords: best loan tenure, optimal repayment plan.

Conclusion: Making Informed Decisions with Finance Loans

Understanding finance loans, from the application process and interest rates to EMIs and loan tenure, is crucial for making sound financial decisions. By carefully considering these factors and utilizing available resources like online calculators, you can choose a loan that aligns with your financial capabilities and long-term goals. Start your research today and find the best finance loan options to suit your needs. Learn more about different loan types and compare interest rates using our [link to relevant resource/calculator]. Finding the right finance loan is a significant step towards achieving your financial aspirations.

Featured Posts

-

Ronaldo Nun Saskinligi Portekiz Kampindan Fenerbahce Ye Uzanan Goeruentueler

May 28, 2025

Ronaldo Nun Saskinligi Portekiz Kampindan Fenerbahce Ye Uzanan Goeruentueler

May 28, 2025 -

Marlins Stowers Delivers Game Winning Grand Slam In 9 6 Victory

May 28, 2025

Marlins Stowers Delivers Game Winning Grand Slam In 9 6 Victory

May 28, 2025 -

The Mystery Of Taylor Swifts Easter Eggs A Memorial Day Ama Prediction

May 28, 2025

The Mystery Of Taylor Swifts Easter Eggs A Memorial Day Ama Prediction

May 28, 2025 -

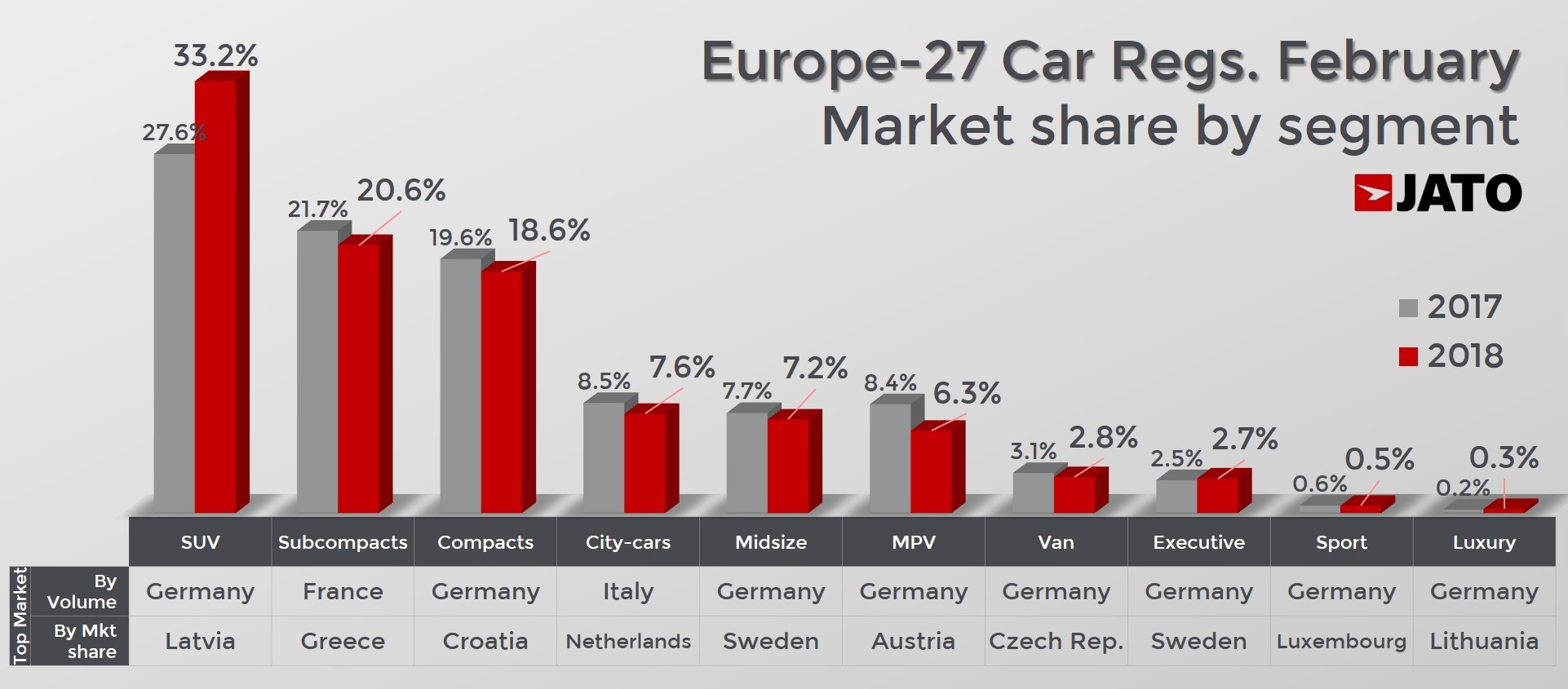

New Car Registrations In Europe Plummet Due To Economic Woes

May 28, 2025

New Car Registrations In Europe Plummet Due To Economic Woes

May 28, 2025 -

Best Tribal Loans For Bad Credit Direct Lenders And Guaranteed Approval

May 28, 2025

Best Tribal Loans For Bad Credit Direct Lenders And Guaranteed Approval

May 28, 2025