Finance Loans: A Step-by-Step Guide To Securing The Right Loan

Table of Contents

Understanding Your Financial Needs and Goals

Before you even begin searching for finance loans, it's crucial to assess your current financial situation and clearly define your goals. This foundational step will help you determine the type and amount of loan that best suits your needs and avoid potential financial pitfalls.

-

Determine the loan amount you need: How much money do you actually require? Be realistic; avoid borrowing more than necessary to minimize interest payments over the loan's lifetime. Consider creating a detailed budget to accurately assess your needs.

-

Define the purpose of the loan: Are you looking for a personal loan for debt consolidation, a home improvement loan for renovations, a business loan for expansion, or a student loan for education? The purpose significantly impacts the type of loan you should pursue. Knowing your purpose helps you target your search more effectively.

-

Assess your credit score and debt-to-income ratio (DTI): Your credit score is a critical factor in determining your eligibility for a loan and the interest rate you'll receive. A higher credit score generally translates to more favorable loan terms. Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, also plays a significant role in lender approval.

-

Set a realistic budget and repayment plan: Before applying, create a detailed budget that incorporates the monthly loan payment. Ensure you can comfortably afford the payments without jeopardizing other essential expenses. Failing to plan for repayment can lead to financial difficulties.

-

Research different loan types: Explore various options such as personal loans, secured loans, unsecured loans, payday loans (note the high-interest rates and potential risks), and lines of credit. Understanding the differences is vital to choosing the right finance loan for your situation.

Exploring Different Types of Finance Loans

The market offers a diverse range of finance loans, each designed for specific purposes and financial situations. Understanding the nuances of each type is crucial for making an informed decision.

-

Personal Loans: These are unsecured loans used for various purposes, from debt consolidation to home improvements. Interest rates vary depending on your credit score and the lender. Repayment terms are typically fixed, and eligibility criteria are based on creditworthiness and income.

-

Secured Loans: These loans require collateral, such as a car or house, to secure the loan. The collateral reduces the lender's risk, resulting in potentially lower interest rates. However, failure to repay could lead to the loss of the collateral.

-

Unsecured Loans: These loans don't require collateral but carry higher interest rates due to the increased risk for the lender. Your creditworthiness is the primary factor determining your eligibility and interest rate.

-

Business Loans: Obtaining business financing often requires a comprehensive business plan demonstrating the viability and profitability of your venture. Lenders assess your business's financial health and potential for repayment.

-

Student Loans: These loans help finance higher education. Government-backed loans often offer more favorable terms than private student loans. Understanding the repayment options and potential for loan forgiveness is vital.

-

Auto Loans: Used to finance the purchase of a vehicle, these loans can be secured (using the vehicle as collateral) or unsecured. Interest rates vary depending on the vehicle's value, your credit score, and the loan term.

-

Mortgage Loans: These loans are specifically for purchasing real estate. Different mortgage types exist, including fixed-rate mortgages (consistent interest rates) and adjustable-rate mortgages (interest rates fluctuate).

Improving Your Credit Score for Better Loan Terms

Your credit score significantly impacts your ability to secure a loan and the interest rate you'll receive. A higher credit score translates to more favorable loan terms, lower interest rates, and potentially better loan offers.

-

Check your credit report for errors: Review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) and correct any inaccuracies. Errors can negatively impact your score.

-

Pay bills on time: Consistent on-time payments are a cornerstone of good credit. Late payments severely damage your credit score.

-

Keep credit utilization low: Maintaining a low credit utilization ratio (the percentage of your available credit you're using) demonstrates responsible credit management. Aim to keep it below 30%.

-

Avoid applying for too many loans at once: Multiple loan applications in a short period can negatively impact your credit score. Space out your applications.

-

Consider using a credit-building strategy: Strategies like using a secured credit card can help improve your credit score over time.

The Loan Application Process: A Step-by-Step Guide

Applying for a finance loan involves several steps. Careful preparation and attention to detail are critical for a successful application.

-

Gather necessary documents: This typically includes proof of income (pay stubs, tax returns), identification (driver's license, passport), and other documents as required by the lender.

-

Compare loan offers from multiple lenders: Don't settle for the first offer you receive. Compare interest rates, fees, and repayment terms from different lenders to secure the best deal.

-

Complete the application form accurately: Ensure all information is accurate and complete to avoid delays or rejection.

-

Provide all requested documentation: Submit all necessary documents promptly to expedite the application process.

-

Understand the terms and conditions before signing: Carefully read and understand the loan agreement before signing. Clarify any doubts with the lender.

Managing Your Finance Loan Effectively

Responsible loan management is crucial to avoid financial hardship. By following these tips, you can ensure a smooth repayment process.

-

Make timely payments: Consistent on-time payments prevent late fees and penalties, protecting your credit score.

-

Track your loan balance and payments: Keep records of your loan balance, payments, and due dates.

-

Budget effectively: Create and stick to a budget that accommodates your monthly loan payment.

-

Explore refinancing options: If interest rates drop, consider refinancing your loan to potentially lower your monthly payment or shorten the repayment term.

-

Contact your lender: If you anticipate difficulty making payments, contact your lender immediately to explore potential solutions, such as a payment plan or forbearance.

Conclusion

Securing the right finance loan involves careful planning, research, and a clear understanding of your financial situation. By following the steps outlined above—from assessing your needs and exploring various loan types to improving your credit score and managing your loan effectively—you can significantly increase your chances of securing the best possible finance loan for your specific circumstances. Don't hesitate to take the first step towards achieving your financial goals. Start researching and comparing different types of finance loans today!

Featured Posts

-

Taylor Swifts Upcoming Ama Performance Hidden Clues And Fan Theories

May 28, 2025

Taylor Swifts Upcoming Ama Performance Hidden Clues And Fan Theories

May 28, 2025 -

Jennifer Lopez To Host The American Music Awards In Las Vegas

May 28, 2025

Jennifer Lopez To Host The American Music Awards In Las Vegas

May 28, 2025 -

Psv Pastikan Gelar Liga Belanda Dengan Menang 3 1

May 28, 2025

Psv Pastikan Gelar Liga Belanda Dengan Menang 3 1

May 28, 2025 -

Late Match Jitters Sinners Paris Masters Triumph

May 28, 2025

Late Match Jitters Sinners Paris Masters Triumph

May 28, 2025 -

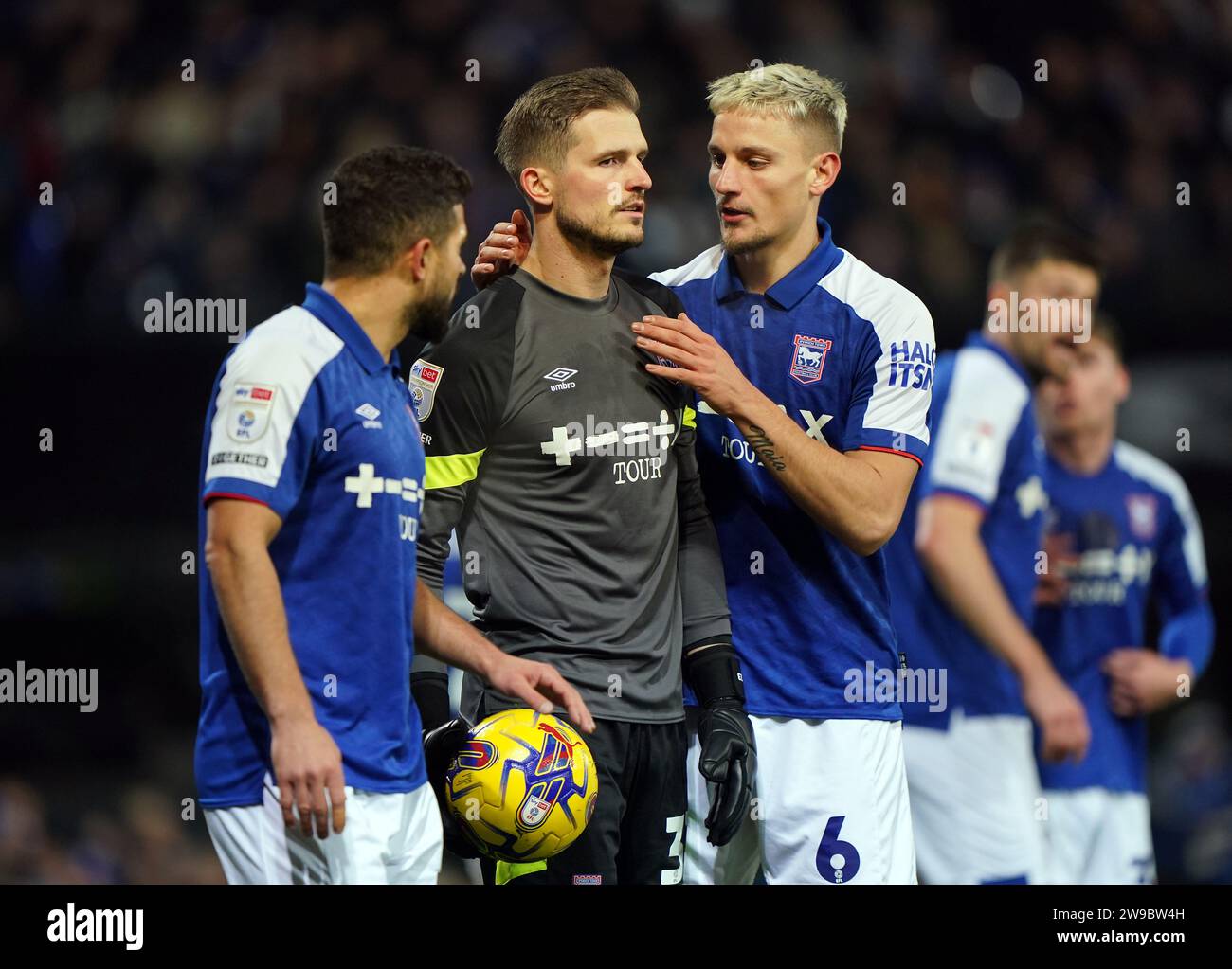

Enciso Phillips And Woolfenden New Signings At Ipswich Town

May 28, 2025

Enciso Phillips And Woolfenden New Signings At Ipswich Town

May 28, 2025